Best Women’s Credit Cards in Singapore (2025)

Updated: 22 May 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

Whether you’re a luxe shopper, savvy mom, or culture vulture, here are the best women's credit cards that give you the best bang for your buck.

When it comes to credit cards, Singaporean women are spoilt for choice. Whether your interests lie in designer fashion, theatre and musicals, fitness, dining, or more practical activities like grocery shopping, there is a credit card that rewards you for it – which makes it all the more confusing to choose the right one.

Here, we break down the best women's credit cards for the different types of Singaporean women in 2025.

No Personal Loans Match Your Criteria

Try adjusting your loan amount or tenure to see more options.For the luxe shopper

Product details

-

Earn up to 25 UNI$ (10 mpd) per $5 spend in a chosen category (choose from Beauty & Wellness, Fashion, Dining, Family, Travel, Transport and Entertainment)

-

No minimum spend required

-

First year annual fee waiver

-

eCommerce protection for online purchases

-

Interest free payment plan with LuxePay over 6 or 12 months

-

BNPL platform, LuxePay, available for purchases of luxury items

-

Enjoy a birthday treat during your birth month

SingSaver’s take

The UOB Lady’s Card offers those who are large spenders in a chosen category (fashion & shopping, beauty & wellness, dining & entertainment) a great way to earn enhanced UNI$ which can be converted into rewards or miles.

For the savvy mom

Product details

-

Earn 1 SmartPoint for all purchases, 10 SmartPoints for online and in-store shopping purchases

-

Points can be redeemed as cash rebates, gift vouchers and merchandise

-

No minimum spend required

-

First year annual fee waiver

-

Enjoy exclusive deals and discounts with Citi World privileges

-

Break down large expenses into instalments with Citi PayLite and Citi FlexiBill

SingSaver’s take

The Citi Rewards Card makes shopping more rewarding for those who frequently make online purchases. In addition, cardholders can make use of a range of deals across various categories (from dining to travel) with Citi World privileges.

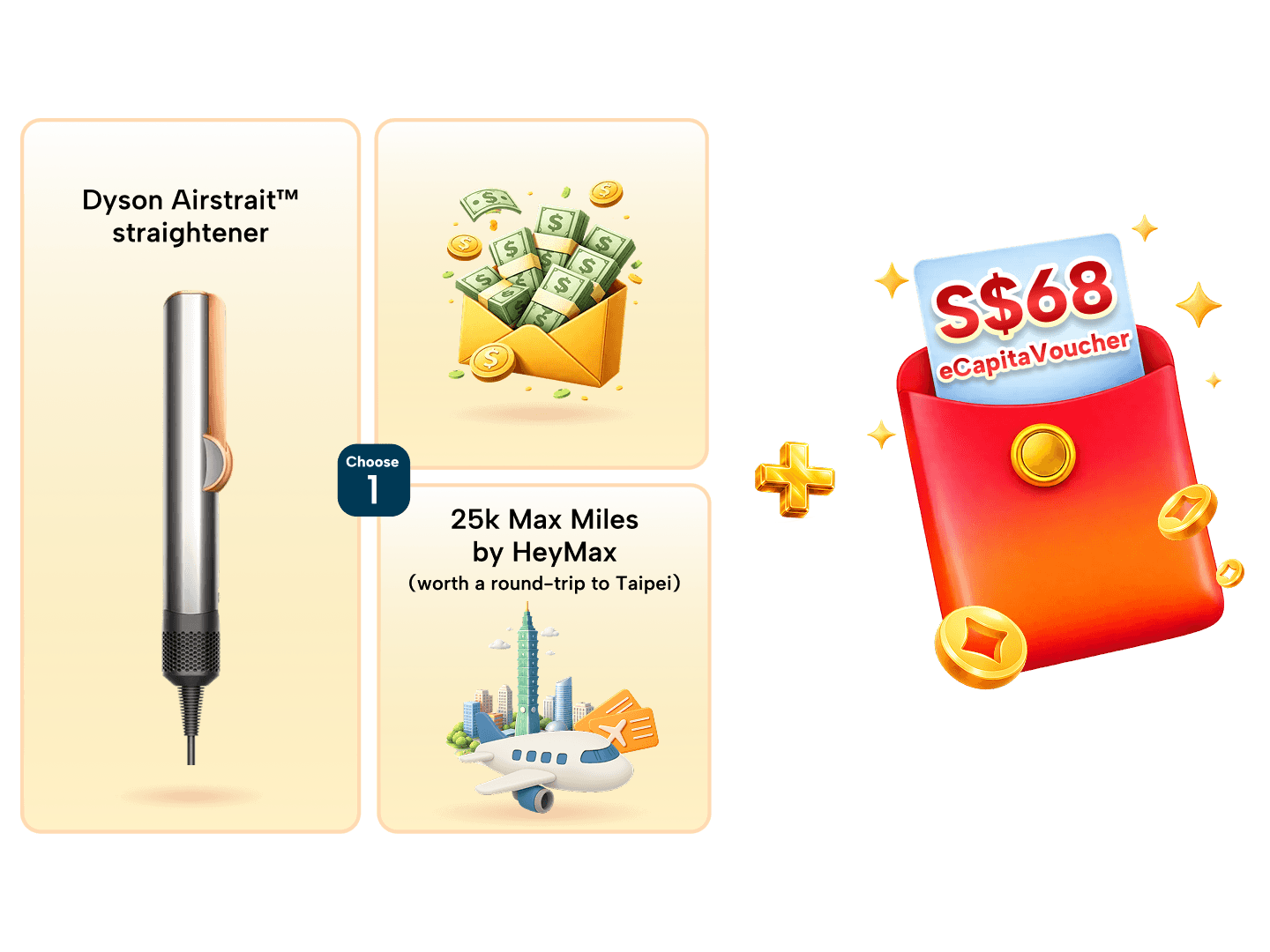

SingSaver x Citi Rewards Credit Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 40mm (GPS), or S$380 Cash when you apply for a Citi Rewards Card and fulfil promo requirements. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

For the online shopaholic

Product details

-

Earn 1 DBS Point for every $5 spent and 5 DBS Points for every $5 spent online

-

DBS Points can be converted into miles, cash credits, dining vouchers, and more

-

Complimentary eCommerce protection on online purchases

-

Instalment plans of up to 24 months offered with 0% interest

-

Exclusive deals for cardholders on categories that include dining and travel

SingSaver’s take

The DBS Woman’s Card is a great option for those who are big online shoppers. Frequent travelers can consider upgrading to the DBS Woman’s World Card and earn additional DBS Points on overseas transactions.

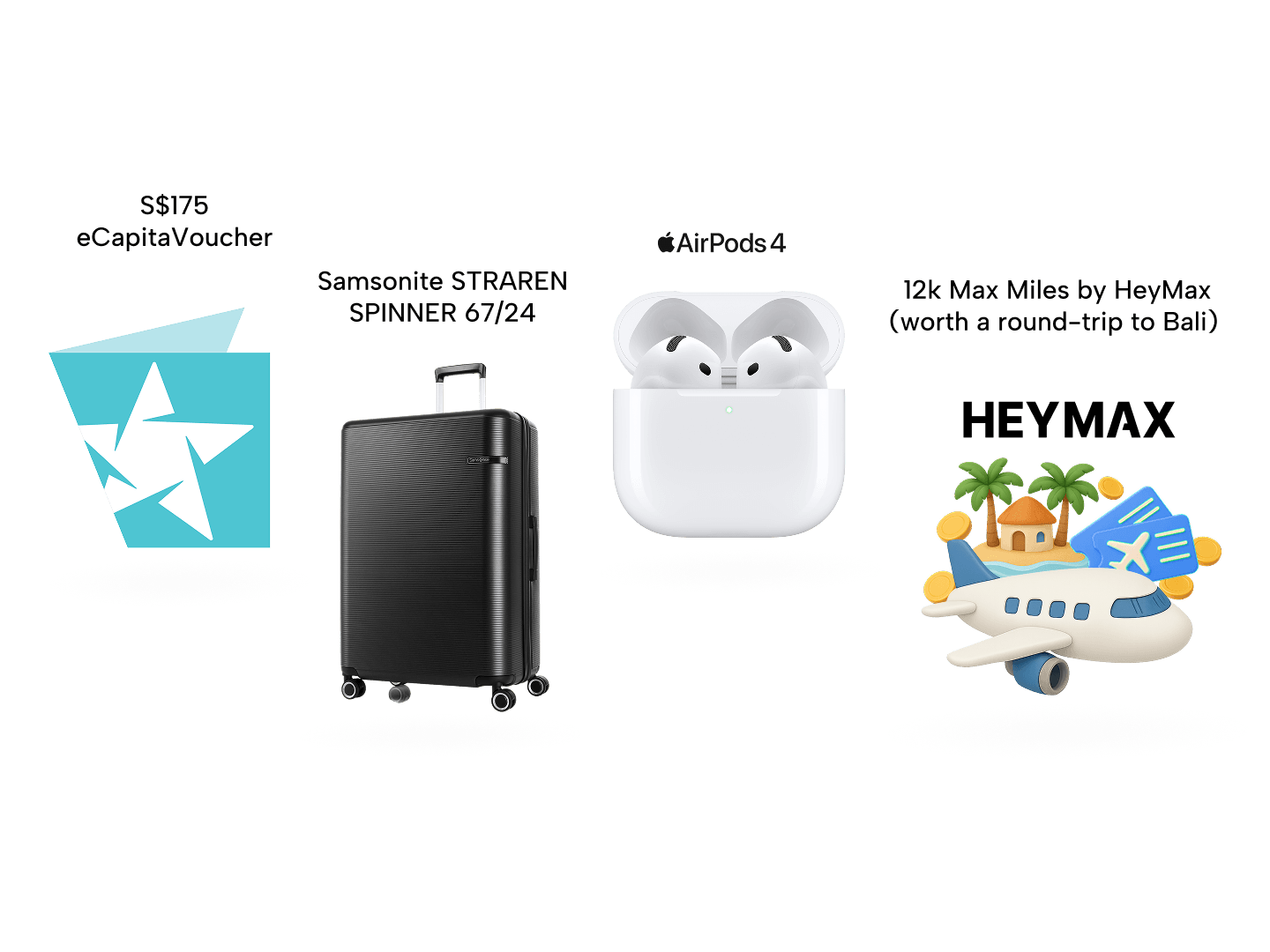

SingSaver x DBS Exclusive Offer

Get rewarded when you apply for select DBS/POSB Credit Cards via SingSaver. Enjoy S$175 eCapita vouchers, 12,000 MaxMiles by HeyMax (worth S$216), Apple AirPods 4, SAMSONITE STRAREN SPINNER 67/24, or a Xiaomi Truclean W20 Wet Dry Vacuum when you meet the minimum spend of S$100 within 30 days of card approval. Or top up as low as S$250 to get the latest Dyson, Nintendo, or Sony products! Valid till 1 March 2026. T&Cs apply.

Frequently asked questions about the best women’s credit cards

While you cannot apply for a principal credit card for someone else, you can apply for a supplementary credit card for them. A supplementary cardholder does not have to meet the minimum income requirement. However, owning a supplementary card will not help the cardholder build credit.

While there’s no limit to how many credit cards you can apply for, it’s important to consider your financial habits and budgeting discipline. Two is a great number to start off with – one for everyday expenses and another that offers enhanced rewards in a category you frequently spend in.

Yes, men can apply for cards like the UOB Lady’s Card and DBS Woman’s Card.

Relevant articles

My Take On The DBS Woman’s World Card and UOB Lady’s Card Devaluations

How do the DBS Woman's World Card and UOB Lady's Card nerfs affect you?

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.