Home mortgage rates are threatening to hit a 20-year high of 5%. What can homeowners do to head off the expected crest in mortgage payments?

Mortgage rates in Singapore are headed for a 20-year high, which is understandably a concern for homeowners. The reason for the increase is, of course, the incessant interest rate hikes undertaken by the US Federal Reserve, which is grappling with levels of inflation not seen in 40 years.

As mortgage rates soar, homeowners start to explore options like refinancing their home loans or considering personal loans to alleviate the financial strain. This surge in interest rates highlights the importance of proactive financial planning to navigate potential increases in mortgage payments.

But why would Fed interest rate hikes cause your mortgage payments to go up? You see, the issue is the US Dollar’s status as the world’s reserve currency, which prompts other economies like ours to track its interest rates.

Thus, when the Fed hikes interest rates, the Dollar tends to strengthen, leading to inflationary pressures around the world, inspiring other economies to also raise interest rates.

That is, of course, an ultra-simplified explanation, so don’t go trying to win an Internet argument with it. However, it’s sufficient to illustrate the context which frames our discussion in this article.

How home mortgage interest rates are looking

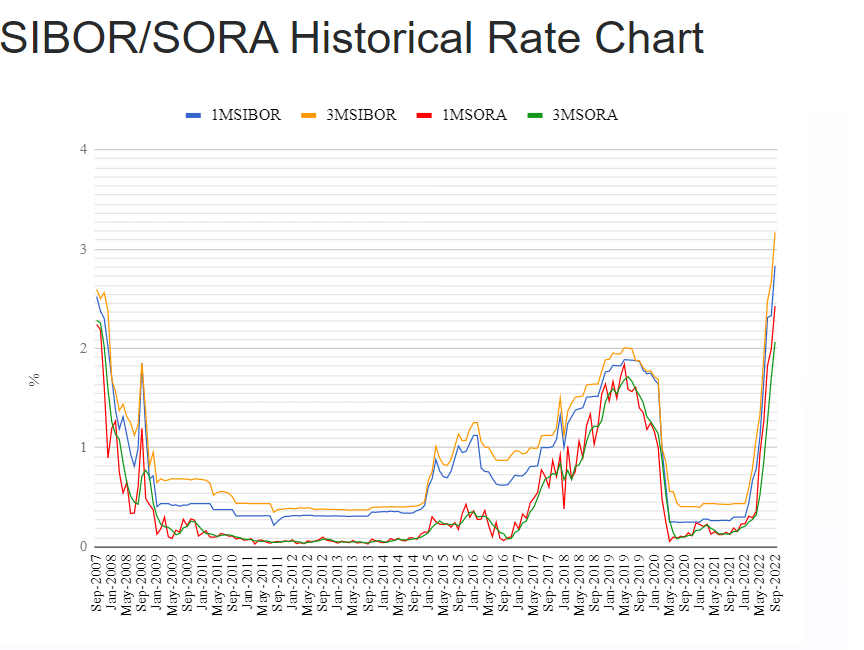

Here’s the five-year historical chart for SIBOR and SORA, which are two metrics that form the basis for many home mortgage packages.

Explaining what SIBOR and SORA is, and their relationship to home loans is best left to a separate article. But for now, the only thing you need to note is that big vertical line at the right hand side of the graph.

A spike of this magnitude is only welcome when it appears on your investment portfolio. But as it stands, this chart is an indicator of mortgage rates in Singapore – an unfortunate development that will no doubt bring pain to homeowners.

If you have some spare cash, consider putting it towards a short-term endowment plan such as Great Eastern's SP Series 9. It offers 3.38% p.a. guaranteed return upon maturity as well as coverage against Death and Total & Permanent Disability (no medical examination required). Simply apply online with your SingPass login, and you'll be notified of approval via email.

Three ways homeowners can save

Go for an HDB loan or CPF Home Rate Loan

If you haven’t yet bought your property, and are looking for an HDB flat, the best option for you is to get an HDB home loan, or a bank loan following the CPF Home Rate (CHR loan).

This is because with home mortgage interest rates spiking in Singapore, many bank mortgage packages are now more costly than the HDB Home Loan – which is still sitting pretty at a steady 2.6% per annum.

Furthermore, because the HDB Home Loan is tied to the CPF Ordinary Account interest rate of 2.5% (HDB home loans being 0.1% higher) it is highly likely that this rate will remain locked in for the foreseeable future.

That is unless the Government somehow decides to revise the CPF OA rate upwards. But for that to happen, we’ll need to see dramatic rises in several other indicators, including bank fixed deposit and savings interest rates, as well as Singapore Government Securities bonds.

Long story short, taking an HDB home loan – if possible – is the most affordable option for homeowners right now. Additionally, you can refinance to a bank loan once interest rates go back down, but note that this is a one-way move.

That’s to say, once you switch away from an HDB loan, you won’t be able to switch back, leaving you at the mercy of interest rate fluctuations.

Refinance your home loan

If you already have an HDB home loan, hold on to it. Now is not the time to go looking for a new home mortgage package, as explained above.

However, if you are already servicing an existing bank home loan, and now find yourself faced with elevated interest rates that translate into significantly larger monthly payments, you should consider refinancing into a new mortgage package with the lowest possible interest rate you can find.

This will require some effort. You’ll have to research and evaluate different home loan packages, and work out what your monthly payments each month would look like.

Also, you should be aware of lock-in periods – the duration during which switching to another lender, or fully paying off your home loan will incur a penalty fee.

With interest rates being so volatile right now, bank home loans have shortened their lock-in periods to around 2 years, which means you should be prepared to refinance your mortgage again.

Pay down your mortgage as much as possible

This may sound counter-intuitive but, another thing you can do is to pay down your mortgage as much as possible so as to save on future interest charges.

This can add up to a significant difference over time, especially if you’re forced to refinance your mortgage at higher and higher rates down the line.

Not everyone will be able to take this action, of course, so don’t feel discouraged if you don't have the means to redeem a large chunk of your mortgage right now.

On the other hand, don’t underestimate the sum you can pay – even if it’s just a few thousand dollars, you could be saving yourself several hundreds in future interest.

One note though: Take care not to go overboard in paying down your mortgage. You should always make sure you have sufficient buffer funds or liquid assets that you can use to absorb who knows what other financial shocks may be in store for us all.

Only pay down your mortgage using extra funds you can spare.

Other tips for coping with high mortgage rates in Singapore

Rent out spare rooms

If you have a spare room or two, consider renting them out to help offset the increase in your mortgage payments.

The good news is that the rental market is red-hot right now, which means you are more likely to land a lucrative rental agreement, one that could even furnish some additional cashflow.

Downsize your property

Another option, albeit a rather inconvenient one, is to downsize your property, which could foster two benefits.

One, switching to a smaller home will reduce the size of your mortgage, which translates to smaller, more manageable mortgage payments.

Two, the profit generated from the sale of your larger property will increase your ability to weather further financial storms, or put towards retirement needs, as the case would be if the proceeds of the sale is channelled back into your CPF account.

Obviously, switching properties is a complicated move at the best of times, so be sure to research and work out a watertight plan before embarking on this option.

Similar articles

Rising Interest Rates And The Effect On Mortgage Debt In Singapore

2017 Rate Hikes Will Make Your Flat More Expensive

Should You Still Choose A Bank Home Loan Over An HDB Loan?

How to Minimise Your Home Loan Costs?

Should You Pay Off Your Mortgage Early in Singapore

Singapore Mortgage Rates 2023 – Will They Rise or Fall?

When Should You Start Planning To Refinance Your Mortgage?

Know Your CPF Withdrawal Limit Before You Wreck Your Mortgage

.png?width=280&name=Housing6%20Things%20First-time%20Home%20Buyers%20Must%20Know%20to%20Avoid%20Regrets%20(2).png)