Whether you got your sights set on the new Samsung Galaxy S21 or not, here’s a unique feature of Samsung phones every Samsungnite should know: Samsung Pay

With all the buzz surrounding the Samsung Galaxy S21’s release, those not intending to upgrade to the company’s latest flagship may feel a little left out. But even if you’re holding on to your last generation Samsung phone, there’s one unique feature every Samsung user should know about: Samsung Pay.

What is Samsung Pay?

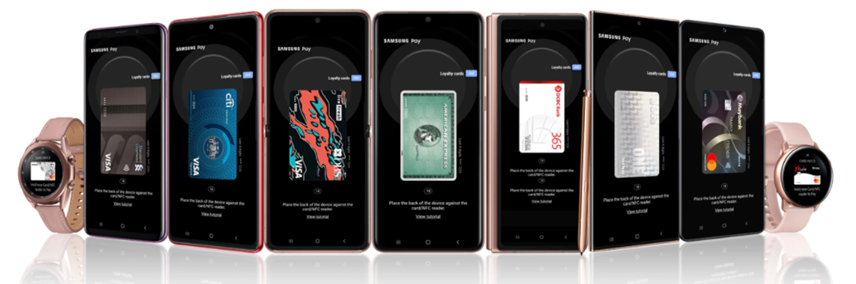

Samsung Pay is a mobile wallet solution, similar to Apple Pay or Google Pay. It’s compatible with a wide range of Samsung phones and watches, with support starting from the S6 line of phones.

Samsung Pay currently supports cards from the following issuers:

- American Express

- Citibank

- DBS

- Fevo

- Grab

- Maybank

- OCBC Bank

- POSB

- Standard Chartered

- UOB

*Samsung Pay also allows you to digitise your loyalty cards from retailers like TANGS, Swarovski, Mango and Courts. This is arguably less useful, in light of how most loyalty programs already offer digital cards (or link your account to your phone number).

Just like Apple Pay and Google Pay, transactions can be made through NFC; simply hold your phone up to the terminal wherever contactless payments are accepted

But even if you encounter the odd terminal that doesn’t take contactless payments, Samsung has a nifty trick up its sleeve known as Magnetic Secure Transmission (MST). In plain English, the phone simulates a magnetic pulse that makes the credit card terminal believe a physical card has been used (even for chip-only machines). This allows you to use your phone to pay even at very old machines.

Do note that the Samsung Galaxy S21 will not support MST, however, a sign that contactless payments have become so ubiquitous that the technology is no longer needed.

Why should I use Samsung Pay?

That’s all good and well, you say. But why bother with Samsung Pay when all Samsung phones run Android, and Google Pay offers fundamentally the same thing?

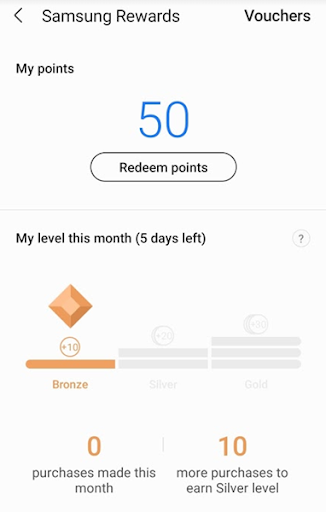

Two words: Samsung Rewards. Samsung Rewards launched in Singapore on 15 September 2017, making it the first Southeast Asian country to get the loyalty program. Rewards points are earned when using Samsung Pay, and can be redeemed for a range of gift vouchers and merchandise.

There are three tiers in the scheme: Bronze, Silver, and Gold. All members start off at the Bronze level, and will qualify for Silver or Gold based on the number of transactions they make during a given calendar month.

| Bronze | Silver^ | Gold* | |

| Qualification | N/A | 11-30 transactions per month | 31-50 transactions per month |

| Points per transaction | 10 | 20 | 30 |

^Earned with the 10th transaction, but you only earn 20 points per transaction from the 11th transaction onwards

*Earned with the 30th transaction, but you only earn 30 points per transaction from the 31st transaction onwards

The first thing you’ll note about Samsung Rewards is that points are awarded based on the number of transactions, not transaction size. This means you could easily game your way to Gold by breaking down your transaction into smaller quantities. A simple way to do this would be to do your grocery shopping at an NTUC or Cold Storage with a self check-out kiosk, and pay for each item separately (please do it during off peak times though!).

However, you can only accrue points for up to 50 transactions per month, which means the maximum points you could earn each month is 1,500 (by a Gold member making 50 transactions at 30 points/transaction).

Any points earned are valid for six calendar months, through to the last day of the month. For example, all the points I earn in January 2021 will be valid till 31 July 2021. Transaction counts reset on the first day of each month, and you’ll carry over your status accordingly.

Samsung Rewards are issued on top of your usual credit card rewards. For example, if I digitise my DBS Altitude Visa and use it with Samsung Pay for a S$50 transaction, I’ll earn 60 miles (at 1.2 miles per dollar), plus 10 Samsung Rewards points (assuming I’m a Bronze member). It’s essentially double dipping, at no additional cost to you.

What rewards can I claim?

The Samsung Pay Rewards catalogue is regularly rotated, so be sure to check your Samsung Pay app for the latest selections. Some sample rewards include:

- 2,000 points for a S$20 Samsung accessories voucher

- 2,900 points for a Pizza Hut personal pan pizza

- 3,900 points for Italian Black Summer Truffle Popcorn

- 5,000 points for a S$50 Samsung accessories voucher

Based on the cost of Samsung accessories vouchers, there’s a rough value of S$0.01 per point. Samsung will occasionally add limited-quantity vouchers which boost the value significantly (for example, a S$5 foodpanda voucher for 2,800 points). These disappear quickly, so be sure to grab them when you see them.

Are there any downsides?

In one sense, there’s no outright cost to using Samsung Pay. As mentioned, you’ll still earn your credit card rewards as per normal – it’s conceptually similar to paying with your physical card.

In another sense, however, there’s an opportunity cost involved. Paying with Samsung Pay means foregoing Google Pay and its scratch card rewards. These vary from week to week, but the current promotion allows you to earn up to S$10, twice a week, by using Google Pay’s Scan and Pay function for a payment of at least S$3.

Realistically speaking, you probably won’t earn S$10. The value is determined by Google’s algorithm, and based on my personal experience, rewards of less than S$1 are more common. Besides, with a cap of just two scratch cards per week, you’re likely to max it out in no time at all.

Therefore, there’s very little reason why you shouldn’t be using Samsung Pay, assuming your phone supports it. Earn your Google Pay scratch cards where you can, but after you exhaust the limit, switch over to Samsung Pay to rack up points on the rest of your transactions.

Conclusion

Samsung Pay is easy to set up and use, and helps lighten your wallet (in terms of cards you carry around, hopefully not in terms of overspending!). The rewards points earned with each transaction let you claim a nice treat every now and then, and given how easy it is to hit Gold status, you should be racking up 30 points per transaction in no time flat.

Best of all, you don’t need the latest Galaxy S21 to use it.

Read these next:

Google Pay: Free Cashback On PayNow Transfers And In-store Payments

Mobile Wallets In Singapore: Complete 2021 Guide

Best Cashback Credit Cards In Singapore

Top Credit Card Promotions And Deals On SingSaver

9 Best Budgeting Apps To Save Your Way To Success

Similar articles

How Your Mobile Phone Makes You Spend More Money

Google Pay: Free Cashback On PayNow Transfers And In-store Payments

Miles All Locked Up From 2020? Why Not Give These Rewards A Shot?

How Much Can You Get From Trading In Your Old Phone in Singapore?

Mobile Wallets In Singapore: Complete 2023 Guide

Which Is The Best Phone To Buy In 2022? Top Smartphones To Consider

All You Need To Know About The New Singtel Dash Rewards Program

Your Travel Essentials List for 2024