Citi ULTIMA Card Review: An Invitation-only Luxury for Citigold Clients

Updated: 22 Aug 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

For those who value curated experiences over card rewards, the Citi ULTIMA offers exclusivity with a capital E — but only if you’re invited.

If you’ve ever wondered what a credit card looks like when it's not just a payment tool, but a gateway to ultra-premium travel and lifestyle experiences, the Citi ULTIMA Card gives you a peek into that world. Now relaunched as a World Elite Mastercard, it remains an invitation-only privilege for Citi’s wealthiest clientele — complete with high annual spend requirements, concierge-level perks, and luxury tailored for Citigold Private Clients.

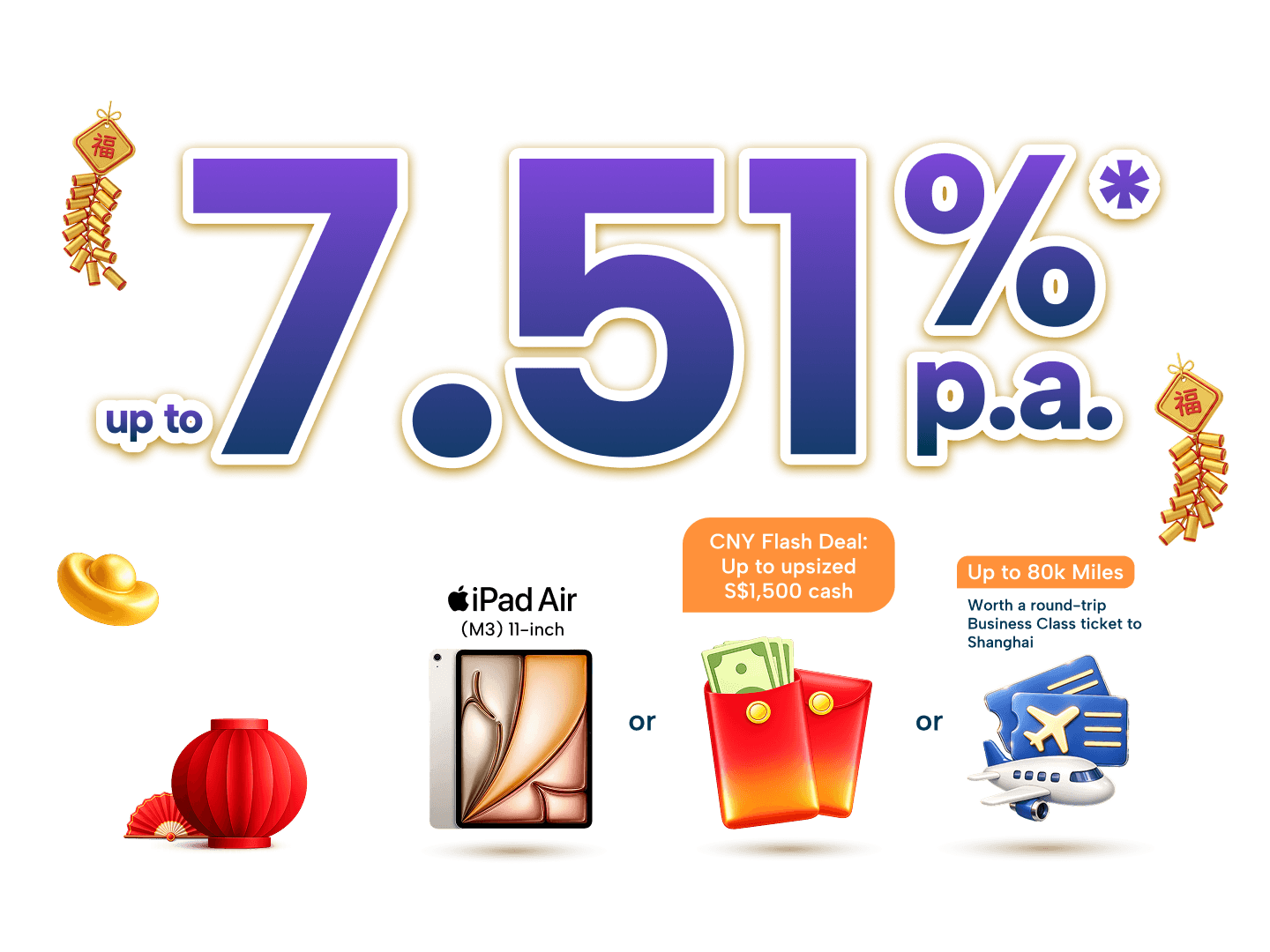

⚡SingSaver x Citigold Flash Deal⚡

Enjoy up to 7.51% p.a. interest when you join Citigold and open a Wealth First account. Plus, get up to 80,000 Max Miles by Heymax (worth S$1,440), an Apple iPhone 17 512GB (worth S$1,599), or Upsized S$1,500 Cash when you successfully apply for a Citigold account, become an Accredited Investor, and make a S$350,000 deposit within 3 months of account opening, maintaining these funds until gift fulfilment. Valid till 31 March 2026. T&Cs apply.

SingSaver feature: Citi ULTIMA for invite-only luxury

SingSaver’s take

The Citi ULTIMA Card isn’t for everyone — and that’s the point. It’s built for those who value time, convenience, and tailored experiences more than they do chasing air miles. If you’re already a Citigold Private Client, the ULTIMA seamlessly integrates with your wealth management needs. From hotel privileges to personalised travel planning, the card’s perks feel like a natural extension of the Citigold lifestyle, not a separate product.

Pros

Access to Citigold Private Client privileges

Elevated travel and dining perks

Personalised concierge and lifestyle support

Cons

Extremely high barrier to entry

Non-waivable high annual fee

What the Citi ULTIMA Card can do for you

The Citi ULTIMA Card is a by-invite-only luxury card reserved for Citi’s top-tier clients. Relaunched in August 2023 as a World Elite Mastercard (formerly a Visa Infinite), it continues to cater to ultra-high-net-worth individuals (UHNWIs) who prioritise bespoke lifestyle perks over everyday cashback or air miles.

Citi doesn’t publicly list the eligibility requirements — a nod to just how exclusive this card is.

Clear, however, is that Citi ULTIMA is positioned as a premium travel and lifestyle card for Citigold Private Clients — individuals who typically maintain at least AUM S$1.5 Million and above. The card was relaunched in 2023 as a World Elite Mastercard, replacing its earlier Visa Infinite version.

What sets this card apart is less about strict earn rates and rewards and more about access to Citigold Private Client privileges, including wealth advisory services, concierge support, luxury travel experiences, and enhanced global banking access. These services are valuable to certain user segments but may not be meaningful to those outside the bank’s wealth management network.

What are the advantages of the Citi ULTIMA Card?

#1 A suite of Citigold privileges

Many of the Citi ULTIMA Card’s perks aren’t tied to the card alone, but to your status as a Citigold Private Client. This means the benefits go beyond rewards or lounge access and extend into Citi’s premium banking ecosystem — including investment insights, wealth advisory services, and curated lifestyle privileges. It’s a tightly integrated offering, but only relevant if you're already managing a sizeable portfolio with Citi (minimum S$1.5 Million in AUM). Those not already banking with Citi won’t be able to access most of these privileges.

» MORE: Citigold review 2025: An abundance of wealth solutions for the well-heeled

#2 Dedicated Relationship Manager

As part of the Citigold Private Client programme, cardholders receive a dedicated Relationship Manager backed by a team of product specialists. This setup is useful for those who want a more hands-on approach to wealth management, though how beneficial it is depends on how frequently you engage your banking team. It’s worth noting that this is a banking privilege, not a credit card-exclusive feature.

#3 Total Wealth Advisor

The Total Wealth Advisor tool offers consolidated tracking of your global portfolio and simulates different investment scenarios. It's a helpful tool for long-term financial planning, particularly for those managing multiple accounts or assets. Again, it’s not exclusive to the card, but rather to Citigold members.

#4 Citibank Global Wallet

This feature allows you to hold and spend in multiple currencies without conversion fees — useful for travellers or those who shop on international platforms. While it's not unique to Citi ULTIMA (Citigold debit cardholders get it too), it pairs well with the card’s overseas earn rate and travel perks.

#5 Lifestyle privileges

Citi ULTIMA offers access to concierge services, curated dining, wellness experiences, and ticketed events. While these perks align with what you’d expect from a World Elite Mastercard, much depends on how often you take advantage of them. If you frequently travel or entertain, the value can add up; if not, many of these perks may go unused.

#6 Global services

Citi’s global banking presence allows Citigold members to access in-person support and emergency cash services overseas. This makes the card more practical for those who live abroad part-time, travel often, or manage assets in multiple countries. Still, these services are part of Citigold, not the card itself.

#7 Golf privileges

Cardholders get complimentary access to a list of golf courses in Asia and Europe. While this might appeal to frequent golfers, the true value depends on how often you use it — and whether the listed courses align with your location or preferences.

Live the high life with a premium credit card

Time to enjoy first-class flights, Michelin-starred meals and all the perks that come with some of the best luxury credit cards in Singapore

Who is the Citi ULTIMA Card for?

Great for:

-

Ultra-high-net-worth (UHNW) individuals already banking with Citi: Ideal for those who are already Citigold Private Clients or Citi Private Banking customers, as the ULTIMA card integrates seamlessly with Citi’s wealth management privileges and curated investment solutions.

-

Frequent first or business class travellers: If you regularly fly premium cabins for work or leisure, the card’s luxury travel perks — including airfare privileges, complimentary hotel nights, and unlimited lounge access for up to three — offer tangible, ongoing value.

-

Those who value white-glove concierge experiences: Perfect for individuals who prefer to outsource travel planning, dining reservations, event access, and lifestyle arrangements to a highly capable concierge team — freeing up personal time and elevating everyday experiences.

Not recommended for:

-

Average consumers looking for the best miles or cashback earn rates: While the ULTIMA does earn miles, its rates aren’t market-leading. Other cards offer better returns on spend for those optimising travel rewards or cashback percentages.

-

Those unwilling to pay a steep annual fee: With a non-waivable annual fee of over S$4,200, the card requires a strong appetite — and budget — for premium services. Unless you can fully utilise its luxury perks, the cost may outweigh the benefits.

-

Budget-conscious travellers or occasional card users: This card is not meant for light spenders or those who travel occasionally. If you’re not maximising the travel, hotel, and lifestyle privileges, a mid-tier miles or cashback card would be more appropriate and cost-effective.

» MORE: Priority banking vs private banking: Which one suits you better?

Are there any ongoing promotions?

Currently, Citi ULTIMA Card is available by invitation only. Promotions are typically bundled with Citigold Private Client onboarding or milestone spend campaigns — speak with your Relationship Manager for the latest updates.

⚡SingSaver x Citigold Flash Deal⚡

Enjoy up to 7.51% p.a. interest when you join Citigold and open a Wealth First account. Plus, get up to 80,000 Max Miles by Heymax (worth S$1,440), an Apple iPhone 17 512GB (worth S$1,599), or Upsized S$1,500 Cash when you successfully apply for a Citigold account, become an Accredited Investor, and make a S$350,000 deposit within 3 months of account opening, maintaining these funds until gift fulfilment. Valid till 31 March 2026. T&Cs apply.

Compared to other premium credit cards

While the Citi ULTIMA Card delivers exceptional concierge service and bespoke lifestyle privileges, how does it stack up against other invite-only or premium-tier cards in Singapore?

Comparison to other premium credit cards

|

Local earn rate |

Overseas earn rate |

Annual fee (incl. 9% GST) |

Airport lounge access |

Key benefits |

|

|

Citi ULTIMA |

Unknown |

Unknown |

S$4,237.92 |

Unlimited (up to 3 pax) |

Citigold Private perks, hotel nights, APEC card, concierge |

|

DBS Insignia |

1.6 mpd |

2.0 mpd |

S$3,270 (inclusive of 9% GST) |

Unlimited (cardholder) |

Miles on annual fee, luxury travel privileges |

|

UOB Reserve |

1.6 mpd |

2.4 mpd |

S$3,924 (inclusive of 9% GST) |

Unlimited (cardholder) |

Exclusive access to private events, higher FX earn rate |

|

1 mpd |

2 mpd |

S$650 |

Unlimited (cardholder) |

Accessible, great travel perks, lower cost |

DBS Insignia

The DBS Insignia Visa Infinite Card is another invite-only card targeting high-net-worth individuals. Like Citi ULTIMA, it requires high annual spend (reportedly S$150,000 per year) and offers similar earn rates of 1.6 mpd locally and 2.0 mpd overseas.

Where DBS Insignia shines is its inclusion of 100,000 miles awarded upon payment of the annual fee, offering upfront value for travel enthusiasts. However, it lacks some of the specialised perks Citi ULTIMA offers, such as the complimentary APEC Business Travel Card, hotel night programme, and multi-cardholder lounge access.

Choose DBS Insignia if you're focused on straightforward miles and prestige. Go with Citi ULTIMA if you value tailored concierge services and Citigold integration.

UOB Reserve

The UOB Reserve Card is also by invitation only and positioned as an elite lifestyle and travel card. It offers a high foreign currency earn rate (2.4 mpd), making it a better option for heavy overseas spenders. Like ULTIMA, it offers complimentary lounge access, concierge services, and luxury travel arrangements.

However, UOB Reserve lacks a structured hotel night programme and does not include perks like the multiple cardholder lounge access. It is also known more for its event access and lifestyle partnerships, appealing to those who prioritise social prestige.

Go for UOB Reserve if you're maximising FX spending and social status. Citi ULTIMA wins on family travel convenience and all-rounded luxury.

HSBC Visa Infinite

Unlike the others, the HSBC Visa Infinite is not invitation-only — making it the most accessible premium card in this comparison. It comes with a much lower annual fee (S$650), but its earn rate is lower (1 mpd local, 2 mpd overseas) and its benefits are more modest.

HSBC Visa Infinite provides a good selection of travel and dining benefits, but doesn’t offer the white-glove concierge service, personalised wealth privileges, or bonus perks like the APEC card and free hotel nights that ULTIMA provides.

HSBC Visa Infinite is a solid option for frequent flyers seeking premium perks at a lower cost. Citi ULTIMA is in another league, suited for clients seeking exclusivity and elite-level curation.

How do I apply for a Citi ULTIMA Card?

You cannot apply directly online. Instead, speak to your Citigold Private Client Relationship Manager or Wealth Specialist. If you're not yet a Citigold Private Client, you'll need to first qualify and onboard with Citi’s wealth management services.

Frequently asked questions about the Citi ULTIMA Card

No, this card is strictly by invitation only. To be considered, you must be a Citigold Private Client with significant assets under management and a high annual income.

The Citi ULTIMA is not really for miles earning or cashback rewards, it is best suited for those who want premium travel experiences and concierge-level service in a full wealth experience.

Yes, the Citi ULTIMA Card is exclusively available by invitation to Citigold Private Clients and Citi Private Bank clients. To qualify as a Citigold Private Client in Singapore, you typically need to maintain a minimum of S$1.5 million in AUM with Citibank. This includes balances across various accounts such as checking, savings, time deposits, investments, and certain insurance products.

Relevant articles

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.