The Best Gold ETFs For Singapore Investors

Updated: 29 Jan 2026

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

Top gold ETFs to consider

Here are some of the top-performing gold ETFs in 2025.

|

Ticker |

ETF |

Expense ratio |

Price (as of 29 Jan 2026) |

|

GSD.SI |

SPDR Gold Shares |

0.4% |

SGD641.10 |

|

IAU |

iShares Gold Trust |

0.25% |

SGD101.25 |

|

SGOL |

abrdn Physical Gold Shares |

0.17% |

SGD51.24 |

|

BAR |

GraniteShares Gold Trust |

0.17% |

SGD54.50 |

|

GDX |

VanEck Vectors Gold Miners |

0.51% |

SGD113.99 |

|

GDXJ |

VanEck Vectors JuniorGold Miners |

0.51% |

SGD152.76 |

|

FGDL |

Franklin Responsibly Sourced Gold |

0.15% |

SGD70.42 |

|

AAAU |

Goldman Sachs Physical Gold |

0.18% |

SGD54.57 |

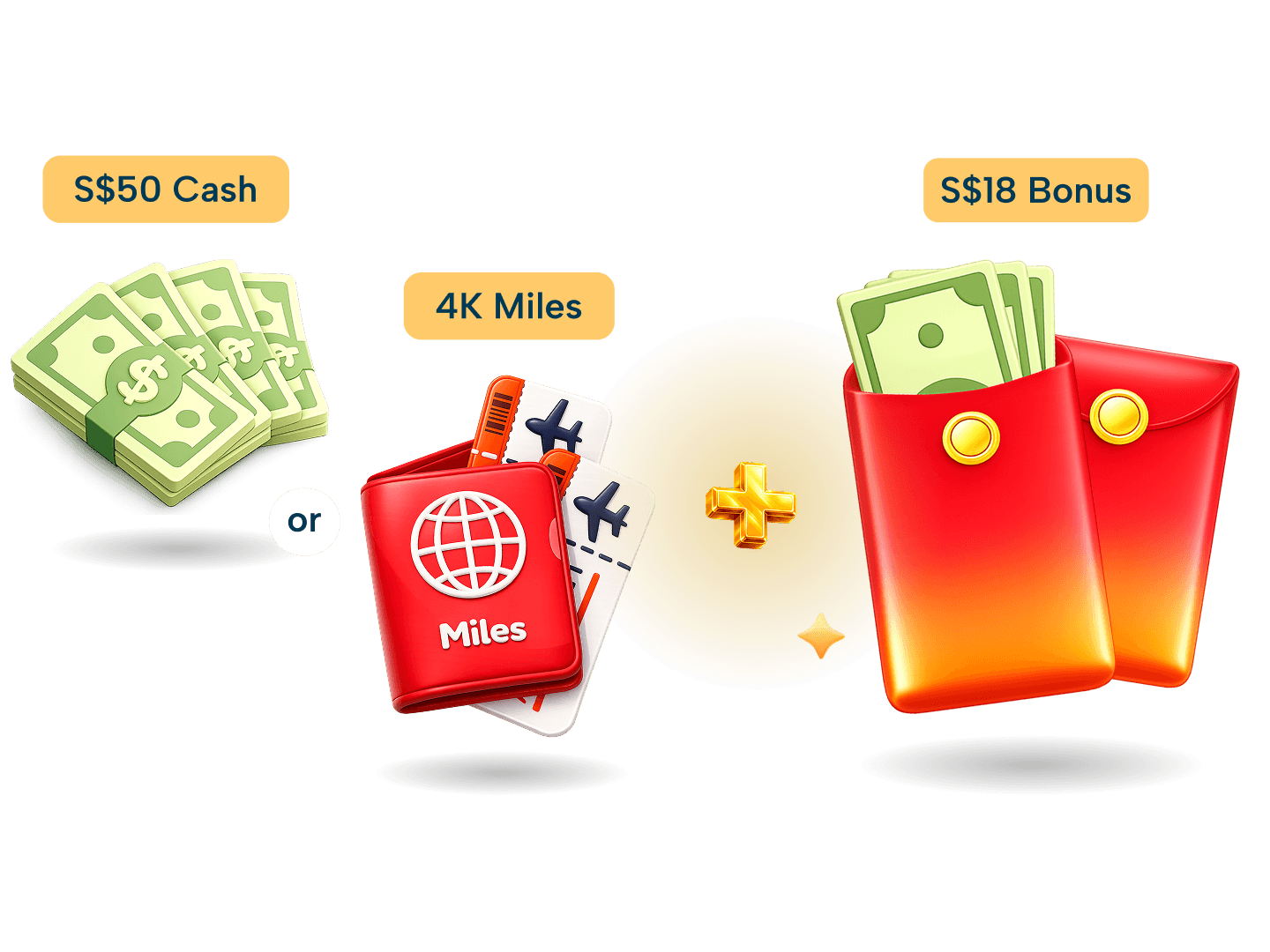

⚡SingSaver x Plus500 Flash Deal⚡

Get S$300 Cash, S$320 Grab voucher, or 20,000 Heymax miles (worth S$342) when you open a Plus500 account through SingSaver, make a min. deposit of S$1,500, and execute at least 3 trades within 14 days. Valid till 15 February 2026. T&Cs apply.

💎 Exclusive Deposit Bonuses from Plus500

Get S$13,000 plus 8,000 Trader Points when you deposit min. S$75,000 with bonus code DIAMOND, S$688 plus 408 Trader Points with min. S$1,000 using SingSaver688, or S$288 plus 128 Trader Points with min. S$500 using SingSaver500. Valid till 1 February 2026. T&Cs apply.

🧧SingSaver CNY Special Offer🧧

Fire up your investing with over S$3,188 in daily red packet bonuses! At 8 pm daily, the first 20 applicants of select brokerages get an extra S$18 on top of guaranteed rewards. Over 2,000 red packets up for grabs! Valid till 15 February 2026. T&Cs apply.

1. SPDR Gold Trust (GLD)

SPDR Gold Trust (GLD) is the largest and most liquid gold ETF globally, with over US$160 billion in assets under management as of early 2026. It’s designed to give investors direct exposure to the price of gold and is backed entirely by physical gold bullion stored in secure vaults.

GLD’s scale and liquidity make it a popular choice among both retail and institutional investors, particularly those using gold as a hedge against inflation or market risk. However, this comes at a higher cost, with an expense ratio of about 0.40%, which is more expensive than some other physically backed gold ETFs.

Even so, GLD remains a relatively cost-effective alternative to owning physical gold when factoring in storage, insurance, and ease of trading.

2. iShares Gold Trust (IAU)

iShares Gold Trust (IAU) offers investors a straightforward way to gain direct exposure to the price of gold. Structurally, it’s very similar to SPDR Gold Trust, as it’s backed entirely by physical gold bullion held in secure vaults and is designed to closely track spot gold prices, before fees.

One of IAU’s main advantages is cost. With an expense ratio of around 0.25%, it is cheaper than larger peers like GLD, making it a more cost-efficient option for long-term investors who prioritise lower ongoing fees. This can be especially appealing for those using gold as a strategic allocation rather than a short-term trading instrument.

While IAU is smaller and slightly less liquid than GLD, it still provides sufficient trading volume for most retail investors. Overall, it serves as a practical alternative for those seeking physical gold exposure at a lower cost, without the challenges of owning and storing gold directly.

3. abrdn Physical Gold Shares ETF (SGOL)

The abrdn Physical Gold Shares ETF (SGOL) provides direct exposure to gold by holding physical gold bullion. What sets it apart is its focus on responsible sourcing: the fund only holds London Good Delivery bars refined on or after 1 January 2012, in line with the London Bullion Market Association’s Responsible Gold Guidance.

SGOL is also one of the more cost-efficient physically backed gold ETFs, with a relatively low expense ratio of around 0.17%. This combination of responsible sourcing and lower fees makes it an appealing option for investors seeking physical gold exposure with an added sustainability consideration.

4. VanEck Gold Miners ETF (GDX)

The VanEck Gold Miners ETF (GDX) provides exposure to the world’s largest gold mining companies by market capitalisation. Its portfolio is led by major global miners such as Agnico Eagle Mines, Newmont, AngloGold Ashanti, Barrick Gold, and Gold Fields, giving investors access to established industry leaders rather than smaller, higher-risk producers.

The fund is relatively concentrated, with its top 10 holdings accounting for just over half of total assets. This structure offers greater exposure to large, well-capitalised mining companies, making GDX more suitable for investors who prioritise scale and operational stability over broad diversification.

With an expense ratio of around 0.51%, GDX offers a cost-effective way to gain equity-based exposure to gold through leading mining stocks, though returns may be more volatile than those of physically backed gold ETFs.

5. VanEck Junior Gold Miners ETF (GDXJ)

The VanEck Junior Gold Miners ETF (GDXJ) focuses on smaller and mid-sized gold mining companies, including some that are still in the exploration or early production stages. This gives the fund greater upside potential, as successful junior miners can grow production more rapidly than established industry leaders.

However, that potential comes with a higher risk. Smaller mining companies tend to be more sensitive to factors such as rising costs, project delays, and operational setbacks, which can lead to sharper price swings compared to larger miners.

GDXJ holds over 100 stocks, providing broad exposure across the junior mining space. Its top holdings include Pan American Silver, Coeur Mining, Alamos Gold, Equinox Gold, and Royal Gold. The ETF has an expense ratio of around 0.51%, making it a reasonably priced option for investors seeking higher-growth, higher-volatility exposure to gold and silver mining stocks.

6. Franklin Responsibly Sourced Gold ETF (FGDL)

The Franklin Responsibly Sourced Gold ETF (FGDL) provides direct exposure to gold by holding physical gold bullion sourced from accredited refiners. The fund applies responsible sourcing standards that take into account environmental practices, anti–money laundering measures, and human rights considerations.

FGDL also stands out for its low cost, with an expense ratio of around 0.15%, making it one of the more cost-efficient options among physically backed gold ETFs.

7. Goldman Sachs Physical Gold ETF

The Goldman Sachs Physical Gold ETF (AAAU) offers direct exposure to gold through physical gold bullion held in secure vaults, with custody provided by JPMorgan Chase’s London branch. Its structure is similar to other physically backed gold ETFs designed to closely track the price of gold.

AAAU stands out for its relatively low cost, with an expense ratio of around 0.18%, making it a more cost-efficient alternative to larger, higher-fee gold ETFs.

Understanding gold ETFs

Gold ETFs are investment funds that aim to track the price of gold, allowing investors to gain exposure to gold's price movements without the need to own physical gold.

Here are two types of gold ETFs available:

-

Physical gold ETFs: These ETFs are backed by physical gold bullion, which is stored in secure vaults. This type of ETF closely mirrors the price of gold.

-

Gold mining ETFs: These ETFs invest in the shares of companies involved in gold mining. Their performance is linked to the profitability of these companies, which is influenced by gold prices.

Gold ETFs offer several benefits:

-

Liquidity: Gold ETFs can be easily bought and sold on stock exchanges, providing greater flexibility compared to physical gold.

-

Cost-effectiveness: Investing in gold ETFs often involves lower transaction costs compared to buying and storing physical gold.

-

Diversification: Gold ETFs can provide a hedge against inflation and currency fluctuations, diversifying your investment portfolio.

However, there are also considerations to keep in mind when investing in ETFs:

-

Expense ratios: These are the annual fees charged by the ETF, which can impact your long-term returns.

-

Storage and insurance costs: For physically backed ETFs, these costs are factored into the expense ratio.

-

Market risks: Like any investment, gold prices can be volatile, influenced by global economic factors and investor sentiment.

>> MORE: How to add gold to your investment portfolio in Singapore

Start your journey with a robo advisor!

Discover the top platforms for investing today.

Steps to investing in gold ETFs in Singapore

Ready to add gold ETFs to your investment portfolio? Here's how to go about it.

1. Identify suitable gold ETFs

When choosing a gold ETF, consider factors such as the expense ratio, liquidity, and fund size.

For SGD-denominated ETFs like SPDR Gold Shares (GSD.SI), trading on the Singapore Exchange (SGX) is straightforward. Meanwhile, for USD-denominated ETFs like IAU, SGOL, and BAR, you should ensure your brokerage platform supports international trading.

2. Open a brokerage account

Select a brokerage platform that offers access to your chosen ETFs. If you plan to diversify across different markets, ensure the platform supports both local and international ETF transactions.

⚡ SingSaver x IG Markets Flash Deal ⚡

Get 4,000 Max Miles by HeyMax(worth S$72), an upsized S$70 eCapitaVoucher or S$50 Cash via PayNow when you open an IG Markets account and make a min. deposit of S$1,000 and make at least 2 trades within 30 days of opening your account. Valid till 15 February 2026. T&Cs apply.

🧧SingSaver CNY Special Offer🧧

Fire up your investing with over S$3,188 in daily red packet bonuses! At 8 pm daily, the first 20 applicants of select brokerages get an extra S$18 on top of guaranteed rewards. Over 2,000 red packets up for grabs! Valid till 15 February 2026. T&Cs apply.

3. Fund your account

You'll need to deposit sufficient funds into your brokerage account to cover the cost of your ETF purchases and any associated transaction fees.

4. Place your order

Decide on the number of ETF units you wish to purchase. You can choose between market orders, which are executed immediately at the current market price, or limit orders, which allow for a specified price.

5. Monitor your investment

Regularly review the performance of your gold ETFs. Stay informed about factors influencing gold prices, such as global economic indicators, interest rates, and geopolitical events, as these can significantly impact your investment.

Pros and cons of investing in gold ETFs in Singapore

Gold ETFs are a popular way for Singapore investors to gain exposure to gold without holding the physical metal. They’re easily accessible through local brokerages and the SGX, but they still come with trade-offs that are worth understanding before investing.

Pros

Lower risk and fewer logistical concerns

For investors in Singapore, gold ETFs remove the need to store physical gold at home or in a safe deposit box, which can add cost and security concerns. Compared to investing in individual gold mining stocks, gold ETFs also offer more diversified exposure, helping to reduce company-specific risk.

Easy access through local platforms

Gold ETFs can be bought and sold through SGX-listed funds or international exchanges using most Singapore-based brokerage accounts. This makes it straightforward for local investors to add gold exposure to their portfolios without dealing with bullion dealers or overseas logistics.

Simple, hands-off investment option

Gold ETFs are typically passively managed, making them suitable for investors who prefer a low-maintenance approach. There’s no need to track gold prices daily, manage physical holdings, or actively rebalance a portfolio of gold-related stocks.

Cons

Returns may underperform other asset classes

While gold is often viewed as a defensive asset, gold ETFs may lag behind equities, REITs, or other growth-oriented investments during strong market cycles. Gold mining ETFs can also underperform spot gold prices due to factors such as rising operating costs or regulatory issues affecting mining companies.

No physical gold ownership

Investing in a gold ETF does not give you direct ownership of physical gold. For Singapore investors who see gold as a long-term store of value or a hedge against extreme economic scenarios, this lack of tangible ownership may be a downside.

Fees and currency considerations

Most gold ETFs charge management fees, which can gradually reduce returns over time. In addition, Singapore investors buying gold ETFs listed overseas may face currency risk if the fund is denominated in USD or another foreign currency.

Frequently asked questions about buying gold ETFs

There is no single best gold ETF, as the right option depends on your investment goals and preferences. Investors typically compare factors such as whether the ETF is backed by physical gold, its expense ratio, trading liquidity, and whether it is listed on the SGX or overseas markets.

Gold ETFs may be worth buying if you’re looking to diversify your portfolio or add a defensive asset during periods of market uncertainty. However, they are not designed for high growth and may underperform equities over the long term.

To invest in gold in Singapore, you can buy gold ETFs through a local or international brokerage account. These ETFs trade like shares on the SGX or overseas exchanges and provide exposure to gold prices without the need to store physical gold.

Yes, SRS funds can be used to invest in certain gold ETFs, provided they are approved under SRS investment rules. These are usually SGX-listed ETFs, so it’s important to confirm SRS eligibility before investing.

Relevant articles

8 Best ETFs for February 2025 and How to Invest

A Guide on How To Invest in ETF for Beginners Online

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.