Not all bank accounts are made equal. Here's what you need to know.

We keep hearing about how bank accounts are “all the same”, but it’s not true. There are significant differences between bank accounts, and it’s important to pick the one that serves your purpose. Brief yourself on these account types, so you can make an informed choice:

Common types of bank accounts

The common types of bank accounts to understand are:

1. Current Account

A current account is a type of transactional account. That means it’s not meant for storing large sums of money for long periods. The main reason to have a current account is to use it as a mode of payment — it’s convenient as you can make payments with a linked debit card, pay through online banking, perform a money transfer to other accounts, etc.

Current accounts are often regarded as non-interest bearing accounts. Current accounts also tend to have minimum balance fees. For example, the OCBC and UOB Current Accounts charge a minimum balance fee of $7.50 if you can’t maintain at least S$3,000 daily in the account.

Current Accounts are good for:

- A convenient mode of payment, which can be accessed through online banking, debit cards, or ATMs.

- Keeping your money safe (deposits are insured for up to S$50,000).

- Holding funds that you use for regular spending, such as going to the movies or shopping.

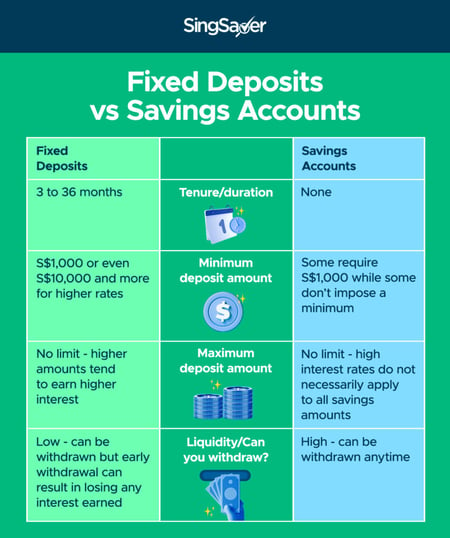

2. Savings Account

This is the type of account used to hold your emergency fund, or for short-term savings.

For example, if you have an emergency fund of six months of your income, it would be unsafe to store so much money at home. Even with home insurance, many policies don’t cover lost cash or will cover it only up to a few hundred dollars.

The typical savings account has an interest rate from 0.05% p.a. However, many accounts have bonus tiers that can easily earn you 1-2% interest rates. For example, the Standard Chartered Bonus$aver account is a multiplier account that offers up to 2.38% interest p.a. You can earn this attractive interest rate on your first S$80,000 deposit, provided that you consolidate your card spends, salary credit, bill payments and wealth needs in a single Bonus$aver account.

At the same time, you can’t put it in a fixed deposit, as it would be difficult to withdraw the money without paying a penalty. You also want to enjoy a higher interest rate, compared to current accounts. This is also because your emergency fund may only be used once every few years.

Alternatively, get updates on the best savings account interest rates at SingSaver, if multiplier or tiered interest rates do not appeal to you.

As with current accounts, a savings account provides a convenient mode of payment. You can also access it through online banking, debit cards, ATMs, and other facilities.

Savings Accounts are good for:

- Holding your emergency fund

- Keeping money that you use infrequently (once every few years), but that you may need on short notice

- Keeping your money safe (deposits are insured for up to $50,000)

- A convenient mode of payment, similar to current accounts

3. Multi-Currency Account

Many bank accounts in Singapore only holds Singapore dollars, so if you were to receive payment in Australian dollars, it would have to be immediately converted to Singapore dollars to go into your current account.

This can cause you to lose money if you’re forced to make the exchange when the Singapore dollar is weak. As such, people who often receive or spend money in multiple currencies – such as foreign workers or business owners – may prefer a multi-currency account (MCA).

An MCA allows you to hold different types of currency, without having to immediately convert it. In addition, you avoid foreign exchange costs when buying in different currencies.

For example, say you have both US dollars and Singapore dollars in the same MCA. While you’re shopping abroad, you can spend directly from the US dollars in your account with no need to convert your cash into Singapore dollars.

Multi-Currency Accounts are good for:

- People who often receive or spend in foreign currencies

- Frequent flyers

- Business owners who have holdings in different countries

4. Fixed Deposit

A Fixed Deposit (FD) is a bank account meant to hold and grow money, over long periods. It's also commonly known as a time deposit.

The interest rate on FDs is higher than most other accounts, sometimes reaching 0.8% to 1%. FDs have a maturity date, at which point all the cash, plus the accrued interest, is given back to the depositor. This maturity date can range from one month to as long as three years.

If you attempt to withdraw the money before the maturity date, however, you will face a penalty. This is usually the loss of all the accrued interest, although other fees can be imposed as well. Ideally, this won't happen because you're the one determining how much to deposit beforehand.

This fixed deposit amount is in stark contrast to the other three bank account types listed, where you can make deposits and withdrawals at any time.

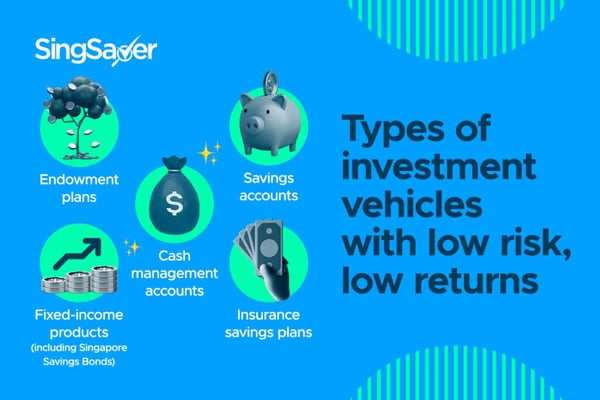

FDs are often used to hold and grow cash during periods of economic uncertainty. An example is the aftermath of a major recession when investors are unsure where to invest.

FDs may also be used by people nearing retirement, who are more focused on protecting their wealth than growing it with riskier assets like stocks.

Fixed Deposits are good for:

- Older investors, who are focused on wealth protection rather than accumulation

- A safe haven in periods of economic uncertainty

- Depositors who are absolutely certain they won’t need the money until the maturity date is up

Read these next:

Best Savings Accounts in Singapore to Park Your Money (2021)

Endowment vs Insurance Savings vs Bank Savings: What’s The Difference?

3 Reasons Why Cash is King in Uncertain Times Like COVID-19

Fixed Deposits in Singapore: Complete 2021 Guide

How to Pick a Savings Account (When They All Look the Same)

Similar articles

4 CEO-Proven Tips For a Healthier Bank Account

Best USD Fixed Deposits: A Comparison Of Interest Rates (January 2023)

Interest Rate Hike? Here’s Why You Should Grow Your Funds With Sing Investments & Finance Ltd

Current Account, Savings Account (CASA) Singapore: Complete 2019 Guide

HSBC Everyday Global Account (EGA) Review: Multiple Ways to Stack Rewards

14 Best Fixed Deposit Rates in Singapore to Lock in Your Savings (2024)

Fixed Deposits vs. Endowment Plans vs. Cash Management Accounts: Which Should You Choose?

7 Good Reasons to Change Your Savings Account