How to Check My Credit Card Application Status?

Updated: 26 Jan 2026

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

Your bank will need a few business days to process your application. If your application appears to be taking longer than usual, you may want to check on the status of your application to determine if it's a delay due to incomplete documents or just business as usual.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 1 March 2026. T&Cs apply.

✨Get the Reward Upgrade You Deserve✨

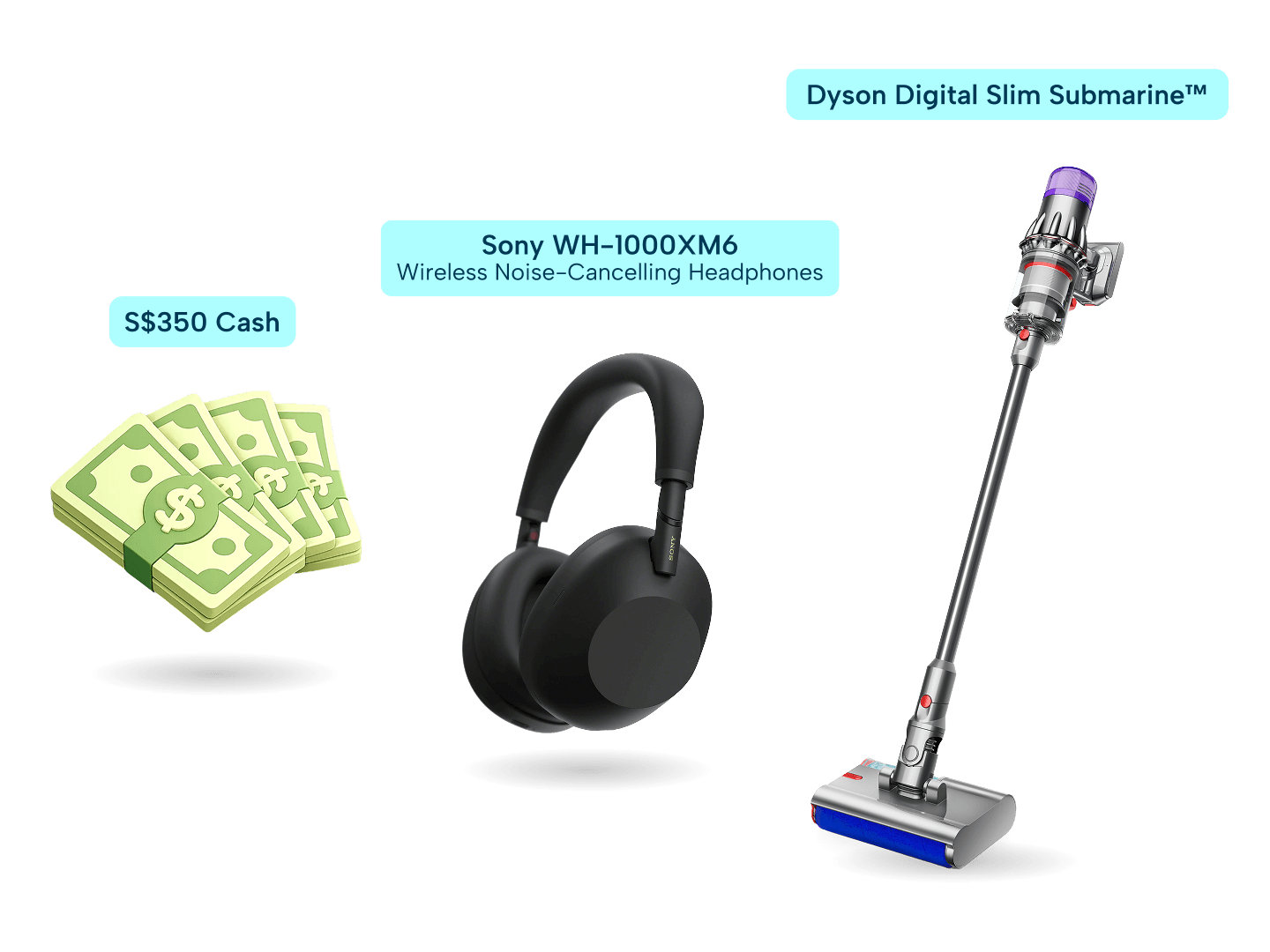

Get your dream Apple, Dyson, Sony, or Nintendo gadgets when you apply for select Citi, HSBC, OCBC, or Standard Chartered credit cards via SingSaver and top up as low as S$60! Valid till 1 March 2026. T&Cs apply.

How do I know my credit card has been approved?

Generally, the best way to check your credit card application status is by contacting your bank directly. You will be given an update on your application, or informed if you need to take any further steps such as submitting additional documents.

You may also check on the status of your credit card application via:

-

Your mobile banking app

-

Online banking

-

Calling the bank's hotline

-

Emailing your bank

-

Submitting an online request form

It may be helpful to take note of the expected duration of your credit card application, which should have been communicated to you during the application process.

Credit cards may take anywhere from 3 to 14 business days to be processed, with lengthier processing periods expected for manual applications done without Singpass MyInfo. Longer processing times may also arise as a result of missing or incomplete documentation.

Tracking your credit card applications: A bank-by-bank guide

How to check your AMEX card application status?

American Express typically takes 10-14 business days to process a new credit card application. Speed up the process by applying online via Singpass MyInfo, and receive your card within 3-5 working days.

New applicants may enquire about the status of their application by calling the American Express New Accounts at +1 800 392 2000.

How to check your DBS/POSB credit card application status?

DBS takes an average of 7 to 9 working days to process credit card applications. Once your application has been processed, you will be informed via SMS.

You can check the status of your application via:

- Your digibank mobile app or

- By logging onto digibank online

How to check your UOB credit card application status?

You will receive your credit card within 5 working days of approval. You can check the status of your card application via:

-

Keying your application reference ID and your date of birth into UOB's application status form

-

Logging onto UOB's online banking service. Click on "Cards" under "Tools", and then select "Card Application Status".

>> MORE: Best Credit Cards in Singapore 2025

How to check your Standard Chartered card application status?

Standard Chartered Bank may take up to 14 days to process manual credit card applications. For applications made via Singpass MyInfo, the process is usually instant.

You can check your credit card application status by raising a service request on the SC Mobile app, or via online banking.

-

Select "Other Banking Services and Other Request"

-

Type your request into the text box

-

Tap "Next" once you've completed drafting your query

-

You should a reference number for your query and that it has been submitted

Any updates on your service request will be sent to your online banking mailbox.

The SingSaver guide to credit card application

Start your credit card journey with our step-by-step guide, which walks you through credit scores and the application process.

SingSaver x Standard Chartered Bank Exclusive Offer

Choose products from Dyson, Apple, or Samsonite, up to 50K Miles, or up to S$370 when you apply for an SCB Credit Card via SingSaver, plus one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT, then fulfil additional requirements. Valid till 1 March 2026. T&Cs apply.

How to check your Citibank credit card application status?

Citibank may take up to 6 working days to process online credit card applications.

Once you've submitted your online application form, you'll receive an email from Citibank with a personalised link that allows you to check on your application status.

You may also call Citibank's 24/7 credit card application hotline at 6363 6666 to inquire about your card’s application status.

How to check your OCBC credit card application status?

OCBC may take up to 5 working days to process online credit card applications. Manual applications may take up to 2 weeks to process.

You may check on your credit card application status via:

Calling OCBC's personal banking hotline at 6363 3333 from 8am to 11:59pm

Emailing OCBC through your email service client or via online banking

How to check your HSBC credit card application status?

You can check on your credit card's application status by contacting HSBC directly via:

-

Your HSBC Singapore app: Select "Chat with us" under the "Support" tab.

-

HSBC’s online banking portal: Select the "Chat" button on the right side of the page

-

Calling HSBC's Personal Banking hotline at 6472 2 669 or HSBC's Premier Banking hotline at 6227 8889 between 9am to 9pm.

How do I know if my application got rejected or approved?

Haven't received any updates on your credit card application? Before you panic, there are several ways you can check on your card's application status.

-

Log onto your bank's online banking portal, which may list the outcome of your application.

-

Check your physical mailbox. Credit card issuers such as UOB and Standard Chartered Bank will mail you a notification letter detailing your next steps if more documents are needed before your application can move forward.

-

Fire up your mobile banking app and check if your new card has been added to your account.

-

Check your SMS inbox to determine if the bank's message to you has inadvertently been marked as spam. DBS/POSB both notify clients on the outcome of their applications through SMS.

-

Last but not least, check your email. This especially applies to Citibank clients, who should have received an automated email containing a link upon submitting their credit card application online. This link will allow you to check on your card's application status.

A smarter way to apply for credit cards

Explore the best credit options from reputable banks without damaging your credit profile.

How long do banks take to process credit card applications?

Banks can take anywhere from 3 to 14 days to process your credit card application. The process is usually faster for online applications done via Singpass MyInfo, as verified government data (including financial information) will be automatically retrieved. Clients who already have an account with the bank, whether it's a debit card or a savings account, will also enjoy faster processing times as their creditworthiness has already been established. However, clients who are new to the bank or those who are making manual credit card applications, will have to put up with longer processing times.a

Why do banks reject credit card applications?

-

Too many concurrent credit card applications. Banks may interpret this as a sign of impending financial strain and deny your application.

-

Your debt-to-income (DTI) ratio is too high. If your DTI is over 30%, it may be wise to pay off your debts before applying for a credit card.

-

You've reached your credit limit. Your credit score takes a hit every time you go beyond 50% of your credit limit, so spend wisely.

-

You don't meet the minimum annual salary requirement. Most credit cards have a minimum annual income requirement of around S$30,000-40,000. However, some banks, like American Express, may not list any hard figures, making it a challenge to know if you will qualify.

-

You are too young to qualify. Most credit cards require you to be at least 21 years of age to be eligible for a credit card.

-

You have a limited credit history. This is linked to our last point, since younger individuals will need at least 6 months of credit activity to build up their credit history.

>> MORE: 4 Major Reasons Why Your Credit Card Application Was Declined

Frequently asked questions about the status of credit card application

If your application was rejected because it was deemed incomplete, this is easy to remedy as banks will happily inform you of what documents and details you will need to supply. If your application was rejected due to reasons such as a low credit score or high debt-to-income ratio, you'll need to work to improve those metrics before applying again.

You can speed up your application process by applying via Singpass MyInfo. If you are applying manually, ensure all your information and personal details are accurate and up to date.

Apart from making sure you fulfil all eligibility requirements, you should also pay special attention to your desired credit card's fees and charges, for a full picture of what you're signing up for.

Generally speaking, it can take anywhere from 3 to 14 business days for banks to approve your credit card application. If you urgently require a credit card, look for banks that integrate Singpass MyInfo into their online application process. Digital approval is usually nearly instant, though you may need to wait up to 5 days for your physical card to arrive.

Relevant articles

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.