How to Redeem Your Citibank Cash Back?

Updated: 11 Apr 2025

Love cashback and love Citi credit cards? Here's how to redeem your beloved cashback rewards from Citibank.

Written bySingSaver Team

Team

Are you a strong proponent of cashback? With an abundance of cashback credit cards on the market, it can be overwhelming to pick the best one that suits your spending habits.

In particular, Citi Cash Back and Citi Cash Back+ Cards are great options – offering up to 8% cashback on select everyday purchases and unlimited 1.6% cashback, respectively. But then begs the question: how can you redeem said Citi cashback and for what rewards?

Take advantage of our exciting Citi credit card sign-up rewards on SingSaver today and let us guide you on how to redeem your cashback for rewards and rebates thereafter. 😉

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 1 March 2026. T&Cs apply.

✨Get the Reward Upgrade You Deserve✨

Get your dream Apple, Dyson, Sony, or Nintendo gadgets when you apply for select Citi, HSBC, OCBC, or Standard Chartered credit cards via SingSaver and top up as low as S$60! Valid till 1 March 2026. T&Cs apply.

How does Citibank's cash back programme work?

In general, credit card cashback is earned by meeting a minimum spend requirement on eligible spend such as dining, groceries, retail, and more. Conversely for unlimited cashback cards, you can earn cashback on almost all spend unless stated otherwise. Thereafter, the cashback can be used to offset your current or next month's credit card bill.

Manual cashback redemption

Albeit straightforward, Citibank's cash back programme functions a bit differently from other credit card's. Despite the cashback being automatically credited to your Citibank card account, it cannot be automatically redeemed as cash rebates. This has to be redeemed manually.

However, this could be advantageous to those who wish to strategically offset their bills. For instance, if you have big-ticket purchase upcoming and would like to "soften the blow" of the expense, you may choose to offset that month's bill instead.

Redemption blocks

Secondly, Citibank cash back can only be redeemed in minimum blocks of S$10 and up to S$50 cash rebates at a time. As a result of the former, this may result in a potential problem of idle cashback locked in your card account until you accumulate enough to redeem.

While this isn't a huge concern, this may be slightly frustrating if you wish to cancel your Citi card but still have remaining cashback "stuck" in your account.

How to check my Citibank cash back balance?

You can refer to your monthly statement for cashback earned under "Total Available" or in the post log found in the Citi mobile app, with the cashback displayed at the top of the dashboard.

As seen in the above example, the Citi cashback earned on the Citi Cash Back Card is prominently displayed as a top banner on the homepage dashboard. Upon clicking on it, you'll be redirected to further action prompts for cashback redemption.

How to redeem Citibank cash back?

Citibank cash back can be redeemed in two ways:

-

Cash rebate via online

-

Cash rebate via SMS

|

Cash rebate via online |

Cash rebate via SMS |

|

Step #1: Login to the Citi Mobile app > Tap on "Rewards Balance" on top of screen > Open "Rewards Dashboard" |

Step #1: SMS to 72484: RWDS<space>Last 4 digits of card number<space><keyword> |

|

Step #2: Tap on "Cash Rebate" |

Step #2: Congrats! You've successfully redeemed your cash rebate and it'll be reflected in your next month's statement |

|

Step #3: Key in desired amount / Use slider to select amount of Cash Rebate to redeem |

|

|

Step #4: Congrats! You've successfully redeemed your cash rebate and it'll be reflected in your next month's statement |

Conversion rate

S$1 Citi cash back = S$1 Citi cash rebate

You have the flexibility to redeem your Citibank cash back for cash rebate through either method, based on whichever's more convenient or intuitive for you.

Frequently asked questions (FAQs)

-

Pay With Points via Online

-

Always Pay with Points

-

Pay with Points via SMS

-

Pay with Points via Merchants

-

Pay with Points via Samsung Pay

No, it doesn't expire.

Yes, you can redeem Citi rewards points (e.g. Citi ThankYou Points) or miles (e.g. Citi Mile) for cash rebate via Citi Pay with Points.

Based on your preferred method, the points/miles-to-cash conversion rates are as follows:

|

Points |

440 points = S$1 |

|

Miles |

165 miles = S$1 |

|

Citi M1 rebate |

1 Citi M1 Rebate = S$1 |

|

Rewards Points |

440 Reward Points = S$1 |

No, there are no fees or charges involved in the cash rebate redemption via SMS or online service – except that you shall bear the cost of any mobile data or SMS costs incurred during the redemption process.

No, there is no limit on cashback redemption. The amount of redeemable cash rebate is depends on the amount of Citibank cash back you've accumulated on your card account in the first place.

When is the best time to redeem Citibank cash back?

There is no "best time", it's up to you to be strategic with your cashback redemption. Notwithstanding the manual redemption, the cashback redeemed for cash rebate will be automatically applied to your card's next billing statement.

Please note that this means that the cash rebate has to be redeemed before the credit card bill is reflected in your statement. Otherwise, the rebate will be applied to the following bill instead.

SingSaver x Citi Credit Cards Exclusive Offer

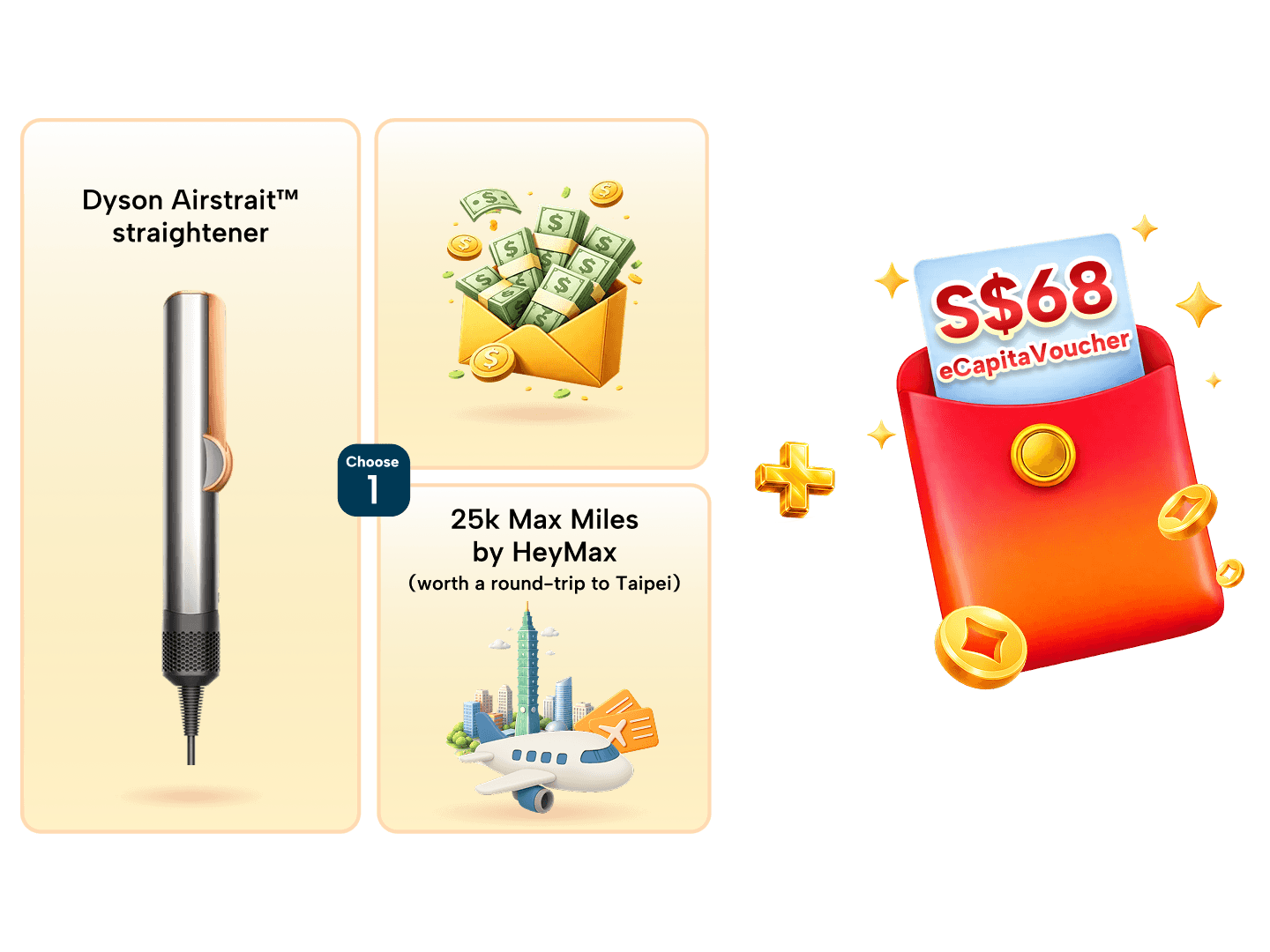

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 40mm (GPS), or up to S$410 when you apply for a Citi credit card and spend a minimum of S$500 within 30 days of card approval. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid until 1 March 2026. T&Cs apply.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.