Best Annual Travel Insurance Plans in Singapore (2026)

Updated: 2 Mar 2026

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

If you plan to visit a few destinations this year, you’re probably shopping for an annual travel insurance plan.

Compared to a single trip plan, an annual travel insurance plan (also known as an annual multi-trip plan) provides coverage for up to one calendar year, offering greater value and convenience while saving on cost.

So if you’re looking for the best one to fit your needs, we've compiled 8 of the best travel insurance plans to buy.

What is an annual travel insurance plan?

Annual travel insurance, or multi-trip travel insurance, is designed for those who frequently embark on journeys. It's an efficient solution for the avid traveller which offers coverage for an unlimited number of trips within a year.

This type of plan is best tailored to cater to the needs of individuals who seek comprehensive protection, including medical coverage and assistance during trip inconveniences, across various global destinations.

Why choose annual travel insurance over single-trip travel insurance?

Annual travel insurance is like an EZ-Link concession pass: pay once (often about S$200 to S$250) and you’re covered for every jaunt out of Changi for a year, saving hassle and, once you hit three or more trips, real cash compared with stacking separate single-trip policies that quickly total S$300-S$400; it also means no last-minute scrambling for cover when you impulsively book that JB weekend or Phuket flash sale.

The benefits of annual travel insurance plans

-

One payment, year-round protection

-

Big savings for frequent flyers—from your third holiday onward, an annual plan usually costs less than buying multiple single-trip policies

-

No last-minute scrambles

-

Unlimited spontaneity—impromptu JB drives, weekend Phuket escapes, or sudden work trips are all included without extra paperwork

-

Easy claims tracking with only one policy number and one insurer portal, which simplifies filing and following up on claims

What does annual travel insurance cover?

When selecting an annual travel insurance plan, understanding the breadth and depth of coverage it offers will influence your decision heavily.

From geographical flexibility and medical emergencies to unexpected travel disruptions and adventurous activities, knowing what your policy includes can significantly impact your travel experience.

Let’s explore the key areas of coverage that are essential for the Singapore traveller, ensuring you're well-prepared for your journey ahead.

Comprehensive protection for most, if not all countries

Insurance plans typically offer a range of coverage options from specific regions to global protection.

Opting for a worldwide plan ensures flexibility, allowing for last-minute changes to travel destinations without the worry of coverage limitations.

Medical coverage: A safety net abroad (may or may not include COVID-19)

A crucial component of travel insurance is medical coverage, which can also extend to include ailments such as COVID-19. This ensures that travellers can receive necessary medical treatment without the burden of high costs, providing peace of mind during international travels.

Safeguard against trip disruptions (including cancelled flights)

Travel insurance also protects against the inconvenience caused by unexpected disruptions like flight delays or even cancelled flights.

These can be caused by severe weather, technical issues with transportation, or they can just be health-related cancellations.

Compensation varies by plan, covering potential financial losses from such interruptions.

Coverage for adventure seekers

Recognising the needs of adventure enthusiasts, many insurers now cover activities that were once considered too risky, from skydiving to scuba diving. This expansion allows travellers to explore and participate in extreme sports with confidence, knowing they are protected.

Emergency assistance when you need it most: Evacuation and repatriation

The provision for emergency medical evacuation and repatriation is a testament to the comprehensive nature of travel insurance. This ensures that in critical health situations, including those related to COVID-19, travellers have access to necessary medical facilities and, if needed, can be safely transported back to their home country.

What does annual travel insurance not cover?

While annual travel insurance gives you broad protection for the year, it’s not a magic shield for everything. Like most policies in Singapore, there are a few important exclusions you should know so that you don’t get caught off guard when it matters most.

Pre-existing medical conditions

If you’ve got chronic conditions like diabetes, high blood pressure, or heart problems, most annual plans won’t cover you for anything related to those issues. That means if you fall ill overseas because of a condition you already had before your trip, you’ll likely have to pay out of pocket.

Some insurers offer separate riders or special policies for this, but they’re usually not included in a standard annual plan.

Replacement of traveller or employee before flight departure

Annual plans are meant to protect the named traveller. If you’re unable to go and someone else, like a colleague or relative, takes your place, the insurance doesn’t transfer. Even for business trips, if your company swaps out travellers last-minute, your personal policy won’t cover that replacement’s trip. The coverage stays tied to your name.

Activities that violate the law

If you get injured while doing something illegal overseas—say, riding a motorbike without a valid license or taking part in banned activities, your claim will almost certainly be rejected. Insurance is for accidents, not for risky behaviour that breaks the law, even if you didn’t know the local rules. When in doubt, check before you act.

Any travel against prohibitions or official warnings

If ICA, MFA, or other government bodies issue travel advisories, such as during political unrest, disease outbreaks, or natural disasters, your insurer might not pay out if you travel despite those warnings. Most policies have a clause excluding cover if you ignore such bulletins, even if you have a valid ticket. Always check official notices before flying.

Understanding these limits helps you travel smarter. Annual travel insurance gives great peace of mind, but it’s still important to read the fine print so that you know where the safety net stops.

Should you purchase single trip or annual travel insurance?

Multi-trip travel insurance is most beneficial for individuals who may find themselves travelling several times throughout the year. It's a cost-effective and time-saving option, eliminating the need to secure a new policy for each trip.

Frequent travellers can leverage its benefits, enjoying peace of mind with extensive coverage that spans many regions worldwide, ensuring they're well-protected on every journey.

Further, annual travel insurance is particularly suited for unique travellers like digital nomads, business travellers, and anyone who may frequently cross borders for leisure or work. These travellers benefit from the extended coverage and flexibility that a multi-trip policy provides, covering everything from medical emergencies to trip cancellations across a wide range of destinations worldwide.

Using MSIG as an example in the table below, let’s compare which type of travel insurance place is more cost-efficient for a simple trip from Singapore to Malaysia.

|

Type of Travel Insurance |

Single Trip (before discount) |

Annual Travel (before discount) |

|

Cost |

S$50 |

S$289 |

|

Coverage |

S$5,000 for trip cancellation S$250,000 of overseas medical coverage S$3,000 for bags and belongings S$600 for baggage delay (S$150/6h) |

S$5,000 for trip cancellation S$250,000 of overseas medical coverage S$3,000 for bags and belongings S$600 for baggage delay (S$150/6h) |

|

Total |

S$50 x 8 = S$400 (assuming the plan costs the same throughout the year) |

S$289 |

On top of that, like a single trip travel insurance, you can also choose whether you want an individual or a group annual travel insurance plan.

While they both offer similar benefits and coverage, the difference is the cost per person, policy limit, and customisation. For example, a group plan has a lower cost per person because you can add family members with no additional cost. However, the drawback is that the coverage limit is shared and lower than an individual plan.

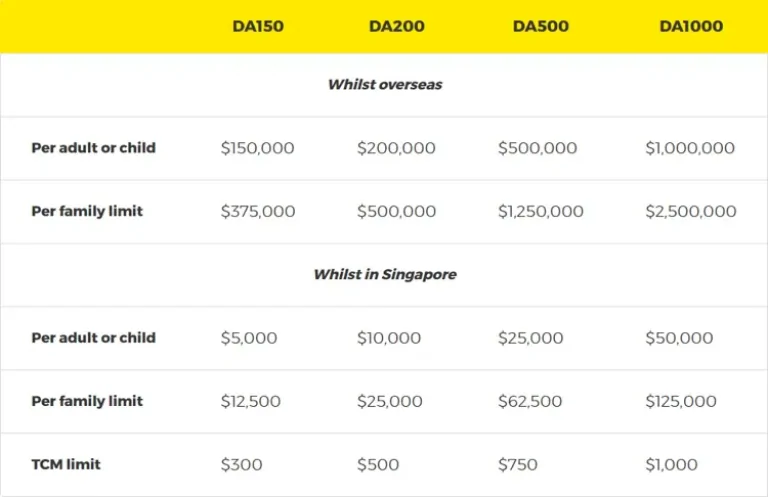

Here's an example for overseas medical expenses for an individual vs group plan:

Frequently asked questions about annual travel insurance plans

Your annual travel insurance kicks in from the start date you choose when you buy the plan, not necessarily the purchase date. So if you buy it today but set the start date for next Monday, coverage begins Monday. Once active, it automatically covers every trip (usually up to 90 days per trip) for one full year—no need to apply each time you travel.

Most insurers in Singapore offer a free look period—typically 14 days from the policy start date—where you can cancel for a full refund, as long as you haven’t made a claim or started a trip.

After that, cancellations may be allowed, but partial refunds aren’t guaranteed. Always check the cancellation terms before buying, especially if you’re buying it early but not flying soon.

Yes—if you travel three times or more a year, annual plans are usually more cost-effective than stacking single-trip policies. You also get peace of mind knowing you’re always covered, even for spontaneous getaways or urgent work trips. It saves money and mental load. But if you’re only flying once or twice a year, a single-trip plan might still be cheaper overall.

Yes. While the pandemic is no longer at its peak, COVID-related costs can still hit hard, especially in countries with strict isolation rules or high hospital fees. If you catch COVID overseas and need to extend your stay, cancel plans, or seek treatment, insurance with COVID coverage can save you thousands.

It’s strongly recommended. Most reputable annual plans in Singapore already include COVID-19 protection by default, but some may limit payouts or require you to opt in. Look for plans that cover trip cancellations, medical treatment, and extended stays due to COVID, especially if you’re travelling to countries that still enforce quarantine or isolation rules.

Relevant articles

Annual vs Single Trip Travel Insurance: Which Policy Saves You More Money and Hassle?

Planning your next holiday? Don't forget to consider your travel insurance options. As a Singaporean traveller, you're faced with a crucial decision: annual or single trip travel insurance. Both choices offer unique benefits, but which one truly saves you more money and reduces hassle? Let's explore the key differences between these two types of policies so that you can make an informed decision that ensures you're covered without breaking the bank.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.