Tiger Brokers 2025 Review: Low Commissions And Attractive Sign-Up Promotions

Updated: 11 Apr 2025

Tiger Brokers has seen tremendous growth in account openings since joining the big boys in Singapore in 2020. Check out why they’ve made waves in the investment and trading community, plus how you can score a free share, commission-free trades, and more.

Written bySingSaver Team

Team

It’s not every day that we see a new player enter the fray, especially when it comes to online brokerages. In March 2020, Tiger Brokers launched in Singapore and it’s safe to say that they’ve more than made their mark.

In 2022, the brokerage launched Tiger Vault, their cash management solution which gives investors up to 5% yield. The cash is liquid and can be used to fund your Tiger Brokers investments over one business day. You can also opt for the Auto Sweep function, which automatically channels your idle cash into the Vault.

Tiger Brokers' early success has been buoyed by heightened investor interest surrounding trading and investing amidst COVID-19. In Q3 2020 compared to Q2 2020, Tiger Brokers announced a three-fold growth in account openings and a 540% increase in trading value.

A year later, Tiger Brokers also saw the average first-timer account deposit increase from S$4,000 in Q2 and Q3 2021 to S$5,000 in Q4 2021.

Given its growth and competitive pricing, it's safe to say that Tiger Brokers is one of the most popular brokerages in Singapore. So, is it for you?

What’s Tiger Brokers all about?

Tiger Brokers is an online brokerage platform that is listed on NASDAQ. They provide customers with easy access to global markets, including Singapore, USA, Hong Kong, China, Australia and New Zealand at low commissions. Investors have access to stocks, ETFs, REITs, options, warrants, futures, funds and more on Tiger’s platform.

Here’s what you can find in this review of Tiger Brokers:

Overview of Tiger Brokers

Product summary:

-

What you can invest in: Stocks, ETFs, options, warrants, CBBCs, REITs, futures, funds

-

Minimum balance required: No min. balance or deposit required

-

Fees for Singapore stocks: 0.03% commission fee, minimum S$0.99 per order; 0.03% platform fee, minimum S$1 per order

-

Fees for US stocks: US$0.005 commission fee, minimum US$0.99 per order; US$0.005 platform fee, minimum US$1 per order

-

Fees for HK stocks: 0.03% commission fee, minimum HK$7 per order; 0.03% platform fee, minimum HK$8 per order

-

Fees for AU stocks: 0.03% commission fee, minimum A$2 per trade; 0.07% platform fee, minimum A$6 per order

-

Fees for China A-shares: 0.03% commission fee, minimum CNH7 per trade; 0.03% platform fee, minimum CNH 8 per order

Pros and Cons

Here are the pros and cons of using Tiger Brokers for your investment and trading needs.

|

Pros of using Tiger Brokers |

Cons of using Tiger Brokers |

|

Competitive commission fees |

Commission fee of US$0.99 per trade for US equities. Min. fee amount also applies for equity trades made on other markets. |

|

Attractive sign-up perks and rewards for trading |

High number of trade orders required to enjoy the perks of a Silver, Gold or Ace Trader |

|

Wide range of products available for trading |

|

|

Dedicated app with a wide range of tools at your disposal |

Why should you trade with Tiger Brokers?

#1 Competitive commission fees

Tiger Brokers offers competitive commission fees for trades across different markets. It is also practically fee-less in these aspects: no custody fees, deposit (or withdrawal) fees, currency exchange fees, inactivity fees or account maintenance fees to contend with!

You'll incur a minimum platform and commission fee of S$1.99 per order for trading Singapore stocks, ETFs or REITs. If you predominantly trade in the US markets, Tiger charges an affordable US$0.005 commission fee (min. US$0.99) and US$0.005 platform fee (min. US$1 per trade). However, note that you'll also need to pay a settlement fee of US$0.003 per share.

If you’re looking beyond the shores of Singapore and the popular US market, the charges for other markets aren’t too shabby either.

Check out the fees charged for the respective markets below.

#2 Attractive sign-up perks and rewards for trading

Get rewarded with commission-free trades, access to market data and stock vouchers when you sign up for a new Tiger Brokers account. More specifically, new Tiger Brokers users can now receive free shares collectively worth up to US$3,600. More details below.

#3 Wide range of products available for trading

An online brokerage platform, Tiger Brokers allows you to trade stocks from markets including Singapore, USA, Hong Kong, Australia and China. Tiger Brokers also offers more than just stock trading, providing access to trade ETFs, options, warrants, futures, funds and more on their platform.

#4 Dedicated app with a plethora of tools at your disposal

Tiger Brokers has an app for both mobile and desktop, iOS or Android. A visual treat, the Tiger Brokers app is interactive and customisable.

Tiger Brokers also provides their customers with tools including valuation analysis, earnings calendar, a newsroom and the latest research to help your investment strategies. You can also filter popular ETFs and customise filters for your own stock screening purposes.

For whom is Tiger Brokers best for?

If you’re looking for an online brokerage that allows you to trade both Singapore and US markets at competitive commission rates, Tiger Brokers could just be your king of the jungle. With their generous sign-up promotions, Tiger Brokers attracts both new traders as well as traders that execute a large number of orders.

Frequent traders will be rewarded handsomely with the privileges of being a Silver, Gold or Ace Trader.

While Tiger Brokers’ commission fees are competitive, customers that trade in small sizes should still take note of the minimum commission fee charged.

What charges or fees should you look out for?

Tiger Brokers does not charge custody fees, deposit or withdrawal fees, currency exchange fees, inactivity fees or account maintenance fees. However, your trade isn’t executed for free. Here are the commissions that are charged for stock and ETF trades.

-

Singapore stocks: min. S$1.99 commission and platform fees per order

-

US stocks: min. US$1.99 commission and platform fees per order

-

Hong Kong stocks: min. HK$15 commission and platform fees per order

-

China A-shares: Min. CNH15 commission and platform fees per order

-

Australia stocks: AU$8 commission and platform fees per order

What does this fee include?

This is the fee charged by Tiger Brokers for executing the trade. It does not include the fees charged by the individual stock markets, such as the trading fee, settlement fee and more. Keep in mind that Tiger Brokers charges a platform fee per trade, on top of the aforementioned commissions.

Platform fee charged for stocks and ETFs:

-

Singapore stocks: 0.03% platform fee with min. S$1 per order

-

US stocks: US$0.005 with min. US$1 per order

-

Hong Kong stocks: 0.03% per trade, min. HK$8 per order

-

China A-shares: 0.03% per trade, min. CNH8 per order

-

Australian stocks: 0.07% per trade, min. A$6 per order

How is this fee charged?

You’ll incur this fee when you execute your trade.

Tiger Brokers has a fee schedule for more advanced assets like options and futures as well. But fret not, because these are largely similar, with commissions and platform fees being levied along with charges that each stock exchange has.

On this note, do not be fooled by zero-commission free trades that might convince users that trading is absolutely free, as advertised by some online brokerage accounts. Do beware of other fees like a per-share settlement fee that some brokerage accounts charge, especially those without a cap. This could potentially put you in a deficit if the price of each share is low.

An article by The Business Times highlighted a trader who sold his shares for a total of US$5,000, only to realise that he found himself with a US$11,000 deficit because of the high settlement fee that he was charged.

What are the promotions available for Tiger Brokers?

Tiger Brokers is currently running a welcome promotion from 7 August to 7 September 2024 for new Tiger Brokers users:

Open An Account

Sign up and open an account with Tiger Brokers (Singapore) Pte Ltd ("TBSPL") during the promotional period to receive a 6.8% p.a. Interest-Boost Voucher for 60 Days.

(This bonus package is valid for first-time account opening only.)

Fund and Trade

-

Fund your newly approved account with any amount and claim three months SGX LV2 advanced quotes (worth S$60).

-

Fund your newly approved account and accumulate deposits of S$1,000 or more within the promotion period to receive a USD 10 voucher package (2x USD 5 vouchers) on top of the 6.8% p.a. Interest-Boost Voucher.

-

Fund your newly approved account and accumulate deposits of S$10,000 or more within the promotion period to receive a USD 35 voucher package (7x USD 5 vouchers).

-

Fund your newly approved account and accumulate deposits of S$100,000 or more within the promotion period to receive a USD 100 voucher package (20x USD 5 vouchers).

Additional Rewards

|

Task / Eligibility |

Reward |

|

For first-time registration and opening of a Tiger Account during the promotion period.

(Issued immediately upon registration and account opening.) |

3-Month SGX LV2 Market Data Card |

|

Free Real-Time US Stock Quotes |

|

|

Free Real-Time NYSE Arca Depth Data (available for non-professional users) |

|

|

Real-Time Singapore Stock Quotes |

|

|

Real-Time US Options Quotes |

|

|

Ultra-Low US Stock Commission Benefits |

If you already have a Tiger Brokers account, you can also check out the Promotions & Rewards or Popular Events’ sections of the app to get first dibs on the latest deals and promotions. Tiger Brokers account holders are also encouraged to refer friends to earn even more rewards.

How do you open and fund your Tiger Brokers account?

On Tiger Brokers’ online application page, follow the steps to submit supporting documents such as your NRIC and proof of address. You can also choose between a cash or margin account.

Pro tip: Use SingPass to speed up your application process!

To fund your account, you will have to do a bank transfer. You can transfer in SGD, USD, HKD, EUR and AUD and your Tiger account can hold funds in multiple currencies at the same time.

After depositing the funds, you will have to click the button that says ‘Funds Remitted. Inform Tiger to check on the app. Your fund deposit status will be updated via the Tiger Trade app. Once the funds have been deposited into your account, you’re good to go!

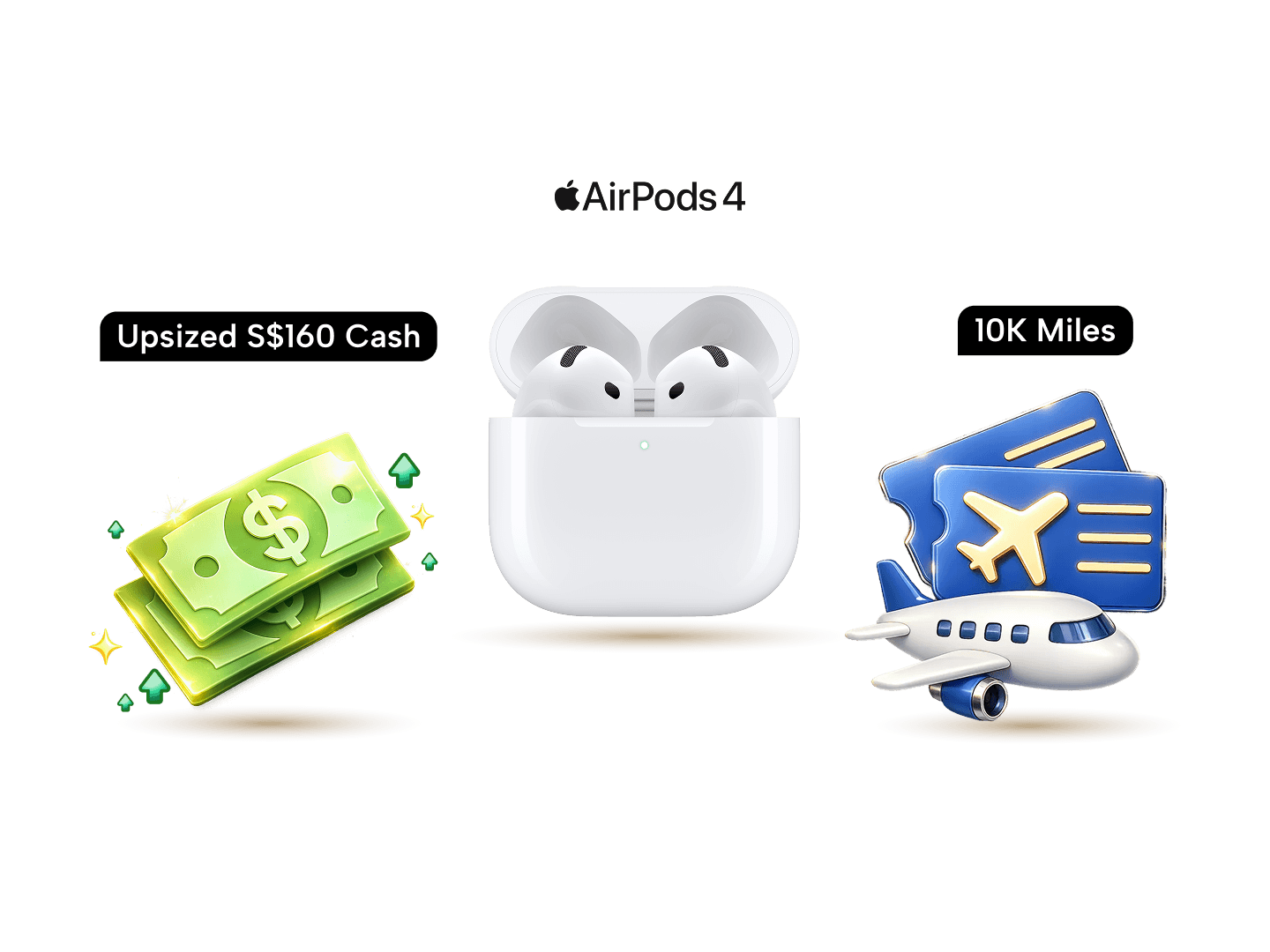

⚡SingSaver x Tiger Brokers Flash Deal⚡

Open a Tiger Brokers account and fund a minimum amount of USD 1,000 within the promotional period to receive an upsized S$160 cash, S$180 Grab voucher, 10,000 upsized Max Miles by HeyMax (worth S$180), or Apple AirPods Gen 4 (worth S$199). Offer is stackable with Tiger Brokers' welcome offer. Valid till 1 March 2026. T&Cs apply.

Tiger Brokers vs IBKR vs Webull vs moomoo vs CMC Invest

|

Tiger Brokers |

Interactive Brokers (IBKR) |

Webull |

moomoo |

CMC Invest |

|

|

Commission fee |

SGX stocks: 0.03% trade value (min. S$0.99 per order) US stocks: US$0.005 per share (min. US$0.99 per order) |

SGX stocks: 0.08% of total trade value. (min. S$2.50 per order) US stocks: US$0.005 per share, or min. US$1 per order |

SGX stocks: 0.025% of total trade amount (min. S$0.80) US stocks: 0.025% of total trade amount (min. US$0.50) |

SGX stocks: 0.03% of the transaction amount (min. S$0.99 per order) (free for a year) US stocks: US$0.0049 per share, min. US$0.99 per order. Permanent 0 commissions from 13 April 2024 onwards for eligible customers. |

SGX stocks: 0.05% or min. S$3 (after two free trades) US stocks: 0.04% or min. US$4 (after five free trades) |

|

Platform fee |

SGX stocks: 0.03% trade value (min. S$1 per order) US stocks: US$0.005 per share (min. US$1 per order) |

None |

SGX stocks: 0.025% of total trade amount (min. S$0.80) |

SGX stocks: 0.03% of transaction amount (min. S$0.99 per order) US stocks: US$0.99 per order |

None |

|

Minimum deposit |

None |

None |

None |

None |

None |

|

Maintenance fee |

None |

None |

None |

None |

None |

IBKR, Webull, and moomoo all offer lower fees if you include both platform and commission fees, particularly for US stocks. However, Tiger Brokers remain competitively priced while dangling enticing promotions for new customers.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.