Top Strategies for Managing a Personal Loan and Reducing Debt in Singapore

Updated: 11 Apr 2025

Managing your finances well is key to financial freedom in Singapore and to do so, it's important to handle personal loans and debts with a strong repayment plan and find ways to reduce debt. This guide will show you how to manage your loans and reduce debt!

Written bySingSaver Team

Team

Types of personal loans available

In Singapore, there are many loan types to meet different needs:

-

Unsecured personal loans: No collateral needed

-

Secured personal loans: Require assets as security

-

Debt consolidation loans: Combine multiple debts into one

-

Credit line: Borrowers are required to open a line of credit with the borrower

Interest rates and terms

Interest rates for personal loans in Singapore change based on the loan amount, tenure, and credit score. Here's a look at typical rates:

Eligibility criteria for personal loans

To get a personal loan in Singapore, you usually need to meet these criteria:

-

Age: 21-65 years old

-

Minimum annual income: S$20,000 for Singaporeans, S$40,000 for foreigners

-

Employment: Stable job with at least 3-6 months of service

-

Credit score: Good credit history preferred

Knowing these details about personal loans can help you choose the right one for your financial needs. Always compare offers from various lenders, such as DBS, UOB, and OCBC, to find the best terms.

Read More: Best Personal Loans

Things to Pay For Personal Loans

Besides paying for how much you’re borrowing, there are applicable fees you possibly will need to pay for:

|

Interest Rate |

Effective Interest Rate |

|---|---|

|

Banks typically give you a customised interest rate that you’ll see only after an approved application, as each situation is unique. Your credit score, income, and repayment history will determine your final loan interest rate. You will likely get a better rate if you have a good track record. |

The EIR is a more accurate reflection of the cost of borrowing because it also considers other factors, such as the processing fee and loan repayment schedule. While a loan might have a lower interest rate, if it has a a higher EIR could mean that there are additional fees and charges imposed, and you might end up paying more. Basically, the higher this is, the more likely you need to pay more overtime. |

|

Processing/Administrative Fees |

Early Repayment Penalty |

|

These usually range from $0 to 3% of the loan amount borrowed and are deducted from the loan amount borrowed. E.g., your loan amount is $30,000, and it comes with a 2% processing fee, which means that the amount disbursed to you will be $29,400. Banks will occasionally waive the processing fee and offer promotional interest rates.

|

These loans usually come with an early repayment penalty. |

Read More: Best Credit Card Guide

Creating a Budget for Loan Repayment

Making a budget is key to paying off your loan. Begin by tracking every expense, from your morning kopi to your bills. This helps you see where you can spend less and save more for your loan repayments.

Then, set aside money for your loan payments. Make sure these payments are a top priority in your budget, even more important than saving for your next Tze Char feast. Setting up automatic transfers can help you keep up with your payments easily.

Here's a simple breakdown of a budget for loan repayment:

Category | Percentage of Income |

|---|---|

Loan Repayment | 30% |

Housing | 25% |

Food | 15% |

Transportation | 10% |

Utilities | 10% |

Savings | 10% |

While focusing on loan repayment, don't forget about other important costs or savings. Check and adjust your budget regularly. With careful budgeting and tracking expenses, managing your loan will become easier.

Effective Strategies for Managing a Personal Loan

Managing your personal loan wisely can greatly reduce your debt. Let's look at some practical ways to handle your finances better and avoid being "kiasu" about your loan.

Prioritising debt repayment

It's important to focus on paying off high-interest loans first. They cost you more money over time. Make a list of your debts, putting them in order from highest to lowest interest rates.

This method, called the 'debt avalanche', can save you money. It helps you pay off your loans quicker, giving you more cash for your favourite laksa.

Making extra payments when possible

Putting extra money towards your loan can make a big difference. Whenever you have extra cash, use it to pay off your loan. Even small extra payments can help reduce your loan balance faster.

This can save you hundreds in interest over the life of your loan, which could be enough for an overseas trip nearby.

Payment Strategy | Loan Term | Interest Saved |

|---|---|---|

Minimum payments only | 5 years | $0 |

Extra S$100 monthly | 4 years 2 months | S$523 |

Extra S$200 monthly | 3 years 7 months | S$897 |

Negotiating with lenders for better terms

Talking to your lender can help you get better loan terms. If your credit score has gone up, you might get a lower interest rate. Some lenders offer special programmes if you're having trouble paying back the loan.

Using these strategies, you can manage your personal loan better. Remember, being consistent is key to getting out of debt and achieving financial freedom in Singapore.

Building an Emergency Fund While Repaying Your Loan

Managing your personal loan means building an emergency fund. This fund keeps you on track with repayments during unexpected costs, like when your aircon breaks down during a heatwave. Let's look at how to balance saving and paying off debt for better financial security.

Strategies for saving while repaying debt

To save while paying off your loan, cut non-essential spending. Use extra cash for your emergency fund. Automate savings by setting up a monthly transfer to a separate account. This makes saving easier and helps you stick to your plan, just like how you stick to your favourite hawker stall.

Balancing savings and debt repayment

Finding the right balance between saving and debt repayment is crucial. Keep up with your loan payments, but also save a bit. As your emergency fund grows, you'll feel more secure in handling your loan and unexpected costs.

Frequently asked questions

There are many personal loans in Singapore, like unsecured loans, renovation loans, education loans, and debt consolidation loans. Each loan has its own purpose, much like how different types of kopi suit different tastes. It's key to know the details before you apply.

Creditors look at your credit score, income, job status, and debts when checking if you're eligible for a loan. You usually need a good income, a solid credit history, and a show that you can make regular payments. It's like proving you're a regular at your local kopitiam.

Creating a budget for loan repayment is key. It helps you manage your money well and ensures you have enough for payments. A good budget lets you keep track of spending, adjust it, and focus on paying off the loan. It's as essential as having a good chilli sauce for your chicken rice.

Good ways to manage your loan include paying off debts with the highest interest first, making extra payments, and talking to lenders for better deals. Automating payments also helps you stay on track. It's like using a food delivery app to ensure you always have your favourite mee rebus on time.

Having an emergency fund while paying off a loan is crucial for your financial safety. Unexpected costs can mess up your repayment plan. A savings fund helps you avoid falling behind or taking more debt. It's your financial 'umbrella' for those unexpected rainy days in Singapore.

To balance saving and paying off debt, budget carefully and stay disciplined. Begin by saving a bit each month, even if it's just the cost of a few coffees. You can then save more to grow your emergency fund as you repay your loan. It's all about finding the right balance, just like perfecting your teh tarik recipe.

If you're having trouble making loan payments, don't "act blur". Communicate with your lender immediately. Many Singaporean banks offer hardship programmes or can restructure your loan. You might also consider seeking advice from credit counselling services. Remember, addressing the issue early is better than letting it snowball.

The typical personal loan cap is up to four times your monthly income and sometimes six times if your annual income is S$120,000 or above.

Conclusion

Managing a personal loan in Singapore requires discipline, smart strategies, and a good understanding of your financial situation. By following these tips and staying committed to your repayment plan, you can successfully navigate your loan journey and achieve financial stability.

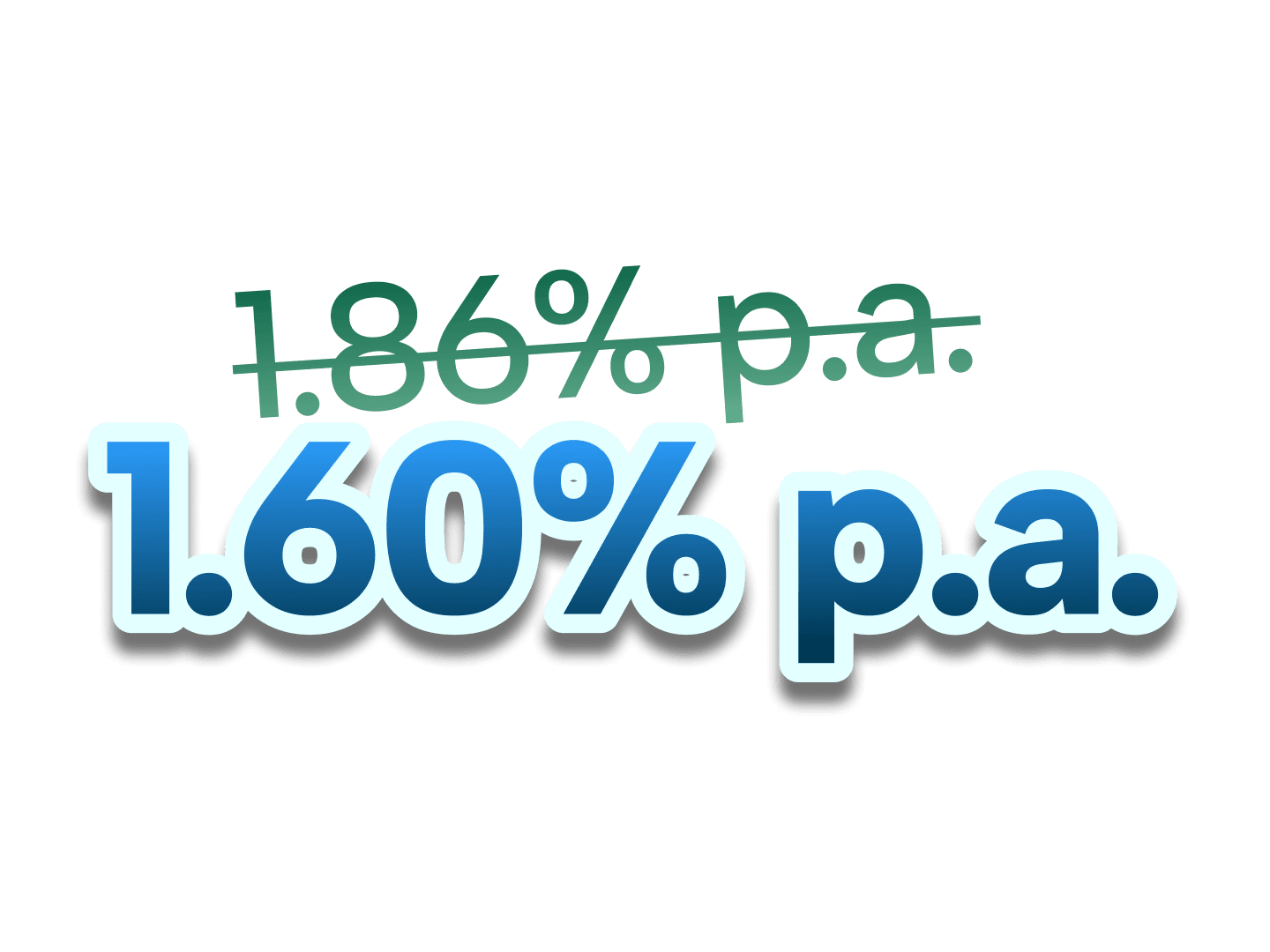

CIMB Personal Loan Welcome Offer

Enjoy low interest rates from 1.60% p.a. (EIR from 3.07% p.a.) when you apply for a CIMB Personal Loan! Valid till 1 March 2026. T&Cs apply.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.