Compare and Find the Best Car Insurance Quotes of 2025 Online in Singapore

Don't miss the daily Flash Deals at 2 PM & 8 PM to snag S$250 worth of petrol vouchers. SingSaver helps you discover car insurance plans that best fit your and your family's needs. Benefit from SingSaver's exclusive offers and discounts today! Need help deciding? Reach out to our licensed brokers, and we'll get back to you within 24 hours.

The quote is for , years old with years driving experience, NCD and number of claims.

Getting best prices for you...

Compare car insurance rates by companies

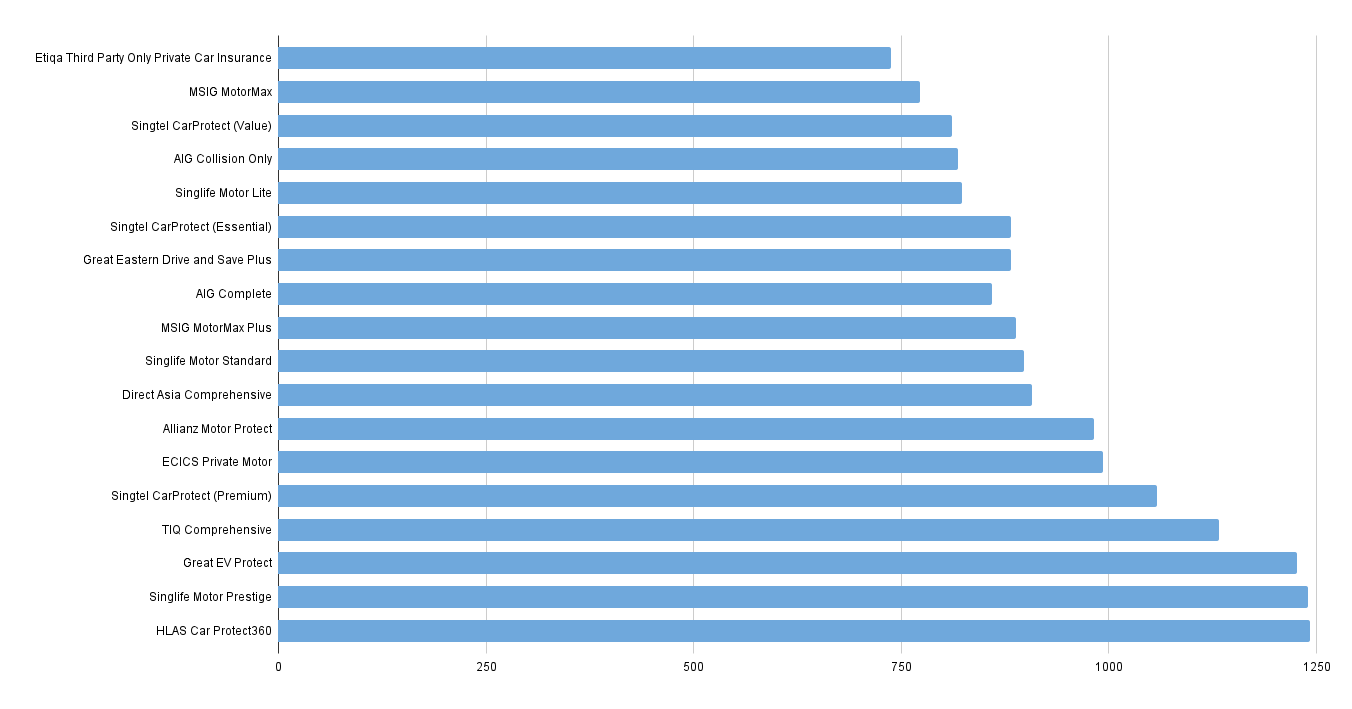

At SingSaver, we've curated the top picks for car insurance companies in Singapore to help you find the perfect plan. We offer a wide range of options, from comprehensive coverage to third-party only, to suit every need and budget. Check out these coverage rates for a married male with at least three years of driving experience, 50% NCD, and 0 claims:

Average monthly rates

The prices below are the starting rates, which also means that the actual cost of your car insurance plan may increase depending on your individual coverage and other factors.

- Personal finance is not just about finding the cheapest products, but also about making smart financial decisions.

- SingSaver's expert team analyses and compares over 350 financial products from more than 60 trusted financial institutions, spanning 42 categories including credit cards, loans, investments, and insurance.

- Every month, over 2 million users visit SingSaver and Seedly, with more than 100,000 users applying for financial and insurance products through our platform.

- As a leading personal finance comparison platform in the Asia-Pacific region, SingSaver is part of a company publicly listed on the NASDAQ Stock Exchange (NASDAQ: MNY).

Table of Contents

- Compare car insurance rates by companies

- How to compare car insurance quotes

- How to estimate your car insurance costs

- Ways to get a quote for your car insurance

- Car insurance rates vs. quotes

- Comparing car insurance quotes side by side

- What Reddit users are saying about car insurance

- Car insurance rates

- Frequently asked questions about car insurance

How to compare car insurance quotes

To make the process of choosing and comparing car insurance quotes easier, follow the tips below.

Gathering the right information

Just as you would have the information about your property when looking for home insurance quotes, you also need certain details for your auto insurance. So, before you start comparing quotes, it's important to gather the necessary information about yourself and your vehicle.

Driver details

- Age, occupation, and marital status

- Driving experience

- NCD status

- Past accidents or claims

Vehicle details

- Make, model, and manufacture year

- Purchase year

- Mileage

- Current market value of the car

- Current car insurance provider (if applicable)

Choosing the right coverage

There are two main types of car insurance coverage in Singapore:

- Third-Party Only: This is the most basic and affordable type of coverage, which only covers damage or injury you cause to others. Also, it doesn't cover damage to your own vehicle.

- Comprehensive: This is the most extensive type of coverage, which covers damage to your own vehicle as well as damage or injury you cause to others. It also includes additional benefits like fire and theft coverage, and coverage for natural disasters.

Remember, the right type of coverage depends on your individual needs and circumstances. For instance, third-party-only coverage is a budget-friendly option that suits drivers with older vehicles, where comprehensive coverage may not be cost-effective. On the other hand, comprehensive coverage offers extensive protection and peace of mind, especially for those with newer or more expensive vehicles.

Take a moment to determine your ideal coverage levels. The default options presented in online quotes might not align with your needs, so consider customising your quotes by adjusting liability limits and adding optional coverages like comprehensive and collision.

Conduct quote comparisons using SingSaver's comparison tool

When comparing car insurance quotes, ensure consistency across all options. Make sure you're comparing apples to apples and ensure that the quotes you're comparing have similar coverage limits and benefits. This practice enables informed decision-making based on a true assessment of value.

Consider these other key factors:

- Claim excess and deductibles: The excess is the amount you have to pay out of pocket in the event of a claim. Choosing a higher excess can lower your premium, but make sure you can afford to pay it if you need to make a claim.

- Additional benefits: Some policies may include additional benefits like roadside assistance, loss of use coverage, and medical expenses coverage.

To make the process of comparing car insurance quotes easier, we've created a comparison tool that allows you to compare quotes from different providers and find the best deal for your needs.

- Enter your car details: Start by entering your car brand, model, and year of manufacture.

- Customise the filters: Next, customise the filters based on your personal details, such as gender, marital status, age, driving experience, NCD, and the number of claims in the last three years.

- Update and compare: Once you've entered your details and customized the filters, click "Update Quote" to generate a list of personalised car insurance quotes. Compare the quotes side-by-side to find the best deal for your needs.

Know the insurance provider

When comparing car insurance quotes, don't just focus on the premium price. Research the insurance provider’s reputation for customer service and claims processing. While at it, read online reviews and check independent ratings to get an idea of the insurance provider’s reliability and customer satisfaction.

Additionally, ensure the companies offer the features that are important to you. For instance, if you prefer online claims filing, check if their website or app supports this functionality.

Evaluate the overall value

If you're also looking for other insurance policies, such as home insurance, explore bundling options with your car insurance. Opting for a multi-policy approach with a single insurance provider’s can often reveal opportunities for discounts and streamline policy management.

However, it's still wise to compare prices and coverage from separate companies to ensure you're getting the best overall value.

Saver-savvy tip

If you're not a fan of phone calls, compare car insurance quotes online and get personalised quotes from insurance provider’s without having to pick up the phone. This allows you to find the best coverage at the best price, all from the comfort of your own home (and without the dreaded hold music!).

Don't assume your current insurance policy remains the best option, especially if you've moved or your circumstances have changed. Proactively comparing rates from different insurance provider’s can uncover significant savings opportunities, potentially leading to better coverage for a fraction of the cost. Take charge of your insurance journey and ensure you're getting the most value for your money.

When comparing insurance quotes, pay close attention to the policy term. Don't get caught out by shorter terms that appear cheaper upfront! Always ensure you're comparing quotes for the same coverage period to make a fair and accurate decision.

How to estimate your car insurance costs

Estimating your car insurance costs in Singapore can be tricky, as several factors influence the final premium:

- Car model and age: The type of car you drive and its age significantly impact the cost. For instance, newer, more expensive cars generally attract higher premiums due to their higher value and repair costs.

- Driver's age and experience: Younger and less experienced drivers typically pay higher premiums due to their higher risk profile. But as you gain more driving experience and maintain a clean driving record, your premiums may decrease.

- No Claim Discount (NCD): NCD is a valuable discount awarded to drivers with a history of no claims. The discount increases for each consecutive year of no claims, up to a maximum of 50%. Also, maintaining a good NCD can significantly lower your premiums.

- Coverage type: The type of coverage you choose also affects the cost. Comprehensive coverage, which offers the most extensive protection, is typically more expensive than third-party-only coverage.

- Other factors: Additional factors such as your driving history, the excess amount you choose, and any optional add-ons like roadside assistance can also influence the final cost.

Ways to get a quote for your car insurance

You can get car insurance quotes through various methods, each with specific advantages and disadvantages.

Direct quotation online or via phone

Getting instant car insurance quotes is a breeze with SingSaver's user-friendly platform. Simply enter your vehicle and driver details, and we'll generate personalised quotes from multiple insurance providers, including Allianz, AIG, DirectAsia, MSIG, and more. And if you need comprehensive and collision coverage, you can also customise your coverage options to see how they impact your quote.

Pros:

- Get instant quotes from multiple insurance providers and buy your car insurance online without making multiple phone calls or entering your information repeatedly.

- Compare quotes and apply for car insurance online from the comfort of your own home.

- Customise your coverage options to fit your specific needs and budget.

Cons:

- You may not have access to all insurance providers in the market, as some smaller insurance providers may not be available on SingSaver's platform.

Using an insurance comparison website

For a streamlined approach, consider using online comparison platforms to explore multiple car insurance quotes simultaneously.

SingSaver, for example, offers a user-friendly tool that allows you to input your car details and customise filters based on your personal information to generate personalised quotes. Simply enter your details and vehicle information, and the platform will match you with suitable car insurance providers. Keep in mind that you might need to visit individual insurance providers’; websites for a final personalised quote.

Pros:

- Online comparison platforms save you time by allowing you to check out several companies at once.

- These platforms are ideal for users who prefer to compare and purchase car insurance online instead of making phone calls.

- Comparison sites often pre-fill some of your information with insurance providers, saving you from repetitive data entry.

Cons:

- Depending on your individual circumstances and the platform's partnerships, you may not see quotes from all available insurance providers in the market.

- Be prepared for potential follow-up phone calls or emails from insurance providers, as comparison sites often share your information with their partners.

- Some platforms may partner with a limited number of carriers, which could restrict your choices.

Using an insurance broker

An independent insurance agent can offer a wider range of car insurance options from multiple insurance providers. They can help you compare quotes, find the best policy for your needs, and show you how to buy car insurance efficiently. However, traditional brokers may charge a fee for their services.

SingSaver:

- Our online comparison tool is completely free to use, allowing you to save on broker fees.

- Get instant quotes from multiple insurance providers without having to wait for a broker to get back to you.

- Enjoy exclusive discounts and promotions on car insurance plans when you apply through SingSaver.

- Our objective car insurance reviews and comparisons help you make informed decisions without any pressure from a broker.

Traditional brokers:

- Unlike SingSaver, a traditional broker may charge a fee for their services.

- It may take some time for brokers to gather quotes from different insurance providers.

- Access to exclusive discounts and promotions may be limited when using a traditional broker.

- There is also a risk of potential bias towards certain insurance providers or insurance products.

MORE: How to buy car insurance

Car insurance rates vs. quotes

It's important to understand that advertised car insurance rates are often just estimates and may differ from the final quote you receive. While these rates provide a general idea of what you might pay, they don't consider your unique circumstances.

Several factors can influence your final car insurance premium, including your claim history, vehicle modifications, and even your occupation. For example, if you've made multiple claims in the past or have modified your vehicle with performance-enhancing parts, your premium could be higher than the advertised rate.

However, SingSaver's comparison tool helps bridge this gap by considering your personal details and providing more accurate quotes tailored to your specific situation. By inputting your information, such as your age, driving experience, NCD, and claim history, our tool can generate quotes that more closely reflect the actual premium you'll pay. At the same time, this personalised approach ensures you get a realistic estimate and can make informed decisions about your car insurance coverage.

Comparing car insurance quotes side by side

Below is an illustration of three car insurance quotes as well as advice on how to compare them:

| Car insurance | Coverage highlights | Claim excess | Starting price |

|---|---|---|---|

| Great Eastern Drive and Save Plus | Death benefits of S$120,000 for you and S$50,000 for authorised drivers/passengers. | From S$500 | S$882 |

| Singlife Motor Lite | S$0 death benefit but up to S$500 medical expense coverage. | From S$300 | S$822.48 |

| Allianz Motor Protect | Death and injuries coverage up to S$50,000. | S$0 | S$982 |

Singlife Motor Lite offers the most affordable starting price at S$822.48, but it doesn't come with death benefit and medical expense coverage. Great Eastern Drive and Save Plus, on the other hand, offers a higher death benefit of S$120,000 for you and S$50,000 for authorised drivers/passengers. However, it comes with a higher starting price of S$882. Allianz Motor Protect sits in the middle with a starting price of S$982 and a death and injuries coverage of up to S$50,000.

When choosing between these options, it's important to consider your priorities and needs. If price is your main concern, Singlife Motor Lite might be the most attractive option. However, if you prioritise comprehensive coverage and benefits, Great Eastern Drive and Save Plus might be a better choice, despite the higher price.

Remember that these are just fictionalised examples, and the actual car insurance quotes you receive may vary depending on your individual circumstances. It's crucial to compare quotes based on your specific needs and preferences to find the best value.

Beyond the coverage and price, it's also essential to be aware of potential hidden costs, such as administrative fees, policy exclusions, and additional charges for modifications or named drivers. At the same time, we recommend reviewing the overall value that each insurance provider brings, not just the quotes. Here's a quick look at the examples we shared above:

Great Eastern Drive and Save Plus: Offers comprehensive coverage and death benefits, but comes with a higher starting price.

Ultimately, the best value deal doesn't always come from the cheapest insurance companies. It's also about finding the right balance between motor insurance price, coverage, and benefits that suit your needs. So, consider factors like 24/7 roadside assistance, an easy claims process, and add-ons that offer valuable protection and peace of mind.

What Reddit users are saying about car insurance

We checked out Reddit forums to get insights from Singaporean drivers about their car insurance experiences. Also, many express frustration with rising premiums and the complexities of comparing policies.

Here are some common tips and observations from Reddit users:

- Shop Around Regularly: Don't just auto-renew your existing car insurance policy, instead, compare quotes from different insurance providers can help you find better deals and potentially save money. (Remember, SingSaver offers a free comparison tool!)

- Negotiate Premiums: Some users have successfully negotiated lower premiums by contacting insurance providers directly or leveraging quotes from competitors.

- Choose the Right Excess: Consider your financial situation and risk tolerance when selecting your excess amount. A higher excess can lower your premium but means you'll pay more out-of-pocket in the event of a claim.

- Check for Hidden Fees: Be wary of hidden fees, such as administrative charges or cancellation fees, which can inflate the overall cost of your insurance.

- Review Policy Exclusions: Carefully review the policy wording to understand what is and isn't covered. Some common exclusions include damage caused by modifications or illegal activities.

Car insurance rates

Reviewing the car insurance quotes for drivers with similar details as yours can provide you with an overview of the amount you can expect to pay. Below, we illustrate some key factors—age, driving history, credit, coverage type, and vehicle details—that may influence your premiums.

Rates by age

Age is one of the most significant factors that influence car insurance rates. Usually, the younger you are, the higher you will pay, but as you reach your 30s, the premiums will decrease. Then, the rates will increase again in your 70s.

Rates by driving history

Filing claims due to an incident that's primarily your fault will influence your auto insurance rates. Note that car insurance providers compute the rates a bit differently, so it's worth comparing the quotes to get the ideal prices.

Rates by NCD

Your No Claim Discount (NCD) is a significant factor affecting your car insurance premium. By maintaining a clean driving record and accumulating years of no claims, you can earn a substantial discount on your premium, making it more affordable to protect your vehicle.

Rates by vehicle details

Your car's make and model, along with its year of manufacture, can significantly influence your motor insurance premium. In comparison to common consumer vehicles, high-value or luxury cars typically attract higher premiums due to their increased risk profile.

The information provided in this article is based on a combination of desk research, analysis of publicly available data, and insights drawn from reputable sources in the car insurance industry. SingSaver consults a variety of resources, including insurance provider websites, policy documents, industry reports, and consumer reviews, to ensure the accuracy and comprehensiveness of our content. We also strive to keep our information up-to-date by regularly reviewing and updating our articles to reflect the latest trends and changes in the car insurance market.

While we strive to provide accurate and comprehensive information, the car insurance landscape is constantly evolving. Therefore, we encourage you to conduct your own research and compare quotes from different insurance providers before making a decision.

Frequently asked questions about car insurance

At SingSaver, we're committed to providing accurate and unbiased car insurance comparisons to help you make informed decisions. To ensure our information is up-to-date and reliable, we use a rigorous evaluation method:

- Comprehensive Analysis: We thoroughly analyse coverage options, pricing, claim processes, and customer reviews for each insurer.

- Policy Flexibility: We assess the flexibility of policies, including workshop choices, optional add-ons, and customisation options.

- User Experience: We consider the ease of use of online platforms and the overall customer experience with each insurer.

Our data sources:

- Direct Quotes: We collect car insurance quotes directly from major insurers in Singapore, ensuring our comparisons are based on the latest pricing and policy details.

- Real User Feedback: We incorporate feedback from real users, including insights from online reviews, forums, and social media, to provide a comprehensive view of each insurer.

SingSaver is an independent comparison platform that ensures recommendations are unbiased and objective. This commitment to transparency also means that insurance providers cannot pay to alter their rankings or reviews on our platform.

Furthermore, we continuously monitor and update our information to reflect changes in pricing, promotions, and policy details, ensuring our comparisons are always accurate and relevant. Our rigorous methodology and commitment to transparency ensure that you can trust SingSaver to provide reliable and unbiased car insurance comparisons, empowering you to make informed decisions about your coverage.