5 Leading REIT ETFs to Watch in March 2025

Updated: 11 Dec 2025

|

Saver takeaways

|

REIT ETFs simplify investing in Real Estate Investment Trusts by providing access to a diversified portfolio of REITs through a single fund, eliminating the need for direct property ownership and management.

Top REIT ETFs by performance

| ETF name | Ticker symbol | 1-year annualised return |

| iShares Residential and Multisector Real Estate ETF | REZ | 19.84% |

| Residential REIT ETF | HAUS | 18.70% |

| Invesco S&P 500 Equal Weight Real Estate ETF | RSPR | 10.16% |

| iShares Core U.S. REIT ETF | USRT | 7.77% |

| Janus Henderson U.S. Real Estate ETF | JRE | 5.55% |

| Source: Finviz.com Data is current as of 17 March 2025, and is intended for informational purposes only, not for trading purposes. | ||

Reasons to invest in REIT ETFs

REIT ETFs offer several advantages: diversification, liquidity, potential passive income, and a hedge against inflation during market volatility.

The best part about investing in real estate, particularly through REITs and their dividend payouts, is that it is a proven wealth-building avenue, and REIT ETFs simplify sector access compared to direct property purchases.

REIT ETFs vs. individual REITs

REIT ETFs are exchange-traded funds that invest in Real Estate Investment Trusts (REITs). REITs are companies that own and operate properties like housing apartments, warehouses, and hotels, often paying dividends.

While REITs purchase and manage properties, REIT ETFs invest in REIT shares. A key advantage of REIT ETFs over individual REITs is diversification: you gain exposure to numerous REITs in one investment, similar to an index fund composed of many stocks, rather than a single stock.

Find out more: Best performing REITs

⚡SingSaver x Plus500 Flash Deal⚡

Get S$300 cash, S$320 Grab voucher, or 20,000 Heymax miles (worth S$342) when you open a Plus500 account through SingSaver, make a min. deposit of S$1,500, and execute at least 3 trades within 14 days. Valid till 1 March 2026. T&Cs apply.

💎 Exclusive Deposit Bonuses from Plus500

Get S$13,000 plus 8,000 Trader Points when you deposit min. S$75,000 with bonus code DIAMOND, S$688 plus 408 Trader Points with min. S$1,000 using SingSaver688, or S$288 plus 128 Trader Points with min. S$500 using SingSaver500. Valid till 1 February 2026. T&Cs apply.

Advantages and drawbacks of REIT ETFs

Advantages of REIT ETFs

-

Inflation hedge: REIT ETFs can act as a hedge against inflation, as property rents and REIT values tend to rise with prices.

-

Diversification: REIT ETFs provide instant diversification across multiple REITs, reducing risk compared to single property or REIT investments.

-

Income: REIT ETFs, primarily investing in REITs, offer potential high dividend payouts due to REITs' mandated dividend distributions.

Find out more: Best ETFs for 2025 and how to invest in them

-

Liquidity: REIT ETFs can be traded like stocks, providing greater liquidity than direct real estate investments.

Drawbacks of REIT ETFs

-

Interest rate sensitivity: REIT ETFs are affected by interest rate hikes, which increase borrowing costs for real estate, impacting REIT values.

Learn more How to buy and trade stocks in Singapore for beginners

REIT ETFs vs. direct REIT investment:

-

Direct REIT investment:

-

Pros: Allows selection of specific REITs based on individual preferences, potential for higher returns from outperforming REITs.

-

Cons: Requires extensive research, active management, and carries higher risk due to less diversification.

-

REIT ETFs:

-

Pros: Provides instant diversification across numerous REITs and professional management.

-

Cons: Incurs management fees and offers less control over individual REIT selection.

For Singaporean investors seeking a hands-off, diversified approach, REIT ETFs are a suitable choice. Direct REIT investment offers more control but requires greater research and management effort.

Discover more about ETFs & investing

At the time of publication, neither the author nor the editor possessed any holdings in the investments discussed.

Discover more about ETFs & investing

SingSaver writers are experts in their fields, using reliable sources like research studies, government websites, and interviews with industry professionals. All content is checked for accuracy and relevance. For more information on SingSaver’s editorial standards, please refer to our About Us page.

1. iShares Residential and Multisector Real Estate ETF. Finviz. Accessed 18 March 2025.

2. Residential REIT ETF. Finviz. Accessed 18 March 2025.

3. Invesco S&P 500 Equal Weight Real Estate ETF. Finviz. Accessed 18 March 2025.

4. iShares Core U.S. REIT ETF. Finviz. Accessed 18 March 2025.

5. Janus Henderson U.S. Real Estate ETF. Finviz. Accessed 18 March 2025.

⚡ SingSaver x Longbridge Flash Deal ⚡

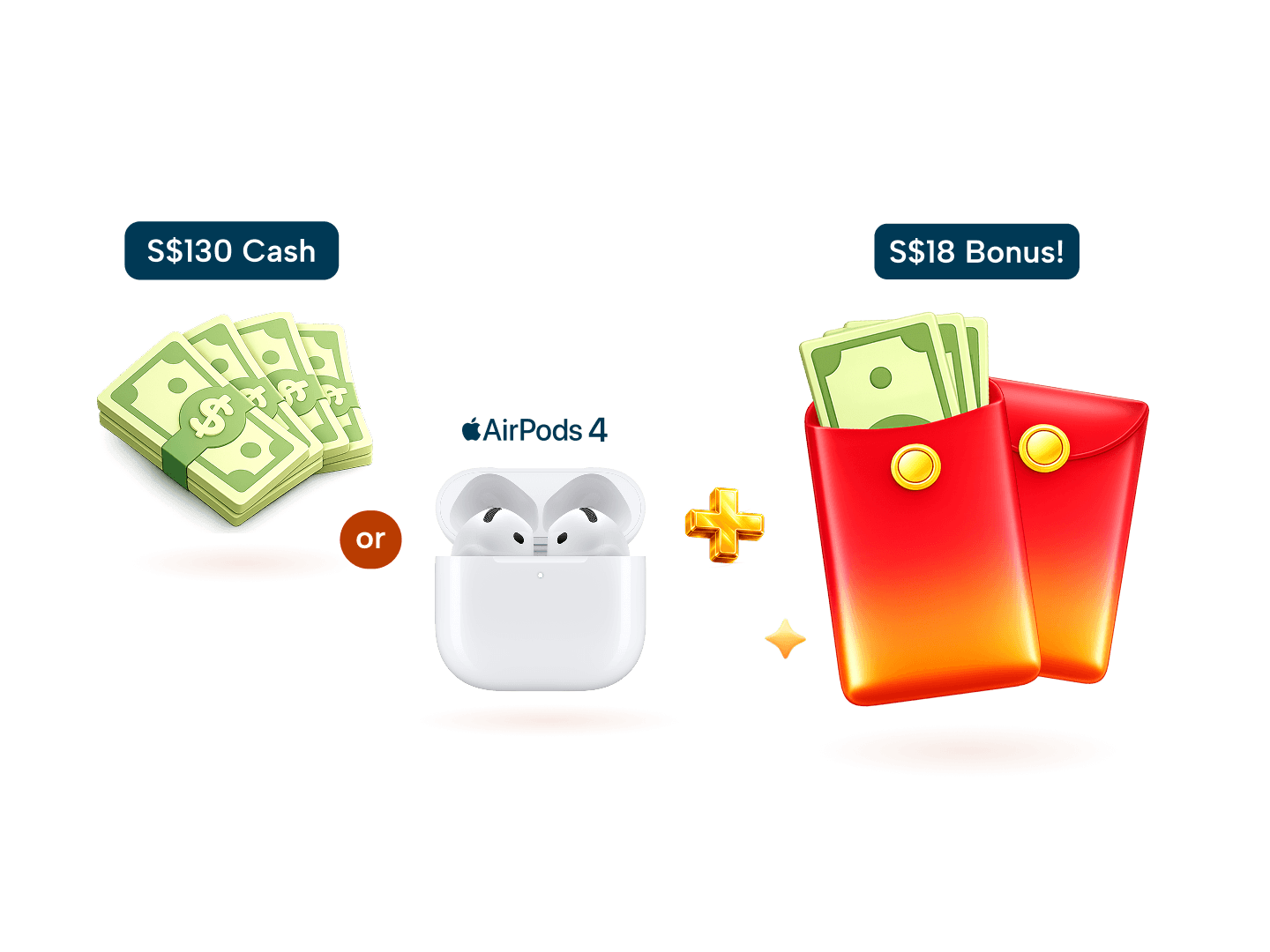

Get S$130 Cash, S$150 Grab Voucher, Apple AirPods 4 or 9,000 Max Miles by HeyMax (worth S$162) when you apply and get approved for a Longbridge SG account, fund a min. of S$2,000 and maintain the assets for 30 days from the day after meeting the deposit criteria. Valid till 15 February 2026. T&Cs apply.

Relevant articles

How to Invest in ETFs: A Guide for Beginners

Exchange Traded Funds (ETFs) have become a popular investment vehicle. Find out how to invest in ETFs, how they work and what ETFs are available for trading in Singapore.

Buy Singapore stocks with a reliable brokerage

Compare and choose the best brokerage for your SGX investments with SingSaver.