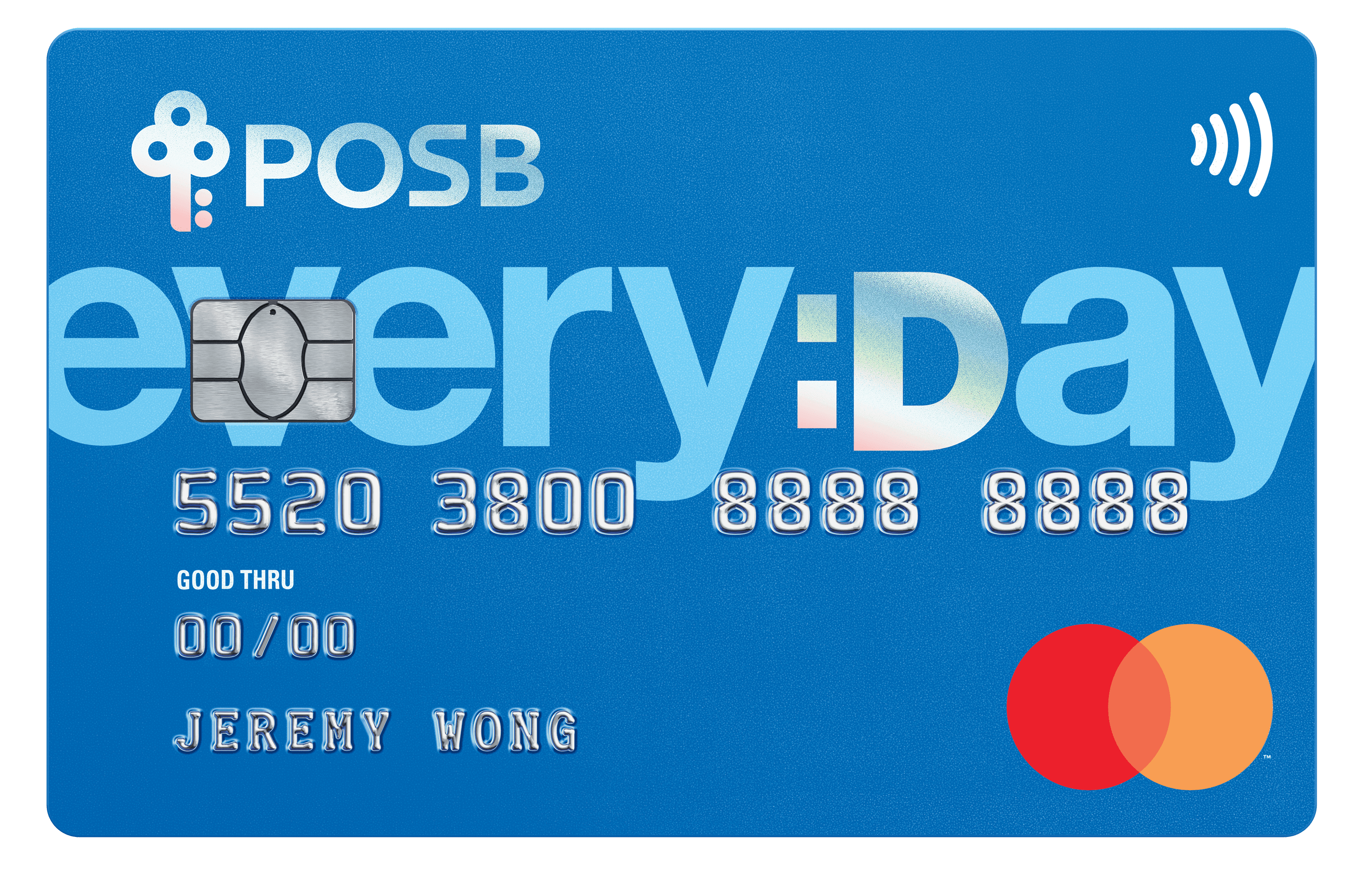

POSB Everyday Card

Highlights

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion is valid from 2 March 2026 to 8 March 2026.

- Promotion is valid for new DBS / POSB credit cardmembers only.

- Apply for selected credit cards from DBS and POSB during the promo period with the promo code "SINGSAVER" during the application and make a min. spend of S$100 within 30 days from card approval date to be eligible for reward.

- Have a valid DBS PayLah! account by the end of the Qualifying Spend period to be eligible for the reward,

- Some rewards will require additional top-up to claim.

- Promotion does not stack with other welcome offers from DBS / POSB.

- Terms and Conditions apply.

Things to consider when choosing this card:

Things to consider

Food delivery

Online shopping rebate

Rebate cap applied

Monthly spend required

Benefits

Cashback

Quick Facts

Up to 10% cash rebates on food delivery via foodpanda, GrabFood and Deliveroo.

Up to 10% cash rebates on in-store spend in Malaysian Ringgit (MYR).

Up to 10% cash rebates on SimplyGo.

Up to 5% cash rebates on Amazon.sg, Lazada, Shopee, RedMart, Taobao and TikTok Shop.

Up to 5% cash rebates at Popular bookstores (in-person and online)

5% cash rebates at Sheng Siong supermarkets.

6% cash rebates at SPC.

3% cash rebates at Pet Lovers Centre.

0.3% cash rebates on all other eligible spend.

Cash rebates (in Daily$) never expire.

Read our full review of the POSB Everyday Card.

Min. spend of S$800 per calendar month required for accelerated cash rebate earn rate.

S$20 monthly cash rebate cap for dining, Sheng Shiong, Popular, online shopping, SimplyGo, and MYR categories respectively.

Guides

Eligibility

Eligibility

Fees / Repayment

Fees

Repayment

Others

Association

Mastercard

Supported Payment Type

Google Pay

Apple Pay

Samsung Pay

NETSPay

Tags

POSB Everyday Card

POSB Everyday Card

Read Singsaver’s full review of the POSB Everyday Card

Pros & cons

Pros |

Cons |

|

|

Who is this card for

-

Parents with young children looking to earn cash rebates on daily expenses will benefit from the POSB Everyday Card. They’d be able to earn 5% cash rebates on groceries, whether they prefer to shop on Redmart or Sheng Siong. On hectic days, they’d be able to take advantage of the 10% cash rebates on online food deliveries. Meanwhile, the 10% cash rebates on offline MYR spend will come in handy during weekend trips in Johor Bahru. If they own a family car, they can also save on fuel at SPC stations islandwide, thanks to the 6% cash rebates.

-

Young working adults looking to save on everyday spending will also find the POSB Everyday Card useful. From 10% cash rebates on bus and train rides with SimplyGo, to 5% cash rebates on major e-commerce platforms including Shopee and TikTok Shop, the POSB Everyday Card can be an effective way to manage spending.

Compare to other cards

Now that you know the POSB Everyday Card makes for a solid everyday rewards card, it’s time to look at its direct competitors.

Compared to the DBS Live Fresh Card and the HSBC Live+ Credit Card, the POSB Everyday Card’s benefits seem to be tailored toward cardholders who rarely spend outside of Singapore and Johor Bahru. Unlike the DBS Live Fresh Card which offers rewards on select overseas spend, and the HSBC Live+ Credit Card, which offers discounts of up to 15% when you dine abroad, POSB Everyday Card members are only rewarded for offline MYR spend.

Another thing to note is the $800 minimum monthly spend needed for enjoying higher cash rebates. The same sum also applies to the DBS Live Fresh Card, whereas HSBC Live+ Credit Card members will need to fork out $1,000 for their first quarter and $600 for the subsequent quarter for that coveted 8% cashback rate.

All in all, the POSB Everyday Card is a good fit for people whose spending habits align with its benefits. If you’re looking to accumulate some savings each month, and you’re not a big spender, POSB’s relatively low cashback caps might not be a deal breaker. On the other hand, if you frequently travel around the region and want to earn rewards on in-person purchases, you might want to consider signing up for the DBS Live Fresh Card instead. Otherwise, there’s always the HSBC Live+ Credit Card with its complimentary travel insurance and dining deals across Asia—perks any traveller would love.

POSB Everyday Card

Interest rate: 27.8%

Annual fee: $196.20 (First year waiver available)

Minimum annual income:

- $30,000 for Singapore citizens and PRs.

- $45,000 for foreigners.

Benefits:

- 10% cash rebates on online food deliveries.

- 5% cash rebates on dining.

- 10% cash rebates on offline MYR spend.

- 10% cash rebates on bus & train rides with SimplyGo.

- Up to 20.1% fuel savings at SPC stations islandwide.

- Exclusive deals on dining, family attractions, fuel and groceries.

- No minimum spend for groceries, fuels and pet supplies.

DBS Live Fresh Card

Interest rate: 27.80%

Annual fee: $196.20 (First year waiver available)

Minimum annual income:

- $30,000 for Singaporeans and PRs

- $45,000 for foreigners

Benefits:

- 5.7% cashback on transport and shopping spend.

- 3.25% cashback on overseas point-of-sales transactions in Brunei, Cambodia, China, Indonesia, Hong Kong, Japan, Laos, Malaysia, Mongolia, Myanmar, Philippines, South Korea, Taiwan, Thailand and Vietnam.

- 0.3% unlimited cashback on all spending.

- Get discounts on AirAsia, Korean Air and Qatar Airways flights and travel bookings with Trip.com, Expedia and more.

HSBC Live+ Credit Card

Interest rate: 26.9%

Annual fee: $196.20 (First year waiver available)

Minimum annual income:

- $30,000 for Singaporeans and PRs.

- $40,000 for foreigners.

Benefits:

- 8% cashback on eligible dining, shopping and entertainment expenses. Get cashback on your streaming subscriptions, like Netflix, Spotify and Disney+.

- 5% cashback at Shell and Caltex stations, and up to 17% in fuel savings.

- 0.3% cashback on all other eligible spend.

- Complimentary AIG insurance coverage on any loss or damage to your online purchases.

- Discounted rates on comprehensive travel insurance from HSBC TravelSure, with over 50 benefits including Cancel For Any Reason.

Credit card application

Step 1: Apply via our POSB Everyday Card page

Start by clicking on our card application link.

Check to see if your income data and identification details are up to date on SingPass MyInfo, so you can apply with SingPass. Your approval-in-principal page should appear within minutes of submitting your application.

Step 2: Make sure you have all your documents

Want to skip the hassle of consolidating all your required documents? Consider applying with SingPass to streamline the process. Otherwise, prepare the following:

-

The front and back of your NRIC

-

Latest 3 computerised payslips or crediting bank statements

-

Latest Income Tax Notice of Assessment

Step 3: Say hello to your new card

Activate your new POSB Everyday Card via the digibank mobile app. You'll need to enter a One-Time-Password after entering your 6-digit online banking PIN to secure your credit card transactions. Now you can start collecting your cash rebates as you spend, and track your transactions on the go!

Credit card application resources

Frequently asked questions about the POSB Everyday Card

Are there annual fees for the POSB Everyday Card?

Yes, the annual fee for the POSB Everyday Card is $196.20. Each supplementary card will cost you $98.10 per card. The annual fee for the first year of your membership is waived.

What is the income requirement for the POSB Everyday Card?

Singaporean citizens and Permanent Residents will need a minimum annual income of $30,000, while foreigners will need to earn $45,000 per year.

What is the mile per dollar or cashback offered?

The POSB Everyday Card offers 10% cash rebates on online food deliveries, offline MYR spend, as well as bus and train rides with SimplyGo. You can also get 5% cash rebates on dining and e-commerce spend on popular online shopping sites like Lazada and Shopee. POSB Everyday Card members can also claim 20.1% fuel savings at SPC stations islandwide.

Are there extra perks for the credit card?

When you spend with your POSB Everyday Card, you get cashback in the form of Daily$. Redeem your Daily$ to offset purchases at Pet Lovers Centre, Sheng Siong or a SPC station. You can also do so online via the DBS Apple Rewards store or through the Zalora, AXS or Shopee app.