Buy Now, Pay Later vs Credit Cards: Which One’s More Dangerous?

Updated: 12 Dec 2025

The BNPL vs credit cards dilemma is real. Find out what each has to offer, which one’s superior or even potentially more dangerous for shoppers.

As more retailers jump onto the Buy Now, Pay Later (BNPL) bandwagon, it’s worth taking a closer look at this increasingly popular payment scheme that’s garnered considerable concern from the Monetary Authority of Singapore (MAS).

In fact, a Buy Now Pay Later code of conduct was announced on 20 October 2022, whereby users will not be able to accumulate more than S$2,000 in outstanding payment. Once a payment is overdue, users will not be able to make further purchases using the service.

Only time will tell whether this will help consumers avoid over-indebtedness, but at least an important step has been made.

The main draw of BNPL facilities is that your purchase becomes more affordable instantly. You only need to pay a third of the price up front and settle your two remaining instalments on their respective payment due date — all without extra fees and charges.

How then does BNPL compare with traditional credit cards? Read on to find out what they have in common, their differences and our two cents on which one’s potentially more dangerous.

✨Get the Reward Upgrade You Deserve✨

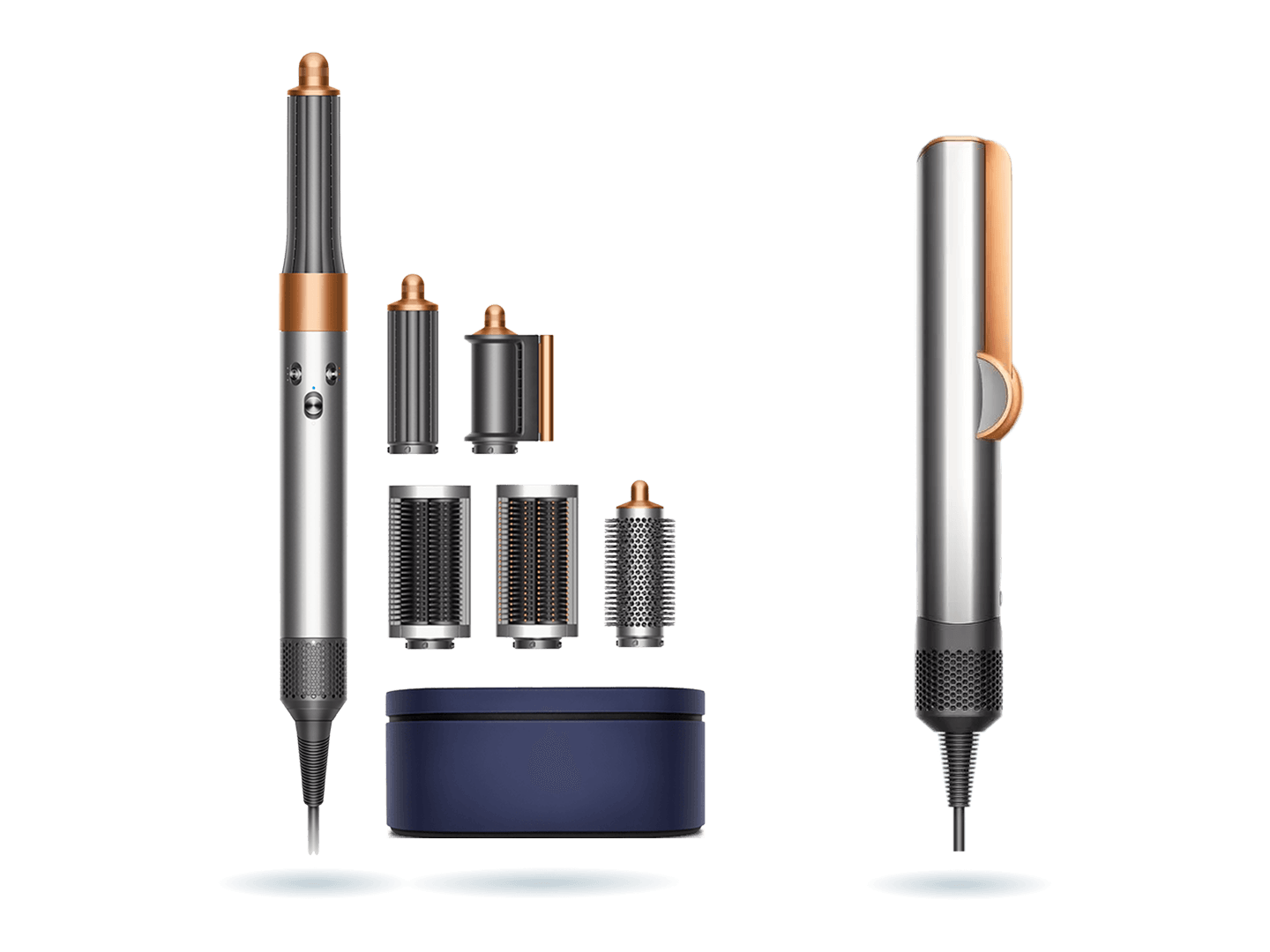

Get your dream Apple, Dyson, Sony, or Nintendo gadgets when you apply for select Citi, HSBC, OCBC, or Standard Chartered credit cards via SingSaver and top up as low as S$60! Valid till 1 March 2026. T&Cs apply.

SingSaver CNY 2026 Flash Deal

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

What Buy Now, Pay Later and credit cards have in common

#1 Convenience

BNPL and credit cards are utterly convenient for consumers making payments. As more and more merchants jump aboard the BNPL bandwagon, consumers have increasingly many opportunities to use BNPL platforms when shopping in store and online. BNPL facilities require users to link their credit or debit cards for payments.

Credit cards have always been a convenient mode of payment for consumers, whether they’re buying things locally, overseas or online. Visa, Mastercard and American Express are the main payment processing networks that facilitate payments made via credit cards.

Of course, when you compare side by side, more merchants are bound to accept credit cards than those who have hopped on the BNPL bandwagon. In Singapore at least, BNPL is so new compared to credit cards.

#2 Promotions

BNPL platforms and their partner merchants often run promotions similar to what banks do with their partner merchants. Similarly, consumers can expect a boost in the number of promotions available to them during big retail events like 11,11 and Black Friday sale, the Great Singapore Sale and more.

SingSaver x HSBC Live+ Credit Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$450), Apple Watch SE Gen 3 or S$400 Cash when you apply for an HSBC Live+ Credit Card via SingSaver and fulfil promo requirements. You can also top up from just S$60 to upgrade to the latest Dyson, Sony or Apple products. Valid until 1 March 2026. T&Cs apply.

SingSaver CNY 2026 Flash Deal

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

How Buy Now, Pay Later and credit cards differ

|

BNPL |

Credit Cards |

|

|

0% interest instalments |

Yes; no processing fee + can earn credit card rewards |

Yes; with processing fee + cannot earn credit card rewards |

|

Late payment fees |

Yes |

Yes |

|

Late payment interest charges |

Not applicable |

Yes; it compounds too |

|

Credit limits |

Much lower than credit card limits |

Usually up to 4X your monthly income |

|

Accessibility |

Unparalleled |

Less accessible |

#1 0% interest instalments

BNPL

BNPL facilities let consumers enjoy 0% interest instalments without any processing fees. Plus, if you use a rewards credit card to make your purchase through Hoolah, Rely, Split or Pace, you can continue to earn your cashback, rewards points or miles even though you are technically paying in instalments.

Credit cards

Major merchants have tie-ups with banks to offer consumers 0% interest instalment plans for a specific duration of time, usually ranging between three and 12 months, when they use certain credit cards. This is especially common when it comes to big ticket items such as furniture, home appliances and fancy aesthetic treatment packages.

However, keep in mind this often comes with a one-time processing fee that ranges according to the transaction amount. Unless the bank is running some special promotion, this processing fee is almost always a given — take this into account if you’re considering 0% interest instalment plans.

Purchases bought on 0% interest instalments through credit cards are also not eligible to earn rewards points, miles or cashback.

#2 Late payment fees

BNPL

BNPL players are quick to tell consumers that what they see is what they’ll pay — no hidden charges and processing fees are involved.

What is often obscure and strategically slid into their FAQ or Help sections? Late payment fees and charges. These fees will kick in if your transactions were paid for using a debit card but there aren’t sufficient funds in your linked savings account.

Here’s a quick rundown of the late payment fees all BNPL consumers need to know.

|

BNPL Provider |

Late Payment Fees |

|

Hoolah |

S$5: Order value S$99.99 or below S$15: Order value between S$100 and S$999.99 S$30: Order value S$1,000 and above Possible suspension of account |

|

Atome |

S$15 administrative fee |

|

Rely |

S$1 to S$40 depending on order value + possible suspension of account |

|

Split |

S$0 |

|

Pace |

S$10: One-time fee applied for each overdue instalment + possible deactivation of account Extra fee of S$1/day will apply if instalment remains unpaid after due date For purchases below S$40: A maximum of one S$10 late fee may be applied per instalment payment For purchases S$40 and above: Additional late fee capped at S$60 or 25% of the original transaction value, whichever is lower, per instalment |

Credit cards

Credit card issuers have no qualms charging late payment fees if you don’t at least make the minimum payment on or before the stated payment due date. For instance, Citibank and DBS both charge a late payment fee of S$100. American Express charges a late fee of S$90.

As it stands, this fee ranges depending on what your credit card issuer charges. Scrutinise your credit card agreement to find out exactly what you’re in for if you make a late payment.

SingSaver x Citi Rewards Credit Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$450), Apple Watch SE Gen 3 40mm (GPS), or S$380 Cash when you apply for a Citi Rewards Card and fulfil promo requirements. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

SingSaver CNY 2026 Flash Deal

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid till 26 February 2026. T&Cs apply.

#3 Late payment interest charges

BNPL

No, there are no late payment interest charges consumers have to deal with when they miss their instalment payments.

Credit cards

One of the biggest reasons why some people refuse to use credit cards is their sky high interest rates that compound and snowball sooner than you can imagine. While different banks have different interest rates, the prevailing interest retail interest rate is around 25.9% to 26.9% p.a. at this time. This interest rate can go up to 29.9% p.a. in the event your credit card account is past due.

#4 Credit limits

BNPL

This might surprise you but BNPL players actually conduct internal assessments and have in-house risk management systems in place in the name of minimising bad credit risk. For instance, BNPL player Split utilises technology to determine whether or not a transaction can be approved. New users are only allowed to have one active instalment plan at any point in time.

Rely has set the maximum transaction limit at S$4,000 for credit card payments and S$1,000 for debit card payments. The BNPL player has made it clear that limits are usually lower for new shoppers until they get to know them better.

Similarly, Pace’s maximum transaction limit is capped at S$3,000 for credit card payments and S$1,500 for debit card payments.

Credit cards

Credit card issuers usually offer cardmembers a credit limit of up to 4X their monthly income. This is in line with MAS regulations pertaining to individuals aged 55 and below with an annual income ranging from S$30,000 to S$120,000.

There’s no regulatory limit for those earning more than S$120,000 or those with net personal assets of at least S$2 million, or net financial assets of at least S$1 million.

What about people with an annual income of S$30,000? MAS regulations allow financial institutions to grant them a credit limit of up to 2X their monthly income.

#5 Accessibility

BNPL

Debit cards are an accepted mode of payment so young consumers can utilise BNPL facilities even without a solid credit history or existing employment. The minimum user age varies across BNPL players, though. For instance, Atome, Pace and Hoolah’s minimum user age is 18 while Rely’s is 21.

Credit cards

Most credit cards in Singapore are available to those earning at least S$30,000 per annum. For those looking to apply for a non-student credit card, they must also be employed for at least three to six months consecutively.

⚡SingSaver x UOB Lady's Card Flash Deal⚡

Get up to S$888 Cash via PayNow or 55,000 MaxMiles by HeyMax (worth S$990) (enough for a round trip to Europe (e.g. Paris, Rome, Madrid) when you apply for a UOB Lady's Card and make a minimum spend of S$800 within the first month of card approval. Valid till 28 February 2026. T&Cs apply.

BNPL vs Credit Cards: Which one is more dangerous?

Not going to sugar coat anything: BNPL facilities are attractive. With its massive rise in popularity, and the fact that you can make split payments at a whim, it’s so easy for one to overspend or purchase on impulse. That in itself is incredibly dangerous as most consumers are inclined to think that their purchases don’t ‘hurt’ their wallets as much as paying everything at one go.

In case you didn’t already know, the Monetary Authority of Singapore has also raised concerns regarding rising consumer debt due to the proliferation of BNPL facilities’ user base. MAS is also considering regulating the BNPL industry.

Can’t wait to be more savvy with your money? Check out these invaluable tips on using credit cards and BNPL facilities to consumers’ advantage.

Learn what really happens if you skip credit card bills, loan & BNPL payments! Late fees and interest charges are just the tip of the iceberg. Trust us, you will not see credit cards and BNPL facilities the same way ever.