Standard Chartered Simply Cash Credit Card Review: Earn Up to 1.5% Fuss-Free Cashback

Updated: 11 Apr 2025

The Standard Chartered Simply Cash Credit Card is a no-brainer when it comes to calculating your cashback per month.

Written bySingSaver Team

Team

With adulting comes a great many things to keep track of in our lives: the office to-do for the week, where your credit card expenditures are going, and the date your Spotify free trial ends so you can pre-empt the auto-renewal.

But with the Standard Chartered (SC) Simply Cash Credit Card, you can scratch off two things to keep tabs on: minimum spend and cashback rewards.

As the name suggests, the amount of cashback you could score for your Standard Chartered Credit Card spend has no limits, and the bothersome tracking of category spending can finally be a thing of the past. Essentially, almost all spending qualifies for up to 1.5% unlimited cashback, with no minimum spend and no cashback cap.

And the best part? You can receive instant digital credit card approval and issuance if you apply via MyInfo! Start shopping right away after you add the card to your Apple Pay, Google Pay, or Samsung Pay wallets.

Want to find out more about the SC Simply Cash Credit Card? This review will explore the benefits of the SC Simply Cash Credit Card and potential drawbacks so you can decide if this card aligns with your financial goals and spending habits.

✨Get the Apple Upgrade You Deserve✨

Get your dream Apple gadget when you apply for select Citi, HSBC, OCBC, or Standard Chartered credit cards via SingSaver and top up as low as S$220! Valid till 1 February 2026. T&Cs apply.

What can the Standard Chartered Simply Cash Cashback Credit Card do for you?

Standard Chartered Simply Cash Cashback Credit Card product summary:

-

Earn up to 1.5% cashback on all spends

-

No cashback cap

-

No minimum spend required to start earning cashback

-

Income requirement: S$30,000 (Singaporeans/PR), S$90,000 (Foreigners)

-

Minimum age: 21

-

Annual fee: S$196.20 (First year waived; 9% GST w.e.f. 1 Jan 2024)

Pros & cons of the Standard Chartered Simply Cash Cashback Credit Card

|

Pros ✅ |

Cons ❌ |

|

Earn up to 1.5% cashback for all spend, no min. spend and no cashback cap |

Cannot be used for EZ-Reload |

|

Get cashback on IRAS, Education, Insurance & Rental payment with SC EasyBill |

Does not come with EZ-Link facility |

|

Enjoy offers and privileges for online, dining, retail and more with The Good Life® |

|

|

1-year annual fee waiver |

|

Benefits of the Standard Chartered Simply Cash Credit Card

#1: Get rewarded with up to 1.5% cashback across all categories

Most cashback cards grant additional cashback for specific categories such as grocery, dining, petrol, online shopping, travel and more.

The Standard Chartered Simply Cash is a fuss-free credit card that rewards you with up to 1.5% cashback on all your spending, regardless of category. This makes it a great go-to card to have in your wallet, especially if you do not have a specific category on which you tend to spend more money.

#2: No minimum spend and no cap

Some credit cards require you to spend a minimum of S$600, S$800 or more before you earn the accelerated cashback rate (e.g. UOB EVOL Card, POSB Everyday Card). However, with Standard Chartered Simply Cash, you earn 1.5% unlimited cashback regardless of your monthly spending.

There is also no cap on cashback that you can earn, making it a suitable card to use if you have a big-ticket purchase coming up, such as home furniture shopping, a wedding banquet, or even designer presents you’ve been meaning to purchase.

In case you were wondering, your cashback earned will be automatically used to offset the following statement cycle month’s billed amount without having you lift a finger. Your earned cashback for a particular statement month will be reflected in that month’s card statement but credited to your card account only in the following statement cycle month.

#3: One-year annual fee waiver

The Standard Chartered Simply Cash Cashback Credit Card offers an automatic 1-year annual fee waiver. Thereafter, the standard S$194.40 (with 8% GST) annual fee applies.

#4: Earn extra cashback of up to 1.5%

While a 1.5% flat rate cashback on literally everything you purchase sounds good, you can also look forward to earning cashback on your IRAS, Education, Insurance & Rental payments with SC EasyBill. This credit card lets you earn 1% cashback on your approved Funds Transfer Amount as well.

Note: The exclusive Unlimited$aver savings account linked to the Standard Chartered Simply Cash Cashback Credit Card is no longer available.

#5 Other card perks & privileges

Cardmembers can enjoy exciting card offers and privileges at over 3,000 outlets in Asia with The Good Life®. These include anything and everything from dining offers to shopping, travel, and lifestyle benefits. From 1-for-1 main courses to bonus cashback and discounts, something in the catalogue will tickle your fancy.

With EasyPay, you can turn your retail transactions above S$500 into 6 or 12 months of interest-free instalments with a one-time service fee.

Disadvantages of the Standard Chartered Simply Cash Credit Card

#1 EZ-Link facility discontinued

In January 2024, the Land Transport Authority (LTA) announced that Standard Chartered Simply Cash Cardholders will no longer be able to use the EZ-Link facility on their cards from June 2024.

This means you will not be able to use your credit card directly for public transport under the SimplyGo scheme. While you can switch your card's payment mode to contactless payment for use with SimplyGo, this requires topping up your card at an Assisted Service Kiosk or Top-Up Kiosk, which might not be the most convenient option for frequent public transport users.

#2 High annual fee

The Standard Chartered Simply Cash Credit Card's annual fee is S$196.20 after the first year, which might be a significant consideration for some users, especially those with lower spending levels. However, the annual fee is waived for the first year, giving you time to assess whether the SC Simply Cash Credit Card's benefits align with your spending habits and justify the fee in subsequent years.

#3 Specialised cards may offer higher cashback

While the Standard Chartered Simply Cash Credit Card offers a flat 1.5% cashback on all eligible spending, other specialised cards might provide higher cashback rates for specific spending categories, such as dining, online shopping, or travel.

If you have specific spending habits or priorities, it might be beneficial to explore other card options and review their cashback rates to determine the best fit for your needs.

#4 Limited periphery rewards

Apart from the cashback, the Standard Chartered Simply Cash Credit Card offers limited additional perks or rewards. It doesn't provide benefits like airport lounge access, travel insurance, or reward points that can be redeemed for other benefits. This might be a drawback for those seeking a card with a wider range of rewards and benefits.

What charges or fees should you look out for?

-

Effective Interest Rate: 26.9% p.a.

-

Late payment fee: S$100

-

Minimum monthly payment: 1% of outstanding balance, interest, fees, overlimit amount, or S$50, whichever is greater

-

Overlimit fee: S$40

-

Foreign currency transaction fee: 3.25%

-

Cash advance fee: 6% of amount withdrawn, or S$15, whichever is greater

-

Cash advance interest rate: 29.9% p.a.

-

Annual fee: S$196.20 (First year waived; 9% GST w.e.f. 1 Jan 2024)

Eligibility criteria

- Minimum annual income: S$30,000 for Singaporeans/PRs, S$90,000 for foreigners

- Minimum age: 21

How to apply?

Click on the ‘Apply Now’ button on this page and complete the application form on the SingSaver site. You will need to prepare the following documents for the application process:

-

Front and back of NRIC/Passport/Employment Pass

-

Salaried employees:

-

Latest original computerised payslip, or

-

Past 6 months' CPF statement, and/or

-

Latest Income Tax Notice of Assessment

-

-

Self-employed: Latest 2 years' Income Tax Notice of Assessment

-

Commission earner:

-

Latest 3 months' original computerised payslip and/or Latest Income Tax Notice of Assessment

-

Past 6 months' CPF statement

-

Copy of 2 year's Income Tax Notice of Assessment (For 100% commission earners)

-

Should you get the Standard Chartered Simply Cash Credit Card?

In a nutshell, the Standard Chartered Simply Cash Credit Card is best suited for fuss-free spenders, new credit card users, and any cashback chasers looking to add an unlimited cashback credit card to their collection.

💡 Pro-tip: The AMEX True Cashback Card offers 1.5% unlimited cashback on most spends as well. The only problem is that the majority of insurance companies don't accept AMEX as a valid payment network – so as a MasterCard, Standard Chartered Simply Cash Card wins in this regard.

SingSaver x SCB Simply Cash Card Exclusive Offer

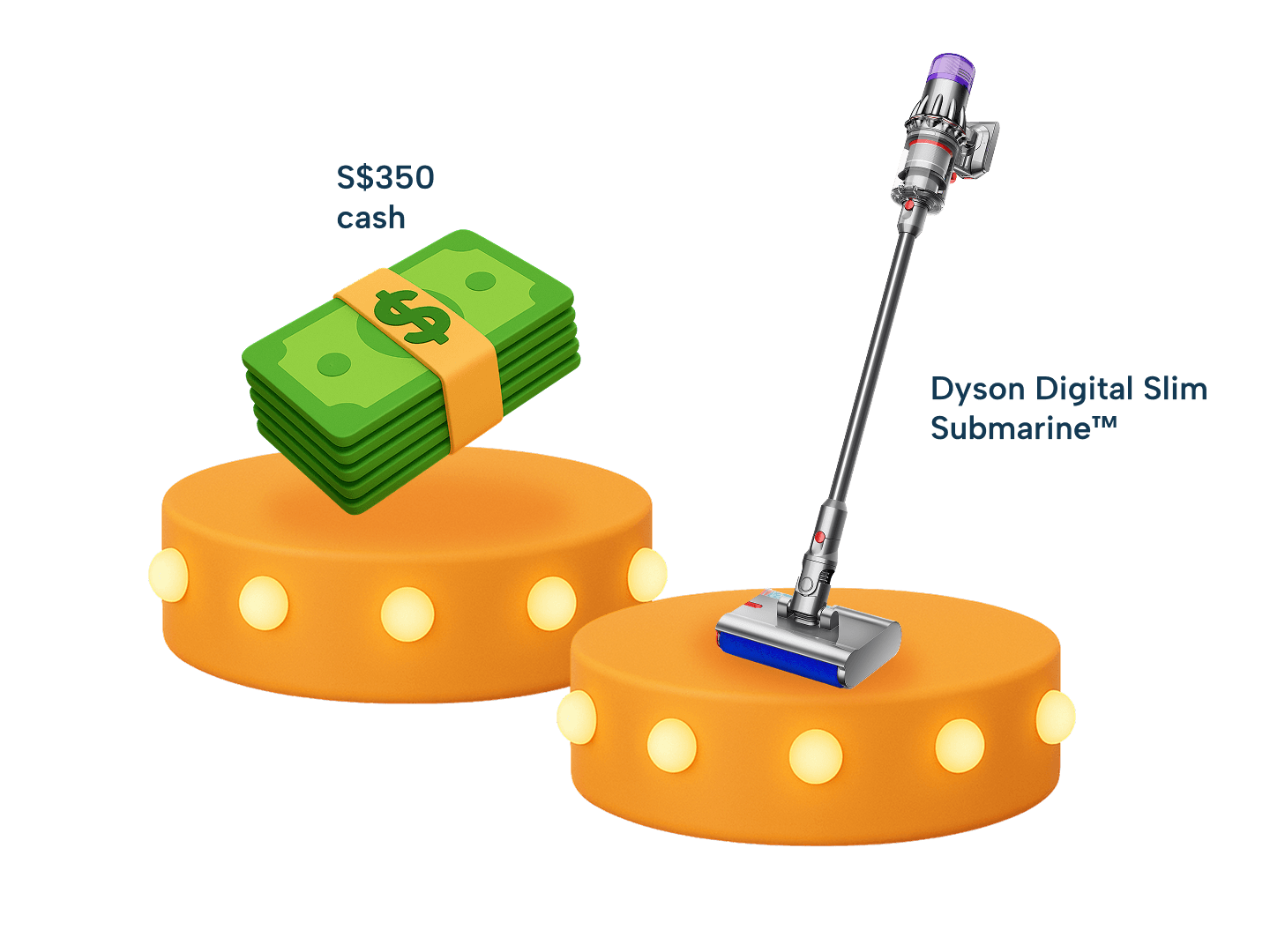

Get up to S$370 or top up as low as S$50 to choose exclusive gifts from Dyson or Apple when you apply for a Standard Chartered Simply Cash Credit Card via SingSaver, spend a minimum of S$800 within 30 days of card approval, and apply for one of these products: EasyPay, Bonus$aver Account, CashOne, or CCFT. Valid till 2 February 2026. T&Cs apply.

Or, Get the Apple Upgrade You Deserve!

Apply via SingSaver and make a simple top-up from S$300 to bring home the latest Apple devices! Valid till 2 February 2026. T&Cs apply.

Frequently asked questions about the Standard Chartered Simply Cash Credit Card

Unfortunately, the cashback earned with the Standard Chartered Simply Cash Credit Card cannot be directly used to offset the SC Simply Cash Credit Card’s annual fee. The cashback is credited to your account as a statement credit, which can be used to offset purchases made with the card. However, this credit cannot be applied towards the annual fee payment.

The 1.5% cashback offered by the Standard Chartered Simply Cash Credit Card applies to all eligible transactions, regardless of whether they are split transactions or payments made in instalments. This means you will still earn your cashback even if you opt to divide your payments over a period of time, providing flexibility in managing your purchases.

Typically, cashback earned with the Standard Chartered Simply Cash Credit Card is credited to your account in the next statement month. Generally, there's no way to expedite this process. The cashback crediting follows the regular crediting cycle, so you will need to wait for the designated period for the cashback to reflect in your account.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.