How to Check Your Personal Loan Application Status?

Updated: 11 Apr 2025

Waiting to know the results of your personal loan application can be nerve-wracking, especially if you urgently need the funds. Here’s how you can check your loan status with various popular banks.

Written bySingSaver Team

Team

Bank personal loans are a convenient and affordable option to access extra funds. While many banks pride themselves on speedy loan approvals, there may be times when your loan application is held up for some reason or another.

This is usually something minor, such as delays in credit checks or that clarifications of income details are needed. Understandably, if your personal loan application seems to be taking a long time, you may want to check on its status to make sure you’ll still be able to get your loan.

To help you, check out our guide on how to check your personal loan application status online or offline at various banks. Additionally, we give you some tips on how you can ensure smooth and fast personal loan approval.

Checking your personal loan status

Follow this step-by-step guide on how you can check your personal loan application status at various banks.

DBS and POSB personal loan application status

Online

-

Scroll down to look for the “Loans” section

-

Choose “Check Loan Application Status”

-

Log in using your identification number, the last 4 digits of your card number, and your card PIN

-

The status of your loan application will be displayed

Offline

-

Call DBS at 1800 111 1111

-

Alternatively, call POSB at 1800 339 6666

-

Follow the voice prompts to check your loan status

OCBC personal loan application status

Online

If you have applied for a personal loan from OCBC with Myinfo using SingPass, you can enjoy instant loan approval.

-

During the loan application process, retrieve your personal details using Myinfo

-

Confirm your details and submit your application

-

After your card or personal loan is approved instantly, you will receive an email and SMS with a link to access your digital card or loan account

Offline

-

Assuming you did not receive instant approval for your loan application, you may check your status via telephone.

-

Call OCBC at 1800 363 3333

-

Follow the voice prompts to check on your loan status

UOB personal loan application status

Online

If you submit your personal loan application online between 8:00am to 9:00pm, you can enjoy instant loan approval and disbursement.

Your loan will be deposited to your bank account upon approval. Note that loan disbursement is automatic upon approval, so you may not receive the amount you initially requested. This is dependent on the bank’s review of your level of debt, creditworthiness and other factors.

Offline

You can also apply for a UOB personal loan by calling 6668 2087 between 9:30am and 6:00pm (Mon to Fri). If you applied via phone, you can also call the same number to check on the status of your loan application.

⚡SingSaver x UOB Personal Loan Flash Deal⚡

Get affordable interest rates from 1.00% p.a. (EIR from 1.93% p.a.) plus up to S$1,900 in cashback and rewards when you apply for a UOB Personal Loan via SingSaver. Valid till 1 March 2026. T&Cs apply.

Citi Quick Cash loan application status

Online

If you have selected a Citi Deposit Account as your designated disbursement account, you can enjoy instant cash disbursement on your Citi Quick Cash Loan. Simply check your account to see if you have received the disbursed amount to know if your loan application has been approved.

You can also try applying with SingPass to further speed up the cash disbursement process.

Offline

If you are unable to receive the loan disbursement, you can contact them through the following channels.

-

Call Citibank’s hotline for loan applications at +65 6238 8888

-

Send a secured email by logging into Citibank online and then going to the My Mailbox section.

Standard Chartered CashOne personal loan application status

Online

Standard Chartered also offers instant loan disbursement, eliminating the need to check on your loan application status.

To enjoy a shorter loan processing time, apply with Myinfo via SingPass. If no documentation review of further documents is required, your loan approval will be instant, and your loan amount will be disbursed within 15 minutes.

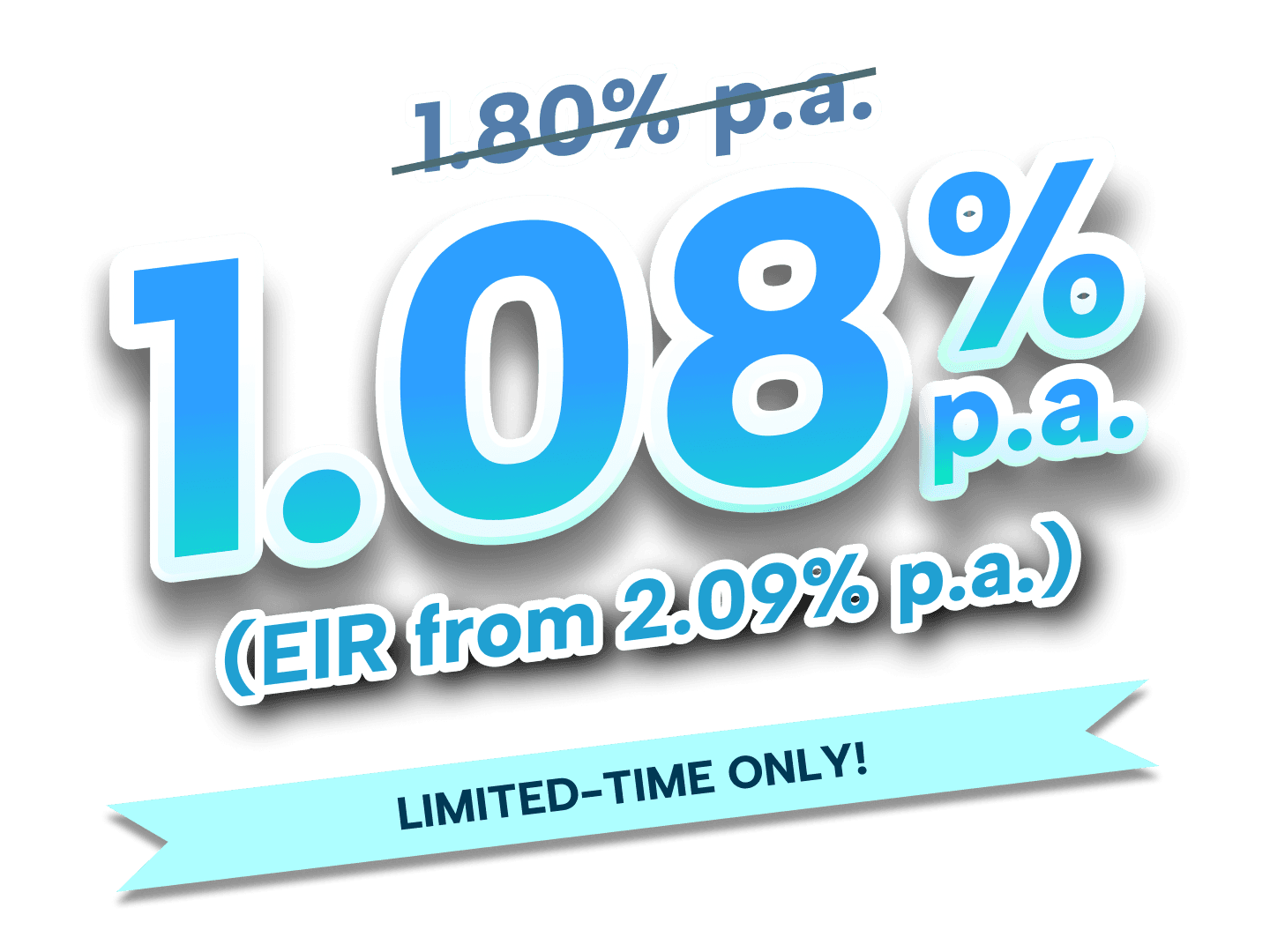

⚡SingSaver x SCB CashOne Personal Loan Flash Deal⚡

Enjoy SCB's Lunar New Year Interest Rate starting from 1.08% p.a. (EIR from 2.09%), the lowest in the market! Plus, get up to S$4,900 in Cashback when you apply for Standard Chartered CashOne Personal Loan via SingSaver. Valid till 1 March 2026. T&Cs apply.

CIMB personal loan application status

Online

If you are an existing CIMB customer and have a CIMB Clicks online banking account, you can use it to check your CIMB personal loan application status.

-

Login using your ID and password

-

Navigate to “Account Enquiry” and look for “Loans”

-

Your loan application status will be displayed

Offline

Alternatively, you can contact CIMB to check on the status of your loan application via the following methods:

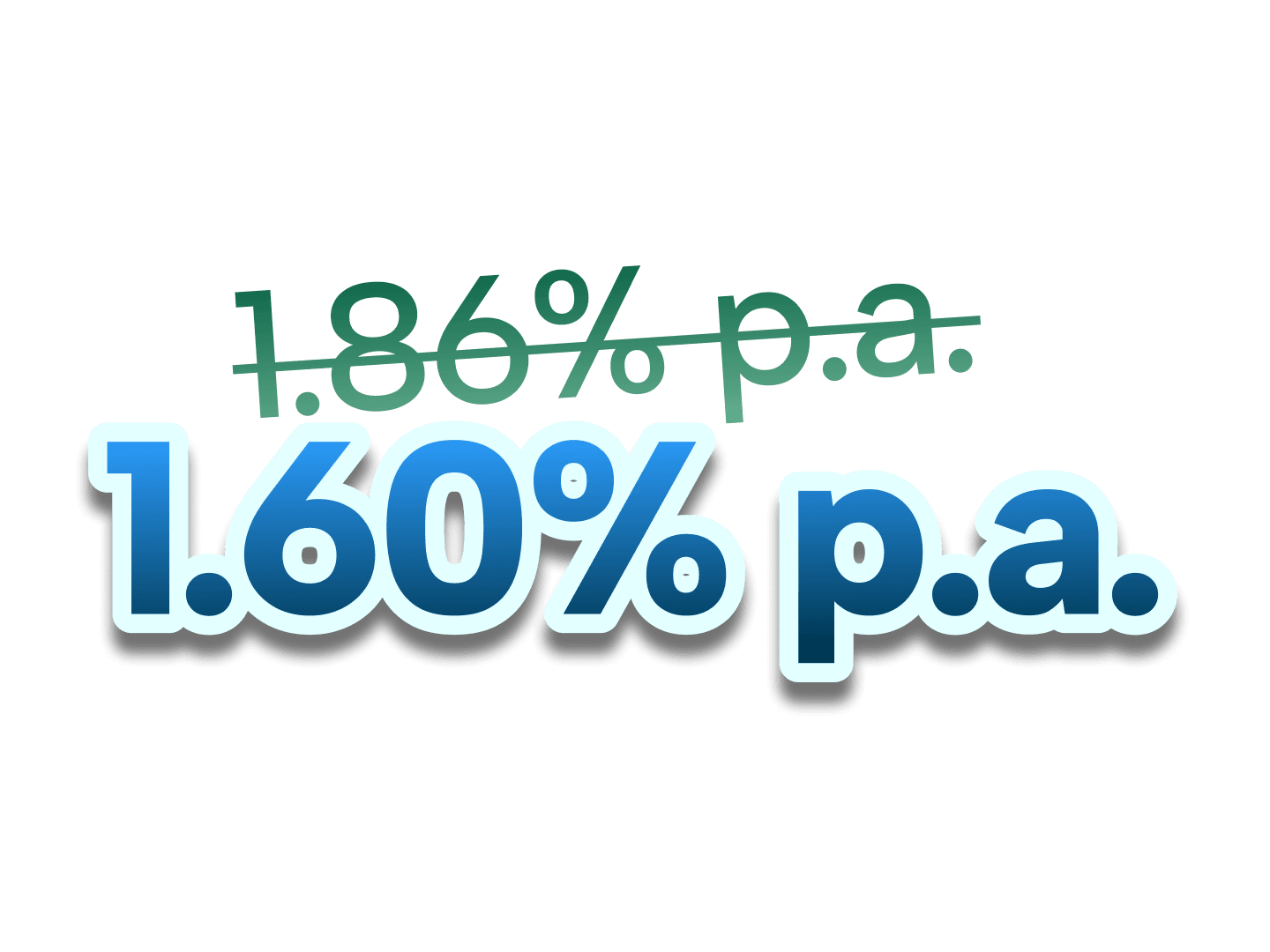

CIMB Personal Loan Welcome Offer

Enjoy low interest rates from 1.60% p.a. (EIR from 3.07% p.a.) when you apply for a CIMB Personal Loan! Valid till 1 March 2026. T&Cs apply.

HSBC personal loan application status

Online

HSBC account holders can enjoy instant loan approval and funds disbursement, so there’s no need to check on your loan application status.

You’ll first need to have an HSBC Personal Line of Credit before applying for an HSBC Instalment Loan. But once you have been approved for your Line of Credit, your personal loan application will be instant.

SingSaver x HSBC Personal Loan Exclusive Offer

Enjoy attractive interest rates from 1.83% p.a. (EIR from 3.5% p.a.) plus get up to S$1,100 in Cashback when you apply for HSBC Personal Loan via SingSaver. Available to new and existing customers! Valid till 1 March 2026. T&Cs apply.

How long does it take for personal loan applications to be completed?

Personal loans can be processed and disbursed virtually instantly or may take a few working days to complete.

The length of time it takes to process a personal loan application depends on the application method used and whether you have an existing relationship with the bank.

As seen with many banks, including HSBC, UOB and OCBC, you can enjoy instant loan approval and funds disbursement if you already have an eligible banking facility with them.

Furthermore, if you have SingPass, you can use it to retrieve your personal information (Myinfo) during the loan application to reduce your processing time. Provided all is in order and no additional information or supporting documents are required, your personal loan application will be approved quickly.

If you do not have the required bank account, you may need to apply for one first, which may take a few days. You can bypass this step by choosing a personal loan that does not have such requirements – such as personal loans by CIMB.

And, if, for some reason, you decide to mail in your application by post instead of making an online application, you can expect your loan application to take a longer time.

How to ensure your loan application process goes as smoothly as possible

-

Check your eligibility for the loan. Be sure you satisfy all the requirements, particularly the annual income,

-

Choose a bank with which you have a bank account or credit card account in good standing. The former lets you receive your cash faster, while the latter may allow you to borrow against your pre-approved credit limit.

-

Use Myinfo to submit your particulars if you have SingPass. Also, have digital copies of supporting documents ready so you can submit them quickly if required.

-

Choose a bank that explicitly offers instant loan approvals. Loans will be automatically disbursed once your application is approved. However, you may not receive the loan amount you initially asked for, and your interest rate may also differ.

Why your personal loan application may be rejected

When you check your personal loan application status and find it rejected, it may be due to the following reasons:

1. Low income

Banks and financial institutions typically set minimum income thresholds to evaluate a borrower’s ability to repay a loan. This threshold varies across lenders and loan types. If your income falls below the required level, the lender may deem you ineligible due to a perceived inability to meet repayment obligations. However, there are alternative personal loans for low income borrowers available.

2. Poor credit history

Having a poor credit history, characterised by missed payments, defaults, or bankruptcies, significantly reduces your chances of approval. This is because lenders use this as a measure of your reliability in handling debt.

If your credit history is holding you back, consider finding loans for bad credit in Singapore.

3. High debt-to-income ratio (DTI)

Your debt-to-income ratio refers to the ratio of total monthly debt payments to your monthly income. If you have a high DTI ratio, this shows lenders that a significant portion of your income is already tied to debt repayment and may have less room for additional financial obligations.

4. Unstable work history

Lenders value stability, particularly in employment. If your work history shows frequent job changes, extended gaps, or a probationary period, it could signal uncertainty in your income. Additionally, this lack of stability may make lenders hesitant to approve your application.

Should this be the case for you, there are lenders where you can get a personal loan without proof of income.

5. Failure to meet basic requirements

Every lender has a set of eligibility criteria, which typically include minimum age, income, residency status, and the requirement for an active bank account. Not meeting these basic requirements can result in automatic disqualification. Therefore, before applying, ensure you meet the lender’s minimum criteria to avoid unnecessary rejections.

6. Missing or inaccurate information

Errors or omissions in your application can lead to delays or outright rejection. For example, inconsistencies between your identification documents and application details, such as a mismatched name or incomplete address, can raise red flags for lenders.

Always double-check your application for accuracy and completeness before submission. Including all necessary documentation, such as proof of income, bank statements, and identification, ensures a smoother review process.

What to do if your personal loan was declined?

Should your personal loan be declined, you can consider the following:

1. Find a different lender

Loan application criteria vary among lenders, and what one institution rejects, another might approve. If your loan application was declined, look for lenders with more flexible requirements.

2. Talk to the lender

While rejection can be frustrating, it’s essential to understand the specific reasons behind the decision. Contact the lender and ask for detailed feedback on why your loan was declined. This step can provide clarity, such as whether the issue was related to your credit score, income, or incomplete documentation.

3. Provide additional documentation

Sometimes, loan applications are rejected due to missing or insufficient documentation. Ensure that you’ve provided everything required, such as recent payslips, bank statements, or tax returns.

If your income sources are unconventional—like freelancing or gig work—consider submitting contracts, invoices, or proof of consistent earnings.

4. Offer assets as collateral

If an unsecured personal loan is difficult to obtain, consider applying for a secured loan. Secured loans require collateral—such as a car, home, or savings account—which reduces the lender’s risk.

By offering collateral, you may gain access to higher loan amounts or better interest rates. However, keep in mind that failure to repay the loan could result in the loss of your pledged assets.

Before proceeding, you should fully read and understand the terms and conditions of the secured loan.

5. Fix your credit score

A low credit score is a common reason for loan rejection. Improving your credit score can significantly enhance your eligibility for future loans. Start by double-checking your credit report for errors and disputing any inaccuracies.

Next, focus on paying off outstanding debts, maintaining low credit card balances, and avoiding late payments. Consider setting up automated reminders or direct debit payments to ensure timely repayment of bills.

Over time, consistent financial discipline will help your credit score, which can improve a lender's perspective of you in the future.

6. Maintain a positive employment record

Another significant aspect of your application that your lender checks is your employment stability. If your work history is inconsistent or includes frequent job changes, it might raise concerns about your ability to sustain regular loan payments.

Focus on building a stable employment record by maintaining your current job for at least six months to a year. Provide proof of income consistency, such as payslips or a letter of employment, to reassure lenders of your financial stability.

7. Get a guarantor

A guarantor, also known as a co-signer, is an individual who has a strong credit profile and agrees to take responsibility for the loan if you are unable to repay it. Adding a guarantor to your loan application can significantly improve your chances of approval, as it reduces the risk for the lender.

Ensure your guarantor understands their financial commitment, as their credit score and financial stability will also be assessed.

8. Seek financial advice

If you’re unsure about the next steps, consider consulting a financial advisor or credit counsellor. An experienced professional can help you assess your current financial situation and come up with strategies to improve your financial health. They can also provide insights into alternative financing options, debt repayment schemes or government assistance programmes.

9. Reassess your financial strategy

Loan rejection can be an opportunity to reevaluate your financial priorities and goals.

Start by closely examining your income, expenses, and savings to identify areas where improvements can be made. Develop a financial strategy that balances effective debt repayment with maintaining a robust emergency fund.

A well-crafted plan tailored to your habits and lifestyle can help you build stronger financial health, making you better positioned to meet loan eligibility criteria in the future.

SingSaver Personal Loans Cashback Offer

Enjoy interest rates as low as 1.08% p.a. (EIR from 2.09% p.a.) and up to S$4,900 in cashback when you apply for a personal loan via SingSaver. Valid till 1 March 2026. T&Cs apply.

Frequently Asked Questions (FAQs)

You can log in to your online banking account to check your personal loan status. You can also call or email your bank to do so.

If you applied for an instant approval loan, and satisfied all the requirements, your funds will be disbursed within minutes of your loan application.

The loan you requested will be deposited into your bank account, which confirms that your personal loan has been approved.

You may also receive an SMS, email or online banking notification on the approval of your loan.

Under the right circumstances, you can get a personal loan approved in as little as a few minutes upon application.

This is most likely if you have a good credit score, have been pre-approved for unsecured credit by the bank, or otherwise have satisfied all the eligibility requirements of the loan.

Yes, most banks allow you to check your status by visiting a branch or calling their customer service hotlines.

While some lenders allow you to reapply quickly if you do so with a co-signer, some may recommend that you wait four to six months before applying again. This is to give you time to resolve any issues regarding your application.

Loan rejections don’t appear on your credit report. However, hard enquiries from lenders remain for up to two years.

Even with a strong credit score or having the capability to pay off a personal loan early or on time, you can potentially still be rejected. Contributing factors to this include a high debt-to-income ratio, unstable employment, or missing documentation. Therefore, it’s essential to address these issues and make sure that every aspect of your application meets the lender’s requirements to improve your chances.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.