With Google Pay, you can earn plenty of rewards for P2P money transfers, plus cashback on top of your credit card rewards.

If you’re not already using Google Pay, you’re missing out on a whole lot of free money.

Google has been making an aggressive push for mobile wallet market share ever since launching P2P payments in Singapore back in April, and has plenty of Mountain View cash to burn.

With Google Pay, you can send money to friends and family, make in-store payments, order, food, buy movie tickets and more – all the while earning instant cash rewards (in fact, it’s the only way to earn rewards on PayNow transfers).

Google Pay's Chinese New Year 2021 promotion: From 4 Feb to 26 March, users stand a chance to win a cash angbao ranging from $8.88 to $88.88 with Google Pay’s new social game, Huat pals. Click here to learn more about the promotion and why you should embrace digital angbaos.

Despite the name, Google Pay is available for both Android and iOS mobile devices (although the former have more opportunities to earn rewards – see below). If you haven’t already opened an account, you can get $3 for signing up via a referral code and making a minimum spend of $10.

What’s in it for me?

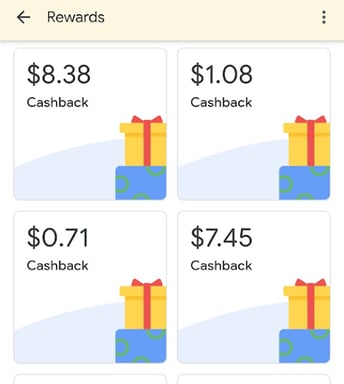

The biggest draw of Google Pay are scratch cards, little surprise mechanics that are awarded upon making in-store payments or sending money to friends. You literally scratch these on your screen, revealing cash prizes of up to $10. All of these are immediately deposited into your bank account via PayNow.

Google allows you to earn up to 4 scratch cards per week (a week is defined as Monday 8.30AM to the following Monday 8.29AM), simply by doing the following.

Send money to friends: Up to 2 cards per week

Instead of using your regular banking app to split the bill after a night out, try sending money through Google Pay instead. You’ll get a scratch card worth up to $10 when a payment of at least S$10 is made.

A maximum of two scratch cards can be received each week for sending money and each transaction must be unique. For example:

- A sends $10 to B = A gets a scratch card

- B sends $10 to A = B gets a scratch card

- A sends $10 to B again = No scratch card because A has already sent to B this month

Tap & Pay OR Scan & Pay: Up to 2 cards per week

Tap & Pay and Scan & Pay used to be separate categories for Google Pay, and each was eligible for up to four scratch cards per week. Google has now grouped them together, and reduced the maximum scratch cards for this category to two.

A maximum of two scratch cards can be received each week for Tap & Pay or Scan & Pay transactions, and each transaction must be unique. For example:

- A uses Tap & Pay for $3 at Merchant X = 1 scratch card

- A uses Tap & Pay for $5 at Merchant X = No additional scratch card, as it’s not a unique transaction

- A uses Tap & Pay for $3 at Merchant Y = 1 scratch card

You will not earn scratch cards for Tap & Pay transactions with American Express and Citibank cards, which do not participate in the Google Pay offers & rewards program in Singapore.

Other Google Pay offers:

- Receive $2.50 cashback when you make a food order of at least $10 on the Google Pay app. A maximum of 1 scratch card can be earned per week.

- Get $2.50 cashback when you purchase movie tickets from Shaw or Golden Village via Google Pay. A maximum of 1 scratch card per movie theater operator can be earned per week.

What credit card should I use with Google Pay?

Google Pay currently supports credit and debit cards from the following issuers in Singapore:

- American Express

- Citibank

- DBS

- MatchMove Pay

- OCBC

- POSB

- Revolut

- Standard Chartered Bank

- TransferWise

- UOB

Notable exclusions are Bank of China, HSBC, and Maybank.

Using Google Pay is conceptually similar to tapping your physical card at the merchant’s credit card terminal, so you should use whatever card you would normally use for that particular merchant.

If you want a quick and easy solution, use the UOB Preferred Platinum Visa. This card awards 4 miles per dollar (mpd) on the first $1,110 spent, regardless of merchant. Alternatively, you could use the UOB Visa Signature for 4 mpd too, but this requires a minimum of $1,000 spending per statement month (with a cap on 4 mpd of $2,000).

Otherwise, you can consider using the following cards for dining transactions:

- UOB Lady’s Card: 4 mpd on the first $1,000 per month. Must declare dining as your quarterly bonus category.

- UOB Lady’s Solitaire Card: 4 mpd on the first $3,000 per month. Must declare dining as your quarterly bonus category.

- OCBC VOYAGE: 2.5 mpd on the first $1,000 of dining, up until 31 January 2021

If you’re shopping for apparels or at department stores, the following cards are good options:

- Citi Rewards: 4 mpd on the first $1,000 per statement month (remember that Citibank cards are not eligible for Google Pay scratch cards)

- OCBC Titanium Rewards: 4 mpd on the first $12,000 per membership year

- UOB Lady’s Card: 4 mpd on the first $1,000 per month. Must declare fashion as your quarterly bonus category.

- UOB Lady’s Solitaire Card: 4 mpd on the first $3,000 per month. Must declare fashion as your quarterly bonus category.

Conclusion

Google Pay is an excellent way to earn cashback on top of your regular credit card rewards, and is the only platform that rewards you for P2P money transfers. It remains to be seen how long they maintain this level of generosity, but it’s a reminder to make hay while the sun shines!

Read these next:

8 Best Budgeting Apps to Save Your Way to Success

Credit Cards That Get You Instant Approval And Digital Cards

Ultimate Guide To Digital Multi-Currency Accounts

Top Credit Card Promotions And Deals On SingSaver

Best Cashback Credit Cards In Singapore 2020

Similar articles

Visa Supplier Locator: Find And Decode Any Credit Card MCC

Card Combos: How to Match Credit Cards to Your Spending Patterns

How To Earn Miles On MRT And Bus Rides With SimplyGo

Samsung Pay and Samsung Rewards: All The Cool Stuff You’re In For

Best Credit Cards For Mobile Wallet Payments (2024)

MCC: The Three Most Important Letters When Earning Air Miles (or Cashback)

FavePay CardLink Launches: Earn Bonus Cashback Plus Credit Card Rewards

GrabPay Wallet Update: You Can Now Make Transfers To Your Bank Account. Here’s Everything To Know.

.png?width=280&name=UOB_MIGHTYFX_FIXED%20FEE_BLOG%20HERO%20(1).png)