Steps to take when disputing a credit card charge

Updated: 11 Dec 2025

Spotted an incorrect or suspicious charge on your credit card statement? Don't panic. Here’s how to file a dispute.

Knowing how to dispute a credit card charge is a crucial consumer right in Singapore. Whether it's a simple billing error or potential fraud, taking swift action is key. This guide walks you through the credit card dispute resolution process and helps you get your money back.

» Learn how to prevent credit card fraud

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

✨Get the Reward Upgrade You Deserve✨

Get your dream Apple, Dyson, Sony, or Nintendo gadgets when you apply for select Citi, HSBC, OCBC, or Standard Chartered credit cards via SingSaver and top up as low as S$60! Valid till 1 March 2026. T&Cs apply.

1. Review the transaction to confirm it’s a mistake

Start by reviewing your credit card statement closely. Look at the transaction in question and note details like the merchant’s name, location, and any contact information provided. Make sure the charge has actually been posted to your account — not just pending. Pending charges often adjust or disappear, so disputes can only be filed once the charge is officially processed.

If the charge has been posted and you’re seeing an incorrect amount or an issue with a product or service, you can move forward with a dispute.

For completely unfamiliar charges:

-

Do a quick search online — some businesses appear under different names on billing statements.

-

Think back to any free trials or auto-renewals you may have signed up for. These can sometimes slip under the radar.

-

Check in with any authorised users on your card account to see if they made the purchase.

If none of these checks clarify the charge, your account may have been compromised. In that case, act quickly: report the issue to your bank or card issuer and take immediate steps to secure your account.

2. Should you talk to the merchant or the bank first?

Who you reach out to first largely depends on the nature of the charge. In some cases, it’s quicker to resolve the issue directly with the merchant, while others require you to go straight to your credit card issuer for help.

If you’re unhappy with a product or service

If you received a product that was damaged, defective, or simply not as described, your first step should be to contact the merchant directly. Retailers often have refund or replacement policies in place to address these concerns. Many are willing to make it right without involving your bank — whether through a product exchange, refund, or store credit.

However, if the merchant is unresponsive or refuses to resolve the issue, you may consider initiating a chargeback through your card issuer. A chargeback reverses the transaction and returns the funds to your account, but this process typically requires you to first show that you’ve attempted to resolve the dispute with the merchant.

Here are some things to keep in mind:

-

Credit card issuers may set specific conditions, such as deadlines for filing disputes or minimum transaction amounts.

-

The process can take time and may involve providing receipts, screenshots, or email communications with the merchant.

Explore, Compare & Apply for Credit Cards in Singapore

Discover credit cards tailored to your lifestyle. Learn what each card offers, compare the perks, and apply online—quick and easy.

» Refer to these credit card resources to maximise your benefits

If there’s a billing mistake

For issues like duplicate charges, incorrect amounts, or orders that were billed but never delivered, it’s usually best to reach out to the merchant first. If you can provide proof of the error, such as a receipt or order confirmation, they can often fix the issue promptly.

If the merchant doesn’t respond or refuses to correct the mistake, escalate the matter to your credit card issuer. You typically have up to 60 days from the transaction date to lodge a formal dispute, depending on your bank’s policies.

Being proactive is key — keeping digital receipts and tracking delivery updates can help support your case if a billing issue arises.

If the charge is fraudulent

If you notice a charge that you definitely didn’t make, act fast. Contact your credit card issuer immediately to report the suspicious activity. Merchants generally can’t assist in cases of suspected fraud — your bank is better equipped to investigate and take action.

Here’s what to do:

-

Lock your card via mobile banking or the card issuer’s app to prevent further unauthorised use.

-

Request a new card number from your issuer.

-

Review recent transactions and report any others you didn’t authorise.

Most Singaporean banks offer zero-liability protection, so you won’t be held responsible for fraudulent charges as long as you report them promptly. This makes it even more important to regularly monitor your card activity.

3. Collect proof to support your dispute

Before you lodge a dispute, gather all the evidence that supports your claim. This could include:

-

Receipts or invoices

-

Email communications with the merchant

-

Screenshots of product listings or order confirmations

-

Photos showing defective or incorrect items

-

The merchant’s terms and conditions on refunds, returns, or cancellation policies

Strong documentation helps your credit card issuer assess the legitimacy of your dispute and can speed up the resolution process.

Keep a detailed record of every interaction you have with the merchant or bank. Note the names of the people you speak to, their contact details, and the time and date of each conversation. These records could prove essential if the case escalates or needs a formal review.

» Discover how to reverse unauthorised credit card transactions

SingSaver x HSBC Live+ Credit Card Exclusive Offer

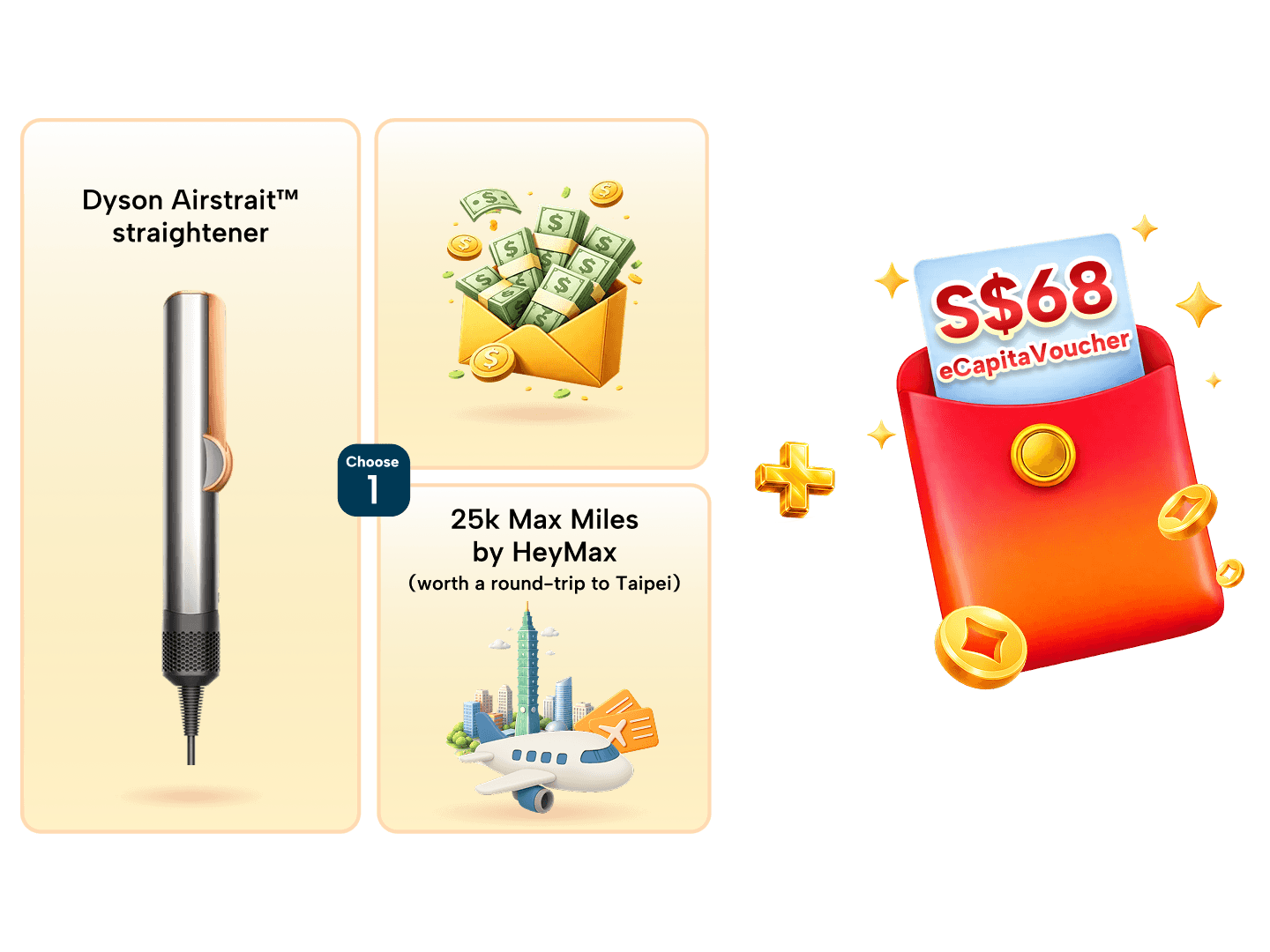

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 or S$400 Cash when you apply for an HSBC Live+ Credit Card via SingSaver and fulfil promo requirements. You can also top up from just S$60 to upgrade to the latest Dyson, Sony or Apple products. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

4. Consider sending a formal written notice

While most disputes today are handled online or over the phone, sending a written letter to your card issuer can still be a smart move — especially for complex cases or when dealing with a billing error. A written record serves as proof that you raised the dispute within the required timeframe.

Here’s what to do:

-

Confirm the correct dispute address with your credit card issuer. It may be different from the address used for payments.

-

Send your letter via registered mail with a return receipt, so you have proof it was delivered.

-

Keep a copy of the letter and any supporting documents for your own records.

In many cases, sending a letter can also trigger additional legal protections that aren’t activated by digital or phone submissions alone.

5. Await the outcome and know your next steps

Once your dispute is submitted, you’ll need to wait while the credit card issuer reviews your case. During this period:

-

You’re not responsible for paying the disputed amount.

-

You should continue making minimum payments on the rest of your credit card bill to avoid late fees and maintain a good payment history.

If the card issuer finds in your favour, the disputed charge will be removed from your account. If they reject your claim, you’ll be informed of the outcome and the payment due date for the charge.

If you disagree with the decision, you may be able to:

-

Appeal the outcome, depending on the issuer’s policies.

-

Escalate the complaint to the relevant consumer protection agency, such as the Consumers Association of Singapore (CASE) or your card provider’s financial ombudsman.

Always check the deadline to appeal — missing it could mean giving up your right to contest the charge further.

SingSaver x Citi Cashback Credit Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 40mm (GPS), or S$380 Cash when you apply for a Citi Cashback Card and fulfil promo requirements. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

Frequently asked questions about credit card disputes

Disputing a charge means formally notifying your credit card issuer (bank) that you believe there's an error, an unauthorised transaction (fraud), or a problem with goods/services related to a specific charge on your statement. This triggers an investigation to see if the charge should be reversed (a chargeback).

Your bank investigates your claim according to card network rules (Visa, Mastercard, Amex). They contact the merchant's bank, review evidence from both sides (yours and the merchant's), and decide if the charge is valid or should be reversed. They may issue a temporary credit while investigating.

Initially, if the bank issues a temporary credit, they are essentially covering the amount while investigating. If the dispute is successful, the merchant ultimately bears the cost (or the loss in case of fraud). If denied, you remain responsible for paying the charge. Importantly, always pay the undisputed portion of your bill on time.

If your dispute is denied, you are responsible for paying the charge. The bank must provide a reason for the denial. You usually have the right to appeal the decision if you have further evidence or believe the assessment was incorrect. If appeals fail, you might consider external mediation like FIDReC.

Generally, you have 60 days from the date the statement on which the disputed charge first appeared was sent to you. However, it's best practice to act much sooner. The investigation itself (credit card dispute time) can take the bank up to 90 days (or two billing cycles) to resolve after receiving your dispute notice. Check your bank's specific terms, but always act promptly.

Find the right credit card for your lifestyle

Searching for a card with great perks, low fees, or cashback rewards? Discover the latest credit card offers in Singapore and choose one that matches your spending habits.