Singapore Salary Guide (2025): What is the Average Salary?

Updated: 1 Sept 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

Do you know whether you are earning an above- or below-average salary in Singapore? Consulting a Singapore salary guide will help you know if you’re drawing a fair salary, as well as guide you in taking useful steps to advance your career. Find out how you compare with your peers, and what salary benchmarks to expect in 2025.

Singapore salary trend over the years

On a nominal level, the median salary in Singapore has grown significantly over the past 10 years. Data from the Ministry of Manpower (MOM) places the median gross monthly income at S$3,770 in 2013. In 2024, the figure had grown to S$5,500 – an increase of approximately 48%.

Having said that, nominal increases in income does not always translate to the same level of improvements in lifestyle, or even spending power. This is because like all other economies, Singapore is affected by inflation, which erodes the beneficial effects of nominal wage increases.

Therefore, it is important to consider the real rate of wage increase, which is a metric that takes inflation into account. Have a look at these figures, taken from MOM’s website.

Total wage change (including employer CPF contributions) from 2013 to 2023

|

Year |

Nominal change (%) |

Real change (%) |

|

2013 |

5.3 |

2.9 |

|

2014 |

4.9 |

3.9 |

|

2015 |

4.9 |

5.4 |

|

2016 |

3.1 |

3.6 |

|

2017 |

3.8 |

3.2 |

|

2018 |

4.6 |

4.2 |

|

2019 |

3.9 |

3.3 |

|

2020 |

1.2 |

1.4 |

|

2021 |

3.9 |

1.6 |

|

2022 |

6.5 |

0.4 |

|

2023 |

5.2 |

0.4 |

Zooming into 2023, we see that even though employers provided one of the largest wage increases in the decade at 5.2%, the benefits were mostly erased by inflation; wages grew only by 0.4% in real terms, making it one of the lowest years on record.

What’s the median salary in Singapore?

The median gross monthly salary in Singapore, including employer CPF contributions, stood at S$5,500 in 2024. This is for all full-time workers in Singapore.

While median salaries may be good for comparing standards of living among different countries, it is quite meaningless when dialled down to a personal level. This is because salaries are impacted by different factors, including age, gender and industry, so knowing the national median salary doesn’t allow for any useful comparisons.

For instance, a salary of S$5,000 might be considered high among restaurant managers, but to C-suite executives or neurosurgeons, it’s a different story.

Just so that we can have a more nuanced understanding, let’s take a closer look at median salaries broken down by age and gender.

Median salary by age (data set for 2024)

|

Age group |

Median monthly salary |

|

15-19 |

S$1,170 |

|

20-24 |

S$3,269 |

|

25-29 |

S$4,680 |

|

30-34 |

S$5,870 |

|

35-39 |

S$7,049 |

|

40-44 |

S$7,434 |

|

45-49 |

S$7,498 |

|

50-54 |

S$6,400 |

|

55-59 |

S$4,731 |

|

60 and above |

S$3,052 |

As expected, median salaries grew sharply from age 20s to mid-30s, but started to plateau for the next decade or so. Median salaries actually dropped off from age 50 onwards – perhaps due to retrenchments as companies attempt to rein in rising manpower costs?

But then again, these are median salaries across several different industries. By no way are these numbers prescriptive, and there is absolutely no need for your individual career to follow the course these numbers suggest.

Is there a gender pay gap in Singapore?

Unfortunately, there is a gender pay gap in Singapore, and a closer look at the data suggests that gender norms still hold sway.

Let’s take a look at the numbers below:

|

Monthly median income (males) |

Monthly median income (females) |

Difference (S$) |

Difference (%) |

|

|

2014 |

S$4,000 |

S$3,518 |

S$482 |

13.7% |

|

2015 |

S$4,118 |

S$3,744 |

S$374 |

10.0% |

|

2016 |

S$4,241 |

S$3,803 |

S$438 |

11.5% |

|

2017 |

S$4,437 |

S$4,027 |

S$410 |

10.2% |

|

2018 |

S$4,680 |

S$4,095 |

S$585 |

14.3% |

|

2019 |

S$4,810 |

S$4,329 |

S$481 |

11.1% |

|

2020 |

S$4,719 |

S$4,374 |

S$345 |

7.9% |

|

2021 |

S$4,875 |

S$4,437 |

S$438 |

9.9% |

|

2022 |

S$5,450 |

S$4,948 |

S$502 |

10.1% |

|

2023 |

S$5,460 |

S$5,070 |

S$390 |

7.7% |

|

2024 |

S$5,850 |

S$5,265 |

S$585 |

11.1% |

Although the general trend seems to be improving, with the 7.7% gap in 2023 being the lowest recorded, there is still some way to go towards narrowing the gap. Again, keep in mind that these are median incomes across various industries, and not an accurate indicator of individual earning potential.

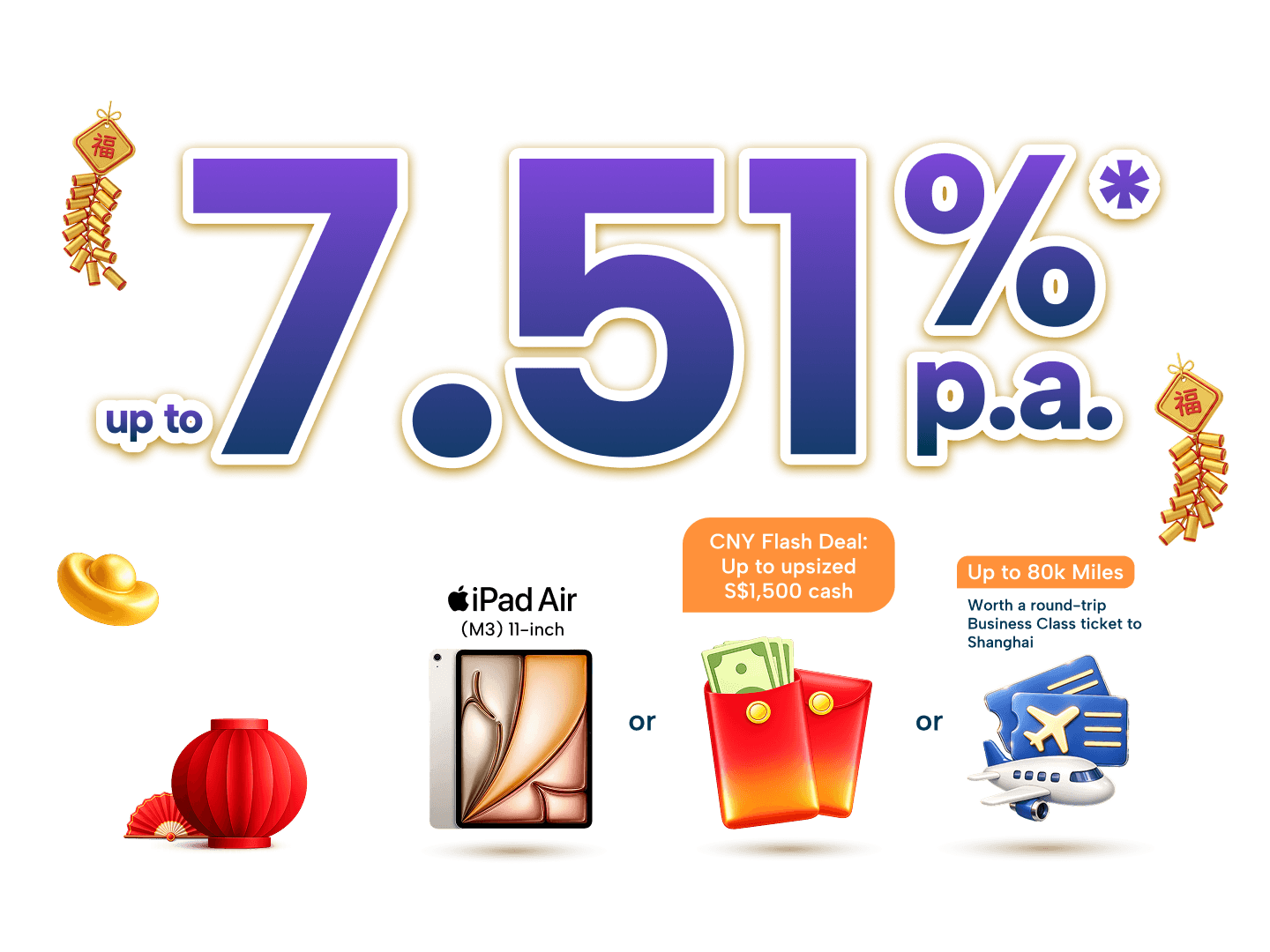

⚡SingSaver x Citigold Flash Deal⚡

Enjoy up to 7.51% p.a. interest when you join Citigold and open a Wealth First account. Plus, get up to 80,000 Max Miles by Heymax (worth S$1,440), an Apple iPhone 17 512GB (worth S$1,599), or Upsized S$1,500 Cash when you successfully apply for a Citigold account, become an Accredited Investor, and make a S$350,000 deposit within 3 months of account opening, maintaining these funds until gift fulfilment. Valid till 31 March 2026. T&Cs apply.

How much should you be paid in Singapore?: Salary guide by industry

Now that we’ve discussed Singapore’s salary landscape and recent trends let’s take a look at some salary benchmarks to get an idea of how much you should be getting paid.

The following salary benchmarks are taken from the 2025 Singapore Salary Guide by Morgan McKinley. Salaries are expressed on a per annum basis.

Accounting and finance

|

Role |

5 to 10 years |

10 to 15 years |

|

Finance Director |

S$180,000 |

S$240,000 |

|

Internal Audit Director |

S$180,000 |

S$250,000 |

|

Internal Auditor |

S$85,000 |

S$95,000 |

|

Tax Manager |

S$85,000 |

S$120,000 |

|

Financial Accountant |

S$50,000 |

S$75,000 |

Banking and financial services

|

Role |

5 to 10 years |

10 to 15 years |

|

Client Services (Banking operations) |

S$100,000 |

S$150,000 |

|

Reference Data (Banking operations) |

S$90,000 |

S$140,000 |

|

VP (Private banking) |

S$160,000 |

S$200,000 |

|

Relationship Manager (Commercial banking) |

S$120,000 |

S$200,000 |

|

Priority/Premier Banking RM (Retail banking) |

S$40,000 |

S$80,000 |

Human resources (HR)

|

Role |

5 to 10 years |

10 to 15 years |

|

HR Director/Head of HR |

S$160,000 |

S$200,000 |

|

Head of Talent Acquisition |

S$120,000 |

S$180,000 |

|

Talent Acquisition Specialist |

S$60,000 |

S$100,000 |

|

Learning & Development Manager |

S$84,000 |

S$100,000 |

|

Compensation & Benefits Specialist |

S$60,000 |

S$84,000 |

Legal, risk and compliance

|

Role |

5 to 10 years |

10 to 15 years |

|

Transaction Monitoring (Compliance) |

S$120,000 |

S$180,000 |

|

Corporate Secretary (Compliance) |

S$120,000 |

S$180,000 |

|

Credit Risk |

S$140,000 |

S$200,000 |

|

Quant |

S$160,000 |

S$250,000 |

|

Asset Management |

S$160,000 |

S$220,000 |

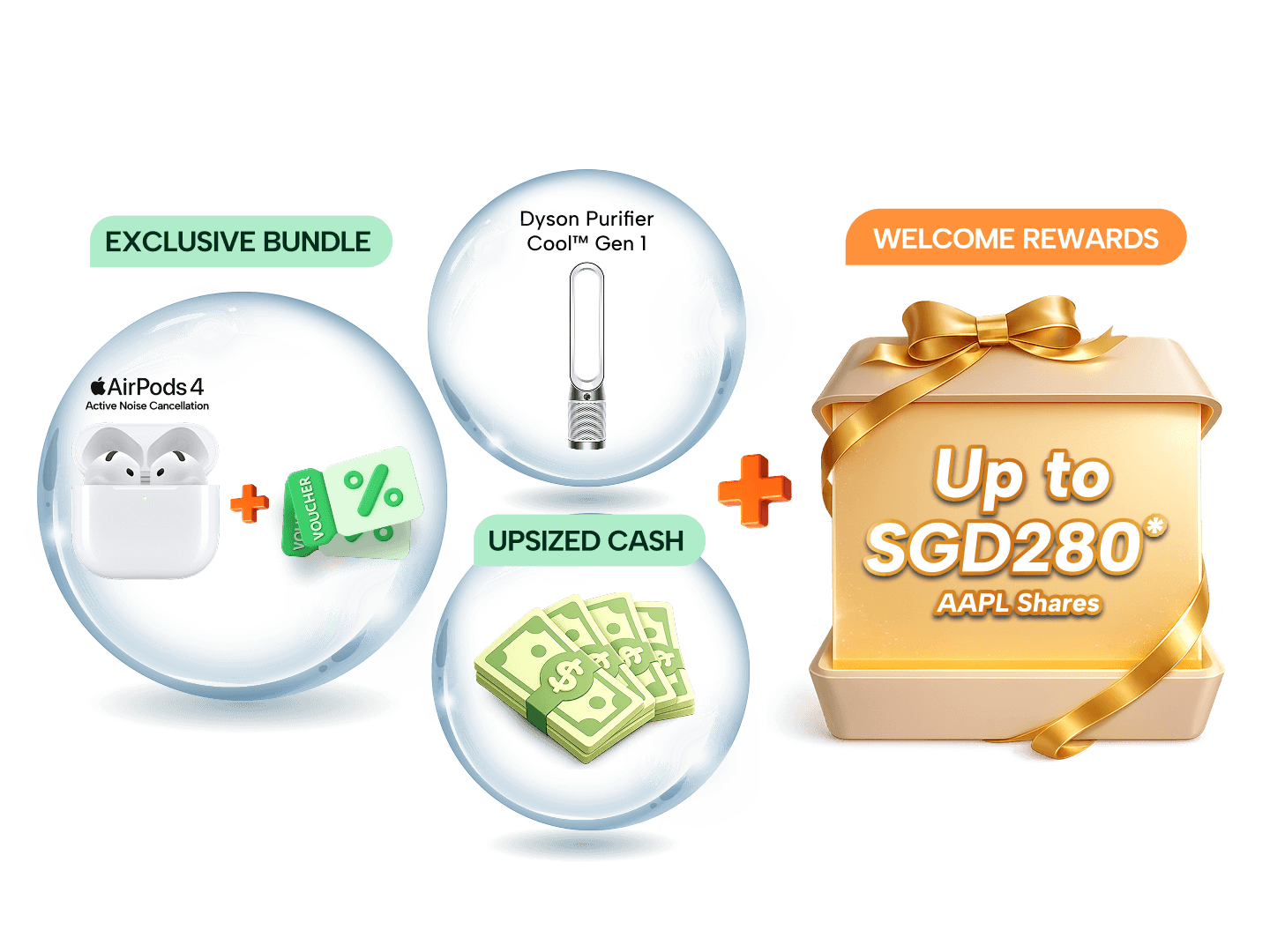

SingSaver x Webull Exclusive Offer

Open a Webull account and fund a minimum of SGD3,000 to receive S$120 Cash. Fund SGD10,000 to get S$260 cash, or a S$50 eCapitaVoucher + AirPods 4 or 17k Max Miles by Heymax (worth S$306). Or, top up as low as S$50 to get a Dyson Purifier Cool™ TP10. Valid till 31 March 2026. T&Cs apply.

Projects and change

|

Role |

5 to 10 years |

10 to 15 years |

|

Strategy Consulting |

S$180,000 |

S$250,000 |

|

Lean Six Sigma/Operational Excellence Expert |

S$175,000 |

S$190,000 |

|

Change Manager |

S$140,000 |

S$190,000 |

|

Project Manager |

S$120,000 |

S$180,000 |

|

Junior Business Analyst |

S$48,000 |

S$75,000 |

Sales and marketing

|

Role |

5 to 10 years |

10 to 15 years |

|

Head of Marketing (Banking) |

S$170,000 |

S$200,000 |

|

Marketing Manager (Banking) |

S$95,000 |

S$120,000 |

|

Digital Marketing Director |

S$180,000 |

S$235,000 |

|

SEO Manager |

S$110,000 |

S$125,000 |

|

Content Strategist |

S$80,000 |

S$95,000 |

Supply chain and procurement

|

Role |

5 to 10 years |

10 to 15 years |

|

Supply Chain Director |

S$140,000 |

S$200,000 |

|

Purchasing Manager |

S$100,000 |

S$150,000 |

|

Inventory Manager |

S$60,000 |

S$80,000 |

|

Logistics Specialist |

S$40,000 |

S$50,000 |

|

Supply Chain Analyst |

S$40,000 |

S$50,000 |

Technology

|

Role |

5 to 10 years |

10 to 15 years |

|

Chief Information Security Officer |

S$150,000 - S$200,000 |

S$180,000 - S$250,000 |

|

Business Development |

S$120,000 - S$250,000 |

S$250,000 - S$350,000 |

|

Cyber Security Operation |

S$70,000 - S$120,000 |

S$120,000 - S$180,000 |

|

IT Audit |

S$100,000 - S$160,000 |

S$160,000 - S$250,000 |

|

UI Developer |

S$40,000 - S$85,000 |

S$85,000 - S$150,000 |

Best brokerage accounts in Singapore (2025)

No matter how much you are earning, you may be looking for a way to get more out of your savings. You can do this by opening a high-yield savings account (HYSA) or if you are looking to go one step further, to start investing. There are plenty of brokerage accounts in Singapore even complete beginners can get started with – take a look at some of our best recommendations below.

For those new to investing

- All-in-one investment platform

- No min. deposit required

- Unlimited free trades for US markets for the first 3 months (subsequently, 2-10 free US trades per month)

- Access US, SG, and HK markets as well as UCITS

- US fractional shares and SG odd lots available

- Supports auto-invest

- Access to real-time stock analysis

- Instant account opening with 24/7 support

- Licensed by MAS

- Read our full review of Syfe

- Management fee and member benefits depend on account tier

In providing the above information, SingSaver is carrying out introducing activities on behalf of financial advisers. SingSaver is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. Neither singsaver.com.sg or the content on it is intended as securities brokerage or investment advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund. The content on singsaver.com.sg is for general information purposes only and does not review or include all available companies, products or offers. SingSaver may receive compensation from the brands providing the offers or services appearing on this website. This advertisement has not been reviewed by the Monetary Authority of Singapore.

SingSaver’s take

If you are taking your first step into the world of investing, consider Syfe’s user-friendly, all-in-one platform that offers a strong mix of portfolio options. There is no minimum investment required and alongside low management fees and automated portfolio rebalancing, it's a great choice for young professionals and passive investors.

Pros

Wide range of portfolios and stocks available

No minimum investment required

Easy-to-use interface

Cons

Customer service is limited to digital channels for customers on lower-tier plans

For diversified investment portfolios

- Trade US Stocks and ETFs at only S$0.88 per order. T&Cs apply.

- Access stocks, but also options, CFDs (including stocks, forex, gold/silver, crypto), and Crypto ETFs.

- US Stocks: Lifetime $0 commission, with a fixed platform fee of $1 per transaction.

- Options: Lowest fees at $0.50 per contract. For premiums less than $0.10, the commission is only $0.10 per contract.

- CFDs: 0 commission, with spreads starting as low as 0.27 points for Gold CFDs.

- Free and interactive learning materials, videos and features to help new investors embark on their investment journey

- Platform fees apply for every trade

SingSaver’s take

uSMART is a great choice for investors looking to diversify their portfolios with a wide range of products, from stocks, fractions, futures, and ETFs. With no commission fees on US stocks and low fees on options, uSMART presents a relatively low barrier to entry. However, one limitation of the platform is that available stocks are limited to the US, SG and HK markets.

Pros

Easy account opening with MyInfo

Low commission fees

Wide range of products to choose from, such as fractions, stocks, and futures

Cons

Stocks are limited to US, SG and HK market

Relatively new platform that’s not as regulated as other brokerage accounts in the market

For no custody, deposit, and account maintenance fees

- Commission-free trades on US, HK, SG and China A stocks

- US Fractional Shares available

- Supports auto-invest in US stocks and ETF

- In-app community of millions of global investors

- Real-time market data and detailed analysis to make informed decisions

- Instant account opening as well as 24/7 support

- Licensed by Monetary Authority of Singapore (MAS)

- Read our full review of Tiger Brokers

- Platform fees apply for every trade

- Min. fee amount also applies for equities trades made on SEHK and HKEx

In providing the above information, SingSaver is carrying out introducing activities on behalf of financial advisers. SingSaver is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. Neither singsaver.com.sg or the content on it is intended as securities brokerage or investment advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund. The content on singsaver.com.sg is for general information purposes only and does not review or include all available companies, products or offers. SingSaver may receive compensation from the brands providing the offers or services appearing on this website. This advertisement has not been reviewed by the Monetary Authority of Singapore.

SingSaver’s take

With Tiger Brokers, investors only need to pay a commission fee on every trade they make. There are no custody, deposit, withdrawal, account maintenance or inactivity fees.

Pros

Low commission fees

Account can hold multiple currencies

Cons

Platform fees applicable on all trades

Minimum fee amount applies for equities trades on SEHK and HKEx

Conclusion

After looking at the salary charts above, you’ll probably find the question as helpful as asking ‘How much should I save?” or “How much do 30 year olds earn in Singapore?”

Apart from getting a promotion, one of the best times to increase your salary is when you have a job offer. On average, jobseekers reported a 20% increase in their salary when they change jobs, with some receiving as much as 38%.

Why are we shining the spotlight on the median salary trend? To encourage you to start thinking about retirement, of course!

Like it or not, it is crucial that we plan ahead for retirement and commit to putting money aside regularly when we have the means to hustle and earn more money. The hard truth is that our earning ability dips when we’re old.

You don’t want to wait till it’s too late before regrets become a thing you have to deal with on the daily with little to no extra money to spare. Case in point, retirees who didn’t plan for their retirement only have an average of S$1/day to spend on things they like! Have a look at these shocking statistics — they will push you to get started on your retirement planning.

While you’re at it, start investing early to take advantage of the magic of compound interest!

Frequently asked questions about salaries in Singapore

Well, that depends on who’s asking. For a 20-something first jobber with no commitments, this salary might offer a pretty carefree lifestyle. However, for a 40-something sole breadwinner with three hungry mouths to feed, S$3,500 might be considered far from good.

Another way to consider the question is to compare it with the median salary in Singapore, which in 2024 stood at S$5,500. This is quite a bit higher than S$3,500, which implies that the majority of Singaporeans wouldn’t consider this a good salary.

According to data from the Singapore Yearbook Of Manpower Statistics, 78,400 out of 2.07 million workers (approx 3.97%) earned average monthly salaries of S$20,000 or more. Of this group, 51,700 earned average salaries of S$22,500 or more.

Hence, for someone earning around S$18,000 or more, we can assume they’re in the top 5% of earners in Singapore.

There is no one-size-fits-all answer to this: It will all depend on the financial obligations you have. For instance, if you are a fresh graduate staying with your parents, a good salary that will allow you to live comfortably will likely be less than what someone with a mortgage and two children would require.

Relevant articles

Salary Guides For Occupations That Only Existed In The Last 10 Years

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.