2024 Income Tax Brackets and Tax Rates in Singapore

Updated: 11 Dec 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

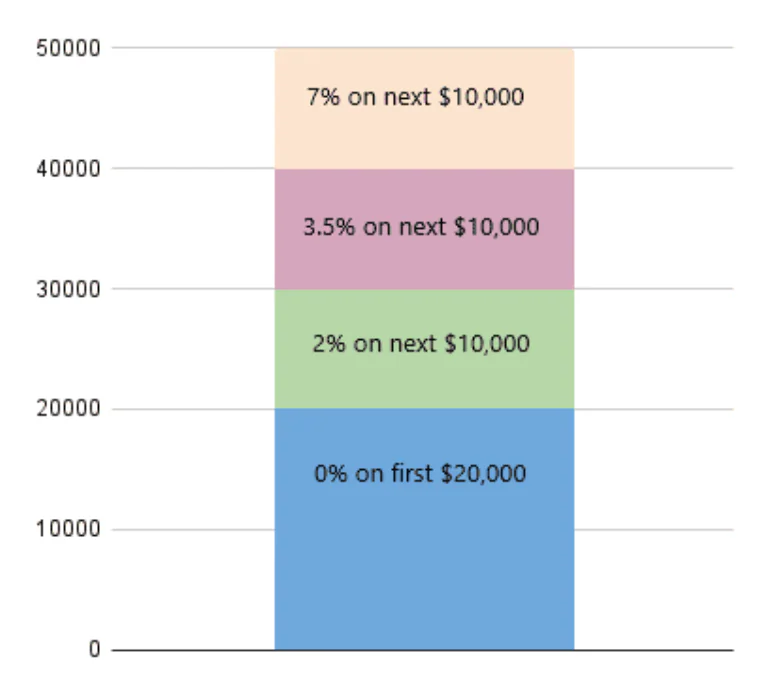

Singapore employs a progressive tax system, common in many countries, where income is taxed in portions based on brackets. Unlike a flat tax, where a single rate applies to all income, Singapore divides taxable income into tiers with increasing rates. As income rises, you enter higher brackets, but only that bracket's income is taxed at its rate, ensuring fairer distribution.

Understanding these brackets is crucial for accurate tax liability calculation. Tax rates vary across brackets, starting at 0% for the first S$20,000 and increasing progressively. Not all income is taxed at the same rate; it's segmented, and each segment is taxed at its bracket's rate. Knowing each bracket's rate is key for financial planning.

In short, Singapore's bracket system provides clarity and fairness. Knowing your income tax bracket helps you understand obligations, comply with laws, make informed decisions, and optimise tax efficiency.

⚡SingSaver x Citigold Flash Deal⚡

Enjoy up to 7.51% p.a. interest when you join Citigold and open a Wealth First account. Plus, get up to 80k Max Miles by Heymax (worth S$1,440), an Apple iPad Air (M3) 11” Wi-Fi 512GB, upsized cash up to S$1,500, or an Apple iPhone 17 256GB when you successfully apply for a Citigold account, become an Accredited Investor, and make a S$350,000 deposit within 3 months of account opening, maintaining these funds until gift fulfilment. Valid till 28 February 2026. T&Cs apply.

2024 tax brackets and rates

The table below outlines Singapore's income tax brackets and the corresponding income tax rates applicable for the Year of Assessment 2025, based on income earned from 1 January 2024 to 31 December 2024.

| Income Level | Income Tax Rate (%) | Gross Tax Payable (S$) |

| Up to $20,000 | 0 | 0 |

| Next $10,000 | 2 | 200 |

| Total to $30,000 | - | 200 |

| Next $10,000 | 3.5 | 350 |

| Total to $40,000 | - | 550 |

| Next $40,000 | 7 | 2,800 |

| Total to $80,000 | - | 3,350 |

| Next $40,000 | 11.5 | 4,600 |

| Total to $120,000 | - | 7,950 |

| Next $40,000 | 15 | 6,000 |

| Total to $160,000 | - | 13,950 |

| Next $40,000 | 18 | 7,200 |

| Total to $200,000 | - | 21,150 |

| Next $40,000 | 19 | 7,600 |

| Total to $240,000 | - | 28,750 |

| Next $40,000 | 19.5 | 7,800 |

| Total to $280,000 | - | 36,550 |

| Next $40,000 | 20 | 8,000 |

| Total to $320,000 | - | 44,550 |

| Next $180,000 | 22 | 39,600 |

| Total to $500,000 | - | 84,150 |

| Next $500,000 | 23 | 115,000 |

| Total to $1,000,000 | - | 199,150 |

| Above $1,000,000 | 24 |

As the table illustrates, Singapore employs a progressive income tax system. This means that different portions of your income are taxed at increasing rates. The highest tax rate is 24%, which applies to the portion of taxable income above $1,000,000.

Singapore income tax resources

2025 tax brackets and rates

The table below outlines Singapore's income tax brackets and the corresponding tax rates applicable for the Year of Assessment 2026, based on income earned from 1 January 2025 to 31 December 2025.

|

Income Level |

Income Tax Rate (%) |

Gross Tax Payable (S$) |

|

Up to $20,000 |

0 |

0 |

|

Next $10,000 |

2 |

200 |

|

Total to $30,000 |

- |

200 |

|

Next $10,000 |

3.5 |

350 |

|

Total to $40,000 |

- |

550 |

|

Next $40,000 |

7 |

2,800 |

|

Total to $80,000 |

- |

3,350 |

|

Next $40,000 |

11.5 |

4,600 |

|

Total to $120,000 |

- |

7,950 |

|

Next $40,000 |

15 |

6,000 |

|

Total to $160,000 |

- |

13,950 |

|

Next $40,000 |

18 |

7,200 |

|

Total to $200,000 |

- |

21,150 |

|

Next $40,000 |

19 |

7,600 |

|

Total to $240,000 |

- |

28,750 |

|

Next $40,000 |

19.5 |

7,800 |

|

Total to $280,000 |

- |

36,550 |

|

Next $40,000 |

20 |

8,000 |

|

Total to $320,000 |

- |

44,550 |

|

Next $180,000 |

22 |

39,600 |

|

Total to $500,000 |

- |

84,150 |

|

Next $500,000 |

23 |

115,000 |

|

Total to $1,000,000 |

- |

199,150 |

|

Above $1,000,000 |

24 |

How tax brackets and rates work in Singapore

Singapore employs a progressive tax system. This means that as your taxable income increases, it's divided into portions, each taxed at a progressively higher rate. Crucially, higher tax rates only apply to the income within that specific portion, not your entire income. This contrasts with a flat tax system, where all income is taxed at the same rate. Singapore's progressive structure ensures that lower-income earners benefit from lower tax rates, with the first S$20,000 exempt from tax, while higher earners contribute more.

1. What are income tax brackets in Singapore?

In Singapore's tax system, income tax bracket refers to the specific ranges of taxable income subject to a particular tax rate. These brackets are structured progressively, meaning that the personal tax rate applied to that additional income increases as your taxable income enters a higher bracket. However, it's crucial to remember that only the portion of your income that falls within a specific bracket is taxed at that bracket's rate. Income falling into lower brackets is taxed at the corresponding lower rates.

For instance, if a portion of your income falls into the 7% tax bracket, only that specific segment of your earnings will be taxed at 7%, while income in lower brackets will be taxed at their respective lower percentages, or even 0% for the initial S$20,000.

This tiered system ensures that while higher earners contribute more through higher income tax rates on their upper-tier income, the lower portions of their income still benefit from the lower tax rates applicable to those brackets.

Example: To calculate the tax payable on a $50,000 income, Singapore's progressive system applies tiered rates. No tax is levied on the first $20,000. The next $10,000 is taxed at 2%, resulting in $200. The subsequent $10,000 is taxed at 3.5%, amounting to $350. Finally, the remaining $10,000 is taxed at 7%, totalling $700. Adding these amounts ($0 + $200 + $350 + $700) gives a total tax payable of $1,250.

2. What is taxable and what is not?

In Singapore, taxable income includes:

-

Gains or profits from any trade or business

-

Income from investments such as dividends, interest, or rental

-

Royalties, premiums, and other profits from property

-

Other gains that are revenue in nature

Non-taxable income includes:

-

Capital gains, such as gains on the sale of fixed assets and gains on foreign exchange on capital transactions

-

Income specifically exempted from tax under the Income Tax Act

3. Are income tax brackets in Singapore adjusted yearly?

While Singapore's tax bracket and income tax rates are not adjusted annually in the same way as some other countries that factor in inflation adjustments yearly, the Singapore government periodically reviews and may revise the tax structure as part of its broader fiscal policy.

These adjustments are typically made to reflect economic conditions, revenue needs, and social objectives. Changes to the income tax bracket or the personal tax rate can occur, but they are usually announced during the annual budget statement and take effect for the Year of Assessment following the income year in question.

These revisions aim to ensure the fairness and efficiency of Singapore's tax system, and while not strictly annual, they serve a similar purpose of adapting the tax framework to the evolving economic landscape of Singapore. Therefore, it is always advisable to refer to the latest official announcements from IRAS to stay informed about the current Singapore tax rate and bracket structure.

4. What happens if you file your taxes late or if you do not file your tax at all?

If you fail to file your taxes by the required date, IRAS could do the following:

-

Impose a late filing fee not exceeding S$1,000;

-

Issue an estimated Notice of Assessment (NOA); and/or

-

Summon you to Court

If IRAS issues an estimated NOA based on your past years’ income or information available to IRAS, you must:

-

Pay the estimated tax within one month from the date of the NOA.

-

File your Tax Return immediately. Upon revision of the estimated assessment, any excess tax paid will be refunded.

5. What happens if you pay your income tax late?

Similar to how late payments on a credit card bill or monthly loan repayment incur charges, you will also face penalties for late income tax payments. If you fail to make your tax payment by the stipulated due date, you will initially incur a late payment penalty of 5% on the outstanding tax amount. Subsequently, an additional penalty of 1% will be imposed for each full month the tax remains unpaid, up to a maximum of 12% of the original tax owed. You will receive official notification, typically in the form of a letter, regarding this initial 5% late payment penalty.

Following this initial penalty, it is crucial to ensure prompt payment before the new due date specified in the letter to avoid further escalation of penalties. If the income tax continues to remain unpaid, IRAS is empowered to take further enforcement actions to recover the outstanding taxes. These actions may include:

-

Appointing agents, such as your bank, employer, tenant, or lawyer, to pay the owed money directly to IRAS.

-

Issuing a Travel Restriction Order (TRO) to prevent you from leaving Singapore until the debt is settled.

-

Commencing legal action against you to recover the unpaid tax.

⚡SingSaver x Citigold Flash Deal⚡

Enjoy up to 7.51% p.a. interest when you join Citigold and open a Wealth First account. Plus, get up to 80k Max Miles by Heymax (worth S$1,440), an Apple iPad Air (M3) 11” Wi-Fi 512GB, upsized cash up to S$1,500, or an Apple iPhone 17 256GB when you successfully apply for a Citigold account, become an Accredited Investor, and make a S$350,000 deposit within 3 months of account opening, maintaining these funds until gift fulfilment. Valid till 28 February 2026. T&Cs apply.

What is a marginal tax rate in Singapore?

In Singapore, the marginal tax rate is the tax rate applied to the last dollar of an individual's taxable income, representing the tax rate for the highest income bracket that a portion of their earnings falls within. For instance, if an individual's income is S$90,000, a portion of it falls within the income bracket where the tax rate is 11.5%. Therefore, their marginal tax rate would be 11.5%, meaning any additional income earned would be taxed at that rate.

What is an effective tax rate in Singapore?

The effective tax rate in Singapore is the actual percentage of your taxable income paid in taxes, calculated as: (Total Tax Payable / Total Taxable Income) x 100%. It differs from the marginal tax rate, which is the rate on your last dollar of income.

For example, when considering a taxable income of $50,000, the total tax payable is calculated to be $1,250, demonstrating an effective tax rate of 2.5%. In contrast, the marginal tax rate, which represents the rate applied to the highest income bracket reached by that income, is 7%. This comparison is crucial for illustrating how the progressive system in Singapore results in an overall tax burden, reflected in the effective rate, that is significantly lower than the rate of the top bracket reached, which is the marginal rate.

How to reduce taxes owed in Singapore

In Singapore, there are several legitimate ways to reduce the amount of income tax you owe, primarily through utilising various tax deductions and reliefs offered by the government. These incentives are designed to encourage certain behaviours and provide support for different life stages and circumstances.

Here are some common strategies for lowering your personal tax rate in Singapore and reducing your overall tax liability:

-

Maximise contributions to the Central Provident Fund (CPF): Contributions to your CPF, particularly voluntary contributions to your Special Account (SA) and Retirement Account (RA), can qualify for tax relief, subject to certain limits. Topping up your parents' or grandparents' CPF accounts may also provide tax benefits. These contributions help build your retirement savings and reduce your taxable income for the current year.

-

Claim eligible tax reliefs: Singapore offers a wide range of tax reliefs based on personal circumstances, such as spouse relief, child relief, parent relief, grandparent caregiver relief, and reliefs for NSman (National Serviceman) contributions. Ensure you understand the eligibility criteria for each relief and claim those that apply to your situation.

-

Contribute to the Supplementary Retirement Scheme (SRS): The SRS is a voluntary savings scheme that complements CPF and provides tax benefits. Contributions to your SRS account are eligible for tax relief and can be invested for retirement. The contribution limits differ for Singaporeans/Permanent Residents and foreigners.

-

Utilise course fees relief: If you have incurred expenses on eligible skills upgrading or professional development courses, you may be able to claim course fees relief, subject to a cap. This encourages lifelong learning and skill enhancement.

-

Life insurance relief: You may be eligible for life insurance relief if you pay premiums on your own life insurance policy, subject to certain conditions related to your total CPF contributions.

-

Make donations to approved institutions: Donations made to approved charities and institutions of a public character (IPCs) in Singapore are typically eligible for tax deduction. This not only supports worthy causes but also helps reduce your taxable income.

-

Understand rental expenses: If you earn rental income from property, you can deduct allowable expenses incurred in generating that income, such as property tax, interest on mortgage, repairs, and maintenance.

Here are tax-saving tips for specific groups:

-

Seniors: Besides potential parent/grandparent reliefs, seniors should ensure they are aware of any specific tax benefits or rebates that may be introduced or are applicable to them. Keeping abreast of announcements during the annual budget is crucial.

-

Individuals in specific income groups: Regardless of income level, understanding all available reliefs and deductions relevant to your personal situation (e.g., family status, education expenses) is key. For higher-income earners, maximising CPF and SRS contributions can be particularly beneficial in reducing taxable income.

It's important to keep accurate records of all eligible expenses and contributions and to understand the specific conditions and limits associated with each tax relief and deduction. By proactively managing your finances and taking advantage of these tax-saving opportunities, you can effectively reduce your tax obligations in Singapore. Always refer to the official IRAS website for the most up-to-date information and guidelines on tax reliefs and deductions.

» Read more: How to optimise your income tax

Tax brackets and rates in Singapore for 2017-2023

To provide a broader perspective on Singapore's income tax framework, the following presents an overview of the income tax brackets and income tax rates for the Years of Assessment 2018 to 2024, based on income earned in the preceding years, spanning from 2017 to 2023. This historical data offers valuable context on how the tax structure has evolved or remained consistent over time in Singapore, allowing for a clearer understanding of current tax policies.

|

Income Level |

Income Tax Rate (%) |

Gross Tax Payable (S$) |

|

Up to $20,000 |

0 |

0 |

|

Next $10,000 |

2 |

200 |

|

Total to $30,000 |

- |

200 |

|

Next $10,000 |

3.5 |

350 |

|

Total to $40,000 |

- |

550 |

|

Next $40,000 |

7 |

2,800 |

|

Total to $80,000 |

- |

3,350 |

|

Next $40,000 |

11.5 |

4,600 |

|

Total to $120,000 |

- |

7,950 |

|

Next $40,000 |

15 |

6,000 |

|

Total to $160,000 |

- |

13,950 |

|

Next $40,000 |

18 |

7,200 |

|

Total to $200,000 |

- |

21,150 |

|

Next $40,000 |

19 |

7,600 |

|

Total to $240,000 |

- |

28,750 |

|

Next $40,000 |

19.5 |

7,800 |

|

Total to $280,000 |

- |

36,550 |

|

Next $40,000 |

20 |

8,000 |

|

Total to $320,000 |

- |

44,550 |

|

Income Above $320,000 |

22 |

Stay ahead in everything finance

Subscribe to our newsletter and receive insightful articles, exclusive tips, and the latest financial news, delivered straight to your inbox.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.