What are SGS Bonds and Should You Invest in Them?

Updated: 26 Aug 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

How are Singapore Government Securities (SGS) bonds different from the existing Singapore government bonds and should you invest in them?

Best investment platforms on SingSaver

Tiger Brokers | Syfe | City Index | Stashaway | POEMS | SAXO | Interactive Brokers | moomoo | Endowus | IG Trading | CMC Markets | ProsperUs | Webull

The Singapore Savings Bonds (SGS) may have gained a lot of traction in popularity lately due to rising interest rates, but there's also another government bond that you can buy: the Singapore Government Securities bonds, or SGS Bonds.

What lies behind the appeal of these SGS bonds? What is the coupon rate offered? And should you jump in and invest in them, too?

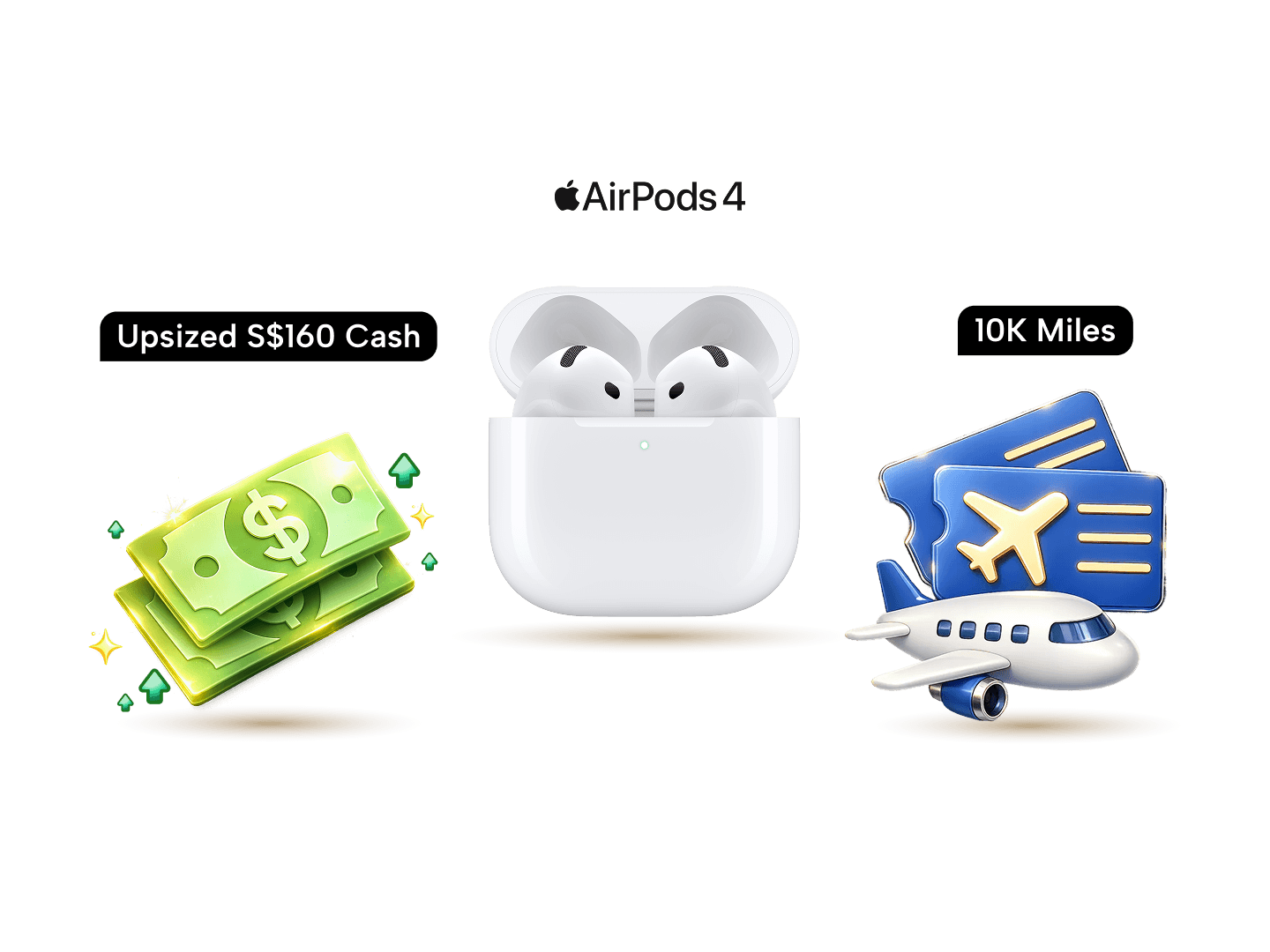

⚡SingSaver x Tiger Brokers Flash Deal⚡

Open a Tiger Brokers account and fund a minimum amount of USD 1,000 within the promotional period to receive an upsized S$160 cash, S$180 Grab voucher, 10,000 upsized Max Miles by HeyMax (worth S$180), or Apple AirPods Gen 4 (worth S$199). Offer is stackable with Tiger Brokers' welcome offer. Valid till 1 March 2026. T&Cs apply.

Top savings accounts that can be used to hold SGS Bonds

If you intend to use cash to fund your SGS bonds, you will need to have a bank account with one of the three local banks: DBS/POSB, UOB or OCBC. While it makes no difference which of the three you choose, a savings account that’s fit for your purposes will allow you to tick off two (or more) boxes at once.

Best savings accounts to hold SGS bonds

| Products | Min. Deposit | Max. Annual Interest Rate | Min. Annual Interest Rate | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

S$0 | N/A | 0.05 % | ||||||||

S$1000 | N/A | 0.05 % | ||||||||

S$1000 | N/A | 0.05 % | ||||||||

For greater interest on your SGD savings

DBS Multiplier Account

- Earn up to max. 3% p.a on your first S$100,000

- Enjoy at least 0.30% p.a. interest rate by making a PayLah! retail spend, no min. transaction amount required

- Boost interest rate by increasing your total eligible transactions per month (i.e. salary crediting, credit card spend, investments, insurance)

- Transfer foreign currency funds overseas directly with your account at zero or lower fees. Learn more.

- No initial deposit required

- No monthly account fees

- No minimum average daily balance required if this is your first DBS/POSB account

- Insured up to S$75,000 by SDIC. Additional T&Cs apply.

- Read our full review of the DBS/POSB Multiplier Account

- Popular

- Fall-below fee of S$5 if average daily balance falls below S$3,000

- Early closure fees of S$30 if account is closed within 6 months

Product details

-

Earn up to 4.1% p.a. interest on SGD savings by crediting your income and transacting in at least three categories: credit card / PayLah retail spend, home loan instalment, insurance and investments

-

Account holders age 29 and below can earn 1.5% p.a. interest with any credit card / PayLah retail spend, with no requirement to credit income

-

Fall below fee of S$5 per month for average daily balance below S$3,000 can be waived for those 29 years and below or for whom DBS Multiplier is their first account with DBS/POSB

SingSaver’s take

The DBS Multiplier Account is a great choice for those looking to earn more interest on their SGD savings and who transact regularly in one or more of the following categories: credit card / PayLah retail spend, home loan instalment, insurance and investments. The more categories you transact in, the higher the interest rate you can earn.

Pros

Earn high interest rates on SGD savings

Cons

Have to transact in one or more categories in order to benefit from high interest rates

For consistent savings

UOB Stash Account

- Earn 0.05% p.a. on your first S$10,000 and up to 5.00% p.a. when your monthly account balance reaches S$100,000

- You automatically receive a UOB One Debit Mastercard upon successful application. Receive up to 3% rebates when you spend with this card. T&Cs apply.

- Insured up to S$75,000 by SDIC. Additional T&Cs apply.

- Read our full review of the UOB Stash Account

- Early closure fee of S$30 if account is closed within 6 months

- Fall-below fee of S$2 if average daily balance falls below S$1,000

Product details

-

Earn 0.5% base interest and up to 4.95% bonus interest

-

No lock-in period while continuing to earn interest every month

-

Receive a UOB One Debit Card with a Stash Account

-

Contactless cash withdrawals allow account holders to travel light and withdraw cash via their phones

SingSaver’s take

For those who have a substantial amount of savings or are looking to grow their savings, the UOB Stash Account is a great choice. From the base interest rate of 0.5%, bonus interest rates increase at S$30,000 intervals up till S$100,000, rewarding account holders for every dollar they save.

Pros

Benefit from bonus interest rates the more you save

Cons

Minimum of S$100,000 to unlock highest bonus interest rate of 4.95%

For insurance and investment

OCBC 360 Account

- Earn bonus interest p.a. on the first S$75,000 of your account balance

- Score higher interest rates when you credit your salary, spend on your credit card, invest, insure, and increase your account balance every month

- Insured up to S$75,000 by SDIC. Additional T&Cs apply.

- Read our full review of the OCBC 360 Account

- Fall-below fee of S$2 if average daily balance falls below S$3,000 (first-year waived)

- Early closure fees of S$30 if account is closed within 6 months.

Product details

-

Earn up to 3.3% p.a interest on your first S$100,000

-

Earn an additional 3.0% p.a interest per year when you insure and invest

-

Qualify for bonus interest rates by crediting salary of at least S$1,800, increasing average daily balance by at least S$500 monthly, charging at least S$500 to selected OCBC credit cards, purchasing an eligible insurance or investment product, and maintaining an average daily balance of at least S$250,000

SingSaver’s take

The OCBC 360 Account is a good choice for those who are looking for a three-in-one savings account which can also be used for insurance and investment. As bonus interest rates increase for purchasing eligible insurance or investment products, account holders can get rewarded while building a financial profile to suit their needs.

Pros

Earn bonus interest by crediting your salary, saving, spending and purchasing eligible insurance or investment products

Cons

Not the best choice for customers who are focused mainly on saving

What are SGS bonds?

SINGA bonds, or SGS bonds, are investment bonds issued by the Singapore government on 28 September 2021.

The purpose of launching these bonds is to raise capital to fund upcoming infrastructure improvement, green infrastructure projects, and to develop the debt market. There are three SGS bonds: SGS (Market Development), SGS (Infrastructure), and Green SGS (Infrastructure), but we will go more into thepe later.

Unlike the SSB, which has a 10-year tenure, SGS bonds are more flexible: you can buy 2-year, 5-year, 10-year, 30-year, and 50-year tenure bonds. SGS bonds also pay a fixed coupon rate, which is paid every six months, on 1 October and 1 April. SGS bonds are issued every month with different interest rates.

Below are the details of the latest SGS bond (NA21200W):

|

Issue Code |

NA21200W |

|

ISIN Code |

SGXF89085702 |

|

SGS type |

SGS (Infrastructure) |

|

Tenor |

30 years |

|

Announcement date |

20 September 2023 (the closing date is typically 1-2 days before the auction date, check with your bank for the cut-off time) |

|

Total amount offered |

S$1.5 billion |

|

Minimum denomination |

S$1,000 |

|

Total amount allotted |

TBA |

|

Amount allotted to non-competitive applications |

TBA |

|

Amount allotted to MAS |

TBA |

|

Total amount applied |

TBA |

|

% of Competitive Applications at Cut-off Allotted |

TBA |

|

% of Non-Competitive Applications Allotted |

TBA |

|

Cut-off yield |

TBA |

|

Cut-off price |

TBA |

|

Median yield |

3.1% p.a. |

|

Average yield |

2.89% p.a. |

|

Auction date |

27 Sep 2023 |

|

Issue date |

2 Oct 2023 |

|

Maturity date |

1 Oct 2051 |

|

Coupon rate |

1.875% p.a. |

|

New/reopen |

Reopen |

|

Coupon payment dates |

1 Oct and 1 Apr |

|

Closing yield |

3.14% p.a. |

|

Closing price |

76.58 |

The previous SGS bond (N520100A) announced on 22 Aug 2023 had a cut-off yield of 3.56% p.a.. You can view the issuance calendar on MAS's website here.

How do SGS bonds compare against other Singapore government bonds?

Given that SGS bonds are issued by the Singapore government, you may be wondering how they compare against other government bonds including the Singapore Savings Bond (SSB) and Treasury Bill (T-bill).

The table below offers a side-by-side reading of the differences (and similarities) between them.

|

SSB |

T-bills |

SGS (Market Development) |

SGS (Infrastructure) |

Green SGS (Infrastructure) |

|

|

Purpose |

To offer safe and flexible investments for retail investors. |

Short-term investments to diversify your portfolio |

To develop Singapore’s debt market, with funds raised remaining unavailable for spending. |

To finance major, long-term infrastructure. |

To finance major, long-term infrastructure with a positive environmental impact. |

|

Issuance status |

Active |

Active |

Active |

Active |

Pending |

|

Tenor |

10 years |

6 months or a year |

2, 5, 10, 15 or 30 years |

30 years |

TBC |

|

Minimum investment amount |

S$500 |

S$1,000 and in multiples of S$1,000 |

S$1,000 and in multiples of S$1,000 |

S$1,000 and in multiples of S$1,000 |

S$1,000 and in multiples of S$1,000 |

|

Investment cap |

S$200,000 per individual |

No limit |

Limit for each auction |

Limit for each auction |

Limit for each auction |

|

Maturity and redemption |

May be redeemed early |

No early redemption |

No early redemption |

No early redemption |

No early redemption |

|

Yield (p.a.) |

3.16% (GX23100T; average over 10 years) |

3.73% (BS23118S) |

3.625% (N520100A) |

TBA |

TBC |

|

Source of funds |

Cash or SRS |

Cash, SRS, CPF |

Cash, SRS, CPF |

Cash, SRS, CPF |

Cash, SRS, CPF |

Understanding the three types of SGS bonds

As mentioned, there are three types of SGS Bonds in total: SGS (Market Development), SGS (Infrastructure), and Green SGS (Infrastructure).

The main purpose of SGS (Infrastructure) is to raise capital to fund upcoming infrastructure improvement and expansion needs. Meanwhile, Green SGS (Infrastructure) will be used to fund major infrastructure developments that are considered to be better for the environment, such as railways. If that has got all those ESG investors excited, you’ll have to wait a little longer for the bond to be issued.

Rounding out the trio is the SGS (Market Development) bond, which was the OG SGS Bond, now renamed to make room for its two new siblings. This bond continues in its original mission, which is to foster the development of Singapore’s debt market.

In a nutshell, the SSB offers more flexibility, as you can redeem your bonds early. However, do note that the coupon rate increases yearly, with the last two or three years enjoying the highest coupon rate.

This also means that you will not be able to achieve the advertised average coupon rate with early redemption. On the plus side, SSBs require only S$500 to start investing, and you can freely increase your investment in any amount you wish.

Last but not least, T-bills are short-term bonds that last for either six months or a year and are issued at a discount to their face value, and investors will receive the full face value at maturity.

Also read: The SSB vs CPF: Which One Has Better Returns?

On the other hand, SGS bonds don't offer early redemption, which could be an issue for investors sensitive towards the long tenor of 30 years. However, you are free to trade your holdings on the secondary market - if you’re willing to accept not receiving the face value of your bonds in return.

You’ll need a higher capital to start investing - S$1,000 at least, with increments in multiples of S$1,000. To fund your SGS (Infrastructure) investment, you can use cash, the funds in your Supplementary Retirement Scheme account, or the balances in your CPF account.

Deciding between SGS bonds, T-bills and SSBs

Struggling to decide between SGS bonds, T-bills and SSBs? Let's break down the importance of liquidity and subscription limits when choosing between the three.

When you compare SSBs to T-bills and SGS bonds, the former comes up top in terms of easy access to your funds. While SSBs have a 10-year lifespan, you can redeem them early and get your principal back along with any interest earned. This means if you suddenly need cash, you can sell your SSB without worrying about losing money.

On the other hand, it's not easy to cash out your T-bills before they mature, and generally, it's best to hold them until the end. As T-bills aren't listed on an exchange, you'll need to visit one of the three local bank branches if you wish to sell them early.

The same liquidity issue applies to SGS bonds, which have longer terms. The price you get when selling SGS bonds is determined by the market. However, SGS bonds have a slight advantage over T-bills because they are traded on the SGX, so you can sell them without needing to go to a physical bank. With SGS bonds, you may also be able to get a better return from the market, and if you time it right, you could even make a capital gain if interest rates start to fall.

However, when it comes to subscription limits, SGS bonds and T-bills come out ahead of SSBs. Currently, there's a $200,000 limit on the total amount of SSBs an individual can hold. So, while you can apply for as many SSBs as you want, your total holdings can't exceed this amount. There’s no such limit with SGS bonds and T-bills, unless you're trying to bid more than the total amount being offered at auction.

In conclusion, if having easy access to your money (liquidity) is your top priority, then SSB is the way to go. However, if you're comfortable locking your money away for the short term (with T-bills) or even longer (with SGS bonds) and are aiming for potentially higher returns, then T-bills and SGS bonds are the better choices for you.

Getting started with SGS bonds

One attractive factor of SGS bonds is their relatively low barrier to entry – everyone can get in on them. The government has opened these up to encourage us all to save and invest.

Want to know when the next opportunity is? The Monetary Authority of Singapore (MAS) has you covered with their handy online issuance calendar, which lays out all the upcoming SGS bond auctions. You can find the latest schedules on the MAS Online Auction Calendar.

SGS bonds can be funded using cash, funds from your Supplementary Retirement Scheme (SRS), or even your CPF Investment Scheme (CPFIS) funds. Just keep in mind that the application process will vary slightly depending on how you're paying.

Applying is pretty straightforward too. You can do it through ATMs, your bank's online platform, or by visiting a participating bank branch. Just a heads-up – you'll need a Central Depository (CDP) account to hold your SGS bonds and T-bills.

One important thing to remember: SGS bonds are different from Singapore Savings Bonds (SSBs). If you're curious about the distinctions, you can check out this guide: Singapore Savings Bonds: Your Complete Guide.

Should you invest in SGS bonds?

Generally speaking, government bonds are considered one of the best ways to balance your portfolio, given their low volatility and tendency to be negatively-related to the equities market. As such, holding some government bonds will offer some needed stability when the markets are roiling.

Of course, not all government bonds are created equal. That said, SGS bonds are one of the safest bonds you can invest in. It has a rating of AAA, which probably has something to do with the fact that it is backed by the Singapore government itself.

On the flipside, if you buy bonds expecting excitement, prepare to be disappointed. However, if you look upon SGS bonds, especially SGS (Infrastructure) as a twice-yearly money drip for the next 30 years, you may come away more than satisfied.

How can I start investing in SGS bonds?

Depending on your chosen source of funds, here’s what you will need to start investing in SGS bonds:

-

For cash applications: A bank account with a local bank (DBS/POSB, UOB, OCBC)

-

For Central Depository (CDP) applications: An account that's linked to your bank account, for coupons and payments to be credited directly

-

For CPFIS applications: A CPF investment account with one of the three CPFIS agent banks (DBS/POSB, OCBC, and UOB). You don't need to open a CPF investment account if you intend to invest with CPFIS-SA funds.

-

For SRS applications: An SRS account with one of the three SRS operators (DBS/POSB, UOB, OCBC)

How to buy SGS bonds:

-

For cash applications: Via DBS/POSB, UOB, OCBC ATMs or iBanking

-

For SRS applications: iBanking or your SRS operator (DBS/POSB, UOB, OCBC)

-

For CPRIS applications: Submit the application in person at any CPFIS or bank branches (DBS/POSB, UOB, OCBC)

Frequently asked questions about SGS bonds

First, you will need to open a SRS account with DBS/POSB, UOB or OCBC. Once you have done so and deposited your desired investment sum into your SRS account, you will need to link it with your broker. From there, you can indicate on your broker’s platform to deduct the money from your SRS account when you purchase the bonds.

You can trade SGS bonds on the secondary market, at any DBS/POSB, UOB or OCBC branch or on SGX. Keep in mind that the price of SGS bonds can fluctuate before reaching maturity, and trading on SGX will incur transaction and brokerage fees.

The minimum investment amount is S$1,000, and subsequent deposits have to be made in blocks of S$1,000. The maximum amount you can hold at any one time is S$200,000.

Relevant articles

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.