Score up to S$5,411 in cash and rewards

Interest Rates from

2.88% p.a.

EIR: 5.84% p.a.

S$0

Processing Fee

Receive your cash as quick as

15 minutes

from loan approval

Standard Chartered CashOne Personal Loan

2 Offers Available

Valid until

02 June 2025

+ 9 other gift options

Valid until

02 June 2025

- Enjoy interest rates from as low as 1.9% p.a. (EIR: 3.63% p.a.) for longer tenures. Get instant loan approval and cash disbursement in as quick as 15 minutes to your designated bank account.

- Enjoy a 5-year annual fee waiver on your Standard Chartered Platinum Visa credit card

- Min. loan amount of S$1,000

- Max. loan amount of up to 4X monthly salary, capped at S$250,000

- Waiver of S$50 annual fee (from 2nd year till expiry of loan) if all instalments for the year are paid on or before the due dateMax. loan amount of up to 4X monthly salary, capped at S$250,000

- Read our full review of the Standard Chartered CashOne Personal Loan

- First year annual fee: S$199

- Early repayment fee: S$150 or 3% of the outstanding principal, whichever is higher

- Change of tenure: S$50 per change

- Late payment fee: S$100

Gift Options

Loan Tenure From 36 month(s) and above + loan amount from S$20,000 and above

- SingSaver #YourBestInterest Lucky Draw promotion runs from 13 May 2025, 3PM SGT to 2 June 2025.

- Promotion is valid for new and existing Standard Chartered personal loan customers.

- Apply for a Standard Chartered personal loan with min. amount of S$20,000 and min. tenure of 3 years to receive 1x Lucky Draw Chance.

- Lucky Draw winners will receive a reward based on their chosen reward package and approved loan amount:

- Renovation Package:

- (S$20,000 – S$29,999): S$1,000 Cash + S$1,000 IKEA Vouchers

- (S$30,000 – S$49,999): S$1,500 Cash + S$1,000 IKEA Vouchers

- (S$50,000 and above): S$2,000 Cash + S$1,000 IKEA Vouchers

- Wedding Package:

- (S$20,000 – S$29,999): S$1,000 Cash + S$1,000 SK Jewellery E-Vouchers

- (S$30,000 – S$49,999): S$1,500 Cash + S$1,000 SK Jewellery E-Vouchers

- (S$50,000 and above): S$2,000 Cash + S$1,000 SK Jewellery E-Vouchers

- Education Package:

- (S$20,000 – S$29,999): S$1,000 Cash + S$1,000 Best Denki Vouchers

- (S$30,000 – S$49,999): S$1,500 Cash + S$1,000 Best Denki Vouchers

- (S$50,000 and above): S$2,000 Cash + S$1,000 Best Denki Vouchers

- Renovation Package:

- Additionally, be one of the first 100 eligible applicants each week during the campaign period to receive S$10 Shopee Voucher on top of existing rewards.

- Terms and Conditions apply.

- Promotion is stackable with SingSaver Exclusive Offer (additional T&Cs apply).

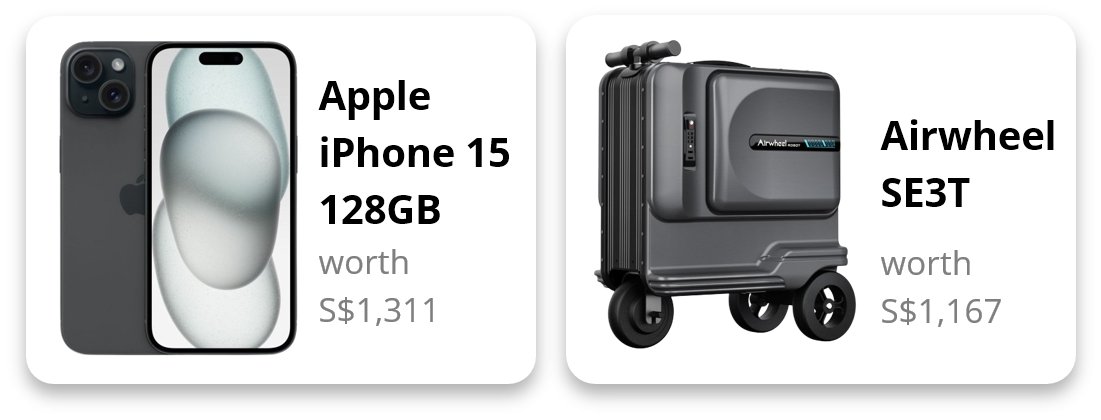

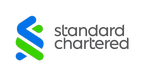

Gift Options

Loan Tenure From 36 month(s) to 60 month(s) + loan amount from S$50,000 and above

Loan Tenure From 36 month(s) to 60 month(s) + loan amount from S$30,000 to S$49,999

Loan Tenure From 36 month(s) to 60 month(s) + loan amount from S$20,000 to S$29,999

Loan Tenure From 36 month(s) to 60 month(s) + loan amount from S$15,000 to S$19,999

Loan Tenure From 36 months to 60 months + loan amount from S$10,000 to S$14,999

Loan Tenure From 36 months to 60 months + loan amount from S$8,000 to S$9,999

- SingSaver Exclusive Offer promotion is valid until 2 June 2025.

- Promotion is valid for new and existing Standard Chartered personal loan customers.

- Apply and get approved for a Standard Chartered CashOne personal loan with a min. amount of S$8,000 and min. tenure of 3 years to be eligible for reward.

- Choice of reward varies depending on approved loan amount:

- (S$8,000 – S$9,999): S$120 Cash via PayNow

- (S$10,000 – S$14,999): S$180 Cash via PayNow

- (S$15,000 – S$19,999): S$310 Cash via PayNow or Dyson AM07 Tower Fan (worth S$449)

- (S$20,000 – S$29,999): S$410 Cash via PayNow or Apple Watch Series 10 GPS 42mm (worth S$599)

- (S$30,000 – S$49,999): S$610 Cash via PayNow or Apple iPad A16 11” WiFi 256GB (worth S$649)

- (S$50,000 and above): S$1,200 Cash via PayNow or Apple iPhone 16 128GB (worth S$1,299)

- Terms and Conditions apply

The information displayed above is for reference only. The actual rates offered to you will be based on your credit score and is subject to the provider’s approval.

-

Early repayment fee: S$ 150

-

Late repayment fee: S$ 100

1. Go to Standard Chartered's website and click "Apply Now” button under Personal Loans

2. Fill out an application and submit all required documents

3. Wait for approval of personal loan from Standard Chartered

1. NRIC (Front & Back)

2. Salaried employees: Latest month’s computerised payslip or latest 6 months’ CPF contribution history statement

3. Self-employed individuals: Last 2 years’ Income Tax Notice of Assessment

4. Commission-based earners: Latest 3 months payslip or latest 6 months' CPF contribution history statement

Choose Your Rewards

Frequently Asked Questions

No worries, we've got you covered!

How can a personal loan help?

Personal loans can come in handy during a period of cashflow difficulty. Some of such situations include sudden medical costs, weddings, funerals, divorces and more. Rest assured that the bank won’t require you to get personal on personal loans and share the reason for taking it up during the approval process.

What are the different types of personal loan interest rates?

Advertised Interest Rate: The advertised rate, or nominal interest rate, is used when calculating the interest charge on your loan. For example, if you are considering a loan for $200,000 with a 6% interest rate, your annual interest charges will come up to $12,000 per year, or a monthly payment of $1,000.

Effective Interest Rate (EIR): The EIR reflects the true cost of borrowing to the consumer. This interest rate is usually higher than the advertised rate because it includes service fees, annual fees or one-time processing fees for processing and approving your loan application.

0% Interest Personal Loans: Some banks offer 0% interest rate personal loans for short-term loans. However, these tend to come with higher processing fees. This means that you will still be paying the bank for the loan, with the main difference being that the bank collects your money upfront rather than through interest payments in the future.

Can foreigners apply for personal loans in Singapore?

Yes, as long as you fulfil the eligibility criteria. These requirements can vary from bank to bank, but generally, personal loan applications for foreigners require you to:

- Hold a valid Singapore employment pass

- Have a residential tenancy agreement (or any other proof of your residential address in Singapore)

- Produce a bank statement (reflecting account activities for the past 6 months)

- Meet the minimum annual income requirement for foreigners (usually $40,000 to $45,000 p.a.)

What are the fees I have to take note of when I take up a personal loan?

Besides the processing fee that is charged, other fees involved when taking up a personal loan include:

- Late payment fee: Charged if you miss your monthly repayment.

- Early repayment fee or cancellation/termination fee: If you choose to repay your loan early, or cancel your loan.

- Change of tenor: Fee incurred if you change your loan tenure.

- Annual fee: To be paid every year (this fee could differ from the first year and subsequent years).

Are personal loans good for your credit score?

A personal loan can help you clear your debts and have more manageable repayments at lower interest rates. The personal loan can have a positive effect on your ability to manage debt responsibly, as long as you make repayments on time and pay off the full amount required during the term of the loan. This could then help to improve your credit score.