DBS Woman’s & Woman's World Card Review: Do They Deliver What Women Want?

Updated: 11 Apr 2025

We find out whether a single credit card can really give women what they want.

Written bySingSaver Team

Team

When life gets tough, there's always retail therapy to provide a quick pick-me-up. While it feels wonderful to indulge in yourself and enjoy your money, it’s never a good idea to spend beyond your means.

That’s why the DBS Woman's Card and DBS Woman’s World Card are such tempting choices. With up to 5X and 10X DBS Points respectively per S$5 spend and the option to convert big purchases into flexible 6-month payments at 0% interest, shopping becomes a guilt-free experience.

But does it really deliver what women want in a credit card? Here’s our take on the DBS Woman's and Woman’s World Card, and whether you should get it or not.

Or, for more credit card options, check out our blog, which lists the best DBS credit cards in Singapore!

SingSaver x DBS Exclusive Offer

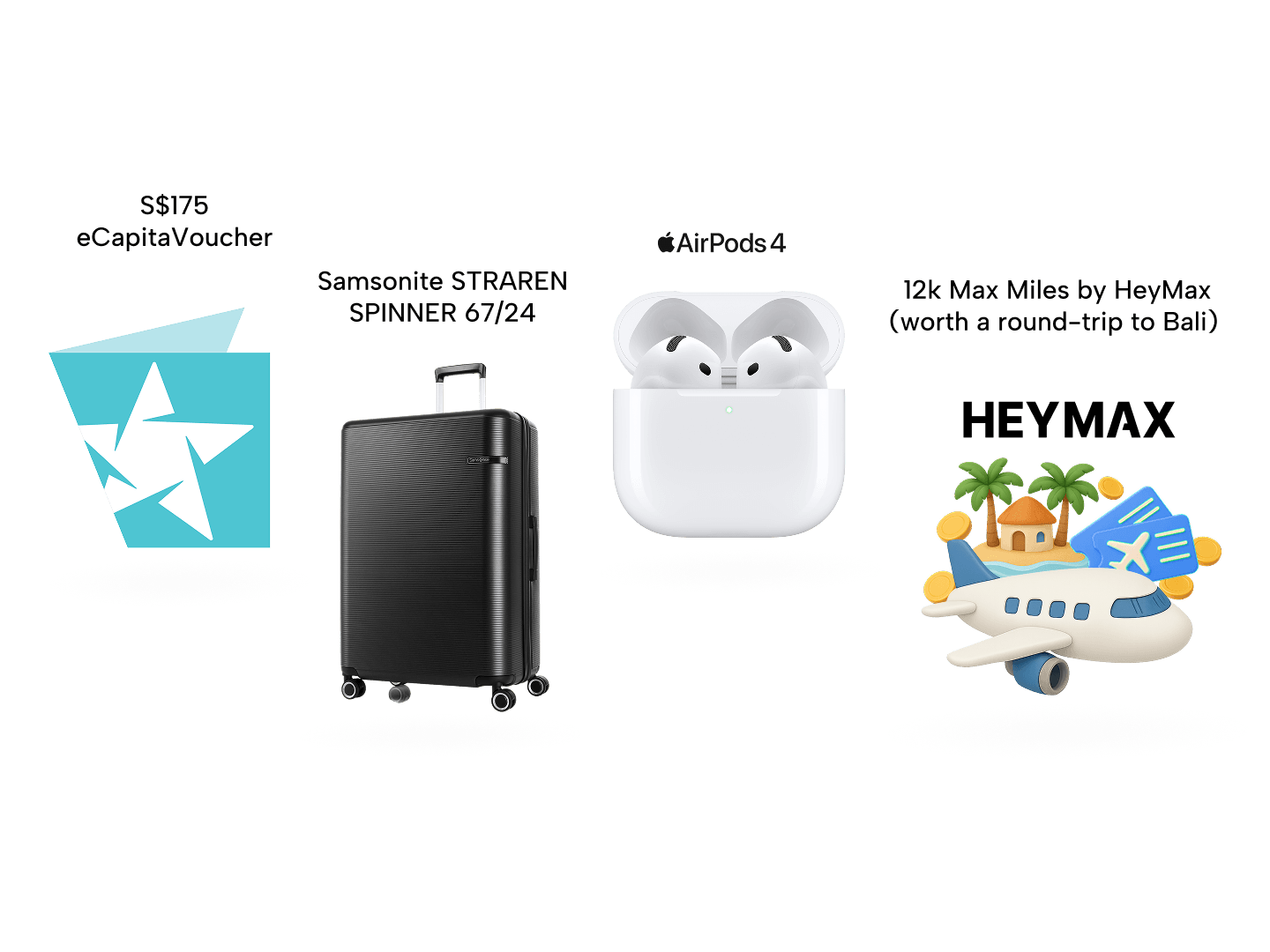

Get rewarded when you apply for select DBS/POSB Credit Cards via SingSaver. Enjoy S$175 eCapita vouchers, 12,000 MaxMiles by HeyMax (worth S$216), Apple AirPods 4, SAMSONITE STRAREN SPINNER 67/24, or a Xiaomi Truclean W20 Wet Dry Vacuum when you meet the minimum spend of S$100 within 30 days of card approval. Or top up as low as S$250 to get the latest Dyson, Nintendo, or Sony products! Valid till 1 March 2026. T&Cs apply.

What the DBS Woman's Card & DBS Woman's World Card can do for you

|

🔑 Key benefits

|

DBS Woman's Card |

DBS Woman's World Card |

|

Online spend

|

Up to 5X DBS Points per S$1 spend / 2 miles per S$1 spend |

Up to 10X DBS Points per S$5 spend / 4 miles per S$1 spend |

|

Overseas spend

|

N/A |

Up to 3X DBS Points per S$5 spend / 1.2 miles per S$1 spend |

|

All other spend

|

1X DBS Points per S$5 spend / 0.4 miles per S$1 spend |

1X DBS Points per S$5 spend / 0.4 miles per S$1 spend |

|

Bonus Points spend cap

|

S$1,000 online spend per calendar month |

[Update!] S$1,500 online spend per calendar month |

|

Complimentary e-Commerce protection

|

Yes |

Yes |

|

Monthly instalment payments

|

Interest-free payments for up to 24 months |

Interest-free payments for up to 24 months |

|

Annual fee

|

S$163.50 |

S$196.20 |

|

Annual income requirement

|

Singaporeans/PRs: S$30,000 Foreigners: S$45,000 |

S$80,000 |

Why should you choose the DBS Woman’s / Woman's World Card?

#1: Earn rewards points on online and overseas shopping at a faster rate

If you can't stand shopping at malls, this card gives is not stingy on points for your online purchases.

The DBS Woman's Card and DBS Woman's World Card are generous in their miles earn rate – offering up to 5X DBS Points (2 mpd) and up to 10X DBS Points (4 mpd) respectively to spur every shopaholic's online shopping addiction! Talk about enabling! All your shopping can be done with a few clicks of a button, and voila!

But that's not all. If you're a DBS Woman's World cardholder specifically, you'll be very incentivised to shop overseas too. All eligible overseas spend will net you a decent 3X DBS Points (1.2 mpd) on your foreign receipt.

Basically, regardless of whether you're in Singapore or across the border, your shopping will be rewarded everywhere you go!

#2: Affordable repayments for large purchases

We always encourage people to pay credit card bills promptly and to never carry over a balance. Credit cards have high-interest rates, and it’s very easy for debt to snowball because the interest compounds daily.

But let’s say your laptop breaks down beyond repair and you don’t have the cash for a new one. Or you need furniture for your new flat but can’t afford to buy a bed and sofa at the same time.

The DBS Woman’s World Card is great for that sort of thing because of the 0% interest repayment for up to 24 months on retail items.

So even if you can’t make the full payment of your purchases by the due date, you don’t have to worry about getting charged interest for the next three months.

Take note that this does not cover Cash Advances, Balance Transfer, or payments made via iBanking. This also isn’t an excuse to skip payments — you need to keep paying the amount in your statement on the due date!

#3: Exclusive card privileges in shopping, dining, and travel

|

Dining 🍽️ |

Shopping 🛍️ |

Travel ✈️ |

|

Foodpanda New users: S$10 off + free delivery with min. S$15 spend on first order

Promo code: DBS23NEW

Existing users: S$12 off with min. S$60 spend

Promo code: DBSXXX12 (where XXX refers to first 3 letters of month e.g. DBSAPR12) |

Zalora

Promo code: DBSZAL23 Valid till 31 Dec 2023 |

Trip.com: Up to S$100 off hotel and flight bookings

Valid till 31 Dec 2023 |

|

ChopeDeals: Additional S$6 off first purchase of dining vouchers with min. S$90 spend

Promo code: 6DBS |

Club21.com 20% off

Promo code: DBS20 Valid till 30 Jun 2024 |

Booking.com: Up to 10% cashback on accommodation bookings

Valid till 31 Dec 2024 |

#4: Easy enough to qualify

While the DBS Woman's Card has a standard MAS-mandated annual income requirement of S$30,000, the DBS Woman’s World Card poses a higher annual income requirement of S$80,000.

💡 Fun fact: If you've read our review, you'd realise that this follows the same pattern as the UOB Lady's / Lady's Solitaire Card – albeit UOB Lady's Solitaire Card has a significantly higher income requirement at S$120,000 than the entry-level UOB Lady's Card at S$30,000.

That's why, when compared to the UOB Lady's Solitaire Card, the barriers to entry in applying for the DBS Woman's World Card are relatively more achievable at S$80,000. It's even more affordable if we're discussing premium cards (see: metal credit cards).

Thus, we'd classify the DBS Woman's / Woman's World Cards as entry-level to mid-tier credit cards.

SingSaver x DBS Exclusive Offer

Get rewarded when you apply for select DBS/POSB Credit Cards via SingSaver. Enjoy S$175 eCapita vouchers, 12,000 MaxMiles by HeyMax (worth S$216), Apple AirPods 4, SAMSONITE STRAREN SPINNER 67/24, or a Xiaomi Truclean W20 Wet Dry Vacuum when you meet the minimum spend of S$100 within 30 days of card approval. Or top up as low as S$250 to get the latest Dyson, Nintendo, or Sony products! Valid till 1 March 2026. T&Cs apply.

Cons ❌

#1: You only earn bonus DBS Points on the first S1,000 or $1,500 online spend per month.

For the DBS Woman's Card, its accelerated 5X DBS Points on online spend is only valid on the first S$1,000 spend per calendar month. Meanwhile, for the DBS Woman's World Card, its accelerated 10X DBS Points on online spend is only valid on the first S$1,500 spend per calendar month.

Moreover, the bonus DBS Points from online spend are awarded differently for each card; the DBS Woman's Card awards additional 4X DBS Points and the DBS Woman's World Card awards additional 9X DBS Points.

Moreover, these additional points are only awarded in the next calendar month.

|

Credit card |

DBS Points |

When DBS Points are awarded |

|

DBS Woman's Card |

All spend: 1X DBS Points per S$5 spend |

Next working day |

|

Online spend: Bonus 4X DBS Points per S$5 spend |

Next calendar month |

|

|

DBS Woman's World Card

|

All spend: 1X DBS Points per S$5 spend |

Next working day |

|

Overseas spend: Bonus 2X DBS Points per S$5 spend |

Next working day |

|

|

Online spend: Bonus 9X DBS Points per S$5 spend |

Next calendar month |

In the meantime, you'll get 1X DBS Point for every S$5 spent online a day after the transaction was made.

Also, these extra DBS Points only apply to the first S$1,500 online spend every month.

It would be great if there were no limit to the points you can earn. On the bright side, at least you’re not encouraged to spend a ridiculous amount just to chase rewards.

#2: Only 1X DBS Point for every $5 spent in real life

If you prefer to shop at malls, you’re going to be disappointed by the earn rate. For all other retail purchases outside of online and overseas shopping, you only get 1 DBS Point for every $5 spent. That's equivalent to 0.4 mpd.

#3: 0% interest only applies to a maximum of 10 retail transactions

Think carefully before you use this feature. You can only take advantage of this perk with a minimum purchase of S$100 within a single transaction, and it only applies to a maximum of 10 purchases. Also, you don’t earn points on purchases with deferred payments.

More details on DBS' instalment plan can be found here.

#4: DBS Points expire in a year

Any DBS Points you earn within the first year of getting your DBS Woman’s World Card should be redeemed within 12 months from the quarterly period in which they were earned. After that, your points expire and your point balance drops to zero.

What DBS rewards can you redeem?

Here’s an idea of what you can get with the DBS Points you can earn in a month, assuming you spend heavily on online retail. Remember, you have 12 months to collect and spend your DBS Points. Save them for something really good, but they’ll expire if you wait too long.

|

Monthly Spend on Online Retail |

DBS Points Collected |

Redeemable for |

|

S$500 |

1,000 |

S$10 Takashimaya Department Store voucher (800 DBS Points) |

|

S$1,000 |

2,000 |

Either a RSH Group S$30 voucher, G2000 S$30 voucher, or BHG S$30 voucher (1,850 DBS Points) |

|

S$2,000 |

4,000 |

CapitaVoucher S$40 voucher (3,200 DBS Points) and S$10 Toys"R"Us voucher (700 DBS points) |

|

S$3,000 |

4,200 |

Selected DBS supplementary card annual fee waivers (3,600 DBS Points) and S$10 Crystal Jade My Bread voucher (600 DBS Points) |

|

S$4,000 |

4,400 |

ESSO Synergy S$40 fuel voucher (2,600 DBS Points) and Tung Lok Group S$30 voucher (1,800 DBS Points) |

|

S$7,000 |

5,000 |

Either 10,000 Asia miles, 10,000 KrisFlyer miles, or 10,000 Qantas points (5,000 DBS Points) |

Visit http://rewards.dbs.com/ or refer to their DBS Rewards 2024 Catalogue to find out more redeemable rewards.

What charges or fees should you look out for?

-

Annual fee: S$196.20 (First year waived)

-

Late payment charge: S$100 (For outstanding balance above S$200)

-

Minimum monthly payment: 3% of statement balance (or S$50, whichever is greater) plus any overdue amount exceeding your credit limit

-

Overlimit fee: S$40 if outstanding balance exceeds credit limit

-

Interest charged on card transactions: 26.80% p.a. chargeable on a daily basis (Subject to compounding)

-

Cash advance fee: 8% of amount withdrawn per transaction or S$15, whichever is greater

-

Interest on cash advance fees: 28% p.a. (Subject to compounding)

More information can be found in this FAQ.

Eligibility criteria

-

At least 21 years old

-

Annual income requirement:

-

DBS Woman's Card: S$30,000 (Singaporeans/PRs), S$45,000 (Foreigners)

-

DBS Woman's World Card: S$80,000 for everyone

-

How to apply?

-

Click on any of the 'Apply Now' buttons found in this article

-

Fill up the card application form on our SingSaver site

-

Prepare the following documents during application:

-

Front and back of NRIC/Passport/Employment Pass

-

Salaried employees

-

For less than 3 months: Latest original computerised payslip or company letter certifying employment and salary

-

For more than 3 months: Latest 3 month's original computerised payslip (otherwise 1 month's) or latest 3 months' salary crediting bank statements, or latest 12 months' CPF statements (otherwise 3 months')

-

-

Self-employed / Commission-earners: Latest 2 years' Income Tax Notice of Assessment

-

SingSaver x DBS Exclusive Offer

Get rewarded when you apply for select DBS/POSB Credit Cards via SingSaver. Enjoy S$175 eCapita vouchers, 12,000 MaxMiles by HeyMax (worth S$216), Apple AirPods 4, SAMSONITE STRAREN SPINNER 67/24, or a Xiaomi Truclean W20 Wet Dry Vacuum when you meet the minimum spend of S$100 within 30 days of card approval. Or top up as low as S$250 to get the latest Dyson, Nintendo, or Sony products! Valid till 1 March 2026. T&Cs apply.

Should you get the DBS Woman’s Card / DBS Woman's World Card?

So does the DBS Woman’s Card and/or DBS Woman's World Card really give what women want? Well, that depends on what kind of woman you are.

If you’re the kind of woman who spends several hundred dollars every month on online stores, the DBS Woman’s World Card is worth looking into. With a decent earn rate for every S$5 spent, and a variety of vouchers to redeem your points with, this card can help you save while you splurge.

If you’re the kind of woman who foresees making several large purchases in the future, and would like to spread payments across 3 months, definitely get the DBS Woman’s World Card.

But if you’re the kind of woman who prefers shopping at malls or department stores, the DBS Woman’s World Card just doesn’t give enough rewards.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.