HSBC TravelOne Credit Card

Highlights

- SingSaver March Madness 2026 campaign runs from 6 March 2026, 3:00 PM SGT to 31 March 2026.

- Promotion is valid for new Citi / DBS / HSBC / OCBC credit cardmembers only.

- Apply for credit cards from participating providers and submit the Rewards Redemption Form to receive 1x chance to open a March Madness Blind Box.

- March Madness Blind Box reward will be granted after the customer has met all eligibility requirements for the credit card.

- Customers may choose to open one of 3 available Blind Box categories, which contain the following rewards:

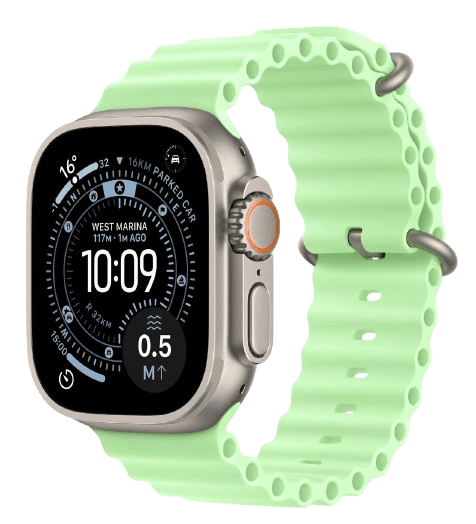

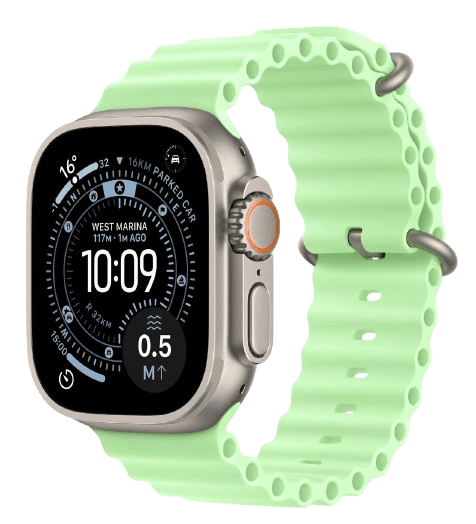

- Blind Box 1: Ultimate Tech Vault

- Apple iPhone 17 Pro 256GB (worth S$1,749)

- DJI Osmo Action 5 Pro Standard Combo (worth S$489)

- Apple AirPods 4 (worth S$199)

- 500 Max Miles by HeyMax

- 100 Max Miles by HeyMax

- Blind Box 2: Home Luxe Edit

- Dyson Airwrap + Airstrait Bundle (worth S$1,598)

- Shark HydroVac 3-in-1 Cordless Wet & Dry Hard Floor Cleaner (worth S$649)

- Stryv Pro Hair Dryer (worth S$239)

- 500 Max Miles by HeyMax

- 100 Max Miles by HeyMax

- Blind Box 3: Pro Gamer Arena

- Sony PlayStation®5 Pro (worth S$1,069)

- AOC Q27G4S Monitor (worth S$449)

- Logitech G Pro X Superlight Mouse (worth S$189)

- 500 Max Miles by HeyMax

- 100 Max Miles by HeyMax

- Blind Box 1: Ultimate Tech Vault

- Promotion is stackable with SingSaver Exclusive Offer reward (additional T&Cs apply).

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

- SingSaver Exclusive Offer promotion runs from 6 March 2026, 3:00 PM to 31 March 2026.

- Promotion is valid for new HSBC credit cardmembers only.

- Apply for participating HSBC credit cards with provided marketing consent, then make a min. spend of S$500 by the end of the following calendar month from card approval date to be eligible for reward

- Terms and Conditions apply.

Things to consider when choosing this card:

Things to consider

Unlimited air miles

Airport lounge

Travel insurance

Bonus air miles

Benefits

Airmiles

Quick Facts

Borrow up to 90% of your available credit limit, enjoy interest rates as low as 2.6% p.a., and get flexible payment terms up to 60 months when you apply with promo code CIPSS. T&Cs apply.

Instant reward redemption with an extensive selection of airline and hotel partners via HSBC Singapore mobile app.

Accelerated earn rate: up to 2.4 miles for your spending.

No conversion fee for air miles or hotel points until 31 January 2025.

Complimentary travel insurance coverage (including COVID-19) and 4x complimentary airport lounge visits for primary cardholders and guests of primary cardholders.

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 1-for-1 deals on dining, lifestyle and travel worldwide.

Split your purchases across a range of flexible tenures with HSBC Instalment Plans.

High base minimum annual income requirement of S$65,000 (w.e.f. 1 October 2025) Learn more.

Guides

Eligibility

Eligibility

Fees / Repayment

Fees

Repayment

Tags

HSBC TravelOne Credit Card

HSBC TravelOne Credit Card

HSBC TravelOne Credit Card

The HSBC TravelOne Credit Card is ideal for frequent travellers who value instant reward redemption and flexible travel benefits.

It allows you to earn 1.2 miles per S$1 on local spend and 2.4 miles per S$1 on overseas spend.

Additionally, you’ll enjoy up to 4 complimentary lounge visits annually, complimentary travel insurance, and instant miles redemption to 20+ airline and hotel partners.

|

Spend Category |

Rewards Earned |

|

S$1 Local Spend |

1.2 miles |

|

S$1 Foreign Currency Spend |

2.4 miles |

|

S$1 (Miles Transfer Promo) |

Up to 8 miles |

SingSaver’s offer

Apply for the HSBC TravelOne Credit Card, pay the annual fee (S$196.20 incl. GST), provide your marketing consent to HSBC and make a min. spend of S$500 by the end of the following month from card approval date to be eligible for rewards below:

- Dyson WashG1™ wet floor cleaner (worth S$999) (Top up S$100)

- Dyson Airstrait™ straightener (worth S$799) (Top up S$80)

- Dyson Digital Slim Submarine™ (worth S$699) (Top up S$50)

- Dyson Airwrap™ Origin multi-styler and dryer (worth S$549)

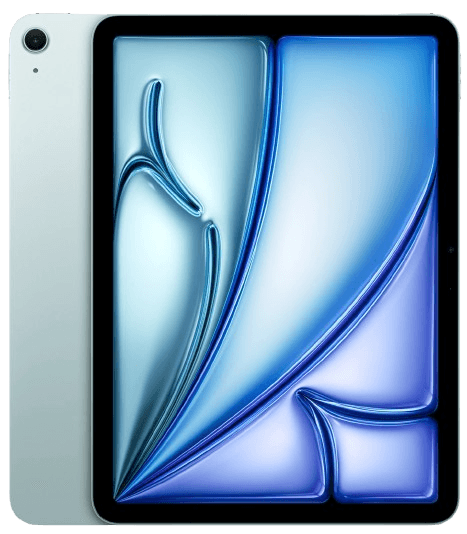

- Apple iPad (A16) 11" WiFi 128GB (worth S$499)

- Dyson OnTrac™ headphones (worth S$699)

- S$420 Grab Vouchers

- S$390 Cash via PayNow

Welcome offer comparison

|

Provider |

Offer |

|

SingSaver |

Gifts worth up to S$899 |

|

HSBC Website |

Spend up to S$1,000 to receive 36,000 miles (award in the form of 90,000 Reward points) |

|

Other Platforms |

S$390 Cash via PayNow or 6,140 SmartPoints |

Best offer: The Singsaver promotion offers the most value, though miles chasers may prefer the HSBC offer.

HSBC TravelOne Card at a glance

Air miles

4/5 Stars

- 1.2 miles per S$1 on local spend

- 2.4 miles per S$1 on overseas spend

- Miles are redeemable instantly via the app

Overseas spending

5/5 Stars

- High earn rate on FCY spend

- No need to wait for miles redemption

- Accepted globally and travel-friendly

Travel

4/5 Stars

- 4 complimentary airport lounge visits

- Complimentary travel insurance

- Partner deals with Agoda and airlines

Bill payment

2/5 Stars

- No rewards on bill payments via AXS or similar channels

- Not ideal for recurring utilities or tax payments

Petrol

1/5 Stars

- No fuel savings or petrol station deals

- Better alternatives for drivers

Annual interest rate and fees

- Annual principal fee: S$196.20 (inclusive of GST)

- Supplementary annual fee: Free

- Fee waiver: 1-year waiver for principal card

- Interest-free period: 21 days

- Annual interest rate: 27.8% p.a.

- Late payment fees: S$100

- Minimum monthly repayment: 100% of your monthly instalment amount

- Foreign currency transaction fee: 2.25%

- Cash advance transaction fee: 8% or S$15, whichever is higher

- Overlimit fee: S$40

Minimum income requirements

- Singaporean/PR minimum income: S$30,000

- Self-employed or Commission-based Singaporean or PR: S$40,000

- Non-Singaporean minimum income: S$60,000

Why apply for the HSBC TravelOne Credit Card

Perks and benefits

- 1.2 miles per S$1 on local spend

- 2.4 miles per S$1 on overseas spend

- Instant miles redemption to airline and hotel partners

Additional benefits

- 4 free airport lounge visits each year

- Complimentary travel insurance

- Deals with travel partners

Everyday value

- No need to wait for monthly statements to redeem miles

- Mobile app access for redemption

- Flexible travel benefits for both personal and business travel

SingSaver’s take

The HSBC TravelOne Credit Card is a smart option for those who travel regularly and want a fuss-free way to earn and use miles. While it may not offer much for petrol or bill payments, its high overseas earn rate and instant redemptions make it a standout. Frequent flyers will appreciate the convenience of tapping into miles anytime without blackout dates, all managed from one app.

Pros & cons

| Pros | Cons |

|

|

Card comparison

|

Card |

Miles/Rewards |

Annual fee (Principal) |

Other perks |

|

HSBC TravelOne |

1.2 mpd local, 2.4 mpd overseas |

S$196.20 (1-year waiver) |

4 lounge visits/year, instant miles redemption to 20+ partners, travel insurance |

|

Citi PremierMiles |

1.2 mpd local, 2.2 mpd overseas |

S$196.20 (1-year waiver) |

Complimentary travel insurance, flexible miles redemption, global acceptance |

|

UOB PRVI Miles |

1.4 mpd local, 2.4 mpd overseas |

S$261.60 (1-year waiver) |

Up to 8 mpd on selected bookings, travel insurance, high overseas earn rate |

The HSBC TravelOne is ideal for frequent travellers who want quick, fuss-free miles redemption, generous lounge access, and strong overseas earn rates — all with a first-year fee waiver.

Application process

- Click “Apply Now” on this page.

- Fill in the online application form.

- Upload the required income and identity documents.

- Wait for HSBC to approve your card (typically 1–2 weeks).

- Pay the annual fee, provide your marketing consent to HSBC, and make a minimum deposit. spend of S$500 by the end of the following month from the card approval date.

- Receive your rewards via Singsaver within 4 weeks.

Frequently asked questions about the HSBC TravelOne Credit Card

Do HSBC TravelOne miles expire?

Yes, HSBC TravelOne miles expire at the end of a 37-month period from the month subsequent to the month in which such Reward points were awarded.

How fast can I redeem miles after spending?

Almost instantly, you can transfer miles via the HSBC Singapore mobile app with 24/7 access.

Are there blackout dates for redemptions?

No, redemptions are made directly to airline or hotel partners and follow their availability rules.

How many lounge visits do I get?

You’ll receive 4 complimentary airport lounge visits per year.

Is this card good for non-travellers?

It’s optimised for travel rewards, so non-travellers may get more value from cashback or lifestyle-focused cards.