Is Bitcoin a Good Investment Long Term?

Updated: 11 Dec 2025

Navigating the volatile world of Bitcoin: Understanding the risks and rewards.

Bitcoin, the world's first and largest cryptocurrency, has carved a unique niche in the financial landscape. Its decentralised nature and potential for high returns have attracted investors and traders alike. But is Bitcoin a good investment, particularly for those in Singapore? This article delves into the intricacies of Bitcoin investment, guiding you through the potential benefits and risks to help you determine if it deserves a place in your portfolio.

Does Bitcoin belong in your portfolio?

Deciding whether to invest in Bitcoin requires careful consideration of your financial situation, risk tolerance, and investment goals. In Singapore, where investors often lean towards stability and regulated markets, Bitcoin's volatility and decentralised nature can seem daunting.

Investing in Bitcoin is generally advisable only if:

-

You have a high risk tolerance.

-

You are in a strong financial position.

-

You can afford to lose some or all of your investment.

If you choose to invest, remember that diversification is key. Maintain a balanced portfolio that includes various asset classes to mitigate your overall risk exposure. As a general rule, limit your investment in volatile assets like Bitcoin to no more than 10% of your total portfolio.

>> More: How to Buy Bitcoin in Singapore.

Bitcoin investment in Singapore for beginners

For those new to the world of cryptocurrency, understanding the pros and cons of Bitcoin investment is crucial.

Bitcoin Pros

-

Potential for high returns: Bitcoin has historically delivered significant returns, attracting investors seeking substantial gains. In December 2024, Bitcoin's price surged past US$100,000, showcasing its potential for eye-popping yields (its closing price 3 years before was US$40,000; 5 years before, it was US$6,612). However, past performance is not indicative of future results.

-

Decentralisation: Bitcoin operates independently of central banks and governments, offering a potential hedge against traditional financial systems.

-

Hedging against inflation: Some proponents believe Bitcoin's finite supply could offer a hedge against inflation, similar to gold. However, this remains a subject of debate as Bitcoin's correlation with inflation has been inconsistent historically. Further research and analysis are needed to determine its true effectiveness as an inflation hedge.

Bitcoin's growing popularity and increasing institutional interest suggest that its value could continue to rise in the long term.

>> More: Should You Use a Credit Card to Buy Cryptocurrency?

Saver-savvy tip

While Bitcoin has shown periods of non-correlation with traditional assets, it's crucial to remember that diversification is not a guarantee against loss. Bitcoin's price can still be influenced – tremendously, even – by factors such as regulatory changes, market sentiment, and technological developments.

Before incorporating Bitcoin into your portfolio, it's essential to:

-

Assess your risk tolerance: Determine how much risk you are comfortable taking with your investments.

-

Conduct thorough research: Understand the factors that can influence Bitcoin's price and the potential risks involved.

-

Consider your investment goals: Align your Bitcoin investment with your overall financial objectives and time horizon.

Diversification is a valuable strategy, but it should be implemented thoughtfully and in conjunction with a well-defined investment plan.

Bitcoin Cons

-

High volatility: Bitcoin's price is notoriously volatile, with dramatic price swings occurring frequently. This volatility can lead to significant gains but also substantial losses. For example, Bitcoin experienced an 80% drop in 2013, highlighting the extreme fluctuations investors may face.

-

Lack of regulation: The cryptocurrency market in Singapore, while evolving, still lacks the comprehensive regulation seen in traditional financial markets. For instance, there is no equivalent of the Securities Investor Protection Corp. or the Federal Deposit Insurance Corp. to protect investors in case of platform failures

-

Security risks: Storing and managing Bitcoin comes with security challenges. Hacks, scams, and the potential for loss due to forgotten or stolen wallet credentials are real concerns.

It's important to remember that Bitcoin is a speculative asset, and its price fluctuations are often driven by sentiment and market speculation.

Saver-savvy tip

Given the security risks associated with Bitcoin, it's crucial to take proactive steps to protect your investment:

-

Choose a reputable exchange: Opt for well-established cryptocurrency exchanges with a strong track record of security.

-

Enable two-factor authentication (2FA): Add an extra layer of security to your exchange account by enabling 2FA.

-

Use a strong password: Create a unique and complex password for your exchange account and any wallets you use.

-

Consider a cold wallet: For enhanced security, consider storing your Bitcoin in a cold wallet, which is an offline storage device.

-

Be wary of scams: Exercise caution when interacting with unfamiliar individuals or websites related to Bitcoin.

By implementing these security measures, you can significantly reduce the risk of losing your Bitcoin to hacks or scams.

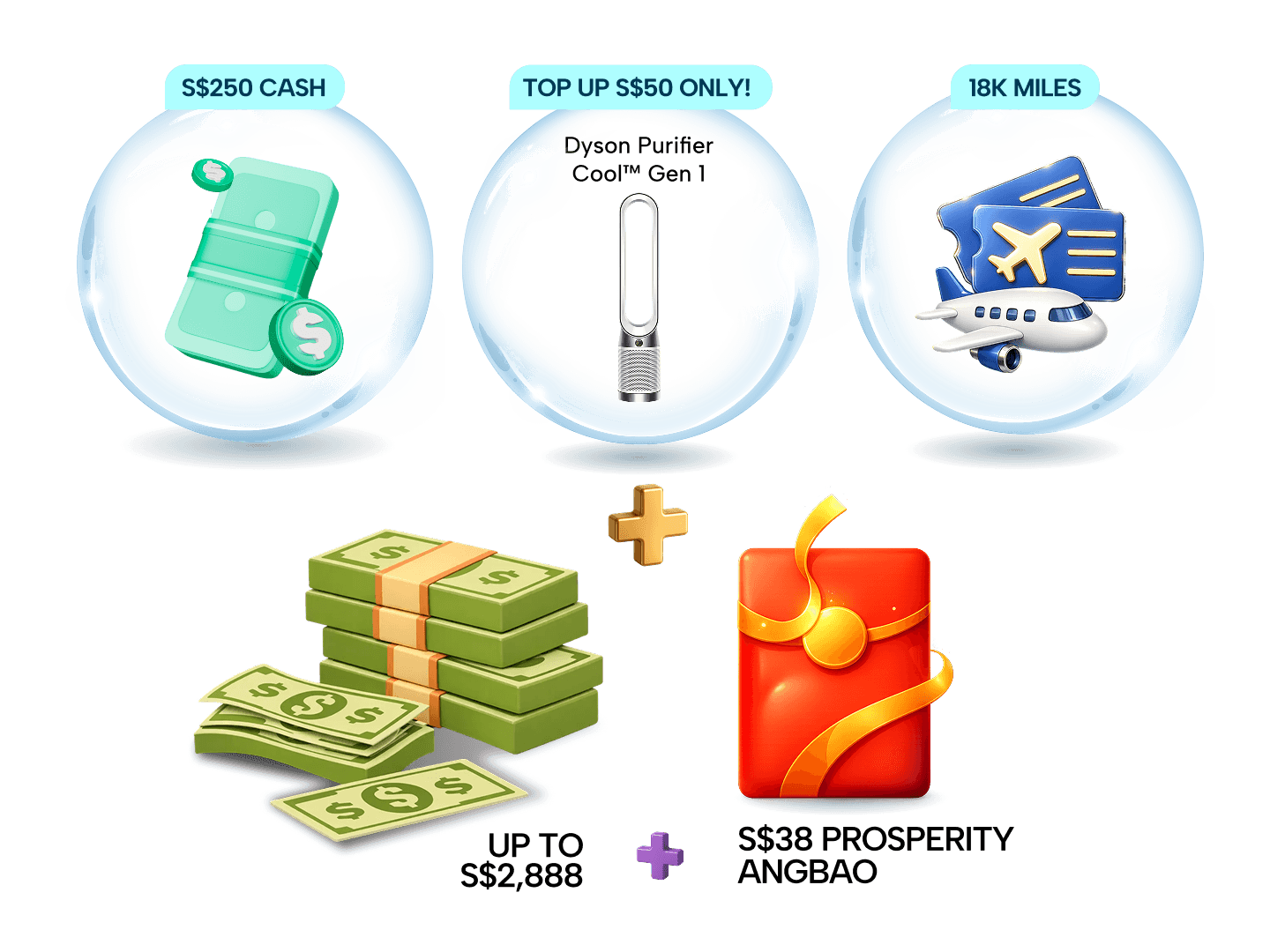

SingSaver x IG Asia Exclusive Offer

Get S$250 cash or an upsized S$300 eCapitaVoucher or 18k Max Miles by Heymax (worth S$324) when you sign up for an account with IG Asia via SingSaver, deposit a minimum of S$1,000, and make one qualified trade. Or, top up as low as S$50 to get a Dyson Purifier Cool™ TP10. Valid till 1 March 2026. T&Cs apply.

What kind of investment is bitcoin?

Bitcoin defies easy categorisation. Unlike stocks or bonds, it doesn't represent ownership in a company or a debt obligation. It doesn't generate revenue, issue dividends, or have a centralised governing body.

To elaborate, Bitcoin operates on a decentralised network, with no single entity controlling its operations. Its value is derived from its scarcity, the underlying technology (blockchain), and market demand. This makes it fundamentally different from traditional investments that are tied to tangible assets or company performance.

Some argue that Bitcoin is a commodity, similar to gold, due to its finite supply. Others believe it's a currency, although its use for everyday transactions remains limited in Singapore. It's also possible that Bitcoin represents an entirely new asset class.

Is Bitcoin a good portfolio diversifier?

Bitcoin's unique characteristics and its relatively low correlation with traditional asset classes like stocks and bonds suggest it could offer benefits when it comes to diversifying portfolios. However, it's essential to consider that Bitcoin's correlation with traditional markets in Singapore may behave differently due to local market conditions and regulatory factors.

For example, while Bitcoin has shown periods of non-correlation with the S&P 500 in the past decade, it also experienced a significant downturn alongside the stock market in 2022. This suggests that Bitcoin is not entirely immune to broader market trends.

Furthermore, regulatory developments in Singapore, such as potential restrictions on cryptocurrency trading or taxation, could impact Bitcoin's performance and its correlation with other assets. Investors should closely monitor the evolving regulatory landscape and consider its potential implications for their portfolios.

Should I invest in Bitcoin considering its volatility?

Bitcoin's volatility is undeniable. Its price can fluctuate dramatically in short periods, posing significant risks for investors. Compared to other investments commonly held by Singaporean investors, such as REITs or stocks, Bitcoin's volatility is considerably higher.

Before investing in Bitcoin, carefully assess your risk tolerance and investment goals. If you're uncomfortable with high volatility, Bitcoin may not be suitable for you. However, if you're willing to accept the risks and believe in Bitcoin's long-term potential, it could be a worthwhile addition to your portfolio.

Remember, thorough research and careful consideration are essential before investing in any asset, especially one as volatile and complex as Bitcoin.

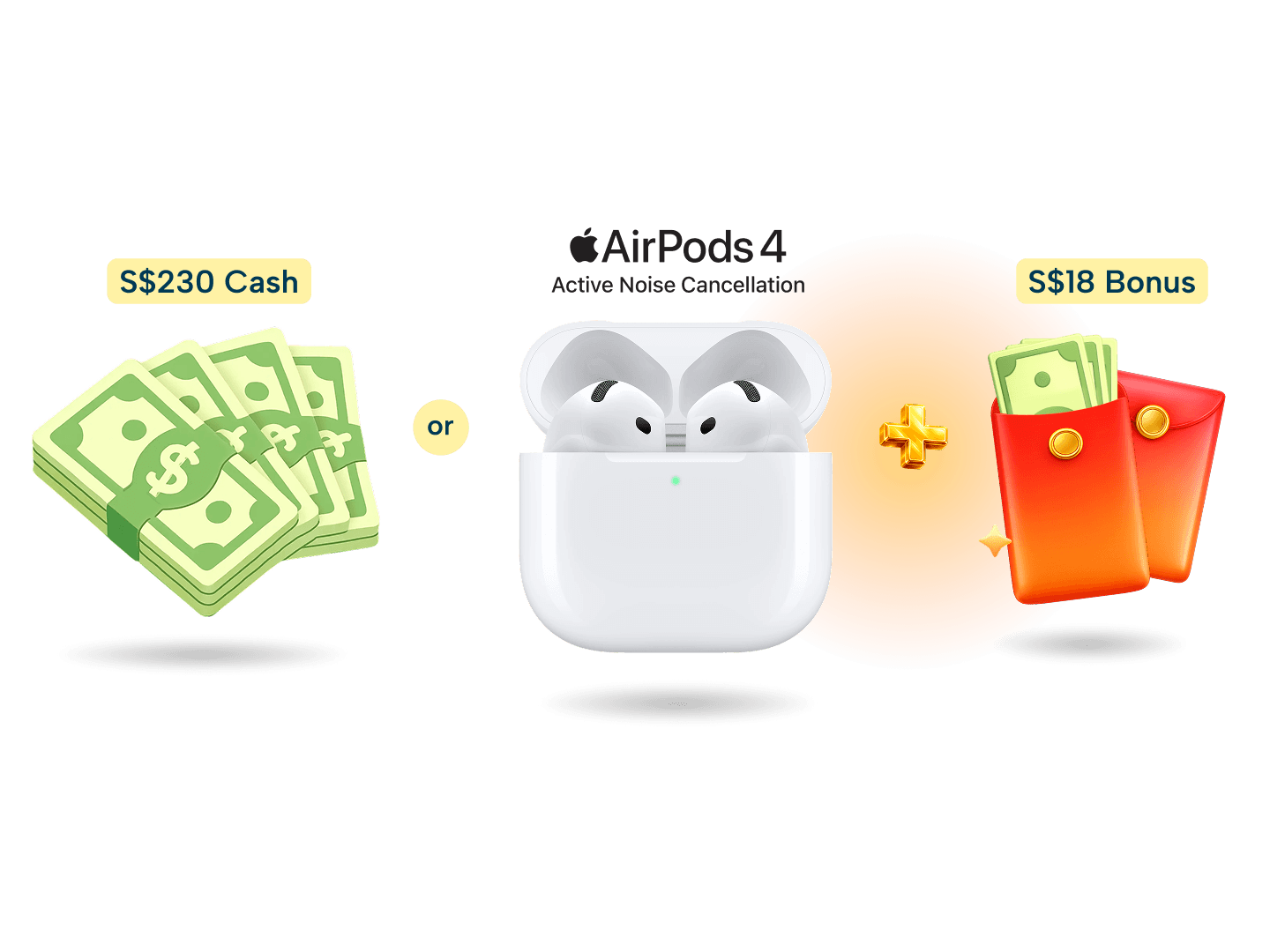

SingSaver x FOREX.com Exclusive Offer

Receive an upsized S$280 Cash, an Apple Airpods 4, or 20k Max Miles by Heymax (worth S$270) when you sign up for a FOREX.com account, fund a minimum of S$1,000.00 and make at least 3 trades. Valid till 15 February 2026. T&Cs apply.

🧧SingSaver CNY Special Offer🧧

Fire up your investing with over S$3,188 in daily red packet bonuses! At 8 pm daily, the first 20 applicants of select brokerages get an extra S$18 on top of guaranteed rewards. Over 2,000 red packets up for grabs! Valid till 15 February 2026. T&Cs apply.