What’s the Average Personal Loan Interest Rate in Singapore?

Updated: 12 Dec 2025

In the financial hub of Singapore, securing the best interest rate for a personal loan is crucial, especially with rates fluctuating based on one's credit profile. This guide offers insights into navigating these waters, helping you secure favourable terms amidst varying economic conditions.

As we venture further into 2025, understanding the dynamics of personal loan interest rates in Singapore becomes crucial for both new borrowers and those considering refinancing. Historically, rates have been influenced by a myriad of factors ranging from global economic conditions to individual credit scores.

Currently, individuals with robust credit ratings tend to enjoy lower rates, which is reflective of a lender’s confidence in their financial stability. As the economic landscape adjusts, it's more important than ever to stay informed about how these changes could affect your borrowing costs.

>> MORE: Personal loan rates: Compare top lenders in Singapore

Average personal loan rates by lenders

|

Borrower credit grade |

Score range |

Probability of Default |

|

AA |

1911 to 2000 |

Less than 0.27% |

|

BB |

1844 to 1910 |

0.27% to 0.67% |

|

CC |

1825 to 1834 |

0.67% to 0.88% |

|

DD |

1813 to 1824 |

0.88% to 1.03% |

|

EE |

1782 to 1812 |

1.03% to 1.58% |

|

FF |

1755 to 1781 |

1.58% to 2.28% |

|

GG |

1724 to 1754 |

2.28% to 3.48% |

|

HH |

1000 to 1723 |

More than 3.48% |

Online personal loan rates

In Singapore, online lenders offer varied Effective Interest Rates (EIR), tailored to accommodate the diverse financial profiles of borrowers. These digital platforms often provide competitive rates that may differ substantially based on the applicant's creditworthiness.

|

Lender |

Interest rate |

|

Cash Direct |

2 to 4% |

|

Lending Bee |

Custom |

|

CreditMaster |

1 to 4 % |

|

1-Cash |

1 to 3.88% |

>> MORE: Best online loans

Bank personal loan rates

The average flat interest rate in the market today is around 6% p.a. The actual personal loan rate offered by the bank can vary by loan amount, loan tenure, annual income, existing or new bank relationship and creditworthiness. This is important to remember, and this is also why personal loan interest rates differ for person to person, from bank to bank.

|

S$10,000 LOAN OVER 24 MONTHS, ANNUAL INCOME S$30-000 - S$80,000 |

||||||

|

Bank |

Annual Flat Interest Fate |

Effctive Interest Rate (EIR) |

Processing / Annual Fee |

Interest charged |

Total loan amount to repay (incl. interest) |

Monthly repayment |

|

OCBC* |

0% p.a. |

9.5% p.a. |

S$900 (9% one-time processing fee) |

S$0 |

S$10,000 |

S$416.67 |

|

HSBC* |

3.7% p.a. |

7.0% p.a. |

S$88 (waived) |

S$740 |

S$10, 740 |

S$447.50 |

|

Standard Chartered Bank* |

3.88% p.a. |

8.27% p.a. |

S$0 |

S$779 |

S$10, 776 |

S$449 |

|

POSB* |

3.88% p.a. |

8.2% p.a. |

S$0 |

S$779 |

S$10, 776 |

S$449 |

|

CIMB |

4.5% p.a. |

8.41% p.a. |

S$0 |

S$900 |

S$10, 900 |

S$454.17 |

|

Citibank (new customers) |

4.82% p.a. |

9.0% p.a. |

S$0 |

S$964 |

S$10, 964 |

S$456.83 |

|

Citibank (existing customers) |

5.39% p.a. |

10.50% p.a. |

S$0 |

S$1, 130 |

S$11, 130 |

S$463.75 |

|

Maybank |

6.38% p.a. |

13.58% p.a. |

S$200 (2% processing fee) |

S$1, 276 |

S$11, 276 |

S$469.83 |

|

BOC |

6.48% p.a. |

15.74% p.a. |

S$300 (3% processing fee) |

S$1, 296 |

S$11, 296 |

S$941.33 |

|

UOB |

8% p.a. |

14.68% p.a. |

S$0 |

S$1, 600 |

S$11, 600 |

S$966.67 |

*Exclusive rate only available on the SingSaver platform, not at the bank

**Estimated rate — actual rat varies depending on bank's approval based on your credit profile

Credit co-ops in Singapore

Credit co-operatives in Singapore stand out by being member-driven entities focused on financial empowerment rather than profit. These organisations aim to offer accessible, affordable financial solutions to their members, who are also the primary stakeholders, fostering a community-centric financial environment.

|

Co-op |

Interest rate |

|

TCC Credit Co-Operative |

6.99% |

|

EsteeMedia Co-operative Ltd (Straits Times Co-op) |

6% |

|

SSBEC |

6.5% |

>> MORE: Best bank loans

Understanding personal loan rates across different credit scores

Credit scores play a pivotal role in your ability to secure personal loans and the interest rates you might incur. In Singapore, credit scores are formulated based on several key financial behaviours and patterns, reflecting a borrower's reliability and risk to lenders.

-

Credit Applications and Utilisation: Applying for multiple credit lines or loans within a short timeframe can raise red flags for lenders. This suggests potential financial stress or over-leveraging, which might lower your credit score.

-

Payment Timeliness (Delinquency): Consistent late payments, or delinquency, tarnish your credit reputation. Regularly missing due dates significantly impacts your score, as timely repayments are a critical measure of creditworthiness.

-

Length of Credit History: A long-standing credit history provides a clearer picture of your financial habits. Lenders favour extensive records of punctual payments over newer or sparse histories.

-

Available Credit: Possessing numerous credit accounts can be a double-edged sword. While this shows you are trusted by multiple financial institutions, excessive open credit lines might suggest potential financial overextension.

>> MORE: How to score a low personal loan rate

Credit scores in Singapore range from 1,000 to 2,000, where a higher score indicates lower risk. The ratings span from HH, signalling high risk, to AA, which represents the lowest risk. These scores influence not only the likelihood of loan approval but also the interest rates offered. Better scores often secure lower rates due to perceived lower risk.

>> MORE: What is an unsecured loan

Impact of your credit score on loan terms

-

Credit Rating and Loan Approval: Your credit score is crucial for lenders when deciding on your loan application. It affects their confidence in your ability to repay and dictates the terms of the loan, including the interest rate.

-

Other Considerations: Lenders also consider factors such as your annual income, employment duration, and any history of bankruptcy when making their decisions.

-

Credit Report Inquiries: When lenders check your credit score, these inquiries are noted and remain on your record for two years, affecting your score. Additionally, different types of default records can remain on your report for up to three years or even indefinitely, depending on their status.

>> MORE: Personal loan requirements

Rebuilding your credit

If your score has dipped, the good news is that credit scores in Singapore are recalculated on a 12-month rolling basis. By ensuring your payments are consistently on time over the next year, you can positively influence your score.

>> MORE: Best personal loans for bad credit

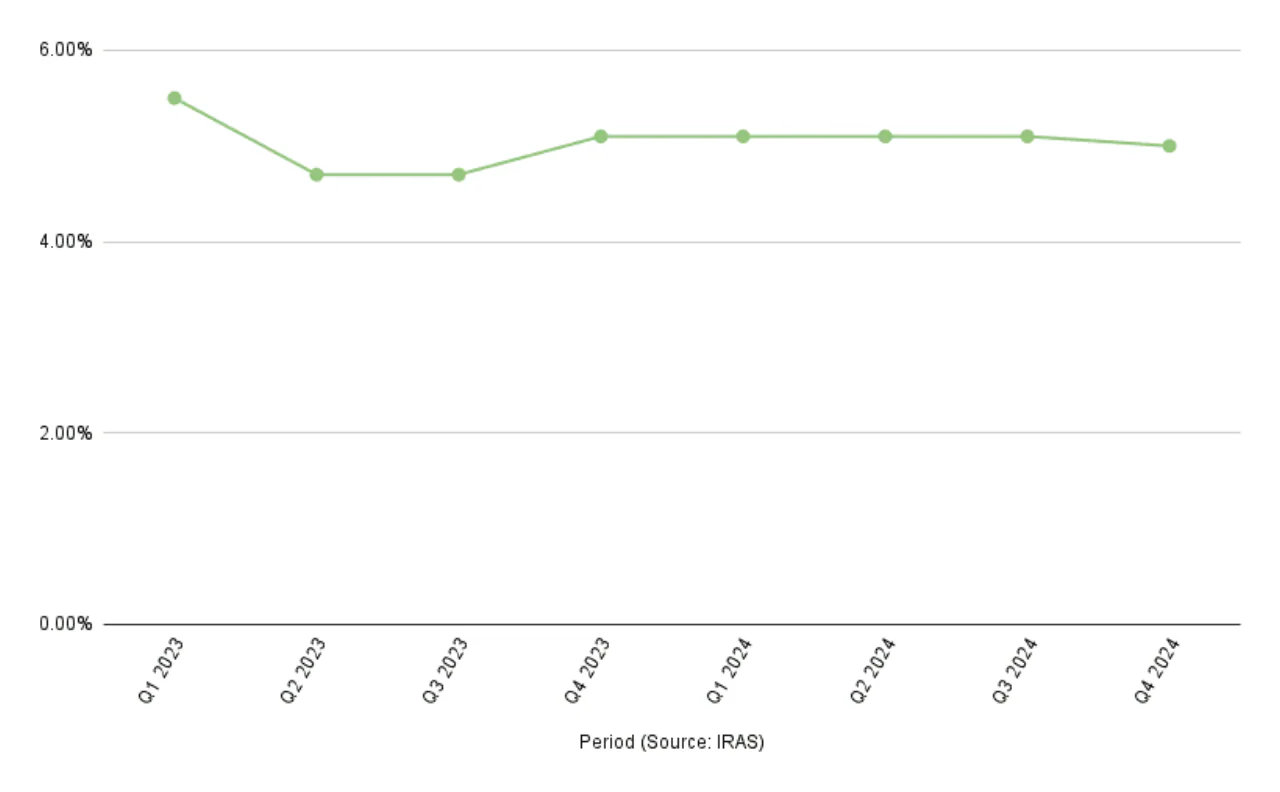

Evaluating current personal loan rates: Are they rising?

In Singapore, personal loan interest rates remain relatively stable. Despite recent stabilisation efforts, rates have not seen significant decreases, mirroring the cautious monetary policy stance. This is in contrast to the refinancing and repricing of mortgage loans among private homeowners and Housing Board flat owners which saw a notable increase in 2024, following a drop in fixed mortgage rates to below 3% starting from the second quarter.

Evolution of bank personal loan rates in Singapore

Co-op personal loan rates in 2025

|

Organization |

Loan rate |

|

SSBEC |

6.5% |

|

TCC Credit Co-Operative |

6.99% |

|

Police Co-Op |

5.50% to 6.00% |

|

EsteeMedia Co-operative Ltd |

6% |

💡 Saver-savvy tip

Navigating rising interest rates? Do not let high APRs weigh you down! Explore a variety of financing options, including personal loans and 0% interest credit cards, to discover the most affordable solution for your needs in Singapore's current financial landscape. Compare rates and features carefully to secure the best deal and keep your borrowing costs low.

Best Personal Loans In Singapore

Exploring the diversity in personal loan interest rates

Lenders determine personal loan interest rates based on various factors that gauge an applicant's risk and repayment capacity. The variability in rates is influenced primarily by the borrower’s creditworthiness, the loan's term length, and the type of lender.

-

Risk Assessment: Lenders evaluate potential risk through a borrower’s credit score, income levels, and debt-to-income ratio. A higher credit score suggests a lower risk, often resulting in more favourable interest rates. Conversely, indicators of financial stress or mismanagement, such as high debt levels or poor payment histories, could lead to higher rates due to perceived higher risks.

-

Loan Term Length: The duration of the loan also impacts the interest rate. Longer loan terms might come with higher interest rates due to the increased uncertainty over extended periods, whereas shorter terms often attract lower rates due to the quicker repayment expectation.

-

Lender Type: The nature of the lender plays a crucial role in the rates offered. Online lenders may cater to specific segments of borrowers, adjusting their rates to match the risk associated with those segments. For example, some online platforms may offer competitive rates to excellent-credit borrowers while charging higher rates for those with less favourable credit histories to mitigate risk.

-

Traditional banks generally offer the lowest rates to existing customers with good credit records, valuing the established relationship and lower perceived risk. Co-ops, on the other hand, can afford to offer lower rates because of their not-for-profit status and member-focused nature.

>> MORE: #ScoreBig Summer Stand to Enjoy 0% Interest on Your Personal Loan

Pre-Qualify to preview loan offers without impacting your credit

While lenders often keep their specific underwriting criteria confidential, many reputable banks, co-ops, and online lenders in Singapore offer pre-qualification options. This allows you to explore potential loan terms, including loan amount, interest rate, and repayment period, without impacting your credit score.

Frequently asked questions about personal loan rates in Singapore

A "good" personal loan rate in Singapore is typically considered to be below 6% per annum (p.a.). However, the best rate for you will depend on factors like your credit score, income, and loan amount. It's always wise to compare offers from multiple lenders to find the most competitive rate.

The interest rate is the basic cost of borrowing, while the EIR reflects the total cost, including the interest rate plus any fees and the effects of compounding. EIR gives you a more accurate picture of the loan's overall cost.

Yes, you can refinance a personal loan to potentially secure a lower interest rate. This involves taking out a new loan to pay off your existing loan, often with more favourable terms. However, carefully consider any associated fees and ensure the new loan aligns with your financial goals.

Alternatives to personal loans include credit cards, which offer revolving credit and potential rewards but often have higher interest rates; lines of credit, providing flexible access to funds; home equity loans, using your home as collateral for a lower rate; and balance transfers, consolidating credit card debt at a lower interest rate for a promotional period. The best choice depends on your individual needs and financial situation.