Every spending situation is unique. SingSaver assembles the 'Best For' list, so you can decide what’s best for you.

New to supplementary credit cards? Learn how they can offer added convenience and benefits for your family and loved ones while helping you manage household expenses.

Best supplementary credit cards on SingSaver: SCB Simply Cash Card | UOB PRVI Miles AMEX Card | UOB One Card | Citi PremierMiles Card | OCBC 365 Card | HSBC Advance Card

Supplementary credit cards can be a great financial tool in any household as they allow the primary cardholder to share credit card benefits and perks with their loved ones, most commonly their family members, spouse or children.

This type of credit card is linked to a primary credit card and typically shares the same reward structure. For example, if you earn 5% cashback on dining with your primary card, the supplementary card member will also enjoy this perk.

They also allow the supplementary cardmember to enjoy some or all of the same perks and privileges as the primary cardmember, although the degree to which this applies varies somewhat between providers.

In this article, we'll examine the pros and cons of supplementary cards and six popular cards you could consider extending to your loved ones.

Table of contents

- What is a supplementary card?

- Advantages and disadvantages of a supplementary card

- 6 popular credit cards to get

Looking for the best credit cards to complement your spending patterns and expenditure in 2024? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

What is a supplementary card?

If you've gotten a credit card already, you're likely qualified to sign up for a supplementary card. These cards can be assigned to a supplementary cardholder, like your spouse or child. As previously mentioned, these supplementary cards share the same reward perks and structure as your primary card, although there may be instances where the benefits do not apply to the supplementary cardholder. One example is the number of free visits to airport lounges.

It is also important to note that supplementary cards do not have their own bonus caps. Instead, the bonus cap is shared with the primary credit card. For example, if a credit card has a S$1,000 bonus spending cap, it will be shared between both the primary and supplementary cards.

Applying for one is pretty straightforward. You can either apply online or send in a form by mail. You might even snag rewards like bonus miles or cashback when you get a supplementary card. And don't stress about the costs—as many of these supplementary cards are free or have a low annual fee.

Using a supplementary credit card is no different than using a debit or credit card. However, do note that all transactions made with a supplementary card will appear on the main cardholder's billing statement, making the primary cardholder responsible for covering all the charges associated with the supplementary card. Supplementary cards also have no impact on the credit score of the supplementary card member.

If a payment is missed, only the credit score of the primary card member will be affected. Similarly, paying the supplementary cardmember's bill on time will enhance the credit score of the primary cardmember.

Lastly, all rewards earned through the supplementary card will be channelled to the primary card member's account. This means any cashback, air miles or rewards points will be credited back to the primary card, and the supplementary cardholder will not be able to use them.

Advantages and disadvantages of a supplementary card

|

Advantages |

Disadvantages |

|

Earn rewards faster |

Risk of overspending |

|

Switching one primary card to a supplementary card can result in a reduction of their total annual fees. |

Rewards earned are funnelled to the primary card member. |

|

Supplementary cardholders may use the card as a source of emergency money. |

Rewards caps are not increased. |

|

As supplementary cards have adjustable credit limits, you can use them to teach children how to set and manage budgets. |

The primary cardholder is responsible for paying charges on any supplementary cards. |

6 popular supplementary credit cards to get

|

Credit card |

Supplementary card annual fee |

Noteworthy rewards or perks |

|

Standard Chartered Simply Cash Card

|

First 5 cards free | 1.5% cashback on all spends, no cap |

|

UOB PRVI Miles American Express Card

|

First card free S$129.60 per card thereafter |

1.4 miles per dollar on local spend 2.4 miles per dollar on overseas spend Up to 6 miles per dollar on hotel bookings |

|

UOB One Card

|

First card free, S$97.20 per card thereafter |

New-to-UOB cardmembers |

|

Citi PremierMiles Card

|

Free for life |

1.2 miles per dollar on local spends 2 miles per dollar on overseas spends Up to 10 miles per dollar on hotel bookings Miles never expire |

|

OCBC 365 Card

|

Free for up to 2 years S$97.20 thereafter |

6% cashback on petrol 5% cashback on dining and online food delivery 3% cashback on groceries, transport, recurring telco and electricity bills, pharmacy purchases, streaming services, electric vehicle charging Cashback capped at S$80/S$160 with S$800/S$1,600 minimum spend |

HSBC Advance Card |

First 5 cards free |

2.5% cashback when you spend more than S$2,000 per month, capped at S$70 per month Otherwise, 1.5% cashback with no min. spend Extra 1% HSBC Everyday+ Cashback when you deposit min. S$2,000 funds into HSBC EGA per month and make 5 eligible transactions per month |

#1: Standard Chartered Simply Cash Credit Card

The SCB Simply Cash Credit Card gives you 1.5% cashback on all your spending, so the more transactions you charge to it, the more savings you’ll get.

This is also why this makes a great supplementary card for your family members. Put a copy into the hands of your spouse and children – which is easy to do as annual fees are waived for up to five supplementary cards – and watch the savings rack up!

.png?width=800&height=250&name=SCB_SIMPLY_BLOGARTICLE_800x250%20(2).png)

SingSaver's Exclusive Offer: Enjoy the following rewards when you sign up for a Standard Chartered Simply Cash Card. Eligible for new Standard Chartered cardholders only.

Plus, get an additional S$20 e-Capitaland Voucher when you split the payment for your purchases with SCB Easy Pay, pay your bills with SCB Easybill or put any of your purchases on instalment in SCB Savings Account or Current Account within 60 days of approval. Valid till 1 May 2024. T&C applies.

#2: UOB PRVI Miles American Express Credit Card

The UOB PRVI Miles credit cards are known for their industry-leading local spend earn rate of 1.4 miles per dollar and 2.4 miles per dollar on overseas spending, including online shopping on overseas websites. It also rewards a remarkable 6 miles per dollar on major airlines and hotels via Agoda, Expedia, and UOB Travel.

But amidst all these rewards, perhaps it’s the American Express variant that makes having supplementary cards rewarding.

See also: Best American Express Credit Cards in Singapore (2023)

You’ll be awarded 50,000 air miles if you pay your primary card's first year's annual fee. Otherwise, you'll still earn 30,000 air miles if you choose to waive it. For context, a return-way Economy Saver Award Ticket from Singapore to Seoul is worth 54,000 KrisFlyer miles already. So by paying the annual fee, you're only 4,000 miles away from redeeming a solo trip to Korea next year. 🤑✈️

Meanwhile, for the supplementary cards, only the annual fees for the first supplementary card can be waived.

UOB PRVI Miles Amex Card Welcome Offer: Get up to 50,000 miles when you make a min. spend of S$1,000 per month for 2 consecutive months from card approval date plus annual fee payment and SMS enrolment. Valid till 30 April 2024 . T&Cs apply.

Alternatively, receive 25,200 miles when you are one of the first 50 to apply with first year annual fee waiver and make a min. spend of S$1,000 for 2 consecutive months from card approval date. Plus, get another 4,800 miles (a total of 30,000 miles) when you make a min. overseas spend of S$1,000 per month for 2 consecutive months.Valid till 30 April 2024 . T&Cs apply.

#3: UOB One Credit Card

The rebate structure of the UOB One Card may take some working out, but the gist is this: spend at least S$500, S$1,000 or S$2,000 per month for three consecutive months (5 eligible transactions per month), and it will let you earn the maximum 15% quarterly cashback.

This insane cashback rate is only valid for new-to-UOB cardmembers. Existing members can only earn a maximum rate of 10% cashback.

But overall, keeping your spending up as long as possible will be the most rewarding way to use this card.

If you're struggling to hit the minimum monthly spend quotas, this is where your family members come in: rope them in to add their spending to the pool to fulfil the S$500, S$1,000, or S$2,000 monthly spend and get the most cashback possible each quarter.

UOB ONE Card Welcome Offer: Get S$350 Cash Credit as one of the first 200 new-to-UOB credit cardmembers with a minimum spend of S$1,000 per month for 2 consecutive months from card approval date. Valid till 30 April 2024. T&Cs apply.

#4: Citi PremierMiles Credit Card

The Citi PremierMiles Card lets you earn air miles at 1.2 miles per dollar spent locally, and 2 miles per dollar overseas.

And the best part is? All supplementary cards are free for life for Citi PremierMiles, so why not get your spouse and (fiscally responsible) kids a piece each and earn air miles on their spending, too?

💡Pro-tip: The Citi Prestige Card is another option that permits free supplementary cards for life.

And if you’re worried about a glut of miles, don’t: Citi Miles have no expiry date.

⚡Flash Deal⚡: Be one of the first 500 applicants to get a PlayStation 5 Disc Version (worth S$799) or Dyson Airwrap (worth S$859) or S$500 ecapitaVoucher when you apply for a Citi Card and spend a minimum of S$500 within 30 days of card approval. Remaining applicants will enjoy existing rewards. Applicable to new-to-Citibank cardmembers only. Promo runs from 9 April, 9AM SGT - 2 May 2024. T&Cs apply.

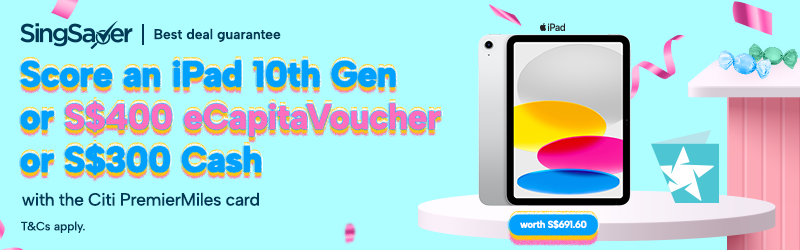

SingSaver's Exclusive Offer: Enjoy the following rewards when you sign up for a Citi PremierMiles Card:

Receive an Apple iPad 10th Gen Wifi 64GB (worth S$691.60) or Dyson Supersonic (worth S$699) or S$400 eCapitaVoucher or S$300 cash via PayNow upon activating and spending a minimum of S$500 within 30 days of card approval. Valid until 30 April 2024. T&Cs apply.

#5: OCBC 365 Credit Card

The OCBC 365 Credit Card offers up to S$160 cashback each month (or S$1,920 a year, not bad!), but you’ll have to spend at least S$1,600 monthly to get the cashback.

S$1,600 is a high monthly minimum to hit – but fret not. If you hit the first tier of a monthly S$800 monthly spend, you stand to get S$80 cashback each month, which is pretty decent as well.

Despite the slightly higher-than-average minimum monthly spend, some like it for the fact that there is no categorical limit on cashback earning, unlike other cards.

Recruit your family members to help you hit the monthly cap by pooling their transactions, especially if they frequently pay for online food delivery and dining (5% cashback), all petrol (6% cashback), groceries (3% cashback), Grab rides (3% cashback) and utility bills (3% cashback).

It’s somewhat of a pity that the OCBC 365 supplementary card annual fees are waived only for the first two years. If you really want to save on the annual fee, maybe put your children on rotation with this card.

#6: HSBC Advance Credit Card

The HSBC Advance Credit Card gives 1.5% cashback on all your spending, rising to 2.5% when you spend more than S$2,000 a month.

If you can’t quite hit this limit on your own, get your spouse and/or children supplementary cards to pool their purchases. And since you can apply for up to five supplementary cards free, there’s little reason not to.

While your base cashback is capped at S$70 per calendar month, you can earn an additional 1% HSBC Everyday+ Cashback for a maximum of 3.5% cashback when you fulfil the following criteria:

- Deposit fresh funds to your HSBC Everyday Global Account every calendar month via salary crediting and/or inward transfers from a non-HSBC bank account (minimum S$2,000 for HSBC Personal Banking customers and S$5,000 for HSBC Premier and Jade customers)

- Perform a minimum of five eligible transactions every calendar month.

The maximum bonus cashback per calendar month is capped at S$300 for HSBC Personal Banking customers, and S$500 for HSBC Premier and Jade customers.

SingSaver's Exclusive Offer: Enjoy the following rewards when you sign up for an HSBC Advance Card:

Receive a Dyson AM07 (worth S$459) or Apple Airpods (3rd Gen) With Magsafe Charging Case (worth S$274) or S$250 eCapitaVoucher or 15K Heymax Miles (worth a free flight to Tokyo, Japan) upon activating and spending min. S$500 by the end of the following calendar month from the card account opening date. Valid till 14 May 2024. T&Cs apply.

Similar articles

Best American Express Credit Cards in Singapore (2024)

Use These 7 Credit Cards To Pay For Your Grab Rides

Which Supplementary Cards Offer The Best Benefits?

Best UOB Credit Cards In Singapore (2024)

Best Dining Credit Cards in Singapore (2024)

Battle of Cards: The Ultimate Fight for the Best Credit Cards in Singapore

4 Types Of Credit Cards With Lifetime Annual Fee Waivers

Should You and Your S.O. Get A Couple’s Credit Card?