For many miles chasers, the past few months may have given reason to pause and reflect on decisions. With borders closed, countless flights cancelled, and airlines flirting with bankruptcy, does it still make sense to collect miles right now?

The concern is understandable. I, myself, have had second thoughts about this, but I’m convinced to stay the course. After all, the travel industry has to bounce back eventually, and no matter how grim it looks now, it’s only a matter of time before we’re flying again.

So, we hunker down and wait. Just because you can’t use your miles at this point, it doesn’t mean they’ve lost all their value.

At the same time, though, I believe the COVID-19 outbreak makes you do a double-check of the way you’d approach the miles game. Here’s some advice for miles chasers during this period.

Re-evaluate your card portfolio and consolidate if necessary

Many miles chasers may be spreading their spending across multiple cards in order to maximise the miles they earn. For example, they may have one card just for dining, another one for online shopping, and yet another card for foreign currency transactions, and so on.

If you’re able to secure annual fee waivers on all your cards, there’s nothing wrong carrying on with this strategy. However, banks look at how much you spend when approving fee waivers, and if your spending has dropped due to the current situation, it is possible the waiver will be denied.

If so, I believe that it doesn’t make sense to pay the annual fee, just so you can optimise miles from spending, especially in the current climate where you’re likely to be spending less anyway. I’d sooner cancel the card and re-apply in the future when the economy (and your discretionary spending) picks up again.

But, as a general rule of thumb, you’ll want to compare the value of the miles earned to the cost of the annual fee, keeping in mind that your personal valuation may need to change in light of the evolving situation. |

Rethink premium credit cards

You may be holding some premium credit cards — not necessarily for spending, but because of the membership benefits. For example, the Citi Prestige, HSBC Visa Infinite, and OCBC VOYAGE offer unlimited lounge access as well as complimentary airport limousine transfers and discounted hotel stays.

Unfortunately, it doesn’t really make sense to pay $500+ annual fees for benefits you can’t use right now. Although there’s no point in prematurely cancelling your card (because you don’t get a prorated refund of the fee), you may want to hold off committing to another year until the situation changes if it’s up for renewal.

Focus your spending on cards with non-expiring points

No one knows how long the Coronavirus situation will last, much less when travel will be feasible again.

With all the uncertainty, it’d be wise to focus your spending on cards that earn non-expiring points. This gives you more breathing room when planning your next steps.

In the table below, I’ve categorised some popular miles cards by their points expiry policy.

| Points Don’t Expire | Points Expire |

| - Citi PremierMiles - Citi Prestige - DBS Altitude - OCBC 90N - OCBC VOYAGE - SCB X Card - SCB Visa Infinite | - BOC Elite Miles (1-2 years) - HSBC Visa Infinite (37 months) - UOB PRVI Miles (2 years) |

Remember that once you transfer your points to a frequent flyer program, those points will be subject to the expiry rules of that particular program. For example, points earned on the UOB PRVI Miles card will be valid for 2 years, but when transferred to KrisFlyer, they will be valid for 3 years.

Hedge your bets by earning flexible points currencies

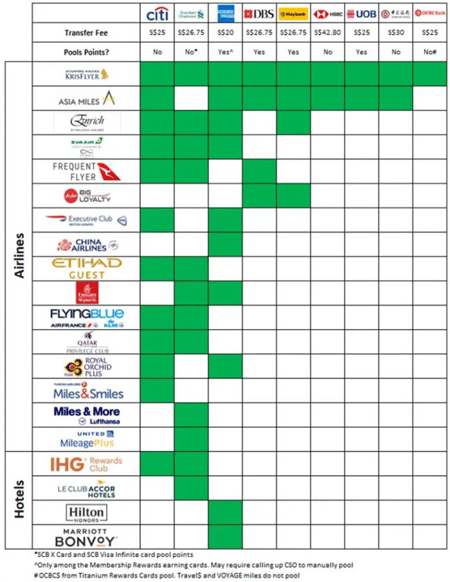

While we’re on non-expiring points, it’s also a good idea to concentrate your spending with a bank that has multiple points transfer partners.

With airlines bleeding cash right now, it’s likely that some won’t survive the crisis. Moreover, even if the airline does survive, there’s a chance it may devalue its miles by raising the cost of redemptions. In such a scenario, the more transfer partners available to you, the more insulated you are against one particular airline going bust or devaluing.

As the table below shows, Citibank, SCB and AMEX have more transfer partners than the average bank in Singapore. This provides cardholders with more diversification, a valuable asset in these times.

Don’t take on sign-up bonuses now

Sign-up bonuses are a great way of turbo-charging your miles balance. For example, spending $9,000 on the Citi PremierMiles card in the first 3 months can get you a total of 37,300 miles. Quite a nice haul, if you ask me.

But that assumes you’re able to hit the spending target. In the current climate where belt-tightening is the order of the day, are you really able to commit to that kind of spending and should you?

My sense if you may want to avoid applying for cards with sign-up bonuses during this period. After all, if you fail to meet the spending requirement, it’s not like you can just try again later by cancelling and re-applying. Most banks only offer sign-up bonuses to new-to-bank customers, generally defined as those who do not currently hold any of the bank’s credit cards, and have not in the past 12 months.

Conclusion

The coronavirus doesn’t mean the end of miles chasing, but it does mean you’ll need to adjust your strategy accordingly. Consolidate your cards, stop paying for benefits you can’t use, turn your spending into non-expiring, flexible points, and skip taking on sign-up bonuses you have no chance of hitting.

Sit tight and stay safe — this too shall pass.

Read these next:

Amid COVID-19, Scoot And Singapore Airlines Offer Cash Refunds, Bonus Travel Credits

COVID-19: Why Now Is Not The Time To Buy Miles

Can’t Fly Due To COVID-19 Circuit Breaker? Here’s What To Do With Your KrisFlyer Miles

26 Cheapest Takeaway Deals As You Support Singapore’s F&B During COVID-19

Which Online Grocery In Singapore Delivers The Biggest Savings?

Similar articles

COVID-19: Why Now Is Not The Time To Buy Miles

Travel Cancelled Due To COVID-19? Here’s How To Save Your Expiring Airline Miles

Can’t Fly Due To COVID-19 Circuit Breaker? Here’s What To Do With Your KrisFlyer Miles

Worried About KrisFlyer Miles Expiring Soon? Singapore Airlines Extends Them

When Does It Make Sense To Pay Your Credit Card Annual Fee?

KrisFlyer Bonus Miles: Earn 15% More By Transferring Your Card Card Points

Standard Chartered Visa Infinite Card Review: When The Good Life® Becomes The Suite Travel Life

Should You Buy Airline Or Hotel Travel Credits Amid COVID-19?