CFDs: What Are They And How Do You Trade CFDs?

Updated: 2 Jan 2026

Written bySingSaver Team

Team

Find out what makes CFDs tick, the risks you should be aware of when trading CFDs, and more in this article.

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

What is a contract for difference (CFD)?

A CFD is a financial instrument that allows you to speculate on the future market movements of stocks, commodities, indices, currencies, and other underlying assets, without owning the underlying asset itself.

When you trade CFDs, you’re not trading to buy or sell an underlying asset but speculating on its price movements. In other words, you’re essentially betting on whether an asset will increase or decrease in value. In fact, IT IS like betting: you'll make a profit if you can correctly predict what's going to happen; on the other hand, you’ll suffer a loss if your prediction is wrong.

CFDs have been gaining popularity among investors because they allow you to make money quickly without a high starting capital. That said, CFDs are extremely risky, and you could lose more money than your initial investment.

How CFD trading works

When you trade with a CFD provider, you’re not buying or selling an asset but speculating on its price movements. There are two ways to trade CFDs.

Buying CFDs in a rising market

If you believe an asset will increase in value, you can buy at the opening price. This is also known as a long trade.

If the asset’s price increases just as you’ve predicted, you will earn a profit when you sell at the closing price. The difference between the opening and closing price, also known as 'the spread', is your profit. The higher the spread, the larger your profit.

Selling CFDs in a falling market

On the other hand, if you expect an asset to fall, you can choose to sell a CFD, otherwise known as a short trade. If the asset’s value goes down as you predicted, you will have earned a profit. The lower the price goes, the larger your profit will be.

If this sounds confusing to you, remember that when making a long trade, the closing price has to be higher than the opening price for you to make a profit. Conversely, the opening price has to be lower than the closing price in a short trade.

Understanding the basics of CFD trading

1. You can profit from rising or falling prices

CFDs let you speculate on price movements without owning the underlying asset. If you expect prices to increase, you open a long (buy) position. If you believe prices will fall, you open a short (sell) position. Your profit or loss depends entirely on how accurate that market view turns out to be.

That said, both long and short positions carry risk: prices can move against you in either direction. Before placing any trade, it’s crucial to understand how CFDs work and put proper risk management measures in place.

On most trading platforms, opening a long position simply means clicking “buy”, while opening a short position means selecting “sell”.

2. CFDs are leveraged products

One defining feature of CFD trading is leverage. Instead of paying the full value of a trade upfront, you only need to commit a fraction of it — known as the margin — to gain full market exposure.

While this lowers the initial capital required, it also magnifies outcomes. Profits and losses are calculated based on the full value of the position, not the margin you put down.

3. Margin requirements vary by market

The amount of margin required depends on what you’re trading. Major stock indices often have lower margin requirements (for example, 5%), while individual shares typically require more (often around 20%). Each market has its own risk profile, which is reflected in its margin rate.

4. CFD prices track the underlying market

CFDs are designed to closely mirror the price movements of their underlying assets, whether that’s shares, indices, commodities, or currencies. Prices move in line with the real market, with costs built in through either spreads or commissions, depending on the asset being traded.

In short, CFDs offer flexible market access and capital efficiency, but they require a clear understanding of leverage, pricing, and risk before you trade.

Types of CFD trading products in Singapore

CFD platforms available to Singapore-based traders offer exposure to global markets without requiring you to buy the actual asset. Instead, you’re trading on price movements. For beginners, knowing how each CFD product works and the risks involved matters just as much as selecting a well-established and reputable broker.

Forex

Forex CFDs are among the most actively traded instruments and are often the entry point for beginners. They allow you to trade currency pairs such as USD/SGD, EUR/USD, GBP/USD, and JPY crosses. The forex market is highly liquid and operates nearly 24 hours a day, making it popular with traders who value flexibility and frequent opportunities.

Indices

Index CFDs track the performance of a group of stocks that represent a market or sector. Common examples include the Straits Times Index (STI), S&P 500, NASDAQ, and FTSE 100. These products are often used by traders who want broad market exposure rather than betting on individual companies.

Shares

Share CFDs let you trade individual stocks listed in Singapore, the US, and other global markets without owning the actual shares. You can potentially profit from both rising and falling prices, making share CFDs useful for traders with specific views on company performance.

>>MORE: How to buy, trade and invest in stocks in Singapore

Commodities

Commodity CFDs give you exposure to assets such as gold, silver, crude oil, natural gas, and agricultural products. Since you’re trading price movements rather than physical goods, commodities become more accessible and are often used to hedge against inflation or global supply-and-demand shifts.

ETFs

ETF CFDs track exchange-traded funds that mirror indices, sectors, or commodities. Trading ETFs via CFDs allows you to gain diversified exposure — such as to technology stocks or emerging markets — without purchasing the actual ETF units.

Sector CFDs

Sector CFDs focus on specific industries like technology, healthcare, energy, or financial services. They’re useful if you have a strong conviction about how a particular sector will perform relative to the broader market.

Bonds and treasuries

Bond and treasury CFDs allow traders to speculate on interest rate movements by trading instruments like US Treasuries or German Bunds. These products are often used in macro-driven strategies or as a hedge during periods of economic uncertainty.

Options

Some brokers also offer CFDs linked to options prices. These products let you speculate on changes in option values without holding the underlying contracts. Due to their complexity, they’re generally more suitable for experienced traders.

No matter which CFD product you choose, it’s important to understand the risks involved, especially the impact of leverage, and to trade only through reputable brokers that are MAS-regulated.

Is CFD trading suitable for you?

CFD trading may appeal to those who want the flexibility to trade both rising and falling markets and are comfortable using leverage. However, it is a high-risk activity, and losses can exceed your initial investment.

Many traders start by using demo accounts to practise strategies in a risk-free environment before moving to live trading.

Why traders use CFDs

People trade CFDs for several reasons:

-

Leverage: Gain market exposure with a smaller upfront capital outlay

-

Flexibility: Profit from both upward and downward price movements

-

Extended trading hours: Access some markets outside regular exchange hours

-

Hedging: Offset potential losses in other investments

CFD trading offers versatility, but it also requires discipline, risk awareness, and a solid understanding of how leveraged products work.

Pros of trading CFDs

Leverage

CFDs are leveraged products, meaning you’re trading with borrowed money. When you trade a CFD, you don’t need to put down the full trade value and need to fork out a small fraction of the trade; the rest is borrowed from the CFD provider. This is known as a margin. The benefit of this is that you have far more purchasing power.

For instance, say that you want to buy 200 Apple shares that are worth S$100 per share. If the CFD provider sets the margin at 5%, your outlay is S$1,000 (S$20,000 X 200 X 5%). In other words, you can buy 200 shares of Apple for just S$1,000, which is much lower compared to the initial cost of S$20,000 if you were to purchase them at full price.

Moreover, you’ll get 100% of the profit if the trade goes in your favour. Going back to our example, if the shares of Apple go up to S$150 per share a week later, the spread is now S$50. If you choose to sell all your CFDs at S$150 per contract, you’ll earn a profit of S$10,000 ((S$150 - S$100) X 200).

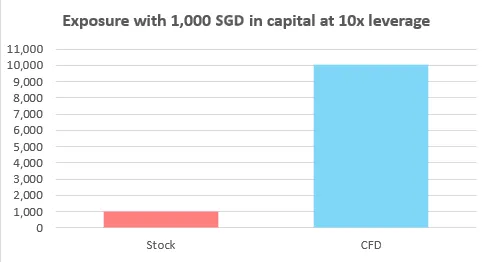

In fact, you can get up to 10X more leverage compared to stock trading. The additional exposure means you can amplify your potential profits.

As you can see from the above table, with only S$1,000, you can gain exposure to up to S$10,000 worth of stocks, or 10X more than investing in stocks. That said, while higher exposure means you can also potentially amplify your profits, your potential loss is also amplified.

Access to a wide range of different asset classes and markets

CFDs allow you to trade in a wide range of markets worldwide, allowing you to trade 24/7. Not only that, but there’s also a wide variety of securities to trade, including indices, shares, forex, commodities, and even cryptocurrencies.

Trade in rising and falling markets

In traditional investing, you buy shares of a company and make a profit when the shares rise in value or through dividend payments. However, if the market is in the red, your stocks will be in turmoil.

In contrast, CFDs allow you to speculate on rising and falling markets. This means that you can profit in both situations as long as you make the right prediction and the market moves in your favour.

Cons of trading CFDs

Leverage

While leverage can greatly work in your favour, the reverse is also true: you’re liable for 100% of the losses if the trade goes south, which means you can lose more than your initial investment.

Using the above example again, say that the shares have fallen to S$50 per share and you decide to sell your CFDs before the share prices slip even further. In this case, you’re selling at S$50, resulting in a loss of S$10,000 ((S$50 - S$100) X 200).

As you can see, this means you would have lost more than the S$1,000 you had initially invested. This is why trading CFDs is extremely risky. In fact, up to 75% of retail investors lose money in CFDs.

CFDs are affected by market conditions

Since you’re speculating on the price movements of assets such as stocks and commodities, your trade is greatly affected by market conditions. For example, during times of economic uncertainty or major world events. And because CFDs are leveraged, a small change in the market can result in big losses.

That said, the market is always affected by random events that influence the price movements of financial products, not just for CFDs.

Overnight fee

You’ll incur a daily overnight fee if you hold your CFDs overnight. As CFDs are leveraged trading, you will also need to pay interest on borrowed money.

Looking for a safer way to grow and protect your cash?

A priority banking account can help you grow through your banking needs, with a dedicated Relationship Manager who will guide you with global investing insights on your wealth journey.

Important things to take note of

You're trading on margin

When you trade CFDs, you’re not paying the full value of the asset upfront. Instead, you’re putting down a small percentage, known as the margin. For example, if a stock’s full value is S$10,000, you might only need to commit S$1,000 to open a CFD position.

Sounds great? It can be, but keep in mind that using margin means borrowing money from your broker. You're effectively trading with leverage, which can increase both your gains and losses.

Profits are magnified, but so are losses

Let’s say you open a CFD on DBS stock at S$30 per share, and you want to control 1,000 shares. Instead of paying the full S$30,000, your broker requires a 10% margin, so you only need to put down S$3,000.

Now, imagine the stock price rises to S$33. That’s a S$3 gain per share, or S$3,000 total profit (S$3 × 1,000 shares). On your original S$3,000 margin, that’s a 100% return.

But if the price drops to S$27, you’d lose S$3,000, wiping out your entire investment. If it falls even further, you could end up owing more money unless your broker provides negative balance protection.

This is why CFD trading is high risk. Small price changes can have an outsized impact on your capital, for better or worse. Always use stop-loss orders and manage your position sizes carefully.

You can be margin called

If the market moves against your position and your account value falls below the required margin, your broker may issue a margin call. That means you’ll need to top up your account with more funds, often at short notice.

If you don’t, your broker can close your positions to limit their risk, which might lock in your losses before you have a chance to recover. For Singaporean investors juggling multiple positions, margin calls can be financially stressful if not planned for.

CFD trading costs

CFD trading isn't free, and fees can quickly add up. Here are some common charges to watch out for:

-

Spread: The difference between the buy and sell price. It’s how brokers make money.

-

Commission: Some brokers charge a fee per trade, especially on shares.

-

Overnight financing: If you hold positions overnight, you might be charged a financing fee. Think of it like interest on borrowed money.

-

Currency conversion fees: If you’re trading foreign assets, these fees can sneak up on you.

Sounds great? It can be, but keep in mind that using margin means borrowing money from your broker. You're effectively trading with leverage, which can increase both your gains and losses.

How to get started on trading CFDs

Step 1: Pick a MAS-regulated CFD broker

Start by choosing a broker licensed by the Monetary Authority of Singapore (MAS) under a Capital Markets Services (CMS) licence. MAS-regulated platforms must segregate client funds from company assets and comply with strict risk controls, including leverage limits (typically capped at 20:1 for major indices).

Before opening an account or transferring money, it’s good practice to verify the broker’s licence status using the MAS Financial Institutions Directory.

Step 2: Pass the MAS Customer Knowledge Assessment (CKA)

CFDs are classified as Specified Investment Products (SIPs), which means MAS requires retail investors to demonstrate sufficient knowledge before trading.

You can qualify by meeting one of the following:

-

Education: A diploma or degree in finance or a related field.

-

Work experience: At least three consecutive years in a finance-related role.

-

Trading background: A minimum of six CFD trades completed within the last three years.

-

e-Learning route: Completing the ABS-SAS e-Learning module via the Association of Banks in Singapore if you don’t meet any of the above criteria

Step 3: Open and verify your CFD trading account

After clearing the CKA, you can proceed to account setup. Most Singapore-based brokers support MyInfo (Singpass) verification, allowing you to confirm your identity digitally without submitting physical documents. This often means faster approvals, sometimes within minutes.

Step 4: Fund your trading account

Deposit funds using local payment methods such as FAST or PayNow for near-instant access to your capital. While some platforms have no minimum deposit, others may require an initial amount (commonly around S$2,000). Always check for funding limits, withdrawal conditions, and potential fees beforehand.

Step 5: Practice with a demo account first

Before trading with real money, use a demo account to familiarise yourself with the platform. CFDs are marked to market in real time, meaning profits and losses fluctuate constantly. A demo environment helps you understand margin usage, price movements, and margin calls, where you may need to top up funds to keep positions open.

Step 6: Move to live trading with a risk plan in place

Once you’re ready to trade live, set clear risk controls from the start. Tools like stop-loss orders help limit downside risk, while take-profit orders lock in gains automatically. Because CFDs are leveraged, losses can exceed your initial deposit during sharp market movements, so position sizing and discipline are crucial.

How to reduce your risk when trading CFDs

Use stops to minimise your risk

Since CFDs are leveraged products, they come with high risk. However, you can manage the risk by setting a stop order with your CFD trading provider. A stop order will limit your loss to a certain amount, much like how limit orders work in investing. This helps to protect you from sudden market movements and also provides you with discipline.

Research, research, research

As with all investments, it’s vital that you do your due diligence before investing. The more you understand CFD and the risks involved, the better prepared you will be.

Start with a small amount

Because you’re trading with leverage, you can make a windfall.

However, it’s also a double-edged sword, as you can potentially also lose a lot of money. As such, starting with a small amount is a good way to get your feet wet, especially if you’re inexperienced in CFD. This way, you can minimise your loss to a small amount.

Invest in something that you know

While you can trade CFDs with a wide range of products, you should stick to something familiar.

Frequently asked questions about CFDs

Yes, CFDs are legal in Singapore. However, they’re classified as Specified Investment Products (SIPs), so you’ll need to meet certain criteria to trade them. This usually means passing a Customer Knowledge Assessment (CKA) unless you’re already an Accredited Investor.

There’s no single “best,” but look for licensed lenders with transparent fees, clear contracts, good reviews, and fast service. Another important thing to look out for in Singapore is MAS regulation.

CFDs are contracts with your broker, not ownership of the underlying asset. If a broker fails, MAS-regulated platforms must keep client funds segregated, which helps protect your deposits, but open positions may be closed and profits aren’t guaranteed. This is why using MAS-regulated brokers matters.

Yes. CFDs are leveraged, so losses are calculated on the full position size, not just your margin. Sharp market moves, plus spreads and overnight fees, can result in losses exceeding your initial deposit.

Relevant articles

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.