Best Online Shopping Credit Cards in Singapore (2025)

Updated: 16 Sept 2025

Online shopping a way of life for you? Then add these credit cards to cart, pronto.

The best thing about online shopping is that you can refresh your wardrobe or gadget stash without contending with the downtown crowd and the commute. And with the heightened anticipation from the delivery, it makes the unboxing of your new loot all the more satisfying.

There are so many online shopping and e-commerce sites today, including Shopee, Lazada, Zalora, Taobao, and more. They cover everything from food, fashion, travel, cosmetics, gadgets and even groceries; everything you could ever want is at the touch of your fingertips. However, to shop online like a pro, make sure you’re using the right credit card to really maximise your online spending. You could be missing out on some big cash rebates, rewards or even bonus miles! Here are the best credit cards in Singapore for online shopping right now.

Citi Rewards Card

- 10X rewards points for all online purchases except mobile wallet and travel-related transactions.

- 10X rewards points for in-store shopping purchases at department stores, clothing stores and more.

- 1X rewards points on all other purchases.

- Pair with amaze card to turn offline transactions into online transactions.

- No cap on base rewards points.

- Rewards points conversion rate: 440 Points = S$1

- Rewards points are rounded down to the nearest 10 points on all purchases.

- Use Citi PayAll to earn ThankYou PointSM when you pay your bills with your Citi Rewards Card.

- Up to S$1 million travel insurance coverage when you charge your travel tickets to this card. There will be a revision made to the Citi Credit Cards complimentary travel insurance. The Travel Insurance coverage in respect of a Trip charged to Citi Rewards Card will be updated to end on 31 March 2026. For more information, please click here.

- Read our full review of the Citi Rewards Card

- Bonus air miles

- Travel insurance

- Annual Fee waiver

- High-value gift

- Bonus rewards points capped at 9,000 points per statement month.

- Can no longer convert Citi ThankYou Points into miles (as of February 2026).

UOB EVOL Card

- Enjoy no FX fees on overseas foreign currency spend worldwide with no min. spend, no cap.

- Enjoy 10% cashback on Local Online and Mobile Contactless (Apple Pay, Samsung Pay, google Pay) Spend

- 10% on Selected Gym, Telco and Streaming Spend

- Get 3% cashback on all Overseas FX Spend till 31 Jan 2026.

- Get 10% cashback on mobile contactless MYR spend in Malaysia till 31 Jan 2026.

- All other spends earn 0.3% cashback.

- Gain access to over 1,000 deals at eco-friendly, dining, and online shopping merchants.

- Receive a first-year annual fee waiver. Annual fee for subsequent years waived with min. 3 transactions every month.

- Get greater savings with up to 4.5% p.a. interest with UOB One Account+.

- Online shopping rebate

- Mobile contactless rebate

- No FX fees

- Overseas in-store FX spend rebate

- Minimum spend of S$800 each statement month to enjoy accelerated cashback earn rate.

- S$80 total cashback cap per statement month (S$30 cap for local online and mobile spend; S$20 cap for selected gym, telco and streaming spend; and S$30 cap for all other spend. Plus, additional $20 cap on the 1% cashback on all Overseas Foreign Currency Spend till 31 Dec 2025.

- Additional S$20 cap on 10% cashback on mobile contactless MYR spend in Malaysia and S$20 cap on 1% cashback on all overseas FX spend till 31 Jan 2026.

- Monthly spend required

UOB Absolute Cashback Card

- 1.7% cashback on all your purchases including travel, home furnishings, weddings, luxury purchases and more.

- 0.3% cashback on local transactions which are commonly excluded from earning rewards such as charity, education, healthcare, professional services, utilities and Grab wallet top-ups.

- No minimum spend.

- No cashback cap.

- Cashback earned in current statement period is automatically used to offset the following month's bill.

- No rebate cap

- No monthly spend required

- Insurance rebate

- Local spending rebate

- Mobile contactless payment methods not supported.

CIMB Visa Signature Card

- 10% cashback on online shopping, groceries, beauty/wellness, pet shops/veterinary services and cruises.

- Unlimited 0.2% cashback on all other spend.

- Complimentary travel insurance of up to S$500,000 when you charge your travel fares to this card.

- No annual fees for life + up to 4 supplementary cards with no annual fees.

- Online shopping rebate

- Supermarket rebate

- Annual Fee waiver

- Minimum spending of S$800 in the statement month to qualify for 10% cashback.

- 10% cashback is capped at S$100 per statement month per principal cardmember and up to S$20 per category. Earn 0.2% cashback on all spend when you exceed the cashback cap.

- Rebate cap applied

- Get up to 6% cashback on Shopping and Transport spend

- Get unlimited 0.3% cashback on all spend

- Earn an extra 3.25% cashback on In-store Overseas Spend at your favourite destinations in Asia from Japan, Malaysia, Thailand and more

- Enjoy first-year annual fee waiver

- Enjoy more fresh deals and exclusive perks

- Spending on the card and crediting your salary can earn you 0.05% p.a. or more on your DBS Multiplier account

- Online Rebate

- Shopping

- Public transportation

- Min. monthly spending of S$800 required to earn up to 6% cashback on Shopping and Transport spend

- Cashback on Shopping spend capped at S$50 per calendar month

- Cashback on Transport spend capped at S$20 per calendar month

- Rebate cap applied

- Monthly spend required

- Earn 15 OCBC$ (equivalent to 6 miles) per S$1 spent at Watsons and online shopping platforms (Lazada, Shopee, Taobao and TikTok Shop).

- Earn 1X OCBC$ (or 0.4 miles) on all other spends, including public transport rides.

- Enjoy complimentary e-commerce protection on all your online purchases made with this card.

- Get fast approval and use your digital card instantly when you apply via MyInfo.

- Read our full review of the OCBC Rewards Card.

- Retail rebate

- Online shopping rebate

- Gift: Apple product

- No monthly spend required

- 15 OCBC$ per S$1 earn rate is capped at 10,000 bonus OCBC$ cap per month.

- OCBC$ awarded in blocks of S$5 charged per transaction.

- 6% cashback on fuel spend at all other petrol stations.

- 5% cash rebate on dining spends all day, everyday (includes local/overseas dining and online food delivery).

- 3% cashback on drugstore purchases, streaming service subscriptions and EV charging expenses.

- 3% cashback on groceries at supermarkets (both local and overseas) and online groceries.

- 3% cashback on private hire (Grab/Gojek) and taxi rides (both local and overseas).

- 3% cashback on recurring telco and electricity bills.

- S$160 monthly cashback cap (up from S$80).

- Up to 22.92% fuel savings at Caltex (incl. 18% instant discount for all fuel) and 6% cashback on fuel spend at all other petrol stations.

- 2-year annual fee waiver.

- Earn up to 4.65% p.a. interest on first S$100,000 of OCBC 365 Account balance.

- Great for homemakers, working adults, cashback lovers, enjoy flexibility over min. spend (S$800 or S$1,600), drive frequently

- Read our full review of the OCBC 365 Credit Card .

- Petrol rebate

- Dining rebate

- High min. spend of either S$800 or S$1,600 per calendar month

- Min. annual spend of S$10,000 from date of issue to qualify for automatic annual fee waiver.

- S$80 monthly cashback cap with minium spend of $800.

- S$160 monthly cashback cap with mininum spend of $1,600.

- Operates on a whitelist basis. Only selected MCCs shown in the T&Cs qualify for bonus cashback.

- Interest on outstanding balance increased from 26.88% p.a. to 27.78% p.a.

- Monthly spend required

Best for shopping rewards redemption: Citi Rewards Card

If your ideal kind of day is spent shopping online at home, then the Citibank Rewards Card is for you.

This is one of the cards that gives the highest reward points: 10 Rewards points (4 miles for every $1) for online spend, both overseas and locally. The best part? No minimum spend is required. Your Rewards points can either be used to offset payment for purchases or to redeem from a catalogue of Citi ThankYou rewards that include various merchandises and travel.

The monthly cap is set at 9,000 bonus Rewards points per statement month (equivalent to S$1,000 per month for online shopping). Meanwhile, base Rewards points have no cap whatsoever. So if you’re an online shopping fiend and spend over S$1,000 per month, you earn only 1 Reward point for every S$1 spent after the cap is reached.

Also, take note, Rewards points aren’t offered on travel-related transactions so don’t book your flight tickets and hotel stays using this card. Check out the full exclusions here.

SingSaver x Citi Rewards Credit Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$450), Apple Watch SE Gen 3 40mm (GPS), or S$380 Cash when you apply for a Citi Rewards Card and fulfil promo requirements. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

SingSaver CNY 2026 Flash Deal

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

Best for easy 8% cashback: UOB EVOL Card

If you enjoy buying anything and everything online as well as adore the cashless lifestyle, the UOB EVOL Card is your BFF.

The main highlight of this easy-to-use credit card is that you get to enjoy a high 10% cashback on all your online spend and mobile contactless spend made via Apple Pay, Google Pay, Samsung Pay or Fitbit Pay.

It's really as simple as that, so long as you meet the decently achievable minimum spend requirement of S$800 per statement month to earn the maximum cashback.

As there is a cap of S$80 per statement month split across the categories, you may need to track your spending.

Best for unlimited cashback: UOB Absolute Cashback Card

If you just want a simple, hassle-free cashback card that has no lid on how much you can get back, the UOB Absolute Cashback Card is the card to get.

It offers the most straightforward cashback rate: 1.7% cashback on everything! If you think 1.7% sounds low, keep in mind there is no minimum spending requirements or cashback caps. This is ideal for those who don’t have time to keep track and split expenses across multiple cards (who does?).

With the unlimited cashback in mind, the best time to get hold of this credit card is when you’re anticipating a big-ticket online purchase, such as household appliances, furniture or electronic gadgets.

Best for high cashback rate: CIMB Visa Signature Card

While the UOB Absolute Cashback Card offers limitless cashback with a relatively low 1.7%, the CIMB Visa Signature card is quite the opposite: it accelerates your online shopping gains with the highest cashback at 10%. But online shopping itself is a wide spectrum, and it includes groceries; if this category takes up a significant portion of your monthly expenditure, it is highly recommended that you charge it to this card too.

Another major benefit of the CIMB Visa Signature Card is that principal cardholders enjoy a lifetime fee waiver of annual fees.

Be sure to spend a minimum of S$800 per month to qualify for the 10% cashback, which is capped at S$100 per statement month, split into S$20 per category.

As stated in the exclusions, the cashback applies strictly to online shopping, which means your brick-and-mortar retail spends only get you 0.2%.

SingSaver x CIMB Visa Signature Credit Card Exclusive Offer

Receive S$50 Cash when you sign up for a CIMB Visa Signature Credit Card and spend a min. of S$108 within 30 days of card approval. Stackable with ongoing CIMB S$188 casback welcome offer. Valid until 1 March 2026. T&Cs apply.

Best for online and offline buys: DBS Live Fresh Card

Fashionistas, you can do no wrong if you carry DBS Live Fresh into your online shopping spree. Whether you’re shopping for your next great #OOTD ensemble, the latest sneaker release or beauty/grooming products, you enjoy 6% cashback on all qualifying online purchases.

But that’s just one of the twin engines of cashback earning; all your Visa contactless (PayWave) payments during physical shopping (not limited to retail) also gets you 6% cashback.

All other spending earns 0.3% unlimited cashback. In a month, assuming you hit the minimum qualifying spend of S$800, you could earn up to a total of S$70 cashback (cashback cap split into S$50 on shopping spend and S$20 on transport spend).

DBS has the occasional credit card promotion whereby you earn higher cashback rate on selected categories of spending, or when you hit certain spending goals. So keep a lookout for those.

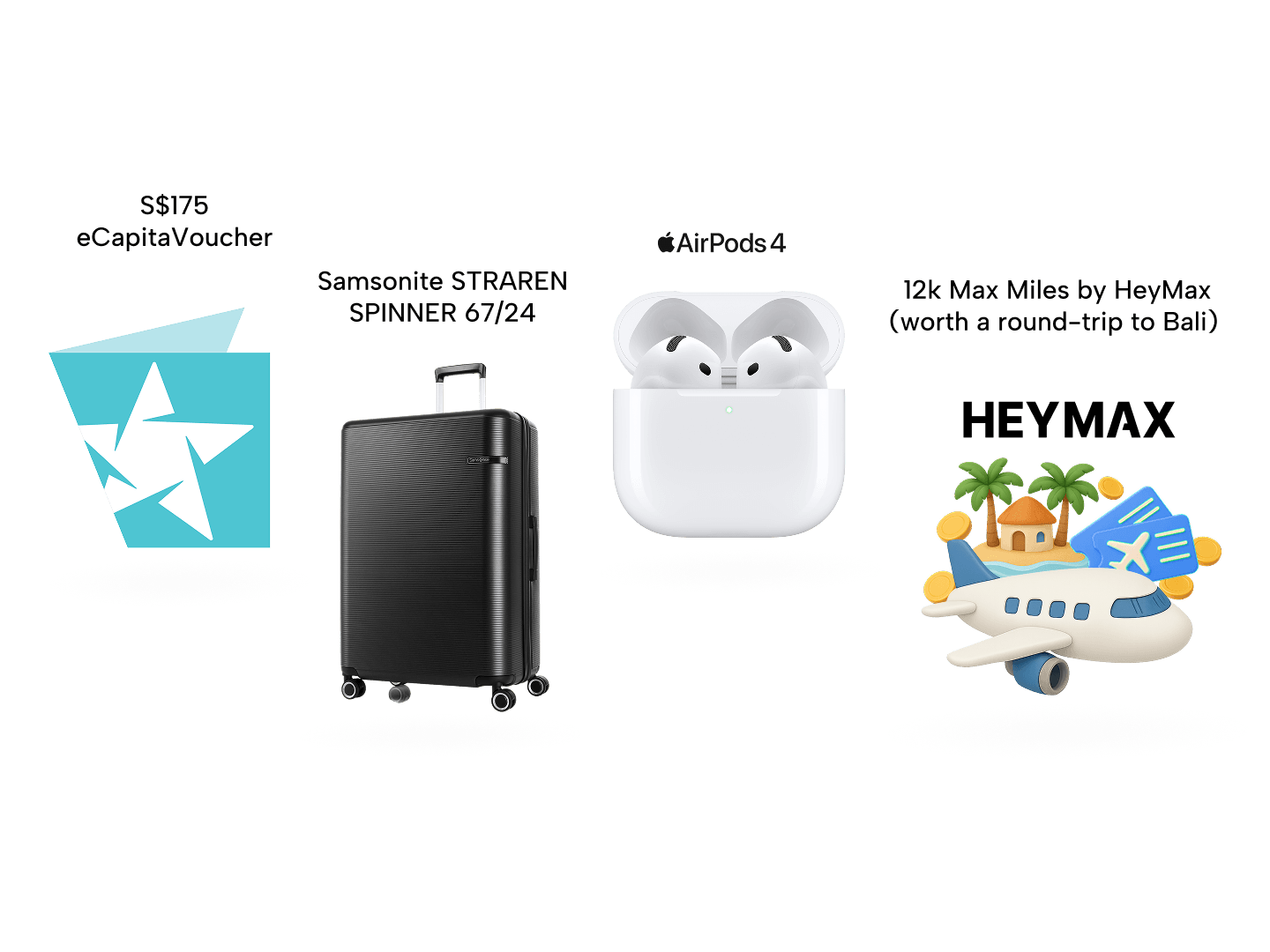

SingSaver x DBS Live Fresh Card Exclusive Offer

Get S$175 eCapita vouchers, 12,000 MaxMiles by HeyMax (worth S$216), Apple AirPods 4, SAMSONITE STRAREN SPINNER 67/24, or a Xiaomi Truclean W20 Wet Dry Vacuum when you apply for a DBS Live Fresh Card via SingSaver and hit a min. spend of S$100 within 30 days of card approval. Or top up as low as S$250 to get the latest Dyson, Nintendo, or Sony products! Valid till 1 March 2026. T&Cs apply.

Best for e-Commerce shopping: OCBC Titanium Rewards Card

If retail and online shopping are high on your agenda, then the OCBC Titanium Card is the card to shop with.

It gives 50 OCBC$ for every S$5 spent on shopping categories (i.e. 10 OCBC$ per dollar or 4 miles per dollar). Examples include duty-free stores, department stores, clothing stores, shoes and bags stores and babies and children’s wear.

Fans of Shopee, Taobao, Ezbuy, Lazada, Qoo10, Amazon, Alibaba, AliExpress, Daigou, Mustafa Centre and Courts can also look forward to racking up rewards quickly with this credit card.

That's not all. You can also earn an additional 2% cash rebate if you are shopping at BEST Denki.

Another perk? With complimentary e-Commerce Protection, the card safeguards you against non-delivery or defective goods for all online purchases charged to the credit card.

Do note that the bonus cap is 10,000 OCBC$ per calendar month or S$1,110 per calendar month.

SingSaver x OCBC Rewards Credit Card Exclusive Offer

Get S$370 Cash, 25,000 MaxMiles by HeyMax (worth S$450), Dyson Airstrait™, S$250 Cash + Xiaomi Luggage Classic Pro 24" Bundle (total worth S$449), or 50,000 OCBC$ (worth a round trip to Bali) when you apply for an OCBC Rewards Credit Card via SingSaver and fulfil promo requirements. Or, top up as low as S$50 to get the latest Dyson, Sony or Apple products! Valid until 1 March 2026. T&Cs apply.

SingSaver CNY 2026 Flash Deal

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

Best for online food delivery: OCBC 365 Card

If your idea of online shopping involves ordering a feast from your favourite delivery platforms, the OCBC 365 Credit Card rewards you for that with 6% cashback on the likes of Deliveroo, GrabFood and foodpanda.

The icing on the cake is that it offers a slightly higher than average cashback cap of S$80 per month, assuming you spend at least S$800 per calendar month.

Besides the 5% cashback on online food deliveries (as well as dining in general), you’ll also get to enjoy an array of cashback privileges on other online spending categories, most notably the 3% on groceries, private hire rides and recurring telco and electricity bills, pharmacy purchases, streaming subscription and electric vehicle charging fees.

For those who drive, the OCBC 365 also comes with fuel perks: up to 22.92% fuel savings at Caltex (including 18% instant discount for all fuel), up to 21.04% fuel savings at Esso, and 5% cashback on fuel spend at all other petrol service stations!

SingSaver x OCBC 365 Credit Card Exclusive Offer

Get S$370 Cash, 25,000 MaxMiles by HeyMax (worth S$450), Dyson Airstrait™, or S$250 Cash + Xiaomi Luggage Classic Pro 24" Bundle (total worth S$449) when you apply for an OCBC 365 Credit Card via SingSaver and fulfil promo requirements. Or, top up as low as S$50 to get the latest Dyson, Sony or Apple products! Valid until 1 March 2026. T&Cs apply.

SingSaver CNY 2026 Flash Deal

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.