Best Grocery Credit Cards In Singapore 2025

Updated: 11 Apr 2025

NTUC Fairprice, Cold Storage or Sheng Siong? Also, which credit card to use at each supermarket? Here’s how you can make the most out of your grocery runs and be your own cashback king or queen.

Written bySingSaver Team

Team

Every spending situation is unique. SingSaver assembles the 'Best For' list, so you can decide what’s best for you.

Grocery shopping is a regular routine for households. Speaking of routines, it’s something we don’t give much thought to unless a sudden price hike on a grocery staple catches the eye. However, it can be much more rewarding when you’re earning cashback, air miles or welcome gifts on all your spending.

However, each credit card has its own terms and conditions such as minimum monthly spend and cashback caps. Here, let’s help you figure out how to pair the right credit card with the right supermarket based on your grocery shopping habits.

Overview: Best grocery credit cards in Singapore 2025

|

Grocery Store |

Credit Card |

Benefits |

|

Maybank Family & Friends Card |

8% cashback |

|

|

HSBC Visa Platinum Credit Card |

5% quarterly cashback |

|

|

NTUC Link and Trust Link Cards |

NTUC Link: Up to 21% rebate Trust Link: Up to 15% rebate |

|

|

BOC Sheng Siong Card DCS Sheng Siong Card POSB Everyday Card |

Unlimited 1.5% rebate 2% REBATE$ 5% rebate |

|

|

Online Grocers (RedMart, Amazon Prime Now) |

CIMB Visa Signature Card |

10% cashback |

|

Citi Cash Back Card |

6% cashback |

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 1 March 2026. T&Cs apply.

✨Get the Reward Upgrade You Deserve✨

Get your dream Apple, Dyson, Sony, or Nintendo gadgets when you apply for select Citi, HSBC, OCBC, or Standard Chartered credit cards via SingSaver and top up as low as S$60! Valid till 1 March 2026. T&Cs apply.

Best For Cold Storage: Maybank Family and Friends Card or UOB One Card

If you prefer shopping at Cold Storage, make sure you bring along your Maybank Family and Friends card or UOB One card.

Maybank Family and Friends Card

|

Cashback 💵 |

8% on five out of 10 categories, including groceries |

|

Cashback cap |

Capped at S$125 per month |

|

Minimum spend requirement |

S$800 per month |

|

Annual fee |

S$181.80 (First 3 years waived) |

With the Maybank Family and Friends card, cardholders earn 8% cashback on five out of eight spend categories. These include groceries, dining & food delivery, transport, online retail, and much more. This makes it a great general spending card with a high cashback rate.

However, you must hit the minimum monthly spend requirement of S$800 to enjoy the 8% cashback rate. Otherwise, this drops to just 0.3%. Cashback is also capped at S$125 per month, with a cap of S$25 per selected category.

UOB One Card

|

Cash rebate 💵 |

Up to 15% cashback Base 3.33% + (Additional & Enhanced) 11.67% = Up to 15% cashback total |

|

Rebate cap |

Capped at S$500 max per quarter |

|

Minimum spend requirement |

S$500/S$1,000/S$2,000 per month per quarter |

|

Annual fee |

S$196.20 (First 2 years waived) |

With the UOB One card, you earn up to 6.67% additional cashback at these supermarkets: Cold Storage, Marketplace, and Jasons depending on how much you spend per month per quarter. This applies to both existing and new-to-UOB cardmembers.

Go a step further, and new-to-UOB cardmembers specifically, can receive up to 6.67% enhanced cashback too, based on the monthly spend per quarter.

Together, that'll give you between 8.33% to 15% cashback based on whether you're an existing or new-to-UOB cardmember. We understand this can all sound a little confusing, so here's what the breakdown looks like:

|

For existing UOB cardmembers |

||

|

Min. S$500 / S$1,000 spend per month |

Min. S$2,000 spend per month |

|

|

Quarterly cashback (Min. 5 transactions per month) |

3.33% |

|

|

Additional cashback |

5% |

6.67% |

|

Total cashback |

8.33% |

10% |

|

For new-to-UOB cardmembers |

||

|

Min. S$500 / S$1,000 spend per month |

Min. S$2,000 spend per month |

|

|

Quarterly cashback (Min. 5 transactions per month) |

3.33% |

|

|

Additional cashback |

5% |

6.67% |

|

Enhanced cashback (New-to-UOB cardmembers only, till 30 Jun only) |

6.67% |

5% |

|

Total cashback |

15% |

|

In general, the UOB One Card is a great everyday cashback credit card – especially if you're a loyal shopper at the aforementioned supermarkets. That said, 15% cashback is the highest rate you can get at the moment – let alone for grocery shopping. So hop on the bandwagon while you can before the sign-up promo ends on 31 December 2023! 🛒🤸🏻

⚡SingSaver x UOB One Credit Card Flash Deal⚡

Get up to S$888 Cash via PayNow or 55,000 MaxMiles by HeyMax (worth S$990) (enough for a round trip to Europe (e.g. Paris, Rome, Madrid) when you apply for a UOB One Credit and make a minimum spend of S$800 within the first month of card approval. Valid till 28 February 2026. T&Cs apply.

Best For Giant: HSBC Visa Platinum Card or Citi SMRT Card

If shopping at Giant is your preferred choice of supermarket, make sure you swipe with the HSBC Visa Platinum or the Citi SMRT Card.

HSBC Visa Platinum Card

|

Cash rebate 💵 |

5% quarterly cash rebate on groceries, dining, and fuel |

|

Rebate cap |

Capped at S$250 per quarter |

|

Minimum spend requirement |

S$600 per month per quarter |

|

Annual fee |

S$196.20 (First 2 years waived) |

The HSBC Visa Platinum grants 5% quarterly cash rebate, not just at Giant, but at all local supermarkets as well. If you're a digital native, you'll be glad to know that this accelerated cashback rate applies to their online counterparts too. However, you'll need to make a minimum monthly spend of S$600 for an entire calendar quarter to receive this rate.

On the bright side, this card has a two-year annual fee waiver.

Citi SMRT Card

|

Rebate rate 💵 |

5% rebate on all supermarkets and grocery stores, online purchases, taxi (incl. Gojek, Grab), and public transport (SimplyGo) |

|

Minimum spend requirement |

S$500 per month |

|

Annual fee |

S$196.20 (First 2 years waived) |

An alternative option would be the Citi SMRT Card. It nets you a healthy 5% rebate on groceries and the best part is that you only need to spend a minimum of S$500 per month — an attainable sum for many. What's more, the 5% savings is not limited to just Giant; you enjoy it across major supermarkets as well as qualifying online spend, making it a highly versatile card.

💡Pro-tip: Since it follows a blacklist approach to its merchant eligibility, its qualifying online spend covers most merchant category codes (MCCs) unless stated otherwise.

For instance, your online movie transactions or online food delivery orders may very well be considered, subject to the bank's approval.

So track your monthly credit card bill statement and check with Citibank accordingly if you need clarifications on which transactions qualified for bonus rebates.

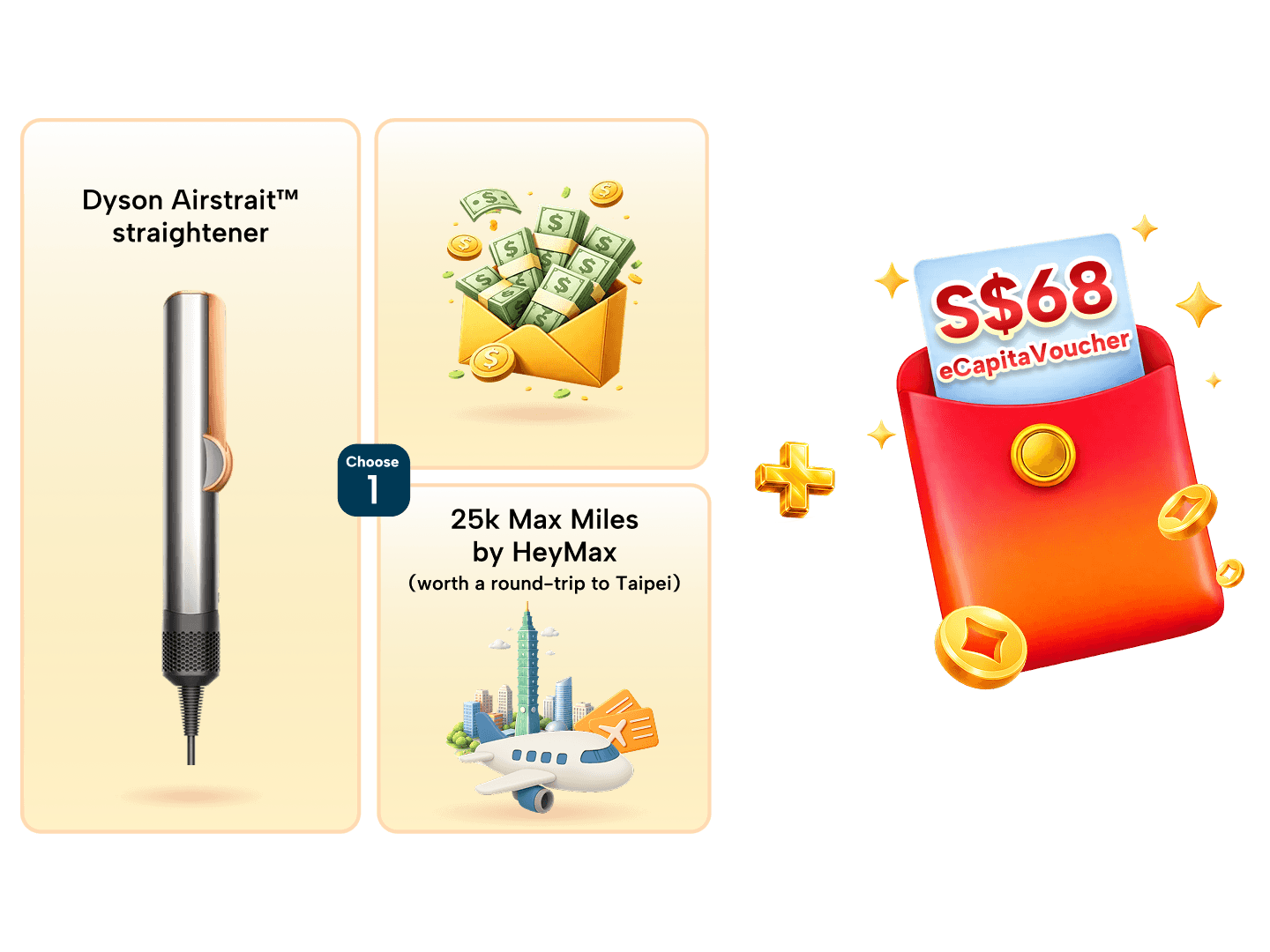

SingSaver x Citi SMRT Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 40mm (GPS), or up to S$410 when you apply for a Citi SMRT Card and fulfil promo requirements. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid until 1 March 2026. T&Cs apply.

Best For NTUC FairPrice: Trust Link/NTUC Link Credit Cards

Trust Credit Cards

If you haven't heard the news by now, Trust Bank – the very first digital bank in Singapore – has launched a new credit card in tandem with their savings account in favour of NTUC's ecosystem.The Trust Bank credit card does not impose any annual fee, foreign transaction fee, cash advance fee or card replacement fee.

|

Credit card |

Debit card |

|

|

NTUC Union member |

Up to 21% rebate on groceries and food at Fairprice (min. S$350 monthly spend)

Up to 20% rebate on fuel spend at Caltex (and other deals)

Up to 0.22% rebate on all other spend

*Capped at 5,500 Linkpoints **Capped at 7,500 Linkpoints ^Capped at 12,000 Linkpoints |

Up to 11% rebate on groceries and food at Fairprice (min. S$200 monthly spend)

Up to 0.22% rebate on all other spend

*Both monthly and quarterly bonuses are capped at 3,500 Linkpoints ^Capped at 12,000 Linkpoints |

|

Non-NTUC Union member |

Up to 15% rebate on groceries and food at Fairprice (min. S$450 monthly spend)

*Capped at 5,500 Linkpoints ^Capped at 7,500 Linkpoints |

Up to 5% rebate on groceries and food at Fairprice (min. S$200 monthly spend)

*^Both monthly and quarterly bonuses are capped at 3,000 Linkpoints quarterly |

|

Note: To qualify, all minimum monthly spend needs to be on purchases outside of Fairprice Group.

"Up to 21% rebate" (NTUC Link credit card) and "up to 15% rebate" (Trust Link credit card) are promotional rates until 31 Oct 2023. |

||

Best For Sheng Siong: BOC Sheng Siong Card, DCS Sheng Siong Card or POSB Everyday Card

BOC Sheng Siong Card

|

Cash rebate 💵 |

6% on Sheng Siong transactions |

|

Unlimited 1.5% on all other spend |

|

|

Rebate cap |

Capped at S$45 per month |

|

Minimum spend requirement |

S$500 per month |

|

Annual fee |

S$196.20 (First 2 years waived) |

Sheng Siong shoppers should not be leaving home without the BOC Sheng Siong Card.

The card offers 6% cash rebate on Sheng Siong spend with no minimum spend required, capped at S$45 rebate per month. Meanwhile, shoppers will also enjoy unlimited 1.5% cash rebate on all other retail spend outside of Sheng Siong, with no minimum spend required again.

Ostensibly, this other retail spend applies to eligible local and overseas spend across dining, transportation, online shopping, and more. Not to mention, the lack of minimum spend is definitely another major plus point.

Another important consideration is the location of the nearest Sheng Siong supermarket. While Sheng Siong has more outlets than Cold Storage, the number of Sheng Siong outlets (57) is only about a quarter of NTUC FairPrice’s (over 200 stores).

Thus, we'd only recommend getting this card if there's a Sheng Siong outlet near you or don't mind using it for its 1.5% cash rebate on other spend (including at other grocery store chains), functioning similarly to an unlimited cashback card.

DCS Sheng Siong Card

|

Cash rebate 💵 |

5% REBATE$ for regular Card on up to S$1,000 spend per month 2% REBATE$ for S$500 Limit Card on up to S$500 spend per month |

|

Rebate cap |

Capped at S$46.30 REBATE$ per month |

|

Annual fee |

S$196.20 (First year waived) |

If you thought the BOC Sheng Siong Card was good, the DCS Sheng Siong Card is another dedicated grocery card right up your alley – especially for those who rack up a hefty grocery bill every month. (You'll see what we mean in just a second.)

Enjoy 5% REBATE$ on all your Sheng Siong spend on up to S$1,000 spend per month with a regular DCS Sheng Siong credit card, capped at S$46.30 REBATE$ per month. Although the S$1,000 receipt might seem like an improbable (and ridiculous) number at first, you'd be surprised at how quickly grocery expenditures can accumulate.

That's why this card is perfect for larger families or for housewives and househusbands needing to make multiple supermarket runs to Sheng Siong in a month.

Do note however, should you somehow exceed this generous S$1,000 monthly spend cap, your REBATE$ will still be capped at a maximum of S$46.30 per month. The good news is, these REBATE$ points never expire.

💡Did you know: You can redeem your REBATE$ into shopping/dining vouchers and even air miles! Plus, cardholders are entitled to one complimentary airport lounge visit per calendar year along with up to S$1 million complimentary travel insurance coverage. ✈️🌍

See also: Which Credit Cards Offer Free Travel Insurance in Singapore?

POSB Everyday Card

|

Cash rebate 💵 |

5% on Sheng Siong transactions |

|

Rebate cap |

Capped at Daily$30 per month |

|

Minimum spend requirement |

No min. spend for Sheng Siong, utility bills, fuel, and select retail spend S$800 per month for food delivery, dining, online shopping, POPULAR stores, and phone bills |

|

Annual fee |

S$196.20 (First year waived) |

Last but not least, you can also consider the POSB Everyday card. For no minimum spend, you already get rewarded with 5% cash rebate at Sheng Siong, capped at Daily$30 per month.

Hit a monthly expenditure of S$800, and you'll unlock other cash rebates on online food delivery (up to 10%), dining (3%), online shopping (5%), POPULAR store spend (8%), and even on your phone bills (3%).

No matter, that 5% cash rebate at Sheng Siong is all yours the moment you start swiping at the supermarket's checkouts.

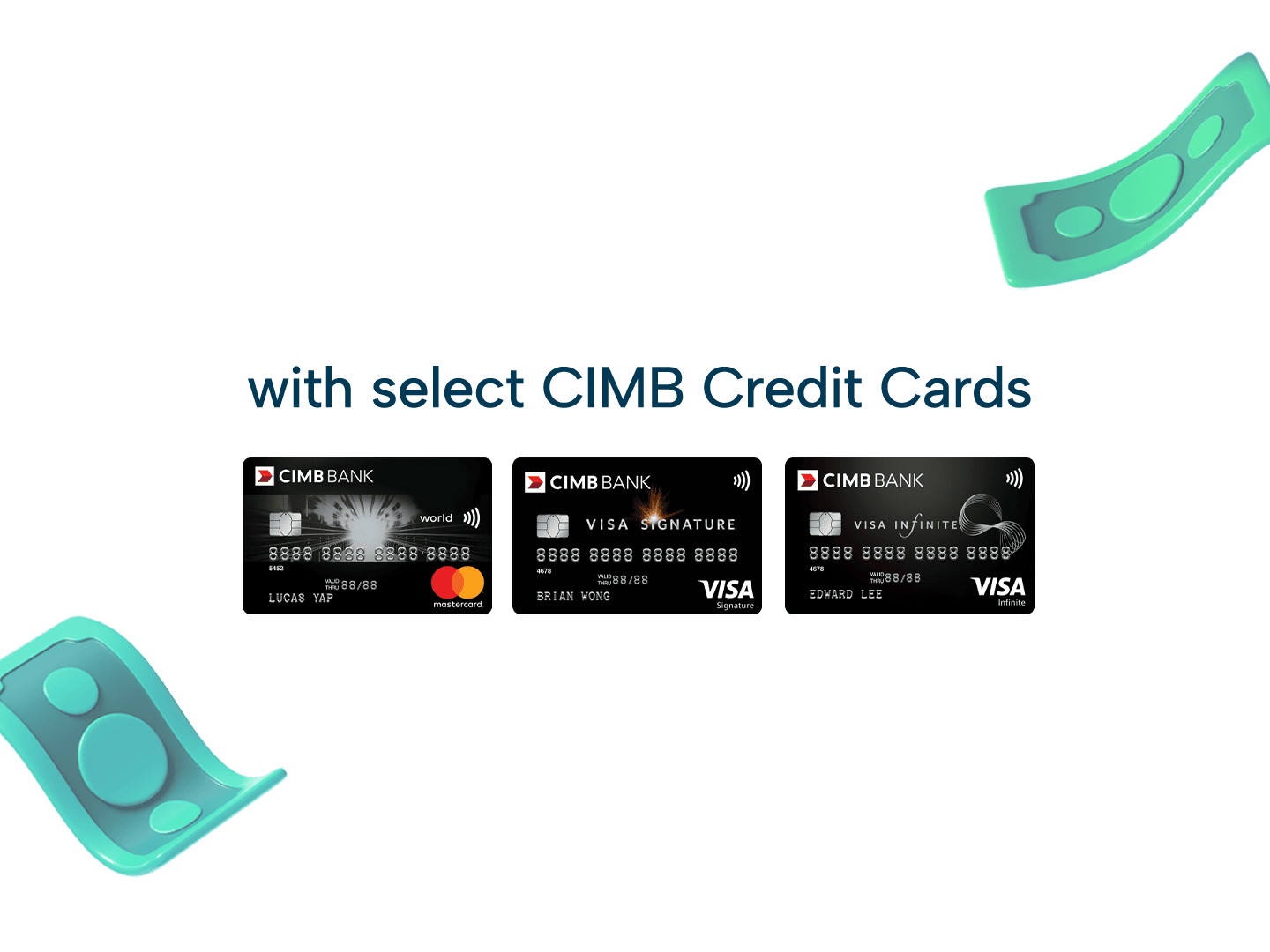

Best For Online Grocers: CIMB Visa Signature Card

|

Cashback 💵 |

Up to 10% on groceries, online shopping, beauty & wellness, pet shops & vet services, cruises |

|

0.2% on all other spend |

|

|

Cashback cap |

Capped at S$100 per month, S$20 per category |

|

Minimum spend requirement |

S$800 per month |

|

Annual fee |

N/A |

If you like the convenience of online grocers like RedMart, Amazon Prime Now and FairPrice Online, check out the CIMB Visa Signature card.

Aside from being able to skip supermarket queues, cardholders can earn a high 10% cashback on groceries with minimum S$800 spend per month! With CIMB Visa Signature, your annual fees are also waived for life.

This high cashback rate can also be earned on a range of other spend categories including online shopping, beauty and wellness, pet shops and veterinary services, and travels by cruise. You can also use this card to pay for your bus and train rides.

However, the downside to this card is the cashback cap of S$100 per statement month and a low cap of S$20 per category spend. You will also earn 0.2% cashback on all other retail spend, albeit with no minimum spend or monthly cap.

Other cards you can consider using at online grocers: UOB Preferred Platinum Visa Card (4 mpd), Standard Chartered Journey Card (3 mpd)

SingSaver x CIMB Visa Signature Credit Card Exclusive Offer

Receive S$50 Cash when you sign up for a CIMB Visa Signature Credit Card and spend a min. of S$108 within 30 days of card approval. Stackable with ongoing CIMB S$188 casback welcome offer. Valid until 1 March 2026. T&Cs apply.

Best For All Supermarkets: Citi Cash Back Card

If you don’t have a favourite supermarket chain or just prefer a good general spending cashback card, consider the CIMB Visa Signature, Maybank Family and Friends card, or Citi Cash Back Card.

|

Cashback 💵 |

6% on groceries and dining 8% on petrol and private commute Up to 20.88% fuel savings at Esso and Shell |

|

0.20% on all other spend |

|

|

Cashback cap |

Capped at S$80 per month |

|

Minimum spend requirement |

S$800 per month |

|

Annual fee |

S$196.20 (First year waived) |

With the Citi Cash Back Card, cardholders earn 6% cashback on grocery spend across all supermarket chains. If you head out for drinks and food regularly, you’ll get 6% cashback on dining bills and food delivery (e.g. GrabFood, foodpanda, Deliveroo, etc.). Petrol and private commute spend will also enjoy 8% cashback rate.

But you'll need to satisfy a minimum S$800 monthly qualifying spend in order to enjoy these accelerated cashback rates, capped at S$80 cashback shared across all spend categories per month.

Moreover, regarding dining, only the following MCCs are covered: 5811 (Caterers), 5812 (Eating Places, Restaurants), and 5814 (Fast Food Restaurants). There are dining establishments that do fall outside these MCCs, so that's something to take note of.

The cashback benefits also cover petrol spend with a high 20.88% discount at both Esso and Shell.

SingSaver x Citi Cashback Credit Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 40mm (GPS), or up to S$410 when you apply for a Citi Cashback Card and fulfil promo requirements. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid until 1 March 2026. T&Cs apply.

No Personal Loans Match Your Criteria

Try adjusting your loan amount or tenure to see more options.Conclusion

With the cost of living and inflation rising hand-in-hand in Singapore, it only makes sense to capitalise on cost savings wherever possible.

Owning a dedicated grocery credit card no doubt comes in handy, regardless of whether you're managing a household or simply living the independent life on your own. All the money saved from grocery trips will go a long way towards several well-deserved vacations throughout the year. 🏖️

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.