The KrisFlyer UOB Credit Card offers a very attractive bonus rate on things you’re most likely to spend on – but it also comes with a major caveat of a miles credit delay of up to 14 months.

For lovers of all things Singapore Airlines, the KrisFlyer UOB Card needs no introduction. But for the uninitiated, this miles credit card might be the addition you need in your wallet to ace the miles game.

Birthed from the partnership between UOB and Singapore Airlines, this co-branded card served as a successful follow-up to its lacklustre debit card counterpart. It transformed both in looks and mechanics; now sporting a golden new look and promising a competitive miles earn rate over a broad range of categories.

Table of contents

- Overview: KrisFlyer UOB Credit Card

- Reasons to get the KrisFlyer UOB Credit Card

- Eligibility, fees & charges

- How to apply?

- Comparison: KrisFlyer UOB vs other KrisFlyer AMEX cards

- Is the KrisFlyer UOB Credit Card worth getting?

Looking for the best credit cards to complement your spending patterns and expenditure in 2024? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

What the KrisFlyer UOB Credit Card can do for you

KrisFlyer UOB card product summary:

- SIA-related spend – 3 miles per S$1 spend on Singapore Airlines, Scoot, KrisShop, and Kris+ purchases

- Everyday spend – 3 miles per S$1 spend on dining, online food delivery, online shopping, online travel, and transport spend

- Base miles rate – 1.2 miles per S$1 spend on all other purchases

- Minimum spend requirement: S$800 per year

- Annual income requirement: S$30,000 (Singaporeans/PRs), S$40,000 (Foreigners)

- Minimum age: 21 years old

- Annual fee: S$196.20 (First year waived)

|

Pros ✅

|

Cons ❌

|

|

Competitive 3 mpd on SIA-related and everyday spend

|

Only beneficial for frequent Singapore Airlines flyers

|

|

Respectable 1.2 mpd base rate on all other spend

|

Minimum S$800 annual spend must consist of SIA, Scoot, and KrisShop transactions

|

|

No cap on bonus miles earned

|

Miles are calculated in S$5 blocks

|

|

Minimum S$800 spend requirement by year, instead of by month

|

Bonus miles are only credited to KrisFlyer membership account after 14 months after paying annual fee*

AKA miles redemption is perpetually delayed |

|

No transfer fees for miles

|

|

|

Exclusive privileges on Scoot flights, KrisShop, and Changi airport benefits

|

|

|

Earn up to 6 bonus mpd with KrisFlyer UOB account

|

|

|

Fast track to KrisFlyer Elite status with minimum spend

|

|

|

Up to S$500,000 complimentary travel insurance coverage

|

|

|

Up to US$200 e-Commerce protection

|

|

*Does not apply to Kris+ Card transactions

KrisFlyer UOB Card Welcome Offer: Get up to 31,000 miles plus a first-year annual fee waiver when you are one of the first 100 eligible new-to-UOB credit cardmembers who apply and make a min. spend of S$2,000 within 2 months from card approval date. Valid till 30 April 2024 . T&Cs apply.

Why should you choose the KrisFlyer UOB Credit Card?

#1: Competitive 3 miles per S$1 spend on SIA-related and everyday spend

For context, the typical miles earn rate hovers around 1.2 to 1.4 mpd on local spend and 2 to 2.4 mpd on foreign spend. However, the KrisFlyer UOB Card offers an impressive 3 mpd rate across a broad range of categories no less.

The eligible 3 mpd spend categories are as follows:

- Singapore Airlines, Scoot, KrisShop, Kris+ purchases

- Dining (e.g. eateries, restaurants, bars, and fast food restaurants)

- Online food delivery (e.g. GrabFood, foodpanda, and honestbee)

- Online shopping (e.g. Fashion websites selling clothes, shoes, jewellery, accessories, and bags)

- Online travel transactions (e.g. Agoda, Airbnb, Kaligo, Expedia etc.)

- Transport (e.g. Gojek, Grab, SimplyGo, etc.)

Right off the bat, the KrisFlyer UOB is positioning itself as a great card for frequent flyers with Singapore Airlines and general everyday spend. However, the caveat is that the 3 mpd on everyday spend is only eligible if you spend a minimum of S$800 on the SIA-related categories annually.

No matter, this minimum spend should be fairly achievable. Firstly, it's by year and not by month, so time is on your side. Secondly, just charge one or two Singapore Airlines or Scoot air tickets and it'll already form a bulk of that minimum spend.

And once you fulfil that requirement, you're home free. There is no cap on bonus miles earned. You're more than welcome to rack up your spend to maximise bonus miles (as much as your budget allows).

Apart from that, you earn a respectable 1.2 mpd on all other spend – which is on par with its other credit card peers like DBS Altitude, HSBC TravelOne, or Standard Chartered Journey.

KrisFlyer UOB Card Welcome Offer: Get up to 31,000 miles plus a first-year annual fee waiver when you are one of the first 100 eligible new-to-UOB credit cardmembers who apply and make a min. spend of S$2,000 within 2 months from card approval date. Valid till 30 April 2024 . T&Cs apply.

#2: No transfer fee on miles

This point is self-explanatory; there is no transfer fee on miles because they're already KrisFlyer miles.

Base KrisFlyer miles will be credited directly to your KrisFlyer membership account each month. Unfortunately, the process isn't exactly the same for Bonus KrisFlyer miles.

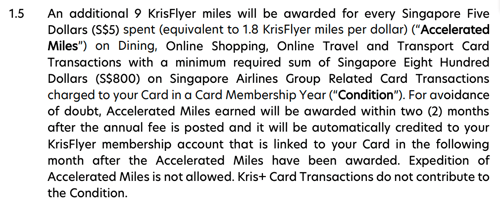

Source: UOB

Source: UOB

The Bonus KrisFlyer miles will be credited to your account only after you pay the KrisFlyer UOB Card's annual fee of S$196.20. Following that, you can expect to receive the bonus miles within two months of the payment.

Basically, there'll be a 14-month delay before your bonus miles can reach your account. There are several issues arising from this.

- There's less time to accumulate your miles. If your bonus miles take 14 months to be credited, this wastes a significant portion of your KrisFlyer miles' 36-month validity period. Overall, there's a tinier window of availability to earn and redeem valid KrisFlyer miles.

- You're locked into your card. If you want to cancel your KrisFlyer UOB Card, your pending bonus miles will be forfeited – unless you didn't spend with the card at all 14 months prior to the cancellation.

- You'll have difficulty reconciling bonus miles. Since the KrisFlyer UOB Card follows a blacklist approach, its list of eligible MCCs isn't explicitly stated. Knowing which merchants are eligible would require more deep-dive research and a bit of guesswork.

#3: Bonus 6 miles per S$1 spend with KrisFlyer UOB Account

KrisFlyer UOB Account

See more

See less

{"__typename":"BankAccount","applicationProcess":[{"data":null,"type":null}],"comparables":[{"__typename":"CompareElementSimple","description":"","displayValue":"1,000","prefix":"S$","sortValue":1000000,"suffix":"","title":{"display":"Min. Initial Deposit","key":"MIN_DEPOSIT_AMOUNT"},"tooltip":null},{"__typename":"CompareElementSimple","description":"","displayValue":"0.05","prefix":"","sortValue":-50,"suffix":"%","title":{"display":"Min Annual Interest Rate","key":"INTEREST_RATE"},"tooltip":null},{"__typename":"CompareElementSimple","description":"","displayValue":"0.05","prefix":"","sortValue":-50,"suffix":"%","title":{"display":"Max Annual Interest Rate","key":"MAX_INTEREST_RATE"},"tooltip":null}],"ctaButton":null,"description":{"shortDescription":[]},"disclaimer":null,"documents":null,"eligibility":[{"description":{"longDescription":null,"shortDescription":"No Requirement","tooltip":null},"type":{"display":"Min. Monthly Income","key":"MINIMUM_MONTHLY_INCOME"},"value":"0"},{"description":{"longDescription":null,"shortDescription":"18","tooltip":null},"type":{"display":"Minimum Age","key":"MINIMUM_AGE"},"value":"18"}],"enableCountdown":true,"enableFlipBanner":false,"featured":true,"features":{"cons":["Base interest rate of 0.05% p.a.","Bonus KrisFlyer miles earned will be capped at 5% of Monthly Average Balance in KrisFlyer UOB Account","Fall-below fee of S$2 if average daily balance falls below S$1,000","Early closure fee of S$30 if account is closed within 6 months"],"pros":["Earn KrisFlyer miles at a base rate of 0.4 miles per S$1 spend","Boost earn rate up to 6.4 KrisFlyer miles per S$1 spend when you credit your salary, spend, and save","Insured up to S$75,000 by SDIC. Additional T&Cs apply.","Read our full review of the KrisFlyer UOB Account"],"title":"Features"},"fees":[{"description":{"longDescription":"","shortDescription":"","tooltip":null},"type":{"display":"FALL_BELOW_MIN_DEPOSIT_FEE","key":"FALL_BELOW_MIN_DEPOSIT_FEE"},"value":"2"}],"functional":{"defaults":null,"fees":null,"metaData":{"alias":"krisflyer-uob-account"},"rateTableEntries":null},"id":"blt6e284a08a7f0d4c9_29_en-sg","image":{"description":"","dimension":null,"url":"https://images.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/bltb5cd299ee06025b0/5c529d87f1667cd10b7839e3/UOB.png"},"imageOrientation":null,"interestRateTiers":null,"productName":"KrisFlyer UOB Account","productPrivileges":null,"promotional":null,"provider":{"alias":"uob","providerName":"UOB"},"title":"SG.BA.UOBX0003.KRISFLYERUOBACCOUNT"}

(SizeLimitingPyMap: {__typename=BankAccount, applicationProcess=[{type=null, data=null}], comparables=[{__typename=CompareElementSimple, title={key=MIN_DEPOSIT_AMOUNT, display=Min. Initial Deposit}, sortValue=1000000, displayValue=1,000, tooltip=null, description=, prefix=S$, suffix=}, {__typename=CompareElementSimple, title={key=INTEREST_RATE, display=Min Annual Interest Rate}, sortValue=-50, displayValue=0.05, tooltip=null, description=, prefix=, suffix=%}, {__typename=CompareElementSimple, title={key=MAX_INTEREST_RATE, display=Max Annual Interest Rate}, sortValue=-50, displayValue=0.05, tooltip=null, description=, prefix=, suffix=%}], ctaButton=null, description={shortDescription=[]}, disclaimer=null, documents=null, eligibility=[{type={key=MINIMUM_MONTHLY_INCOME, display=Min. Monthly Income}, value=0, description={shortDescription=No Requirement, longDescription=null, tooltip=null}}, {type={key=MINIMUM_AGE, display=Minimum Age}, value=18, description={shortDescription=18, longDescription=null, tooltip=null}}], enableCountdown=true, enableFlipBanner=false, featured=true, features={title=Features, pros=[Earn KrisFlyer miles at a base rate of 0.4 miles per S$1 spend, Boost earn rate up to 6.4 KrisFlyer miles per S$1 spend when you credit your salary, spend, and save, Insured up to S$75,000 by SDIC. Additional <a href="https://assets.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/blt68e0388cac0285b9/6092579217fcd110074c9168/krisflyer-account-tnc.pdf" target="_blank">T&Cs</a> apply., Read our full review of the <a href="https://www.singsaver.com.sg/blog/krisflyer-uob-account-review" target="_blank">KrisFlyer UOB Account</a>], cons=[Base interest rate of 0.05% p.a., Bonus KrisFlyer miles earned will be capped at 5% of Monthly Average Balance in KrisFlyer UOB Account, Fall-below fee of S$2 if average daily balance falls below S$1,000, Early closure fee of S$30 if account is closed within 6 months]}, fees=[{type={key=FALL_BELOW_MIN_DEPOSIT_FEE, display=FALL_BELOW_MIN_DEPOSIT_FEE}, value=2, description={shortDescription=, longDescription=, tooltip=null}}], functional={metaData={alias=krisflyer-uob-account}, rateTableEntries=null, fees=null, defaults=null}, id=blt6e284a08a7f0d4c9_29_en-sg, image={url=https://images.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/bltb5cd299ee06025b0/5c529d87f1667cd10b7839e3/UOB.png, description=, dimension=null}, imageOrientation=null, interestRateTiers=null, productName=KrisFlyer UOB Account, productPrivileges=null, promotional=null, provider={alias=uob, providerName=UOB}, title=SG.BA.UOBX0003.KRISFLYERUOBACCOUNT})

{__typename=BankAccount, id=blt6e284a08a7f0d4c9_29_en-sg, image={url=https://images.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/bltb5cd299ee06025b0/5c529d87f1667cd10b7839e3/UOB.png, description=, dimension=null}, featured=true, promotional=null, comparables=[{__typename=CompareElementSimple, title={key=MIN_DEPOSIT_AMOUNT, display=Min. Initial Deposit}, sortValue=1000000, displayValue=1,000, tooltip=null, description=, prefix=S$, suffix=}, {__typename=CompareElementSimple, title={key=INTEREST_RATE, display=Min Annual Interest Rate}, sortValue=-50, displayValue=0.05, tooltip=null, description=, prefix=, suffix=%}, {__typename=CompareElementSimple, title={key=MAX_INTEREST_RATE, display=Max Annual Interest Rate}, sortValue=-50, displayValue=0.05, tooltip=null, description=, prefix=, suffix=%}], ctaButton=null, functional={metaData={alias=krisflyer-uob-account}, rateTableEntries=null, fees=null, defaults=null}, provider={alias=uob, providerName=UOB}, description={shortDescription=[]}, productName=KrisFlyer UOB Account, title=SG.BA.UOBX0003.KRISFLYERUOBACCOUNT, features={title=Features, pros=[Earn KrisFlyer miles at a base rate of 0.4 miles per S$1 spend, Boost earn rate up to 6.4 KrisFlyer miles per S$1 spend when you credit your salary, spend, and save, Insured up to S$75,000 by SDIC. Additional T&Cs apply., Read our full review of the KrisFlyer UOB Account], cons=[Base interest rate of 0.05% p.a., Bonus KrisFlyer miles earned will be capped at 5% of Monthly Average Balance in KrisFlyer UOB Account, Fall-below fee of S$2 if average daily balance falls below S$1,000, Early closure fee of S$30 if account is closed within 6 months]}, eligibility=[{type={key=MINIMUM_MONTHLY_INCOME, display=Min. Monthly Income}, value=0, description={shortDescription=No Requirement, longDescription=null, tooltip=null}}, {type={key=MINIMUM_AGE, display=Minimum Age}, value=18, description={shortDescription=18, longDescription=null, tooltip=null}}], enableCountdown=true, enableFlipBanner=false, documents=null, disclaimer=null, applicationProcess=[{type=null, data=null}], fees=[{type={key=FALL_BELOW_MIN_DEPOSIT_FEE, display=FALL_BELOW_MIN_DEPOSIT_FEE}, value=2, description={shortDescription=, longDescription=, tooltip=null}}], productPrivileges=null, interestRateTiers=null, imageOrientation=null}

(SizeLimitingPyMap: {badges={show=true, exclusive={background={color=#CCFBF1, opacity=100, rgba=rgba(204, 251, 241, 1), rgb=rgb(204, 251, 241), hex=#CCFBF1, css=#CCFBF1}, color={color=#0D968B, opacity=100, rgba=rgba(13, 150, 139, 1), rgb=rgb(13, 150, 139), hex=#0D968B, css=#0D968B}, text=Exclusive Offer}, featured={background={color=#FFF6EB, opacity=100, rgba=rgba(255, 246, 235, 1), rgb=rgb(255, 246, 235), hex=#FFF6EB, css=#FFF6EB}, color={color=#E9590C, opacity=100, rgba=rgba(233, 89, 12, 1), rgb=rgb(233, 89, 12), hex=#E9590C, css=#E9590C}, text=Featured}, welcome={background={color=#E5F4FF, opacity=100, rgba=rgba(229, 244, 255, 1), rgb=rgb(229, 244, 255), hex=#E5F4FF, css=#E5F4FF}, color={color=#0080F0, opacity=100, rgba=rgba(0, 128, 240, 1), rgb=rgb(0, 128, 240), hex=#0080F0, css=#0080F0}, text=Welcome Gift}, popular={background={color=#c6b0d9, opacity=100, rgba=rgba(198, 176, 217, 1), rgb=rgb(198, 176, 217), hex=#c6b0d9, css=#c6b0d9}, color={color=#9a6fbf, opacity=100, rgba=rgba(154, 111, 191, 1), rgb=rgb(154, 111, 191), hex=#9a6fbf, css=#9a6fbf}, text=Popular}, time_limited={background={color=#FEF1F1, opacity=100, rgba=rgba(254, 241, 241, 1), rgb=rgb(254, 241, 241), hex=#FEF1F1, css=#FEF1F1}, color={color=#DC2828, opacity=100, rgba=rgba(220, 40, 40, 1), rgb=rgb(220, 40, 40), hex=#DC2828, css=#DC2828}, text=Time Limited}, time_limited_countdown={background={color=#FEF1F1, opacity=100, rgba=rgba(254, 241, 241, 1), rgb=rgb(254, 241, 241), hex=#FEF1F1, css=#FEF1F1}, color={color=#DC2828, opacity=100, rgba=rgba(220, 40, 40, 1), rgb=rgb(220, 40, 40), hex=#DC2828, css=#DC2828}, text=}, best_value={background={color=#EBFEFF, opacity=100, rgba=rgba(235, 254, 255, 1), rgb=rgb(235, 254, 255), hex=#EBFEFF, css=#EBFEFF}, color={color=#088EAF, opacity=100, rgba=rgba(8, 142, 175, 1), rgb=rgb(8, 142, 175), hex=#088EAF, css=#088EAF}, text=Best Value}}, market=singsaver, product_money101={product=Optional.empty, comparables=[ANNUAL_FEE, MIN_SPEND_INSTALMENTS_TAX, MAX_CASHBACK_ONLINE_SHOPPING], ad_hoc_comparables=[], comparable_order=[], cta_button={show=true, url={url={type=EXTERNAL, content_id=null, href=}, open_in_new_tab=true, no_follow=false, sponsored=false, user_generated_content=false, rel=noopener}}}, product_moneyhero={product=Optional.empty, comparables=[MINIMUM_ANNUAL_INCOME, CASHBACK_LOCAL, ANNUAL_FEE], ad_hoc_comparables=[], reorder_comparables=[], cta_button={show=true, url={url={type=EXTERNAL, content_id=null, href=}, open_in_new_tab=true, no_follow=false, sponsored=false, user_generated_content=false, rel=noopener}}}, product_moneymax={product=Optional.empty, comparables=[MINIMUM_ANNUAL_INCOME, CASHBACK_LOCAL, ANNUAL_FEE], ad_hoc_comparables=[], reorder_comparables=[], cta_button={show=true, url={url={type=EXTERNAL, content_id=null, href=}, open_in_new_tab=true, no_follow=false, sponsored=false, user_generated_content=false, rel=noopener}}}, product_singsaver={comparables=[APR_WITH_YEARLY_INTEREST_RATE, MINIMUM_MONTHLY_INCOME, MINIMUM_MONTHLY_SPEND, FALL_BELOW_MONTHLY_FEES, PREVAILING_INTEREST_RATE, INTEREST_RATE_WITH_APR, INTEREST_RATE_WITH_EIR], product={id=59168069868, table_id=4702395, table_name=product_singsaver, columns={hs_id=59168069868, hs_child_table_id=0, hs_updated_at=1690878129679, hs_published_at=1714003203905, productid=blt6e284a08a7f0d4c9_29_en-sg, data={"__typename":"BankAccount","id":"blt6e284a08a7f0d4c9_29_en-sg","image":{"url":"https://images.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/bltb5cd299ee06025b0/5c529d87f1667cd10b7839e3/UOB.png","description":"","dimension":null},"featured":true,"promotional":null,"comparables":[{"__typename":"CompareElementSimple","title":{"key":"MIN_DEPOSIT_AMOUNT","display":"Min. Initial Deposit"},"sortValue":1000000,"displayValue":"1,000","tooltip":null,"description":"","prefix":"S$","suffix":""},{"__typename":"CompareElementSimple","title":{"key":"INTEREST_RATE","display":"Min Annual Interest Rate"},"sortValue":-50,"displayValue":"0.05","tooltip":null,"description":"","prefix":"","suffix":"%"},{"__typename":"CompareElementSimple","title":{"key":"MAX_INTEREST_RATE","display":"Max Annual Interest Rate"},"sortValue":-50,"displayValue":"0.05","tooltip":null,"description":"","prefix":"","suffix":"%"}],"ctaButton":null,"functional":{"metaData":{"alias":"krisflyer-uob-account"},"rateTableEntries":null,"fees":null,"defaults":null},"provider":{"alias":"uob","providerName":"UOB"},"description":{"shortDescription":[]},"productName":"KrisFlyer UOB Account","title":"SG.BA.UOBX0003.KRISFLYERUOBACCOUNT","features":{"title":"Features","pros":["Earn KrisFlyer miles at a base rate of 0.4 miles per S$1 spend","Boost earn rate up to 6.4 KrisFlyer miles per S$1 spend when you credit your salary, spend, and save","Insured up to S$75,000 by SDIC. Additional <a href=\"https://assets.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/blt68e0388cac0285b9/6092579217fcd110074c9168/krisflyer-account-tnc.pdf\" target=\"_blank\">T&Cs</a> apply.","Read our full review of the <a href=\"https://www.singsaver.com.sg/blog/krisflyer-uob-account-review\" target=\"_blank\">KrisFlyer UOB Account</a>"],"cons":["Base interest rate of 0.05% p.a.","Bonus KrisFlyer miles earned will be capped at 5% of Monthly Average Balance in KrisFlyer UOB Account","Fall-below fee of S$2 if average daily balance falls below S$1,000","Early closure fee of S$30 if account is closed within 6 months"]},"eligibility":[{"type":{"key":"MINIMUM_MONTHLY_INCOME","display":"Min. Monthly Income"},"value":"0","description":{"shortDescription":"No Requirement","longDescription":null,"tooltip":null}},{"type":{"key":"MINIMUM_AGE","display":"Minimum Age"},"value":"18","description":{"shortDescription":"18","longDescription":null,"tooltip":null}}],"enableCountdown":true,"enableFlipBanner":false,"documents":null,"disclaimer":null,"applicationProcess":[{"type":null,"data":null}],"fees":[{"type":{"key":"FALL_BELOW_MIN_DEPOSIT_FEE","display":"FALL_BELOW_MIN_DEPOSIT_FEE"},"value":"2","description":{"shortDescription":"","longDescription":"","tooltip":null}}],"productPrivileges":null,"interestRateTiers":null,"imageOrientation":null}, hs_name=, hs_initial_published_at=1713830411564, hs_created_at=1672893166167, hs_is_edited=false, hs_deleted_at=0, productname=KrisFlyer UOB Account, hs_updated_by_user_id=60412388}}, ad_hoc_comparables=[], reorder_comparables=[], cta_button={show=true, url={url={type=EXTERNAL, content_id=null, href=}, open_in_new_tab=true, no_follow=false, sponsored=false, user_generated_content=false, rel=noopener}}}, promotional={display_within_collapsible=true, show_banner=true, show_promotional_in_card=true}, static_text={rewards=Welcome offer, see_more=See more, see_less=See less, cta_button_label=Apply Now, cta_button_subtext=, yes=Yes, no=No, day=Day, days=Days}, style={primary={color=#00AAFB, opacity=100, rgba=rgba(0, 170, 251, 1), rgb=rgb(0, 170, 251), hex=#00AAFB, css=#00AAFB}, call_to_action_background={color=#F97316, opacity=100, rgba=rgba(249, 115, 22, 1), rgb=rgb(249, 115, 22), hex=#F97316, css=#F97316}, call_to_action_color={color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}, call_to_action_subtext_color={color=#687076, opacity=100, rgba=rgba(104, 112, 118, 1), rgb=rgb(104, 112, 118), hex=#687076, css=#687076}, theme=default, summary_section_label={color=#18794E, opacity=100, rgba=rgba(24, 121, 78, 1), rgb=rgb(24, 121, 78), hex=#18794E, css=#18794E}, star_rating={background={color=#FFFFFF, opacity=100, rgba=rgba(255, 255, 255, 1), rgb=rgb(255, 255, 255), hex=#FFFFFF, css=#FFFFFF}, fill={color=#FFFF04, opacity=100, rgba=rgba(255, 255, 4, 1), rgb=rgb(255, 255, 4), hex=#FFFF04, css=#FFFF04}}}, tabs={fees={labels={account_opening_fee=S$40, fee_amount=Overlimit fee: $40, minimum_trading_fee=S$40, fee_frequency=Fee Frequency, duration_of_inactivity=Duration of Inactivity, duration_of_inactivity_indicator=Duration of Inactivity Indicator}, show=false, expanded=false, order_sequence=1, heading=Fees}, promotions_terms_and_conditions={expanded=false, show=true, order_sequence=1, heading=Terms & Conditions, additional_offer=Additional Offer, exclusive_offer=Exclusive Offer, welcome_offer=Welcome Offer}, usage={show=false, expanded=false, order_sequence=1, heading=Usage, labels=[]}, show=true, features={show=true, expanded=true, order_sequence=1, heading=Features}, eligibility={show=true, expanded=false, order_sequence=1, heading=Eligibility, text=Eligibility}, basic_benefit={show=true, expanded=false, order_sequence=1, heading=Basic Benefits, items=[]}, enhanced_benefit={show=true, expanded=false, order_sequence=1, heading=Enhanced Benefits, items=[]}, other_benefit={show=true, expanded=false, order_sequence=1, heading=Other Benefits, items=[]}, benefit_limits={show=true, expanded=false, order_sequence=1, heading=Benefit Limits, items=[]}}, type=module})

null

(SizeLimitingPyMap: {columns={hs_id=59168069868, hs_child_table_id=0, hs_updated_at=1690878129679, hs_published_at=1714003203905, productid=blt6e284a08a7f0d4c9_29_en-sg, data={"__typename":"BankAccount","id":"blt6e284a08a7f0d4c9_29_en-sg","image":{"url":"https://images.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/bltb5cd299ee06025b0/5c529d87f1667cd10b7839e3/UOB.png","description":"","dimension":null},"featured":true,"promotional":null,"comparables":[{"__typename":"CompareElementSimple","title":{"key":"MIN_DEPOSIT_AMOUNT","display":"Min. Initial Deposit"},"sortValue":1000000,"displayValue":"1,000","tooltip":null,"description":"","prefix":"S$","suffix":""},{"__typename":"CompareElementSimple","title":{"key":"INTEREST_RATE","display":"Min Annual Interest Rate"},"sortValue":-50,"displayValue":"0.05","tooltip":null,"description":"","prefix":"","suffix":"%"},{"__typename":"CompareElementSimple","title":{"key":"MAX_INTEREST_RATE","display":"Max Annual Interest Rate"},"sortValue":-50,"displayValue":"0.05","tooltip":null,"description":"","prefix":"","suffix":"%"}],"ctaButton":null,"functional":{"metaData":{"alias":"krisflyer-uob-account"},"rateTableEntries":null,"fees":null,"defaults":null},"provider":{"alias":"uob","providerName":"UOB"},"description":{"shortDescription":[]},"productName":"KrisFlyer UOB Account","title":"SG.BA.UOBX0003.KRISFLYERUOBACCOUNT","features":{"title":"Features","pros":["Earn KrisFlyer miles at a base rate of 0.4 miles per S$1 spend","Boost earn rate up to 6.4 KrisFlyer miles per S$1 spend when you credit your salary, spend, and save","Insured up to S$75,000 by SDIC. Additional <a href=\"https://assets.contentstack.io/v3/assets/bltc05b5aa7ae1c3a47/blt68e0388cac0285b9/6092579217fcd110074c9168/krisflyer-account-tnc.pdf\" target=\"_blank\">T&Cs</a> apply.","Read our full review of the <a href=\"https://www.singsaver.com.sg/blog/krisflyer-uob-account-review\" target=\"_blank\">KrisFlyer UOB Account</a>"],"cons":["Base interest rate of 0.05% p.a.","Bonus KrisFlyer miles earned will be capped at 5% of Monthly Average Balance in KrisFlyer UOB Account","Fall-below fee of S$2 if average daily balance falls below S$1,000","Early closure fee of S$30 if account is closed within 6 months"]},"eligibility":[{"type":{"key":"MINIMUM_MONTHLY_INCOME","display":"Min. Monthly Income"},"value":"0","description":{"shortDescription":"No Requirement","longDescription":null,"tooltip":null}},{"type":{"key":"MINIMUM_AGE","display":"Minimum Age"},"value":"18","description":{"shortDescription":"18","longDescription":null,"tooltip":null}}],"enableCountdown":true,"enableFlipBanner":false,"documents":null,"disclaimer":null,"applicationProcess":[{"type":null,"data":null}],"fees":[{"type":{"key":"FALL_BELOW_MIN_DEPOSIT_FEE","display":"FALL_BELOW_MIN_DEPOSIT_FEE"},"value":"2","description":{"shortDescription":"","longDescription":"","tooltip":null}}],"productPrivileges":null,"interestRateTiers":null,"imageOrientation":null}, hs_name=, hs_initial_published_at=1713830411564, hs_created_at=1672893166167, hs_is_edited=false, hs_deleted_at=0, productname=KrisFlyer UOB Account, hs_updated_by_user_id=60412388}, id=59168069868, table_id=4702395, table_name=product_singsaver})

As if the bonus 3 mpd rate isn't enough, KrisFlyer UOB Accountholders can earn even more miles of up to 6 mpd! How does that work? You'll need to meet to criteria to qualify for this accelerated rate:

- Credit a minimum S$1,600 monthly salary through GIRO

- Maintain a minimum S$1,000 deposit balance per month

And, that's about it. No minimum credit card spend requirement, no additional insurance product purchases, no need to take up loans – nothing. Fulfil these two base requirements and you can start earning 6 mpd on all eligible KrisFlyer UOB spend.

The only downside is that these bonus miles earned on your account are capped at 5% of its monthly average balance. For more details on account mechanics, refer to the T&Cs here.

💡 Fun fact: The only other miles cards offering this 6 mpd rate are also from UOB – the UOB Lady's & Lady's Solitaire Cards.

#4 Exclusive travel privileges with Scoot, KrisShop, and Changi Airport

While regular credit cards already offer a myriad of perks and benefits, a co-branded credit card just takes it to the next level. As a KrisFlyer UOB cardmember, you'll be entitled to card privileges from both UOB's and Singapore Airlines' end.

Here are all the current ongoing promotions:

|

Exclusive privileges

|

Travel privileges

|

Scoot privileges

|

|

Get up to 5 mpd on all foreign currency transactions. Min. S$1,500 in foreign currency spend required.

Bonus miles capped at 7,600 miles per qualifying period.

Valid till 28 Aug 2023. SMS registration is required.

|

Welcome offer: New-to-UOB cardmembers get up to 31,000 miles* + first year annual fee waiver. T&Cs apply. |

Priority check-in and boarding on flights

|

|

Earn 1 mpd on monthly bills, rent, taxes, and one-off big-ticket purchases via UOB Payment Facility.

|

Renewal offer: Get 10,000 miles when you pay annual fee and renew card membership

|

Additional 5kg baggage allowance when up to 35kg baggage allowance is purchased

|

|

Get S$20 off regular-priced items with min. S$120 nett spend on a single KrisShop transaction.

Promo code: KFUOBKS2023

|

Fast track upgrade to KrisFlyer Elite Silver status when you spend min. S$5,000 on SIA Group-related transactions.

|

Standard seat selection on flights

|

|

Complimentary tier upgrade to KrisShopper Insider with no min. spend.

Earn up to 5.5 mpd on KrisShop spend thereafter.

|

Get S$15 off ChangiWiFi

|

One-time booking flexibility waiver per itinerary

|

|

Get S$10 off eligible Kris+ spend when you sign up for Kris+ membership.

Promo code: KPUOB23 (during first log-in)

Valid till 31 Jul 2023.

|

Get S$15 off Grab rides to and from Changi airport.

Limited to 1x redemption biannually. Limited to first 1,000 redemptions per month.

Promo code: KFUOBCC

|

|

|

*Consists of 20,000 miles for new-to-UOB card applicants, 5,000 miles for first-time applicants, and 6,000 miles with min. S$2,000 SIA-related spend within 60 days of card approval

|

||

KrisFlyer UOB Card Welcome Offer: Get up to 31,000 miles plus a first-year annual fee waiver when you are one of the first 100 eligible new-to-UOB credit cardmembers who apply and make a min. spend of S$2,000 within 2 months from card approval date. Valid till 30 April 2024 . T&Cs apply.

Read more:

Credit Card Promotions: Exclusive on SingSaver

Credit Card Welcome Offer: A Comparison of The Best Gifts

What charges or fees should you look out for?

- Annual fee: S$196.20 (First year waived)

- Late payment charge: S$100 if minimum payment is not received by due date

- Cash advance fee: 8% of due amount, subject to S$15 minimum fee

- Minimum monthly payment: 3% of current balance or $50, whichever is higher, plus any overdue amounts

- Overlimit fee: S$40 if the total outstanding card balance exceeds the total credit limit at any time

- Foreign currency transaction fee: 3.25% on converted amount (1% retained by Mastercard)

- Interest on purchases: 27.8% p.a. on amount unpaid (including late payment charges) until outstanding is paid in full

- Interest on cash advance: 28.5% p.a. from the date of the cash advance until the date the outstanding is paid in full

- Additional interest: 3% p.a. on top of prevailing interest on any remaining unpaid amount if minimum payment is overdue

Eligibility criteria

- At least 21 years of age

- Minimum annual income for Singapore citizens and PRs: S$30,000 or a fixed deposit collateral of at least S$10,000

- Minimum annual income for foreigners: S$40,000 or a fixed deposit collateral of at least S$10,000

How to apply?

Click on the ‘Apply Now’ button on this page and complete the application form on SingSaver site using your Singpass MyInfo. Otherwise, you might need to prepare the following documents for the application process:

- Front and back of NRIC/Passport/Employment Pass

- Salaried employees (Singaporeans/PRs):

- Fixed monthly salary ≥ S$2,500: Past 12 months' CPF statement or latest Income Tax Notice of Assessment or latest original computerised payslip

- Fixed monthly salary < S$2,500: Past 12 months' CPF statement or latest Income Tax Notice of Assessment or latest 3 months' computerised payslip

- Length of employment < 3 months: Last computerised payslip or Company Letter certifying employment & monthly salary

- Self-employed: Latest Income Tax Notice of Assessment

How does KrisFlyer UOB card compare to KrisFlyer AMEX cobrand cards?

|

|

KrisFlyer UOB Credit Card

|

KrisFlyer AMEX Credit Card

|

KrisFlyer AMEX Ascend

|

|

Income Requirement

|

$30,000

|

$30,000

|

$50,000

|

|

Annual Fee

|

S$196.20 (First year waived)

|

S$179.85 (First year waived)

|

S$343.35

|

|

Overseas Transaction Fee

|

3.25%

|

2.5%

|

2.5%

|

|

Local Earn Rate

|

1.2 mpd

|

1.1 mpd

|

1.2 mpd

|

|

Overseas Earn Rate

|

1.2 mpd

|

2 mpd in June/Dec, otherwise 1.1 mpd

|

2 mpd in June/Dec, otherwise 1.2 mpd

|

|

Bonus Earn Rate

|

3 mpd on SIA-related transactions

3 mpd on dining, transport, online shopping and travel (provided min $800 annual spend on SIA-related transactions)

|

2 mpd on Singaporeair.com transactions

3.1 mpd on Grab, first $200 each month

|

2 mpd on Singaporeair.com transactions

3.2 mpd on Grab, first $200 each month

|

|

Other Benefits

|

10,000 miles with payment of annual fee

Fast track to KrisFlyer Elite Silver with $5K SIA-related spend

Scoot privileges

2x $15 Changi WiFi codes

2x $15 Grab codes

$20 KrisShop rebate |

$150 cashback with min. $12,000 spend on singaporeair.com

|

4 lounge passes per year

One complimentary night at selected Hilton hotels and resorts

Hilton Silver status

Fast track to KrisFlyer Elite Gold with $15,000 spend on singaporeair.com

|

Should you get the KrisFlyer UOB Credit Card?

All things considered, the KrisFlyer UOB Card offers a very attractive bonus rate on things you’re most likely to spend on, but that comes with a major caveat of a credit delay of up to 14 months.

If you’re thinking of getting this card, you need to consider whether you’re willing to be locked into the card until your bonus miles post, and how the delayed crediting affects your timelines for award redemptions.

For obvious reasons, frequent flyers or loyal fans of Singapore Airlines and Scoot would benefit the most from this card. Or even if they're not your go-to air carrier of choice, you can always help your friends and family book tickets on their behalf too. And tada! You're on track to effortlessly earning an accelerated 3 mpd on your everyday spend.

KrisFlyer UOB Card Welcome Offer: Get up to 31,000 miles plus a first-year annual fee waiver when you are one of the first 100 eligible new-to-UOB credit cardmembers who apply and make a min. spend of S$2,000 within 2 months from card approval date. Valid till 30 April 2024 . T&Cs apply.

Looking for other UOB credit cards? Check out more.

Similar articles

How to Buy Coffee Machines in Singapore and Save Money

What Are The Best Credit Cards You Should Be Paying Medical Bills With?

3 Ways Technology is Changing Money for Singaporeans

How to Cancel Travel Insurance Policy and Get a Refund on Premiums

Critical Illness vs Cancer Insurance Plans: A Critical Comparison

4 Things to Note When Applying for a Loan as a Self-employed Person

Kris+ App: Foolproof Hacks To Pile On Your Rewards And Miles Here

Best Infant Care & Childcare Singapore | Fees & Subsidy 2021