Understanding Secured Loans: What Is a Secured Loan and How Does It Work?

Updated: 16 Dec 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

What is a secured loan?

Think of a secured loan as a financial agreement where you essentially put something you own on the table as a guarantee. This "something" is what we call collateral. It could be your home, your car, or even your savings. When you take out a secured loan, you're telling the lender, "Hey, I promise I'll pay you back, and if I don't, you can have this." In Singapore, you'll find banks, credit unions, and online lenders offering these types of loans.

It's like having a safety net for the lender. If things don't go according to plan and you can't repay the loan, they can take the collateral to recoup their losses.

SingSaver Personal Loans Cashback Offer

Enjoy interest rates as low as 1.08% p.a. (EIR from 2.09% p.a.) and up to S$4,900 in cashback when you apply for a personal loan via SingSaver. Valid till 1 March 2026. T&Cs apply.

How does a secured loan work?

Secured loans operate on a principle of risk mitigation for the lender. By providing collateral, you're essentially reducing the lender's exposure, which often translates into more favourable loan terms for you. But how does this all work in practice?

Interest and terms: What to expect

When you take out a secured loan, you'll often find that the interest rates are fixed, providing a predictable monthly repayment structure that aids in your budgeting. This stability is a key advantage. Furthermore, because the lender has the security of your collateral, they typically offer lower interest rates compared to unsecured loans, reducing your overall borrowing cost.

The lender will establish the loan repayment terms, outlining the duration of the loan and the amount you'll pay each month, which you agree to upon acceptance. If you're offering high-value collateral, you may have the opportunity to negotiate more favourable terms, potentially securing even lower interest rates or a larger loan amount.

Borrowing limits: How much you can get

The amount you can borrow with a secured loan is generally linked to the value of the collateral you provide. Essentially, the more valuable your asset, the larger the loan you can potentially obtain. For example, when you secure a mortgage to purchase a property, the loan amount is typically calculated based on the property's appraised value, minus any downpayment you've made.

Similarly, if you're taking out an auto loan, the vehicle itself serves as collateral, and the loan amount is determined by the vehicle's market value. In the case of a pawnshop loan, the lender will assess the value of the item you're pledging and then offer you a loan that represents a percentage of that assessed value.

Pros and cons of secured loans

Pros

Easier qualification

Secured loans may be easier to obtain than unsecured loans, especially if you have a less-than-perfect credit history, as the collateral is considered in the application process.

Favourable terms

Secured loans often offer lower interest rates, higher loan amounts, and longer repayment terms compared to unsecured loans, depending on the loan type and lender.

Credit building

Like other forms of credit, secured loan payments are usually reported to credit bureaus in Singapore. On-time payments can help build a positive credit history, while missed payments can negatively impact your credit score.

Cons

Risk of asset loss

The most significant risk is the potential loss of your collateral if you fail to repay the loan. This could have severe consequences, particularly if the collateral is a vital asset like your home or vehicle.

Potentially sower funding

Secured loans may take longer to process and fund than unsecured loans. This is because the lender needs to assess the value of your collateral before approving the loan.

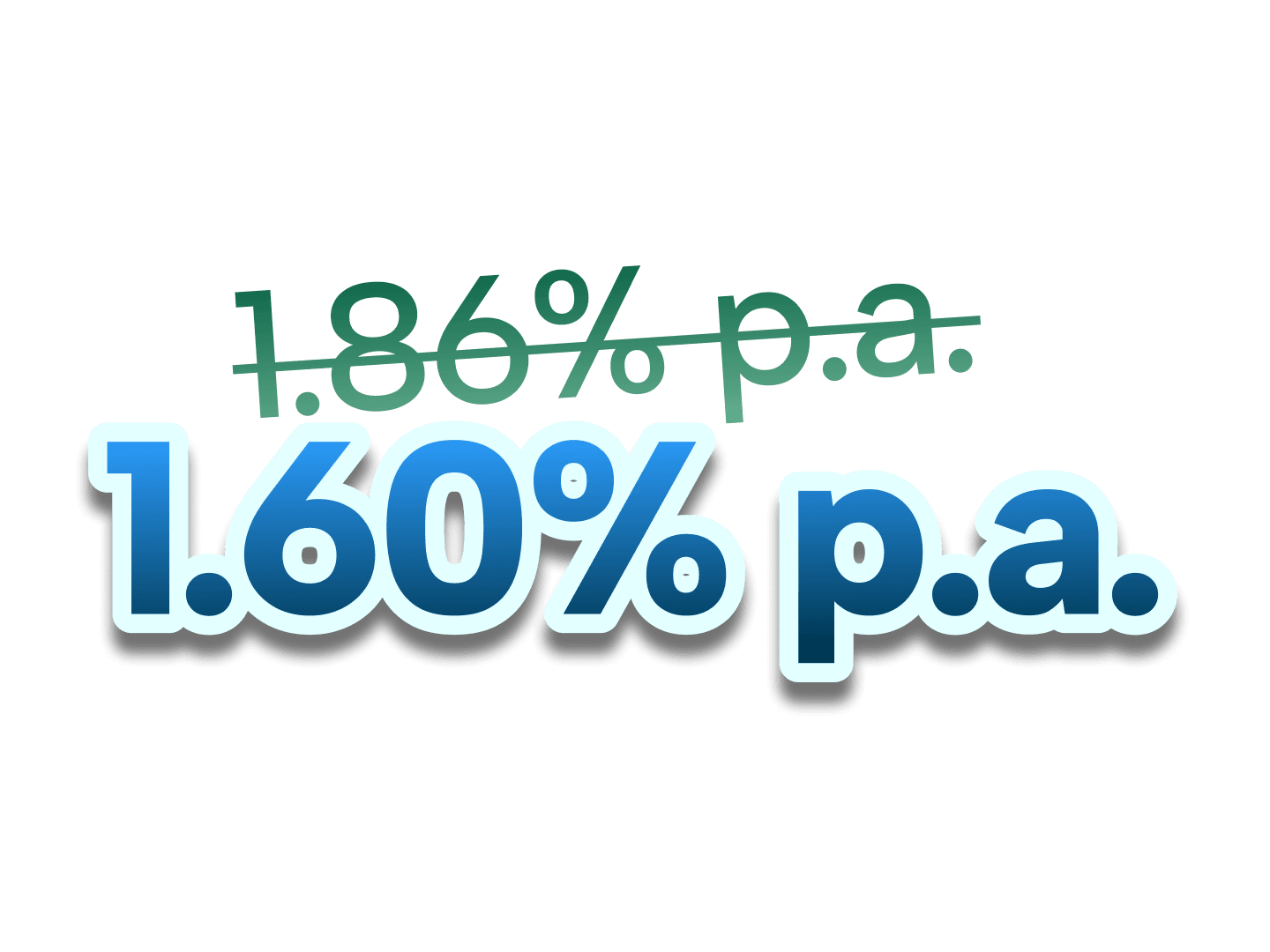

CIMB Personal Loan Welcome Offer

Enjoy low interest rates from 1.60% p.a. (EIR from 3.07% p.a.) when you apply for a CIMB Personal Loan! Valid till 1 March 2026. T&Cs apply.

Common types of secured loans

| Secured loan type | Collateral |

| Home loans | Private residential properties (condominiums, landed properties) or HDB flats |

| Home equity loans | Private residential properties |

| Auto loans | Vehicles (cars, motorcycles) |

| Secured personal loans | Fixed deposit accounts, savings accounts, or certain investment portfolios |

| Pawnshop loans | Personal valuables (jewellery, watches, electronics, etc.) |

When you should get a secured loan

Secured loans, while offering some advantages, come with their own set of considerations. Here’s when they might be a good fit:

-

If your credit score needs a boost: A lower credit score can make it tougher to get loan approvals. If you're working on improving your credit, securing a loan with collateral might be a viable option. Lenders are often more willing to approve your application when they have an asset to fall back on. It’s like having a bit of extra assurance.

-

When you're aiming for lower interest rates: Interest rates can significantly impact the overall cost of your loan. Secured loans often come with lower interest rates compared to unsecured loans. This translates to potential savings on interest payments over the loan's term, which is always a plus.

-

If you're comfortable with the collateral risk: This is a big one. You need to be completely comfortable with the possibility of losing your collateral. If you're confident in your ability to manage your repayments, and you understand the potential risks, then a secured loan could be a practical choice.

>> MORE: Best personal loans for bad credit

When you should go for an unsecured loan instead

Sometimes, an unsecured loan might be the more suitable option. Here’s when:

-

When you need quick access to funds: Life happens, and sometimes you need funds fast. Unsecured loans typically have a quicker approval and disbursement process compared to secured loans. If time is of the essence, an unsecured loan might be the way to go.

-

When you want to avoid collateral risks: Putting your assets on the line can be stressful. If you prefer the peace of mind that comes with knowing your assets are safe, an unsecured loan is a more prudent choice. With an unsecured loan, you don’t have to worry about losing your home, car, or other valuables.

>> GET STARTED: Check out all loan options now

Quick Funds, Zero Hassle with SingSaver

If you’re stuck in a cash crunch, SingSaver makes it easy to find and compare emergency cash options in just minutes with a 70% approval rate—fast, simple, and hassle-free.

How to get a secured loan

Here's a step-by-step guide on how to apply for a secured loan:

-

Check your finances: Review your budget to determine how much you can afford for monthly repayments. Use a loan calculator to see how interest rates and repayment terms affect your monthly payment. Check your credit reports for any errors or past-due accounts you can resolve before applying.

-

Review the collateral: If you're using collateral, assess its value. For an auto-secured loan, use an online pricing guide to check your car's value. For an account-secured loan, review your savings and investment accounts. For a personal item, take it to multiple pawn shops to see which offers the highest valuation.

-

Compare lenders: Look for a secured loan with a competitive interest rate and affordable monthly payments. Compare different lenders, as they may weigh collateral, credit, and income differently. Check if your bank or credit union offers secured loans and if they have any customer perks or discounts.

-

Apply: The application process varies for different types of secured loans. You may be able to apply online, while some banks and credit unions may require an in-person visit. Be aware that applications for secured loans may take longer than unsecured loans because the lender needs to evaluate your collateral.

Consequences of defaulting on a secured loan

Defaulting on a secured loan in Singapore can have serious repercussions, impacting your financial stability and creditworthiness. Here's a breakdown of what you might face:

-

Late payment fees: Lenders in Singapore will typically impose late payment fees if you miss a scheduled repayment. The specific amount will vary depending on the lender and the terms of your loan agreement. It's crucial to check your loan contract for details on late payment penalties.

-

Negative impact on credit score: In Singapore, lenders report loan repayment history to the Credit Bureau Singapore (CBS). Consistent late or missed payments will negatively affect your credit score. A poor credit record can make it significantly harder to obtain loans, credit cards, or even rent a property in the future.

-

Repossession or foreclosure: If you fail to meet your repayment obligations for an extended period, the lender has the right to repossess or foreclose on the asset used as collateral. For example, in the case of a mortgage, the bank could foreclose on your property. For car loans, the vehicle could be repossessed. If the sale of the repossessed asset doesn't cover the outstanding loan amount, you'll still be liable for the remaining balance. This can lead to further debt and financial strain.

-

Legal action: As with other loan types, lenders may pursue legal action to recover the outstanding debt if they fail to repossess or foreclose the collateral asset. This could result in court judgments, which can further damage your credit record and lead to wage garnishment or other enforcement measures.

SingSaver x HSBC Personal Loan Exclusive Offer

Enjoy attractive interest rates from 1.83% p.a. (EIR from 3.5% p.a.) plus get up to S$1,100 in Cashback when you apply for HSBC Personal Loan via SingSaver. Available to new and existing customers! Valid till 1 March 2026. T&Cs apply.

Strategies for managing repayment difficulties

Communicate with your lender

If you anticipate or are experiencing difficulty making your loan repayments, it's crucial to contact your lender immediately. In Singapore, financial institutions are often willing to work with borrowers to find solutions. Discuss your situation openly, as lenders may offer assistance through various arrangements, such as temporary payment deferrals or adjusted repayment plans. Early communication is key to preventing further financial strain.

Renegotiate your payment schedule

Changes in your financial circumstances, like a new job or increased expenses, can make it challenging to keep up with loan repayments. In such cases, consider requesting a revised payment schedule from your lender. This might involve adjusting the payment date or exploring options like larger, less frequent payments. While bi-monthly payments can offer flexibility, remember that they might result in higher overall interest costs compared to monthly payment

Seek professional financial guidance

In Singapore, several organisations provide financial counselling and debt management assistance. Consider reaching out to agencies like the Credit Counselling Singapore (CCS). They offer valuable guidance on budgeting, debt management, and financial planning. These services can help you develop a structured approach to managing your finances and addressing repayment challenges.

Explore alternative support avenues

If you have trusted friends or family members who are willing and able to provide financial assistance, don't hesitate to discuss your situation with them. While it can be a sensitive topic, a loan from a family member or friend might offer a temporary solution to prevent further financial difficulties, such as repossession of assets. Be sure to establish clear terms for any financial arrangement with loved ones to avoid misunderstandings.

Frequently asked questions about secured loans

Payday loans are typically unsecured. Lenders focus more on your current income and employment status rather than requiring specific collateral. They might, however, request access to your bank account for repayment purposes. It's crucial to be aware of the interest rates and fees associated with these loans, as they can be quite high.

Small business loans can be either secured or unsecured. Local lenders often provide secured business loans where you can use assets like commercial property or business equipment as collateral. This can be beneficial for businesses looking to secure larger loan amounts or more favourable interest rates. Some lenders might also use a form of security that allows them to claim business assets in case of default.

The majority of personal loans in Singapore are unsecured. This means you don't need to pledge any specific assets as collateral. However, some financial institutions do offer secured personal loans, where you might use assets like fixed deposit accounts or investment portfolios as security. This is less common but can be an option if you're looking for lower interest rates or have difficulty qualifying for an unsecured loan.

Education loans, whether from banks or other financial institutions in Singapore, are generally unsecured. This means you typically won't need to provide collateral. However, if you're a student facing challenges in qualifying, adding a guarantor with a strong credit history can often improve your chances of approval.

Ready to explore your loan options?

See if you pre-qualify with SingSaver today and discover personalised loan offers tailored to your needs. It's quick, easy, and won't impact your credit score. Start your journey to smarter financial decisions now!

Relevant articles

Stay ahead in everything finance

Subscribe to our newsletter and receive insightful articles, exclusive tips, and the latest financial news, delivered straight to your inbox.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.