Singapore Airlines will end its pandemic-era KrisFlyer miles extension policy from 31 January 2023. Here’s what you need to know.

Article update: Singapore Airlines has since announced that KrisFlyer miles will be extended one “final” time for a further six months, meaning that the earliest any miles will expire is 31 July 2023.

While the past couple of years can’t have been fun for KrisFlyer members, at least they didn’t need to worry about their miles expiring. That’s because Singapore Airlines has been periodically extending the validity of KrisFlyer miles throughout the pandemic, starting from April 2020 onwards. Thanks to this, no miles have expired in nearly three years.

However, with restrictions lifted and travel making a roaring comeback, SIA has decided to revert to its pre-pandemic expiry policy from 31 January 2023 onwards.

“KrisFlyer miles expiring from January 2023 will no longer be eligible for complimentary extension as part of our COVID-19 membership support measures. Please be reminded to redeem your miles before they expire.”

- Singapore Airlines

This means that if you haven’t been redeeming your miles diligently ever since the borders reopened, you might soon find yourself with a problem on your hands...

Looking for the best credit cards to complement your spending patterns and expenditure in 2024? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

KrisFlyer miles expiring again from 31 January 2023

From 31 January 2023, Singapore Airlines will revert to its pre-pandemic expiry policy, where KrisFlyer miles expire after three years on the last day of the equivalent month in which they were earned. For example, all miles earned from 1 - 31 July 2019 expire on 31 July 2022.

The only exception is for Solitaire PPS and PPS Club members, whose miles never expire so long as they maintain their status.

You can see a summary of all miles due to expire in the next 12 months by logging in to your KrisFlyer account and clicking on Miles Validity.

KrisFlyer members have the option of paying for a one-time miles extension, which costs 1,200 miles or US$12 per 10,000 miles. This grants a 6 or 12-month extension, depending on tier.

KrisFlyer members have the option of paying for a one-time miles extension, which costs 1,200 miles or US$12 per 10,000 miles. This grants a 6 or 12-month extension, depending on tier.

|

|

KrisFlyer |

Elite Silver |

Elite Gold |

|

Fee per 10,000 miles |

1,200 miles or US$12 |

||

|

Extension |

6 mo. |

12 mo. |

12 mo. |

However, I’m not really in favour of paying this. All it does is kick the can a little further down the road (sacrificing 12% of them in the process), and it’s not like there’s a dearth of options for spending your miles.

Amex Singapore Airlines KrisFlyer Ascend Credit Card Welcome Gift:

For New-to-American Express Card Members: Receive S$300 eCapitaVouchers and up to 17,000 KrisFlyer Miles (enough to redeem a return trip to Bali) when you pay the annual fee and make a minimum spend of S$1,000 within the first month of card approval. Valid till 30 April 2024. T&Cs apply.

For Existing American Express Card Members: Receive up to 34,000 KrisFlyer Miles (enough to redeem a return trip to Bali) when you pay the annual fee and make a minimum spend of S$1,000 within the first month of card approval. Valid till 30 April 2024 T&Cs apply.

What to do with your expiring miles?

If you have miles that are due to expire from 31 January 2023 onwards, don’t panic. There’s still time to redeem them for a trip, even if you don’t intend to travel during the year-end break. In a worst-case scenario, you can still get some value by spending them on the ground, although I wouldn’t exactly call that a best practice.

The first-best solution is to redeem your miles for a flight, where you can get up to 5 cents per mile of value, depending on cabin and route.

Remember: just because your miles are expiring on a particular date does not mean you need to travel by that particular date. Miles can be used to book an award flight up to 355 days in advance on Singapore Airlines or any of its Star Alliance/other airline partners.

For example, if I have miles expiring on 31 January 2023, I could, on 30 January 2023, book an award flight departing up to 20 January 2024 (+355 days). In other words, miles expiry refers to the date they need to be redeemed by, not necessarily the date you need to travel by.

The only caveat I would add is that award tickets are valid for one year from date of issuance, so in our example above, the maximum I could push this flight out would be 29 January 2024.

Also, if I subsequently decide to cancel this ticket, I may not get a refund of my miles if the expiry date has passed. That’s because miles have a “memory”, and cancelling an award does not give them fresh validity. If I cancel my ticket after 31 January 2023, I will not get any miles back!

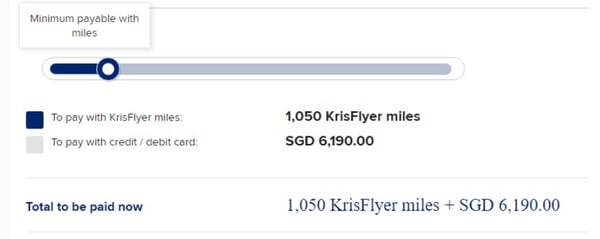

If finding award space is difficult, you can always spend your miles like cash for Singapore Airlines or Scoot tickets at a rate of 0.95 cents per mile. This allows you to select any seat available for sale, with the caveat that your value per mile will be much lower than redeeming an award ticket.

For those who don’t want to fly, you can spend your KrisFlyer miles on KrisFlyer vRooms and KrisShop at 0.8 cents each.

KrisFlyer vRooms is a portal that allows members to use their miles to book rental cars and hotels, while KrisShop is the airline’s online shopping portal. The main thing to highlight is the need to compare shops and ensure the prices quoted to you are competitive - if they’re inflated compared to other channels, then your real value will be lower than 0.8 cents per mile.

KrisFlyer members can spend their miles on Kris+ at a rate of 150 miles= S$1 (0.67 cents per mile). Kris+ has more than 300 dining, lifestyle and wellness merchants across Singapore, including chains like Challenger, Harvey Norman, Bottles & Bottles, Cedele and The Paradise Group.

If you’re determined to go down this path, I’d highly advise waiting for one of Kris+’s frequent miles-back promotions, which refunds part of the miles you use to pay. With a 40% miles-back offer, for example, your value per mile will be boosted to 1.11 cents apiece, a much more palatable scenario.

There are other things you can do with your KrisFlyer miles too, like spending them on activities booking platform Pelago or converting them into Linkpoints and Esso Smiles. However, the value you’ll get is rather poor, and it’s my belief that the ultimate “basement” for your cash out should be Kris+.

Remember: if you accept too low a valuation for your miles, you might as well have earned cashback in the first place!

Read these next:

- Testing, Vaccinations, Travel Insurance and Credit Cards: Your Year-End Travel Checklist

- Travel Insurance Plans For Stolen/Lost Phones: Claim Up To S$2,000

- Cash Vs Credit Card Vs Multicurrency Card For Travelling Overseas

Best ways of earning KF miles

For those looking to rake in the miles in 2023, which cards should you turn to? It all depends on what you’re spending on. Just as there’s no one tool for every household chore, there’s no such thing as a “best card”.

Here’s what I’d advise:

Contactless spending (every time you can tap to pay)

- UOB Preferred Platinum Visa: 4 mpd on the first S$1,110 per month, must use mobile payments

- UOB Visa Signature: 4 mpd on the first S$2,000 per statement month, with a min. spend of S$1,000 per statement month, can tap card or use mobile payments

UOB Credit Card Welcome Offer: Receive S$350 Cash Credit or up to 50,000 miles when you apply for select UOB credit cards and fulfil the minimum spending requirements. Valid till 30 April 2024. T&Cs apply.

Dining

- HSBC Revolution: 4 mpd on the first S$1,000 per month, either online or contactless

- UOB Lady’s Card: 4 mpd on the first S$1,000 per month, provided dining is chosen as your bonus category

- UOB Lady’s Solitaire Card: 4 mpd on the first S$3,000 per month, provided dining is chosen as your bonus category

Shopping

- HSBC Revolution: 4 mpd on the first S$1,000 per month, either online or contactless

- Citi Rewards Card: 4 mpd on the first S$1,000 per statement month, either online or offline

- OCBC Titanium Rewards: 4 mpd on the first S$13,335 per membership year, either offline or online

Petrol

- Maybank World Mastercard: 4 mpd, no caps or minimum spend

- UOB Lady’s Card: 4 mpd on the first S$1,000 per month, provided transport is chosen as your bonus category

- UOB Lady’s Solitaire Card: 4 mpd on the first S$3,000 per month, provided transport is chosen as your bonus category

General online transactions (e.g. Grab, Deliveroo, movie tickets)

- Citi Rewards Card: 4 mpd on the first S$1,000 per statement month spent online, except travel (e.g. airlines and hotels)

- DBS Woman’s World Card: 4 mpd on the first S$2,000 per month spent online

As always, be sure to read the individual card’s T&Cs to understand the definition of each category, and what Merchant Category Codes are included. Do also take note of the caps, which may either be based on the calendar month or statement month.

Conclusion

Singapore Airlines has signalled an end to its pandemic-era miles extension policy, which means that KrisFlyer miles will begin expiring again from 31 January 2023 onwards. This would be a good time to check your statement and see whether you have any miles affected, and if so, start to plan ways of using them.

To the extent possible, I would strongly advise you to use your miles for flights. This is simply the best way of getting value out of them, even if it does require some advance planning. Spending your miles on the ground will always be a second-best solution, and only to be considered if all else fails.

Similar articles

Travelling With Kids? Utilise Their Miles With KrisFlyer For Families

5 Things To Do Before The KrisFlyer Devaluation

Earn Elite Status Credits With KrisFlyer By Converting Credit Card Points (And More)

Can’t Fly Due To COVID-19 Circuit Breaker? Here’s What To Do With Your KrisFlyer Miles

Worried About KrisFlyer Miles Expiring Soon? Singapore Airlines Extends Them

Planning A Wedding? Here’s How To Earn The Most Miles Possible

Miles Credit Card Comparison: What’s Good For First-Time Miles Chasers?

Dining, Shopping, Workshops: Other Ways To Redeem KrisFlyer Miles This Year