POSB Everyday Credit Card Review: Will This Be Your Favourite Card?

Updated: 11 Apr 2025

The POSB Everyday Card is designed to save money on your everyday essentials. Can you make the most out of it? Learn more about what this card has to offer.

Written bySingSaver Team

Team

It’s easy to see why the POSB Everyday Card is said to be Singapore’s favourite credit card. Besides being backed by POSB’s long heritage, the POSB Everyday Card promises cash rebates on groceries, transport/petrol, telecommunications, dining, shopping, travel/attractions and finally, utilities. Who could resist such a well-rounded offer?

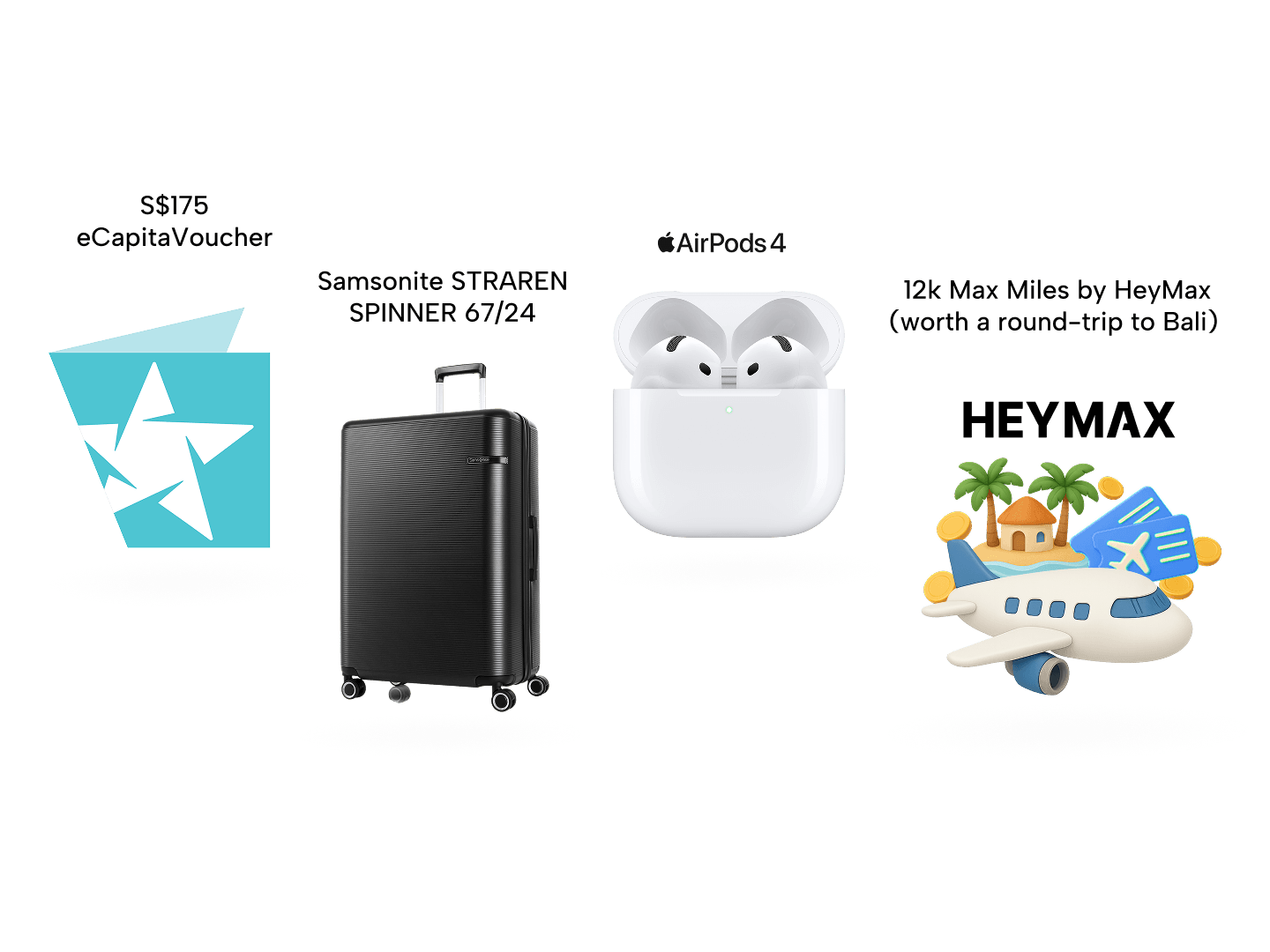

SingSaver x DBS Exclusive Offer

Get rewarded when you apply for select DBS/POSB Credit Cards via SingSaver. Enjoy S$175 eCapita vouchers, 12,000 MaxMiles by HeyMax (worth S$216), Apple AirPods 4, SAMSONITE STRAREN SPINNER 67/24, or a Xiaomi Truclean W20 Wet Dry Vacuum when you meet the minimum spend of S$100 within 30 days of card approval. Or top up as low as S$250 to get the latest Dyson, Nintendo, or Sony products! Valid till 1 March 2026. T&Cs apply.

What can the POSB Everyday Credit Card do for you?

In a nutshell, here’s what you need to know about the POSB Everyday card:

Without minimum spend

-

5% cash rebates at Sheng Siong, capped at Daily$30 per month

-

Up to 3% cash rebates on utility bills, capped at Daily$3 per month

-

Up to 20.1% cash rebates on fuel at SPC and 2% cash rebates at SpeedyCare, no monthly cap imposed

-

Up to 3% cash rebates at Watsons and Pet Lovers Centre (min. S$15 spend), no monthly cap imposed

-

0.3% cash rebate on all other spend

With minimum S$800 spend

-

10% cash rebates on online food delivery at foodpanda and Deliveroo; 3% cash rebates on all other dining spend

-

Capped at Daily$15 per month

-

-

5% cash rebates on online shopping at Amazon.sg, Lazada, Qoo10, Shopee; 8% cash rebates at POPULAR and POPULAR online store

-

Capped at Daily$15 per month

-

-

3% cash rebates on recurring telco bills, capped at Daily$3 per month

-

Earn 0.90% p.a. or more with DBS Multiplier Account when you credit your salary and spend on your card

-

Annual income requirement: S$30,000 (Singaporeans/PR), S$45,000 (Foreigners)

-

Minimum age: 21

-

Annual fee: S$196.20 (Principal Card), S$98.10 (Supplementary card)

|

✅ Pros |

❌ Cons |

|

10% cash rebates on foodpanda and Deliveroo spend; 3% cash rebates on other dining spend (excluding fast food) |

S$800 minimum spend per calendar month to earn online food delivery, dining, online shopping, and telco cash rebates |

|

8% cash rebates on online shopping websites such as Amazon.sg, Lazada, Qoo10, Shopee, RedMart, and Taobao; 8% cash rebates at POPULAR stores |

Dining, food delivery, and online shopping capped at Daily$15 per category per calendar month |

|

5% cash rebates at Sheng Siong |

Sheng Siong cashback capped at Daily$30 per calendar month |

|

3% cash rebates at Watsons; 3% cash rebates at Pet Lovers Centre with min. S$15 spend |

Cashback on recurring utility bills and recurring telco bills are capped at Daily$3 per calendar month respectively |

|

Up to 20.1% fuel savings at SPC + 2% cash rebates at SpeedyCare |

|

|

Up to 3% cash rebates on recurring utilities and telco bills |

|

|

No monthly cap on fuel, Watsons, or Pet Lovers Centre spend |

|

Why should you choose the POSB Everyday card?

#1: Enticing cash rebates

The biggest strength of this card is its versatility. From dining, petrol and food delivery to groceries and online shopping, the POSB Everyday Card has you covered. Apart from earning cash rebates on your recurring telco and utility bills, you even get to earn cash rebates when you shop at Watsons and Pet Lovers Centre.

While there’s a S$800 minimum spend per calendar month required in order to earn cash rebates on your online food delivery, dining, online shopping, and telco transactions, take heart that you can snag cash rebates at Sheng Siong and Watsons even if you don’t meet the S$800 minimum spend requirement. The latter is one of the most unique features of this cashback credit card.

#2: Flexible Daily$ redemption

You can offset any of your purchases with Daily$ at your convenience via DBS PayLah!. Want to offset your credit card bills, redeem Comfort/Citycab taxi vouchers or KrisFlyer miles? Simply redeem your Daily$ via POSB iBanking.

#3: Exclusive merchant deals

The POSB Everyday Card lets you enjoy exclusive merchant deals all year round. The array of offers is broadly categorised into three major sections: shopping, utilities and attractions.

For instance, POSB Everyday card members can enjoy 50% off admission tickets for Singapore Zoo, Jurong Bird Park, Night Safari and River Safari.

What charges or fees should you look out for?

-

Annual fee: S$196.20 for principal card (First year waived; 9% GST w.e.f. 1 Jan 2024), and S$98.10 per supplementary card

-

Late payment charge: S$100 (for outstanding balance over S$200)

-

Minimum monthly payment: 3% of the statement balance or S$50, whichever is greater, plus any amount that is overdue and/or exceeds your credit limit

-

Overlimit fee: S$40 if the total outstanding card balance exceeds the total credit limit at any time

-

Interest on purchases: 27.8% p.a. chargeable on daily basis (subject to compounding), minimum charge of S$2.50 imposed

-

Interest on cash advance: 28.5% of the amount withdrawn per transaction, chargeable on a daily basis (subject to compounding), minimum charge of S$2.50 imposed

-

Cash advance fee: 8% of amount withdrawn per transaction or S$15, whichever is greater

-

Foreign currency transaction fee: 3.25%

-

Dynamic currency conversion fee: 1%

Eligibility criteria

-

At least 21 years of age

-

Minimum annual income for Singapore citizens and PRs: S$30,000

-

Minimum annual income for foreigners: S$45,000

How to apply?

Click on the ‘Apply Now’ button on this page and complete the application form on SingSaver site. You might need to prepare the following documents for the application process:

-

Front and back of NRIC/Passport/Employment Pass

-

Salaried employees

-

For less than 3 months: Latest original computerised payslip or company letter certifying employment and salary

-

For more than 3 months: Latest 3 month's original computerised payslip (otherwise 1 month's) or latest 3 months' salary crediting bank statements, or latest 12 months' CPF statements (otherwise 3 months')

-

-

Self-employed / Commission-earners: Latest 2 years' Income Tax Notice of Assessment

SingSaver x POSB Everyday Card Exclusive Offer

Get S$175 eCapita vouchers, 12,000 MaxMiles by HeyMax (worth S$216), Apple AirPods 4, SAMSONITE STRAREN SPINNER 67/24, or a Xiaomi Truclean W20 Wet Dry Vacuum when you apply for a POSB Everyday Card via SingSaver and hit a min. spend of S$100 within 30 days of card approval. Or top up as low as S$250 to get the latest Dyson, Nintendo, or Sony products! Valid till 1 March 2026. T&Cs apply.

For whom is the POSB Everyday Card best suited for?

This card is great for everyday use (hence the name POSB Everyday Card) and ideal for people who fancy the idea of consolidating their everyday expenses, particularly those who like to shop online, love ordering food in, frequently shop for groceries and more.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.