A Complete Guide to Understanding CPF (2025)

Updated: 22 May 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

CPF might seem complicated at first — but once you understand how it works, it becomes a powerful way to grow your wealth, protect your health, and secure your future.

What is CPF?

The Central Provident Fund (CPF) is Singapore’s mandatory savings scheme, designed to help citizens and Permanent Residents achieve self-reliance across key life needs — housing, healthcare and retirement. CPF works by channelling a portion of your monthly income into three core accounts:

-

Ordinary Account (OA) — mostly for housing, insurance, education and investments

-

Special Account (SA) — earmarked for retirement savings and long-term investments

-

MediSave Account (MA) — reserved for medical expenses and approved insurance premiums

For those aged 55 and above, a fourth account — the Retirement Account (RA) — is created to consolidate your OA and SA savings for CPF LIFE payouts.

Through savings, CPF ensures Singaporeans build a financial safety net as they progress through life.

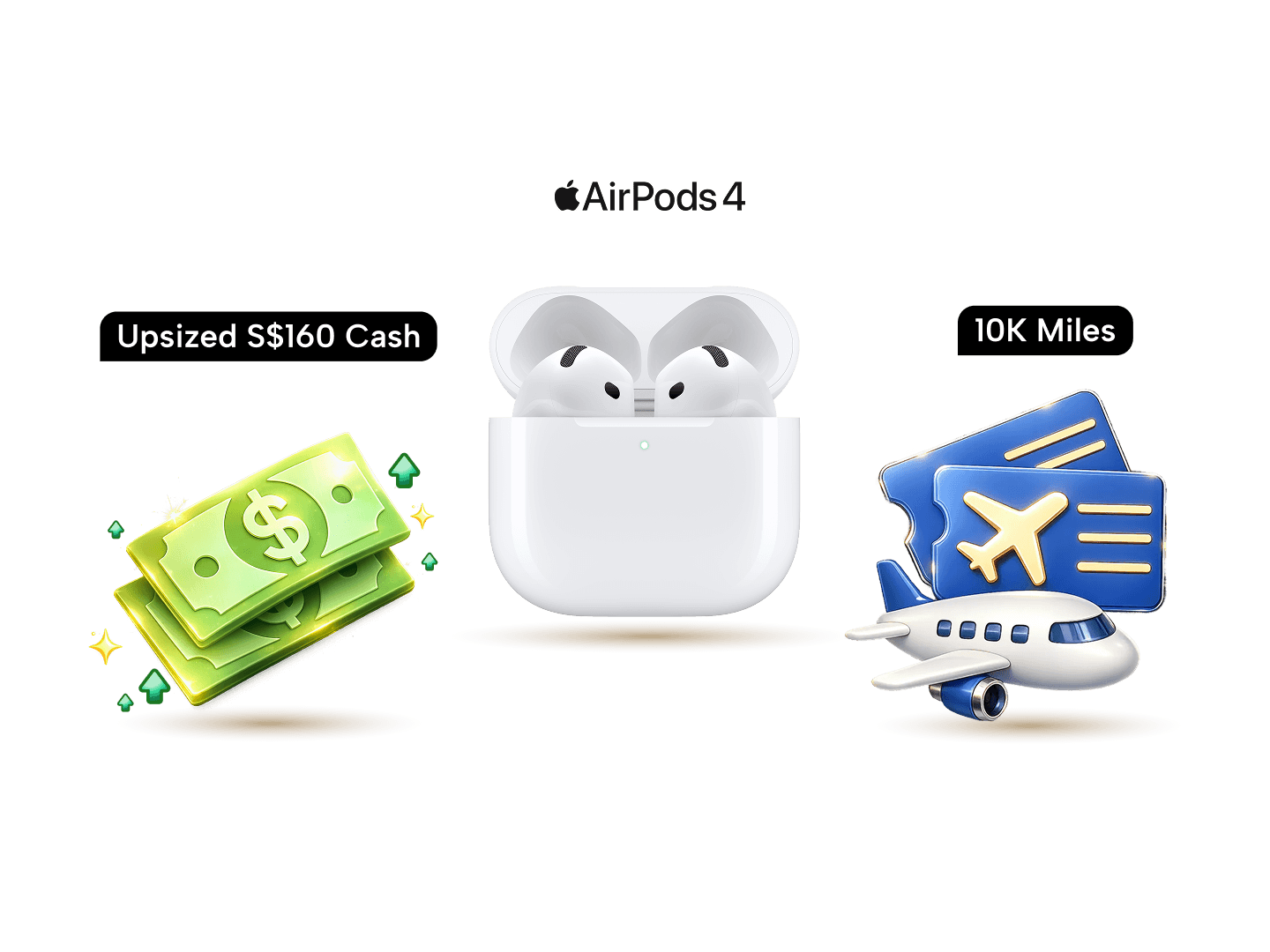

⚡ SingSaver x Longbridge Flash Deal ⚡

Get S$160 Upsized Cash via PayNow, S$180 Upsized Grab Voucher, Apple AirPods Gen 4 (worth S$199), or 10,000 Upsized Max Miles by HeyMax (worth S$180) when you apply and get approved for a Longbridge SG account, fund a min. of S$2,000 and maintain the assets for 30 days from the day after meeting the deposit criteria. Offer is stackable with Longbridge welcome promo. Valid until 31 March 2026. T&Cs apply.

The 4 CPF accounts and their uses

1. Ordinary Account

Your OA is the most flexible of all CPF accounts. It supports:

Housing

Pay for HDB flats, service mortgage loans, and even private properties.

» MORE: 6 misconceptions about using your CPF for housing

Insurance

Use OA funds to pay for premiums under schemes like the Home Protection Scheme.

Education

Fund subsidised tuition fees for approved courses at local tertiary institutions.

Investment

You can invest OA savings through the CPF Investment Scheme - OA (CPFIS-OA) into instruments such as unit trusts, fixed deposits, and ETFs to potentially grow your funds.

» MORE: What a CPF account can be used for

2. Special Account

SA is designed to encourage long-term savings:

-

Earns a higher interest rate to help grow your retirement funds faster.

-

Funds here can also be invested via CPFIS-SA, but only into low-risk instruments like government bonds and selected funds.

-

SA savings cannot be used for housing payments.

3. MediSave Account

MediSave ensures you are covered for healthcare needs:

-

Can be used for hospitalisation, day surgery, and outpatient treatments.

-

Pay premiums for insurance schemes such as Integrated Shield Plans.

-

Once the Basic Healthcare Sum (BHS) is reached, any excess will automatically flow to your SA or RA, boosting your retirement savings.

4. Retirement Account

Created when you turn 55, the RA consolidates your SA and OA balances:

-

Funds here provide payouts via CPF LIFE, which offers a choice of Basic, Standard or Escalating plans.

-

Enjoys the highest interest rates among all CPF accounts to help stretch your retirement dollars.

» MORE: Apply for a CPF personal loan

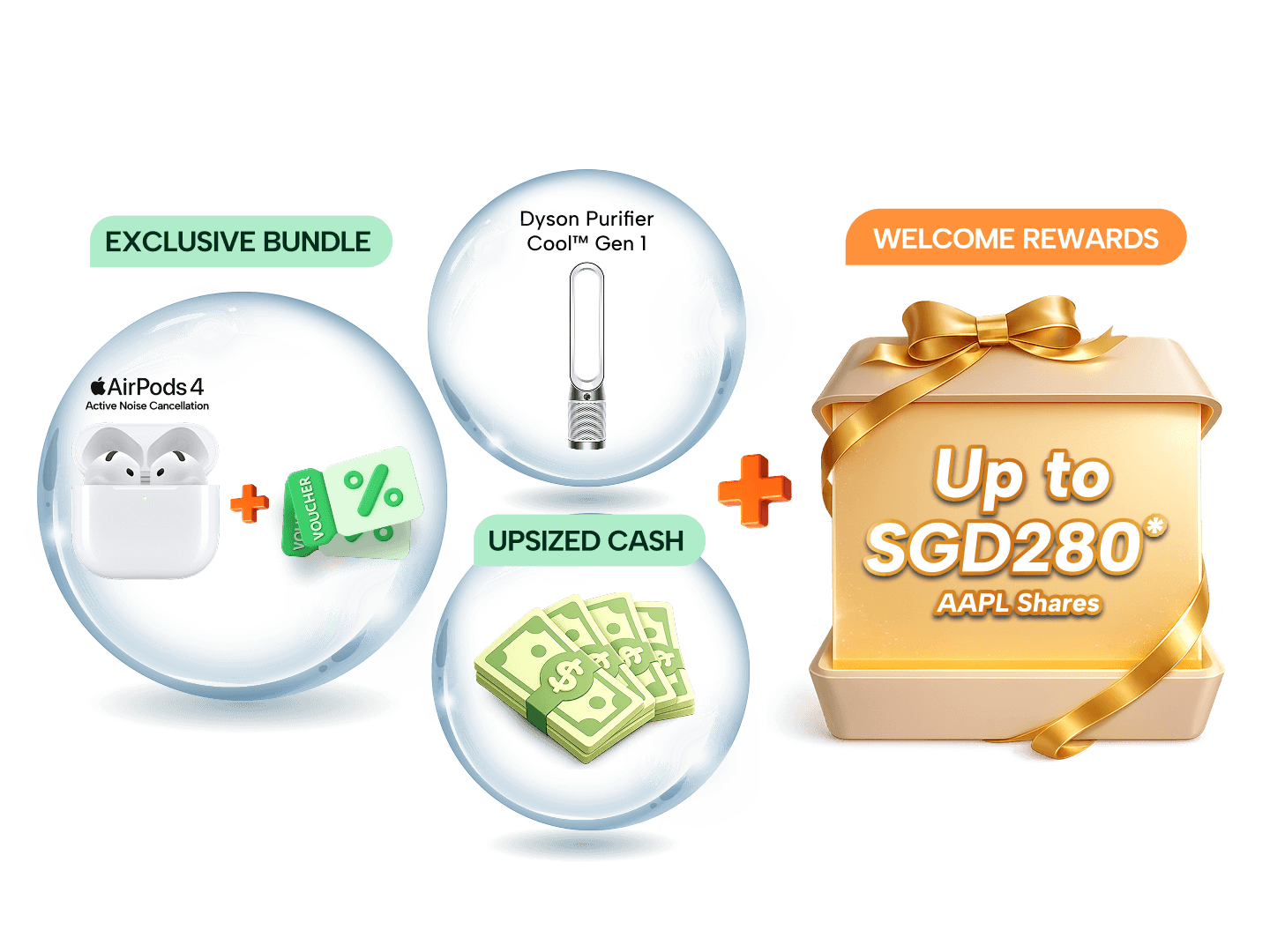

SingSaver x Webull Exclusive Offer

Open a Webull account and fund a minimum of SGD3,000 to receive S$120 Cash. Fund SGD10,000 to get S$260 cash, or a S$50 eCapitaVoucher + AirPods 4 or 17k Max Miles by Heymax (worth S$306). Or, top up as low as S$50 to get a Dyson Purifier Cool™ TP10. Valid till 31 March 2026. T&Cs apply.

How do CPF contributions work?

CPF contributions are shared between you and your employer:

-

Employee contribution: Up to 20% of monthly salary

-

Employer contribution: Up to 17% of monthly salary

However, this is subject to a monthly salary ceiling of $6,800. This means any wages above this amount do not attract CPF contributions.

CPF contributions apply to:

-

Ordinary Wages (OW): Monthly salary

-

Additional Wages (AW): Bonuses, commissions and other irregular payments (subject to an annual cap)

CPF contribution example

Meet Mary, 26 years old and earning $4,000 a month. Since she is under 55, her CPF contributions are as follows:

|

Gross wage |

S$4,000 |

|

Mary’s take-home pay: 80% |

80% x S$4,000 = S$3,200 |

|

Mary’s CPF contribution: 20% |

20% x S$4,000 = S$800 |

|

Employer’s CPF contribution: 17% |

17% x S$4,000 = $680 |

|

Total contribution to Mary’s CPF account = S$1,480 |

|

» MORE: 4 reasons why you should voluntarily contribute to your children’s CPF

Find an online brokerage in Singapore

Compare top platforms for trading and investing and enjoy low fees, user-friendly tools, and secure access to global markets.

CPF contributions and allocations

Earlier, we covered what each CPF account is for. When your contributions go in, they are split automatically according to your age and the allocation rates set by CPF.

The younger you are, the higher the proportion that goes into your OA (as this supports housing and education needs). As you age, more will be channelled to your SA and MA to prioritise retirement and healthcare.

|

Age Group |

Total CPF Contribution Rate (%) starting 1 Jan 2025 |

|

55 and below |

37.0 |

|

Above 55 to 60 |

32.5 |

|

Above 60 to 65 |

23.5 |

|

Above 65 to 70 |

16.5 |

|

Above 70 |

12.5 |

» MORE: Pros and cons of keeping your savings in your CPF Special Account

CPF contribution caps

There are limits to how much you can contribute:

-

Monthly salary ceiling: $6,800

-

Annual limit: $41,000 (inclusive of mandatory and voluntary contributions)

What is the CPF Annual Limit?

The CPF Annual Limit ensures you do not overcontribute. Both mandatory and voluntary contributions (VCs) count towards this cap.

If you top up your CPF voluntarily — for example, via the Retirement Sum Topping-Up Scheme (RSTU) — make sure you stay within the limit to avoid refunds or penalties.

CPF interest rates

CPF is not just for savings — it helps your money grow through interest.

|

Account |

Base interest rate (per annum) |

Extra interest (below 55) |

Extra interest (55 and above) |

|

Ordinary Account (OA) |

2.50% |

+1% on first $60,000 (capped at $20,000 from OA) |

+2% on first $30,000, +1% on next $30,000 |

|

Special Account (SA) |

4% |

+1% on first $60,000 |

+2% on first $30,000, +1% on next $30,000 |

|

MediSave Account (MA) |

4% |

+1% on first $60,000 |

+2% on first $30,000, +1% on next $30,000 |

|

Retirement Account (RA) |

4% |

+1% on first $60,000 |

+2% on first $30,000, +1% on next $30,000 |

Compare the best investment options in Singapore

Explore platforms and products from stocks and ETFs to robo-advisors and more.

Can CPF contributions and their interest allow you to retire rich?

CPF has the potential to form a robust foundation for retirement — but like any tool, its effectiveness depends on how you use it.

-

Regular mandatory contributions help build your nest egg steadily throughout your working life.

-

Using OA funds for housing, while necessary for many, reduces the amount available to grow in SA and RA for retirement.

-

The higher interest rates on SA and RA accelerate compound growth, making it worthwhile to leave funds untouched if possible.

In short, the more you leave in CPF (especially in SA and RA), the more you stand to benefit from compounding interest when you retire.

» MORE: A complete guide to CPF Life

Strategies to maximise your CPF

CPF top-ups & tax relief

Voluntary top-ups via the RSTU are a smart way to boost retirement savings while reducing tax liability.

-

Up to $8,000 tax relief for topping up your own SA or RA.

-

Up to $8,000 tax relief for topping up your loved ones’ SA or RA.

This strategy suits individuals with surplus cash who want to secure better retirement payouts and optimise tax savings.

Combining CPF with stocks for stability & growth

CPF can form the stable portion of a diversified investment portfolio. You can take a more aggressive stance with your cash and stocks, knowing your CPF funds offer guaranteed returns for retirement.

What happens to CPF when you leave Singapore?

If you renounce your Singapore citizenship or Permanent Residency, you can withdraw your entire CPF savings.

Otherwise, your funds remain locked until your statutory retirement age. Exceptions exist for foreigners and those permanently leaving Singapore, but withdrawals must meet specific conditions.

» MORE: CPF nominations: What happens to your CPF money after you die?

In conclusion

CPF is not just a savings scheme — it is a long-term financial partner that supports you through home ownership, medical expenses, and retirement. By understanding how each account works and how to leverage CPF through strategies like voluntary top-ups, you can turn it into a powerful wealth-building tool.

As with any major financial decision, it pays to plan ahead. Consider topping up your SA or RA today — your future self will thank you when compound interest kicks in.

⚡SingSaver x Tiger Brokers Flash Deal⚡

Open a Tiger Brokers account and fund a minimum amount of USD 1,000 within the promotional period to receive an upsized S$160 cash, S$180 Grab voucher, 10,000 upsized Max Miles by HeyMax (worth S$180), or Apple AirPods Gen 4 (worth S$199). Offer is stackable with Tiger Brokers' welcome offer. Valid till 31 March 2026. T&Cs apply.

Frequently asked questions about how CPF works

CPF is a mandatory savings scheme aimed at helping Singaporeans and Permanent Residents meet key financial needs — housing, healthcare, and retirement. It ensures individuals build up savings progressively throughout their working life.

There are four CPF accounts. Ordinary Account (OA) is used mainly for housing, insurance, and investments. Special Account (SA) is reserved for retirement savings and earns higher interest. MediSave Account (MA) covers healthcare expenses. Retirement Account (RA) is created at age 55 to provide retirement payouts through CPF LIFE.

Yes, you can invest your OA and SA savings through the CPF Investment Scheme (CPFIS), depending on your account balances and risk appetite. Options include unit trusts, ETFs, fixed deposits and bonds, though restrictions apply to protect retirement adequacy.

Singaporeans and PRs who renounce their status can withdraw their CPF savings fully. Otherwise, CPF funds generally remain locked until the statutory retirement age, unless special conditions for withdrawal are met.

You can maximise CPF savings by making voluntary top-ups (which also offer tax relief), avoiding unnecessary withdrawals, and allowing funds in SA and RA to compound at higher interest rates over time. Combining CPF with other investments can also provide a balanced approach to growing your wealth.

Relevant articles

CPF Investment Scheme (Original Account): What It Is, How It Works

Thinking about using your CPF Ordinary Account (OA) funds to invest? It’s a common consideration among Singaporeans looking to grow their retirement savings beyond the default 2.5% per annum (p.a.) interest rate. But before you jump in, it's important to weigh the risks and benefits to make an informed decision.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.