Best Home Insurance Plans In Singapore

Product Name

Home Content Coverage

Building Coverage

Premium

Product Name

Home Content Coverage

Building Coverage

Premium

Product Name

Home Content Coverage

Building Coverage

Premium

Best Home Insurance Plans In Singapore

Product Name | Home Content Coverage | Building Coverage | Premium |

|---|---|---|---|

FWD Home Insurance | S$ 20,000 | S$ 82,000 | S$ 42.99 |

Singlife Home Lite | S$ 35,000 | S$ 0 | S$ 56.02 |

TIQ Home Insurance | S$ 45,000 | S$ 82,000 | S$ 67.92 |

MSIG Enhanced HomePlus - Standard Plan | S$ 125,000 | S$ 0 | S$ 95.90 |

AIG Enhanced Public Housing Contents Insurance – For HDB only | S$ 150,000 | S$ 69,500 | S$ 68.18 |

AIG Homes Advantage Package | S$ 20,000 | S$ 85,000 | S$ 183.20 |

SingSaver Explains: Home Insurance 101

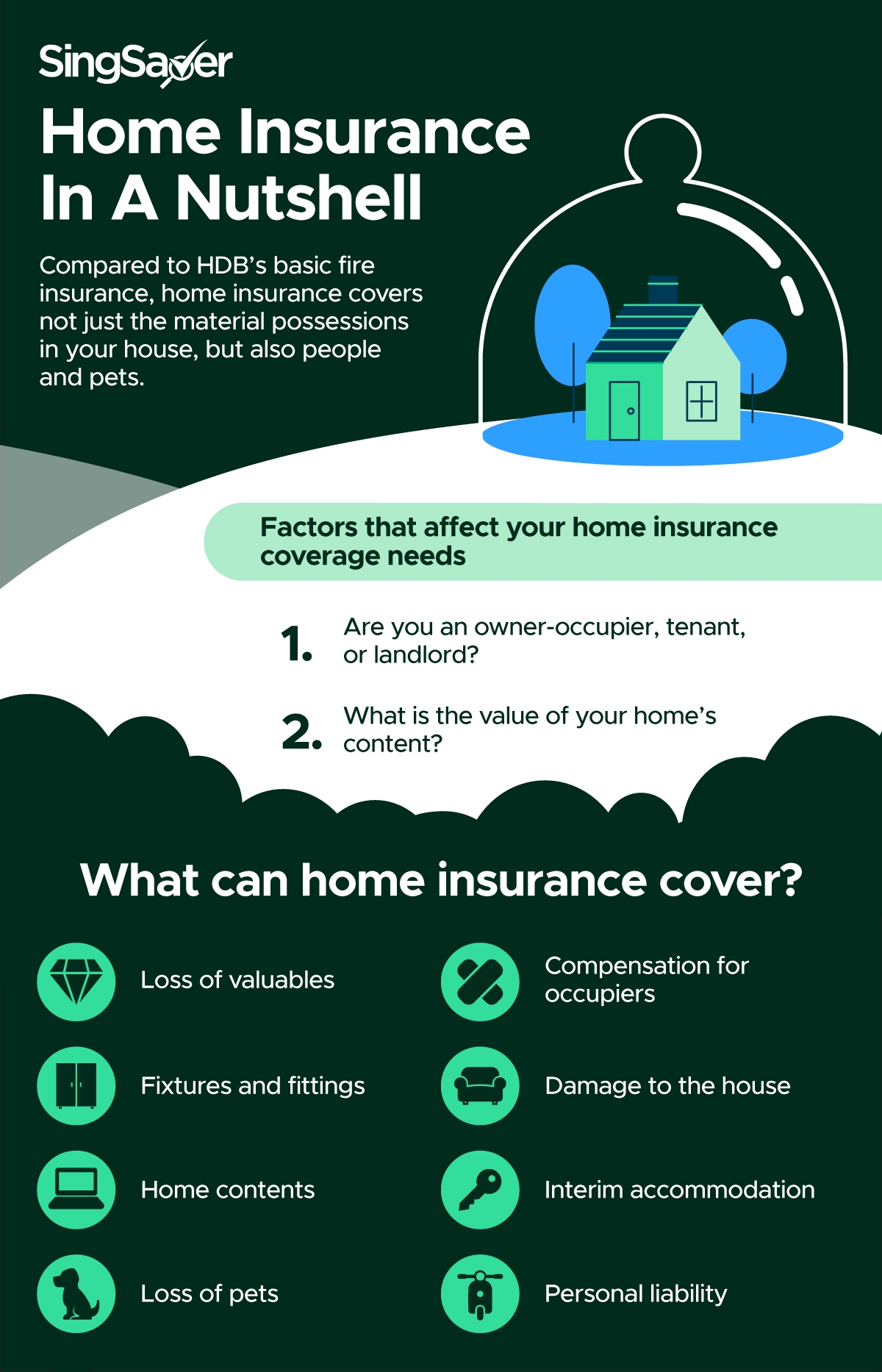

Here's all you need to know about the basic types of Home Insurance, and what you should consider before purchasing one.

Latest Home Insurance News

The latest home insurance promotions, tips and news about home insurance in Singapore.

Is it a must to get home insurance?

If you live in a HDB flat, only fire insurance is compulsory. But it doesn’t provide coverage for loss or damage to your home, home content, personal valuables and more. That’s where home insurance comes in handy.

Main considerations when buying home insurance:

- Coverage for loss or damage to home content and valuables

- Coverage for loss or damage to building or renovations

- Personal liability: How much you’re covered for if something happens to a third party in your home

- Alternative accommodation expenses

- Annual premium

What is the best home insurance to buy?

That would really depend on your type of residence, unique needs and budget. You also have an option to add a rider for fuller coverage. The best way would be to compare home insurance plans on SingSaver for yourself, and enjoy our exclusive promos and discounts in the process!

Read this article to stay updated on the best home insurance promos and discounts.

Home Insurance (also known as Home Content Insurance or Homeowners Insurance) is a type of property insurance that covers a residence and helps in paying for repair or replacing one’s belongings if they are damaged by perils such as fires, vandalism, burglary and more. It also covers accidental damage to another individual’s property or injury to a visitor at your home.

Home insurance helps you manage risk by reducing the amount you have to pay out of your own pocket should something unforeseen happen to your home. Home insurance protects your home from fire, loss of or damage to the contents of your home as well as cover renovations. Home insurance also provides you with liability protection.

Home insurance covers the contents of your unit, if they are damaged or lost as a result of an insured peril. This could include:

- Home contents (e.g. furniture, appliances, electronic gadgets, jewellery, clothes, money etc.)

- Renovation, fixtures and fittings that do not form part of the building

- Personal liability

- Accidental glass breakage

- Alternative accomodation costs

- Loss of personal money or credit cards

Home insurance also tends to provide 24/7 emergency home assistance. Some plans provide more coverage than others, typically at an additional cost. You can refer to the FAQ below for more information about the type of household contents you are covered for.

In Singapore, as long as you are servicing a housing loan from HDB, it is compulsory to buy and renew the HDB Fire Insurance for your home. This HDB Fire Insurance covers the cost of repair work in the event of a fire.

Besides having the HDB Fire Insurance, it is possible to own a home legally without Home Insurance. However, HDB Fire Insurance does not provide coverage for the contents of your home. The damage to your home and personal belongings could be costly to replace. Hence, having home insurance is important as it can help to reduce the financial burden incurred should there be damage to your home and the contents of your home.

With home insurance, your home as well as the contents in your home will be protected, financially. You enjoy peace of mind knowing that the policy will reimburse you for the cost you incur when paying for repair or replacing your belongings if they are damaged. It also covers accidental damage to another individual’s property or injury to a visitor at your home. There are also other benefits of home insurance, such as coverage for loss of rent, emergency cash allowance and 24-hour emergency home assistance for home repairs like plumbing, locksmith, pest control and many more services.

HDB Fire Insurance and Home Insurance are two different types of insurance policies that go hand in hand to help you protect your home. HDB Fire Insurance helps HDB flat owners relieve the financial burden of repair work in the event of a fire. It covers the cost of repairing damaged internal structures, fixtures, as well as areas built and provided by HDB. Home Insurance protects the contents of your home.

The cost of premiums for home insurance varies depending on the coverage you require for your home. This coverage could also differ based on factors such as the type of home, the features of your home and the value of your personal belongings.

There are plans that provide coverage across all property types, differing based on the coverage required. On the SingSaver website, basic home insurance can start from $53 and go up to more than $400 a year. This premium is usually paid annually.

Extra costs will be incurred by including add-ons that can help provide additional coverage for your home. Ultimately, you have to find a balance between getting the lowest price and ensuring a suitable amount of coverage for your home.

While the appropriate coverage depends on the type, size and contents of your home, this coverage should be an amount that you are comfortable with. This coverage is based on a few key factors:

- Household contents: Coverage for the loss or damage of the contents of your home, such as furniture, clothing and appliances

- Renovation, fixtures and fittings: To cover the cost of renovation, fixtures and fittings done to your home, such as built-in wardrobes and air conditioners

- Building cover: To cover for loss or damage to the building

- Personal legal liability: To protect against third party legal liability caused by you

You can do a quick calculation of the cost of your renovations and contents of your home to get a better idea of the amount of coverage you require. For example, if your home has expensive furniture, kitchenware, laptops and more, you might be more comfortable purchasing a policy that provides higher coverage.

The home insurance that suits you most would depend on the level of coverage that you require as well as the price you are willing to pay. You can compare different home insurance policies from different insurance providers. On the SingSaver site, you can compare by: Premium, Building coverage, Maximum household contents cover or Personal liability.

Try not to under-insure your assets. You can do a quick calculation of the cost of your renovations and contents of your home to get a better idea of the amount of coverage you require for your home. You should also keep a lookout for incentives such as discounts and promotions for specific providers or plans.

Yes, you can still get Home Insurance even if you are renting your property. You can get home insurance if you are:

- The owner of a house or

- The landlord (renting out your house) or

- A tenant of a house

However, there are exclusions in the home insurance policy that you should keep in mind. For example, deliberate or malicious damage by tenants might not be covered.

Home Insurance is also known as Home Content Insurance or Homeowners Insurance.

HDB Fire Insurance Scheme helps HDB flat owners relieve the financial burden of repair work in the unfortunate event of a fire. It covers the cost of repairing damaged internal structures, fixtures, as well as areas built and provided by HDB. However, this does not include home contents such as furniture, renovations and personal belongings. This is where Home Insurance comes in.

Home Insurance protects the contents of your home. This could include renovation works, built-in fixtures, furnishings, home decor, valuable personal belongings such as your jewellery, luxury watches, money and more.

On aggregator sites such as SingSaver, you can compare home insurance policies across different providers. You can sort the policies based on:

- Premium

- Building coverage

- Maximum household contents cover

- Personal liability

- Provider

You can also read our guide to help you figure out what home insurance plan you require.

Firstly, you have to be the owner of a house, the landlord (renting out your house) or the tenant of a house. To apply for home insurance, you have to be a Singapore citizen, Permanent Resident of Singapore or foreigner with a valid Work Pass, Student Pass, Dependent’s Pass or Long-Term Visit Pass. You will also have to be at least 18 years old.

Household contents you are covered for could include:

- Furniture

- Ornaments

- Appliances

- Kitchenware

- Locks and keys

- Breakage of glass

- Renovation, fixtures and fittings that do not form part of the building

- Electronic gadgets (e.g. mobile phone, laptops, cameras)

- Jewellery

- Clothes

- Books, toys

- Personal money or credit cards

You can also opt for add-ons for extra protection. Add-ons can help to cover for contents such as bicycles, home security appliances, injury to pets, removal of debris and more. Keep in mind that in the event of an insured loss, you will have to submit details of your belongings and proof of their existence.

Your home is usually covered against insured perils such as fire, lightning, theft by violent or forcible entry, natural disasters, and more. However, if your home is damaged by perils outside of the insured perils specified by your insurer, it will not be covered (unless you purchase an all-risk home insurance that covers all risks that are not specifically excluded). For example, if your home was damaged due to a deliberate and malicious act by your tenant. There are also optional add-ons you can include in your home insurance purchase that can cover you for additional components.

all-risk policy covers everything except what is specifically excluded in the policy (e.g. war is typically an excluded risk). An all-risk policy has a much wider coverage but is usually more costly than an insured peril policy.

Here are a few things to consider:

- Price / cost of premiums

- Building coverage

- Household contents coverage

- Personal liability

- Duration of coverage

- Add-ons (optional)

- Current promotions, discounts, promo codes, referral codes

Read our guide to help you figure out what home insurance plan you require.

_600x360px.jpg?width=480&disable=upscale&fit=bounds&auto=webp)

_600x360px.jpg?width=480&disable=upscale&fit=bounds&auto=webp)