What Is CPF Personal Loan: CPF Loan Eligibility & How To Apply

Updated: 22 Aug 2025

Did you know that your Central Provident Fund (CPF) can do more than just fund your housing and retirement? With the rising cost of living in one of the world’s most expensive countries, the CPF personal loan presents a lifeline for older Singaporeans who find themselves in need of quick cash.

This article will cover all you need to know about the CPF personal loan and how to apply for one.

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

What is a CPF personal loan?

A CPF personal loan allows Singaporeans and Permanent Residents who are 54 years old and above to utilise the savings in their CPF account as collateral for a personal loan. Despite its name, the loan isn’t offered directly by CPF, but by licensed moneylenders who offer borrowers the option to put up their CPF savings as collateral.

You can borrow up to six times your monthly income with competitive interest rates, ranging from 1% to 4% per month. You can choose a repayment period of six to 12 months, with the option to extend repayment until the age of 55.

What can CPF personal loans be used for?

As the credit you receive will be in cash, just like with any other personal loan, you can use it for basically any purpose. This includes medical bills, home repairs and renovations, as well as other financial emergencies.

Take note that CPF personal loans are not meant for funding a home purchase. Individuals who wish to use their CPF savings to purchase a home can utilise funds in their Ordinary Account (OA) to cover their down payment and monthly installments, without the need to take out a CPF personal loan.

Eligibility criteria and requirements

To be eligible for a CPF personal loan, you need to:

-

Be a Singaporean citizen or Permanent Resident who is at least 54 years old

-

Have a minimum salary of $2,000 a month

-

Be able to withdraw at least $5,000 from your Ordinary Account (OA) or Special Account (SA)

You will need to provide the following documents:

-

Identity card / NRIC

-

Proof of residence (utility bill, a letter addressed to you, and or tenancy agreement)

-

Proof of employment (employment letter of contract, certificate of employment, pay slips)

-

SingPass (to log into CPF, HDB, IRAS website)

What’s the difference between a bank loan and a CPF personal loan?

|

Features |

CPF Personal Loan |

Bank Loan |

|

Age |

Singaporeans and PRs aged 54 and above |

Anyone above 21 years old |

|

Minimum income |

S$2,000 per month |

Varies by lender |

|

Eligibility criteria |

|

|

|

Interest rates |

1-4% |

1-4% |

|

Tenure |

6-12 months, or until borrower’s 55th birthday |

6-12 months |

|

Application process |

Quick, with minimal documentation required |

Can be extensive and time-consuming |

If you are eligible for a CPF personal loan, you may be wondering: Why choose it over a bank loan if they give you access to the same amount of funds and serve the same purpose?

The most important difference between a CPF personal loan and a bank loan is that you do not need proof of income or a good credit score to apply for the former. This is great for those who may not have a fixed monthly income or are unable to meet the requirements of a conventional bank loan.

Fees and charges

In Singapore, all licensed moneylenders can only charge up to 4% interest per month. Moreover, they can only impose a maximum late payment interest rate of 4% per month for each month the loan remains unpaid. It's important to note that this interest can only be applied to the overdue amount, not to the outstanding balance that is not yet due.

In addition, there are limitations on the fees licensed moneylenders are allowed to charge. These are:

-

No more than $60 for each month of late repayment;

-

A fee not exceeding 10% of the loan's principal amount when the loan is granted; and

-

Legal costs are mandated by the court if the moneylender successfully claims for loan recovery.

How to apply for a CPF personal loan

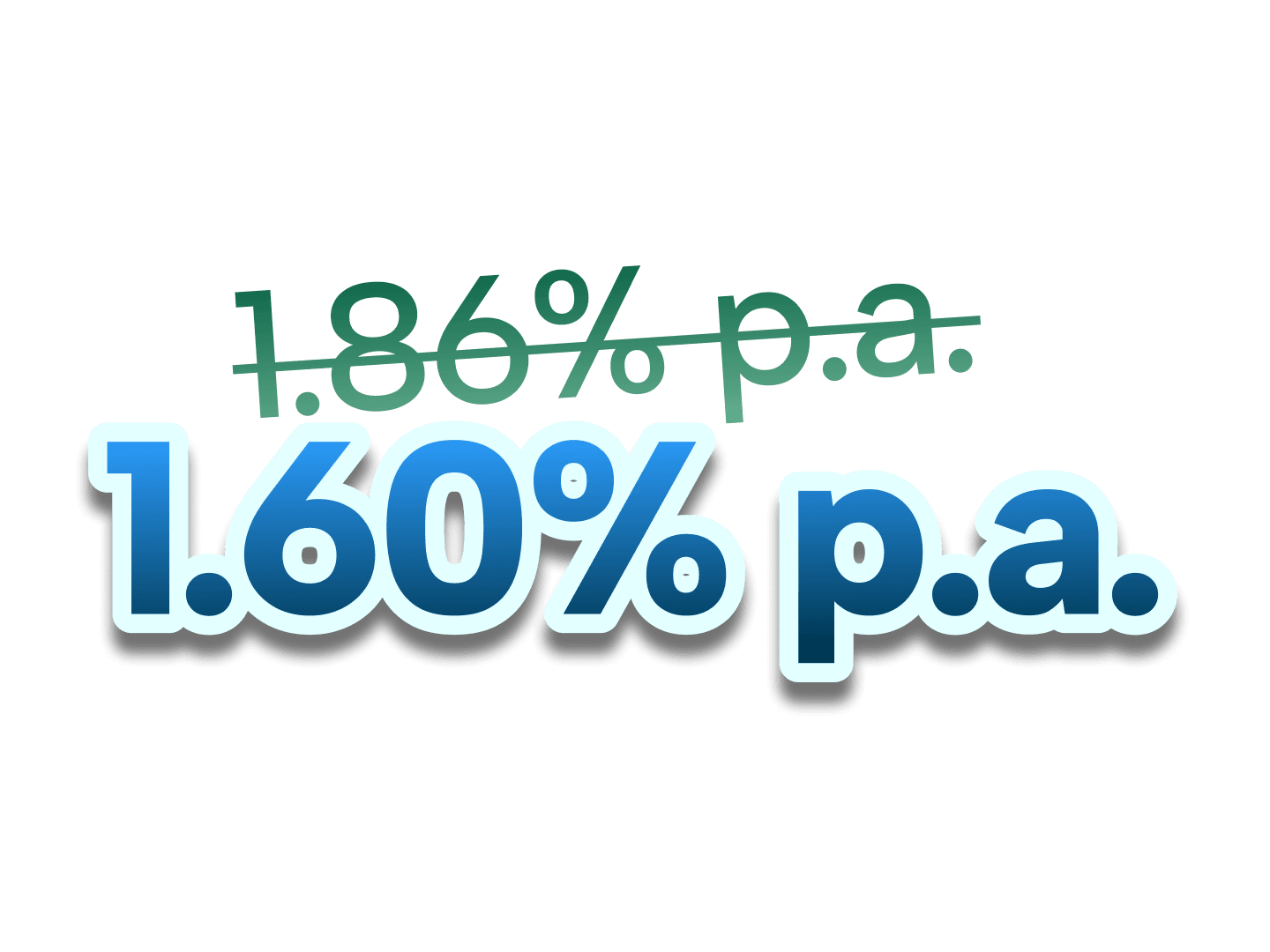

CIMB Personal Loan Welcome Offer

Enjoy low interest rates from 1.60% p.a. (EIR from 3.07% p.a.) when you apply for a CIMB Personal Loan! Valid till 1 March 2026. T&Cs apply.

Applying for a CPF personal loan in Singapore is simple. All you need to do is ensure that you are a CPF member and that your OA has enough savings for the loan you want to apply for. Once you have made sure of these two things, you can approach a licensed moneylender of your choice.

The CPF personal loan is a solid choice if you want more flexibility when it comes to repayment and collateral. Another perk is that the application process is quicker and more seamless than applying for a traditional bank loan, provided that you are a Singaporean or PR who is 54 years old and above and who meets the eligibility criteria.

Don’t meet the eligibility criteria for a CPF personal loan? Consider a bank loan that serves your purposes.

Top banks offering personal loans in Singapore (2025)

Younger Singaporeans and those who do not meet the eligibility criteria for a CPF personal loan may consider taking out a loan from one of the many established banks in Singapore.

For a fully digital experience

GXS FlexiLoan

-

Min. age: 21

-

Min. amount: S$200

-

Min. annual income: S$20,000 (Only for Singaporeans/PRs)

-

Interest rate: 1.88% (EIR 3.17% p.a.)

-

Loan tenure: 2 to 60 months

-

Early repayment fee: None

-

Late repayment fee: 18% p.a. (On unpaid principal)

SingSaver’s take

The GXS FlexiLoan offers a flexible, accessible, and fully digital lending experience, ideal for individuals who may encounter difficulties with conventional bank loans. Backed by Grab and Singtel, GXS Bank's digital loan product caters to a wider audience, including those in early career stages or with lower earning potentials, by setting its personal loan threshold at S$20,000.

A significant advantage of the GXS FlexiLoan is the absence of early repayment fees for either partial or full payments—a common charge among many traditional banks. This policy incentivises borrowers to reduce their debt sooner and minimise interest accumulation. The entire loan application and management process is seamlessly handled through the GXS Bank app, offering a paperless solution tailored for digital-first users.

Pros

Easy application through the app

Quick funds disbursement

No early repayment fee

Interest is calculated on daily non-compounding basis

Cons

Interest is chargeable on late payments

For existing Trust Bank customers who require quick cash

1. Download the Trust App and navigate to the Instant Loan section

2. Fill out an application and submit all required documents

3. Wait for approval of personal loan

- LOWEST Interest Rates in the Market from 1.56% p.a. (EIR 3.00%* p.a.) with no processing or hidden fees (until further notice)

- Flexible repayments. Choose your desired personal loan amount and tenure. Repay with fixed instalments over 3 to 60 months.

- Fast approval in 60 seconds.

- *EIR calculated based on loan amount of S$90,000 and tenure of 60 months from 1 Jan 2024. Maximum EIR may be up to 22.34% p.a. based on your personal credit profile.

- Deposit Insurance Scheme: SGD deposits of non-bank depositors are insured by the SDIC, for up to S$100,000 in aggregate per depositor per Scheme member by law.

- Min. age requirement: 21 years old

- Minimum annual income of S$30,000 for Singaporean citizen or PR or S$60,000 for foreigners with valid work pass

1. NRIC (Front & Back)

2. Salaried employees: Latest month’s computerised payslip or latest 6 months’ CPF contribution history statement

3. Self-employed individuals: Last 2 years’ Income Tax Notice of Assessment

4. Commission-based earners: Latest 3 months payslip or latest 6 months' CPF contribution history statement

The information displayed above is for reference only. The actual rates offered to you will be based on your credit score and is subject to the provider's approval.

Trust Bank Instant Loan

-

Min. age: 21

-

Min. amount: S$500

-

Min. annual income: S$30,000 (Only for Singaporeans/PRs, S$60,000 for foreigners)

-

Interest rate: 2.22% (EIR 4.22% p.a.)

-

Loan tenure: 3 to 60 months

-

Early repayment fee: 3% (On outstanding principal amount)

-

Late repayment fee: 27.9% p.a. (On unpaid principal)

SingSaver’s take

Trust Bank's Instant Loan is ideal for those who already hold a Trust Bank credit card with an adequate credit limit. Its digital-first approach allows for incredibly fast approval and disbursement, often within 60 seconds, with funds directly deposited into your Trust savings account. This speed is unparalleled by many traditional banks.

Furthermore, it's a strong contender for individuals facing genuine financial emergencies, such as unexpected medical bills or urgent home repairs, who require almost immediate access to funds.

Pros

Low interest rate starting from 2.22% p.a. (EIR 4.22%)

Flexible repayment schedule between 3 and 60 months

Fast approval within 60 seconds

Cons

Minimum age requirement of 21

Minimum annual income can be a barrier for some

For a low-income requirement

POSB Personal Loan

-

Min. age: 21

-

Min. amount: S$500

-

Min. annual income: S$20,000 (Only for Singaporeans/PRs, foreigners with existing cashline and/or credit card account with POSB can also apply)

-

Interest rate: 1.99% (EIR 4.17% p.a.)

-

Loan tenure: 6, 12, 24, 36, 48 or 60 months (Only for Singaporeans/PRs taking up loan amounts above S$3,000, choose from 6, 12 or 24 months for foreigners and loan amounts below S$3,000)

-

Early repayment fee: 1.5% (Of outstanding loan amount)

-

Late repayment fee: S$100 (For credit card account, S$120 for cashline customers)

SingSaver’s take

For existing POSB/DBS customers, particularly those who have their salaries credited to a POSB/DBS account, the POSB Personal Loan offers significant advantages. Often, instant approval and immediate fund disbursement directly into your POSB/DBS account are possible, which is invaluable in genuine emergencies.

An additional benefit is POSB/DBS's low minimum annual income requirement of S$20,000 for Singaporean citizens and PRs. This threshold is lower than the S$30,000 or higher requirements of many other major banks in Singapore, making the loan accessible to a broader range of individuals. In essence, the POSB Personal Loan stands out as an excellent option for existing POSB/DBS customers who prioritize quick access to funds, competitive rates, and the dependable service of a prominent local bank.

Pros

Enjoy personalised rates, a plus for those with good credit history

Low minimum income requirement of S$20,000

Borrow up to 10x your monthly salary for those who earn more than S$120,000 annually

Cons

Early repayment and late payment fees apply

For large loan amounts

Citi Quick Cash - Existing Loan Customers

1. Head to Citibank's website and click “Apply Now” under Existing Customers

2. Fill out the loan application

3. Get instant processing within 60 seconds upon verification of loan application

- Instant processing within 60 seconds upon verification of loan application

- No processing fees

- Borrow up to 4x your monthly salary at S$0 processing fee, for a min. loan amount of S$1,000

- Convert unutilised credit limit to cash deposited in your Citi deposits account in under a minute

- Min. income for Singaporeans/PRs: S$30,000 p.a. Min. income for foreigners: S$42,000 p.a.

- Read our full review of the Citibank Quick Cash Loan

- Instant loan disbursement available only for Citi deposit accounts displayed in the 'funds disbursement option' field

- Cancellation fee: 3% of outstanding unbilled principal amount or S$100, whichever is higher

- If min. payment amount is overdue for two consecutive months, the loan will be terminated and the total outstanding amount will be billed

1. NRIC (Front & Back)

2. Salaried employees: Past 12 months CPF statement (Singaporean/PR)

3. Income Tax Notice of Assessment and latest original computerised payslip

4. Self-employed individuals: Latest Income Tax Notice of Assessment and latest original computerised payslip

The information displayed above is for reference only. The actual rates offered to you will be based on your credit score and is subject to the provider’s approval.

Citi Quick Cash

-

Min. age: 21

-

Min. annual income: S$30,000 (Only for Singaporeans/PRs, S$42,000 for foreigners)

-

Advance amount: 4X to 8X of monthly income

-

Additional fees: None

-

Repayment terms: 12 to 60 months

-

Funding time: Next working day (Only for Citi account holders, within 5 working days upon approval for non-Citi account holders)

SingSaver’s take

The Citi Quick Cash loan is particularly suitable for existing Citibank credit card or Ready Credit customers who are facing urgent expenses or unexpected financial needs, as it allows them to convert their available credit limit into cash with minimal fuss. This loan is also beneficial for individuals who prefer structured repayments as it offers fixed monthly installments over a chosen tenure.

Existing Citi account holders can often receive funds almost instantly or the next working day, while non-Citi account holders can expect the funds within a few business days. The application process is also streamlined and can often be completed without additional documentation through the Citi Mobile App or online, making it a convenient option for immediate financial needs.

Pros

No processing fees

Applicaton process can be completed online

Quick cash disbursement for existing Citibank customers

Flexible repayment terms ranging from 12 months to 60 months

Cons

Disbursement may take longer for customers new to Citibank

Service charge during repayment

Prepayment fee of 3% of unbilled outstanding principal amount or S$100, whichever is higher

For structured loan repayments

OCBC ExtraCash Loan

-

Min. age: 21

-

Min. annual income: S$20,000 (Only for Singaporeans/PRs, S$45,000 for foreigners)

-

Advance amount: Up to 6X of monthly income

-

Additional fees: S$100 (Only for those with an annual income between S$20,000 and $29,999, one-time processing fee of S$200 or 2%, whichever is higher, for those with an annual income of S$30,000 and above)

-

Repayment terms: 12 to 60 months

-

Funding time: Instant (Only for online applications)

SingSaver’s take

The OCBC Extra Cash Loan is well-suited for those with a one-time borrowing need who prefer the predictability of fixed monthly repayments. The key benefits of the OCBC Extra Cash Loan include fast approval and disbursement, especially for existing OCBC customers applying via MyInfo, with funds potentially disbursed instantly or within a few working days.

Borrowers can make fixed repayments over a flexible tenure of 12 to 60 months, allowing for easy budgeting and financial planning. While a processing fee applies, the transparency in interest rates and the option for online application enhance convenience for borrowers seeking a structured personal loan.

Pros

Instant approval and cash disbursement for existing OCBC customers and online applicants

Structured repayment terms across 12 to 60 months

Easy application process with MyInfo

Cons

Processing fee may be payable on your annual income

Service charge during repayment

S$150 prepayment fee or an administrative fee of 3% of the unbilled outstanding principal amount, whichever is higher

Frequently asked questions about CPF personal loans

Only individuals who meet the eligibility criteria can borrow money using their CPF savings as collateral. Eligible borrowers have to be a Singaporean citizen or Permanent Resident, at least 54 years of age, and with a minimum of S$5,000 available to withdraw from their CPF Ordinary Account (OA) or Special Account (SA).

It’s important to keep in mind that a CPF personal loan doesn’t come from CPF directly, but through a licensed moneylender.

Upon reaching the age of 55, CPF members can withdraw S$5,000 or any sum exceeding their Full Retirement Sum (FRS), whichever is higher.

Most personal loans allow you to borrow up to six times of your monthly income. The exact amount will be determined by your lender upon approval.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.