Understanding Your Credit Card Limit: What You Need To Know

Updated: 10 Dec 2025

Understanding your credit card limit is essential when using credit cards in Singapore. Here’s what you need to be aware of, how your personal credit card limit is determined, and tips to manage your credit limits successfully.

The reason you can use your credit card to pay for things is because it comes with a credit card limit. Essentially, your card issuer pays on your behalf at the point of sale, then sends you a bill for all your card transactions at the end of the month.

How much you can charge to your credit card each billing cycle hinges on how large your credit card limit is, which is, in turn, influenced by a few factors. Let’s take a closer look at credit card limits and how they work.

Credit card limits explained – how do they work?

Every credit card comes with a credit card limit, which is an amount of funds you are pre-approved to use at your discretion.

Your credit limit is permanent and remains until you start using your credit card.

When you pay with your card, the transaction amount is deducted from your current credit card limit. This happens for every transaction you make, until the end of the billing cycle – or until the credit limit is reached.

At the end of the billing cycle, your card issuer generates a card statement that tallies all the transactions you’ve made. It will also display what’s known as your credit card balance, which is the amount you have to pay by the due date.

Once you make the payment, your credit limit is restored by the same amount, and you are free to continue using your credit card.

If you fail to pay off the balance in full, your credit card will only be restored by the amount you paid. This means your credit card limit will be at a lower level than originally granted. To restore your credit card limit to full, you need to pay off your balance completely.

Note that interest will be charged on the remaining balance, which will be rolled over into your next statement. This is not ideal, and repeated occurrences will damage your credit score and burden you with unnecessary debt.

Hence, you should always strive to pay off your credit card balance in full every billing cycle.

What determines my credit card limit in Singapore?

MAS regulations on credit card limits in Singapore

To control debt levels and encourage responsible use of credit, the Monetary Authority of Singapore (MAS) has put regulations and guidelines in place regarding credit card limits.

Financial institutions are only allowed to issue credit cards to applicants who meet any one of the following criteria:

-

55 years and below

-

Annual income (including non-employment income) of at least S$30,000.

-

Total net personal assets of/exceeding S$2 million

-

Total net financial assets of/exceeding S$1 million

-

-

Above 55 years

-

Annual income (including non-employment income) of at least S$15,000

-

Total net personal assets exceeding S$750,000

-

A guarantor whose annual income is at least S$30,000

-

And here are the regulatory credit limits stipulated by the MAS:

|

55 years and below |

|

|

Annual income |

Credit limit |

|

S$30,000 to S$120,000 |

Up to four months' income |

|

More than S$120,000 (or net personal assets exceeding S$2 million, or net financial assets exceeding S$1 million) |

No regulatory limit |

|

Above 55 years old |

||

|

Net personal assets |

Annual income |

Credit limit |

|

S$750,000 to S$2 mil |

Up to S$15,000 |

Up to S$2,500 |

|

Up to S$2 mil |

S$15,000 to S$30,000 |

Up to two months' income |

|

Up to S$2 mil |

S$30,000 to S$120,000 |

Up to four months' income |

|

Any |

S$120,000 and above |

No regulatory limit |

|

More than S$2 mil |

Any |

No regulatory limit |

Borrower’s consent on credit card limits

Regulatory credit limits notwithstanding, banks and financial institutions are required to either ask the applicant what their preferred credit limit is, or to obtain consent for the credit limit granted.

This is to help reduce overspending and ensure applicants are granted credit limits they are comfortable with.

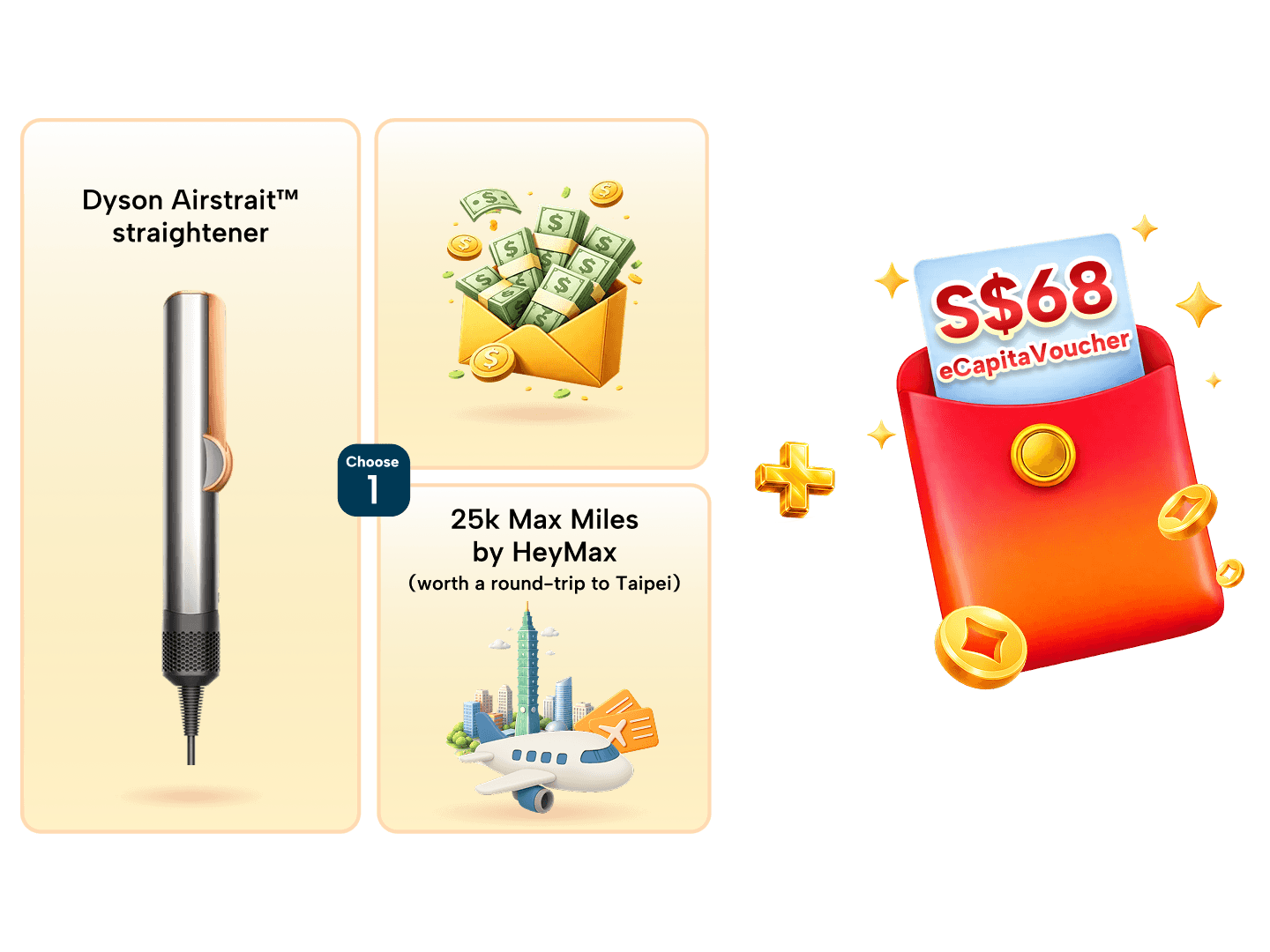

SingSaver x Citi PremierMiles Card Exclusive Offer

Get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 40mm (GPS), or up to S$410 when you apply for a Citi PremierMiles Card and fulfil promo requirements. Valid until 1 March 2026. T&Cs apply.

Or, Get the Reward Upgrade You Deserve!

You can also top up from just S$60 to upgrade to the latest Apple gadgets, Dyson products, Sony Headphones or Nintendo Switch 2. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid until 1 March 2026. T&Cs apply.

Can I have different credit limits on different cards?

Yes, you can, and in fact, it is common to be granted a limit of, say S$8,000, by one card issuer, and a S$6,000 limit by another – even if you request the same limit during application.

Banks independently evaluate your credit risk when processing your card application, and one financial institution may come to a different conclusion than another. This can result in different credit limits on cards issued by different banks.

If that bothers you, try using your credit cards for a few months to establish a credit history, then requesting a credit limit review to alter your credit limits to your preference.

What is the maximum credit card limit in Singapore?

There is no universal upper limit for credit cards in Singapore. Rather, the maximum credit limit depends on the applicant’s income level, as explained above.

Thus, as long as you have the financial standing, you can ask for any credit card limit you want. This doesn't mean you’ll get it though – your card issuer will use their own discretion in granting your credit limit; after all, they are taking on risk since credit cards are unsecured credit facilities.

Tips on proper management of credit card limits

How much of my credit limit can I use in one go?

Once your credit limit is granted, you are at liberty to use the entire sum in one go, if you wish.

But of course, just because you can do so doesn’t mean you should, lest you become unable to pay off your balance and incur interest charges that can snowball deceptively quickly into a debt you can’t handle.

As a rule of thumb, credit cards should never be maxed out unless you have the funds on hand to fully pay off the balance at the end of the billing cycle. As billing cycles are typically shorter than 30 days, you may find yourself with a credit card bill due date that is earlier than your salary. Hence, be sure to plan ahead before balling with your shiny new credit card.

What happens to my credit limit if I use an instalment payment plan?

Credit cards come with zero-interest instalment payment plans that let you pay for large purchases over several monthly payments instead of all at one go.

When you opt for an instalment plan using your credit card, the entire cost of the purchase is blocked off from your credit limit. As you make the monthly repayments, your credit limit will then be progressively restored.

Hence, putting an instalment plan on your credit card lowers your available credit limit. You may need to stop using your credit card for a few months until your credit limit has sufficiently recovered for you to continue using it as you normally would.

What should I do if I need a higher credit card limit?

Use two or more credit cards

The credit limit on each card is independent, and not shared. This means that if you have two credit cards with a S$4,000 credit limit each, you have up to S$8,000 in credit to tap on.

So if you find yourself unable to cover an expense with one card, you can try splitting up the purchase across two or more cards as an alternative.

Request for a credit card limit review

If you prefer to deal with only one credit card, you can contact your bank to request a credit limit review. You will likely be required to submit your latest proof of income, so get ready your latest payslips and other supporting documents.

In seeking a higher credit limit, it may also be helpful to ensure you have a good credit score, which you can build by paying off your credit card and other bills on time for a few months at least.

Pay off your outstanding balance or prepay into your credit card account

The most fuss-free way to raise your credit limit is to pay more money into your credit card account. You do not have to wait till the due date to pay your bill; in fact you don’t even need to wait for your statement.

With mobile banking, you can simply pay money into your credit card account any time you wish. Your credit limit will be updated accordingly in real time, and you can then proceed with your purchase.

This will also work to raise your credit limit beyond its original level. Any extra funds in your credit card account will simply be held until you use your card.

However, know that funds deposited in your credit card account will not earn interest the way it would in a savings account. So while it may be helpful at times to pad your credit limit by an extra few hundred dollars, don’t go overboard and treat your credit card as a savings account.

SingSaver x HSBC Revolution Credit Card Exclusive Offer

Enjoy 10X Rewards Points or 4 mpd for your travel spending with the HSBC Revolution Credit Card! Plus, get a Dyson Airstrait™, 25,000 HeyMax Miles (worth S$600+), Apple Watch SE Gen 3 or S$400 Cash when you apply for an HSBC Revolution Credit Card via SingSaver and fulfil promo requirements. You can also top up from just S$60 to upgrade to the latest Dyson, Sony or Apple products. Valid until 1 March 2026. T&Cs apply.

🧧 SingSaver CNY 2026 Flash Deal 🧧

Get an extra S$68 eCapitaVoucher on top of your reward! 🧧 For a limited time only, the first 8 eligible applicants at 2pm and 8pm daily will score this bonus when applying with Citi, HSBC or OCBC credit cards. Valid until 1 March 2026. T&Cs apply.

The bottom line: what credit card limit should I choose?

Now that you know the ins and outs of credit card limits, you should have a better grasp on the credit limit that is right for you.

As a final piece of advice, we’ll say that having a credit limit that is higher than you may need will likely tempt you to spend more than you probably should.

Hence, it may be more prudent to choose a lower credit limit that is closer to your means, and make adjustments as you go along.