Get your adulting game on. Here are the types of insurance that you shouldn't be missing out on, especially if you live life on the edge (because #YOLO).

When it comes to insurance plans, some are more self-explanatory than others, like travel, home and maid insurance. As for some others? Not so much.

With so many different types and subtypes of insurance plans available, it’s easy to fall down a rabbit hole of choices, confusion and mistakes. Because money is precious, we should only be buying the plans that provide the cover we need.

For those that identify themselves as young millennials or Gen Z in our population, here are the three insurance types that probably don’t sound as appealing as avocado toast (on paper, at least), but would serve you extremely well as you experience life to the fullest.

- Personal accident insurance

- Critical illness insurance

- Term life insurance

- SNACK: YOLO and earn insurance coverage

Personal accident insurance

A personal accident plan covers any accidents that result in death, permanent disability, medical expenses for injuries and other types of treatments caused by an accident.

Accidents can occur even when we least expect it, such as a pulley strain from bouldering, scalding our hand while trying to make our ‘Suan La Fen’ (sour and spicy noodles) from Hai Chi Jia, or even something unsuspecting like a paralysingly stiff neck from bending over our laptops 24/7.

A personal accident plan can’t prevent these accidents from happening. It can, however, help to alleviate the hefty costs required to get medical treatment. Besides getting reimbursement for medical expenses, some personal accident plans also recognise post-treatment recoveries, such as physiotherapy, Traditional Chinese Medicine (TCM) or a good cracking by chiropractors.

Critical illness insurance

Major cancers, heart attack and stroke are all common types of critical illnesses. Despite nearly 1 in 3 deaths attributed to heart diseases or stroke, Singaporeans are underinsured when it comes to critical illness.

As healthy as you are, life sometimes throws a curveball. There has been news coverage of people as young as 24 getting a stroke, or collapsing from a heart attack at 28. It is never too early to get additional coverage for the onset of a disease, especially when we cannot recognise the symptoms.

Critical illness insurance provides coverage in the form of a lump sum if you are diagnosed with a critical illness that is under the policy’s definition. This sum of money can be used for medical expenses not covered by MediShield Life or your integrated shield plan. It can also be used to cover non-medical costs incurred as a result of the illness, such as loss of income or recovery costs.

Term life insurance

Term life insurance provides a lump sum payout in the event of your death. Most term insurance plans also cover total and permanent disability. While it is a morbid topic to broach, it is still one of the first things we should consider as part of our financial planning.

Term insurance covers a fixed period of time, and offers high sum assured at an affordable cost. Unlike whole life insurance, term insurance has no cash value, but it is much friendlier on the wallet in exchange for a substantial coverage amount — something to get you started if you’re budgeting hard in your first job.

Also, it is much cheaper for a younger person to buy insurance than an older person, ceteris paribus.

SNACK: YOLO-ing your way to insurance coverage

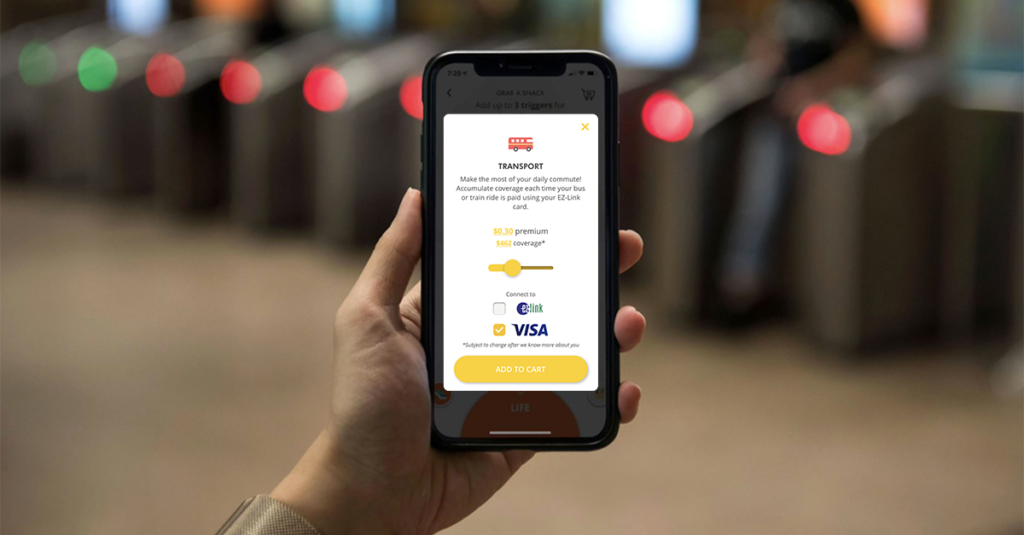

The aforementioned must-have insurance — personal accident, critical illness and term life — are nothing new. But like what we’ve discussed in our previous coverage of SNACK, Income has taken an innovative approach to bring greater accessibility and affordability to the masses, for these 3 types of insurance. It enables you to accumulate insurance coverage in the background as you get on with your daily activities such as running, taking the MRT or getting a takeaway dinner.

This is a boon to the Gen-Z digital natives not just because everything can be managed at a tap on the SNACK app, it requires very low financial commitment in exchange for some measure of protection.

| Insurance type | Coverage you can get from SNACK |

| Personal accident | Up to $100,000 for accidental death and permanent disability due to accidents and up to $2,000 reimbursement for medical expenses due to accidental injuries |

| Critical illness | Up to $200,000 if diagnosed with any of the 37 covered severe-stage critical illnesses |

| Term life insurance | Up to $200,000 in the event of death, total & permanent disability or terminal illness |

“I’ll pay by Visa.”

Visa has become synonymous with credit cards and SNACK has since widened its range of Triggers by getting Visa as a new partner. Now that Visa is on board as a Source, it opens up many more Triggers for you to gain insurance protection, which also means that SNACK will increasingly be integrated into your daily lives and that your insurance game is about to get levelled up a lot faster.

Previously, there were only three Triggers and Sources: Steps (Fitbit), Transport (EZ-Link) and Food & Drinks (Burpple). Now, SNACK has expanded with five new Triggers with Visa: Groceries, Retail, Entertainment, Petrol and Utilities.

| Types of Triggers | Types of Sources |

| GroceriesNEW (i.e. Fairprice, Redmart) | Visa cards |

| RetailNEW(i.e. Shopee, Lazada) | Visa cards |

| EntertainmentNEW (i.e. Netflix, Spotify) | Visa cards |

| PetrolNEW (i.e. SPC, Esso) | Visa cards |

| UtilitiesNEW (i.e. PUB, Singtel) | Visa cards |

| Steps (i.e. running, walking) | Fitbit |

| Food & drinks(i.e. Subway, GrabFood) | Burpple, Visa cards |

| Transport(i.e. MRT, Grab) | EZ-Link, Visa cards |

Nowadays, with SimplyGo, credit cards are our new ‘EZ-Link card’. Spotify is a necessary companion on the go, and Netflix lies at the heart of our stay-at-home new normal. Similarly, insurance is next to be even more integrated with our lifestyles, thanks to SNACK. Here’s how we imagine it to pan out using our Visa cards:

- Online shopping on your favourite e-commerce sites: Restocking your wardrobe in anticipation of the back-to-office days? Complimentary e-commerce protection (from either the merchant or your credit card) won’t be the only insurance you’ll enjoy. You’ll get to build coverage for personal accident, critical illness or term life via SNACK.

- Grocery shopping: Ran out of milk? Be it at a brick-and-mortar FairPrice or online via RedMart, you get to build coverage on personal accident, critical illness or term life out of SNACK.

- Pumping petrol: The best part about having your own ride right now is that you’re definitely socially distanced, compared to the MRT folks. Also, refuelling the tank now means automatically refuelling your personal accident, critical illness or term life coverage.

- Paying utilities bill: The WFH lifestyle may have charged up your power usage, but so will your personal accident, critical illness or term life coverage. The definition of utilities here includes electricity and telco bills.

- Binging your favourite dramas on Netflix: Whether you’re watching ‘It's Okay to Not Be Okay’ or rewatching ‘Money Heist’, Netflix-and-Shell out only $0.30 for your personal accident, critical illness or term life coverage every time you pay for your Netflix subscription.

Netflix-and-Shell out only… 30 cents?

You read that right, you can get protected starting from as low as $0.30, with the next micro-premium tiers being $0.50 and $0.70 — a low-cost way to get started on your insurance journey or to complement your existing portfolio. All you have to do is connect a Trigger (i.e. retail) to a Source (i.e. Visa card) from the SNACK app, and you’re good to go.

With these stackable micro-premiums, you don’t feel the pinch of a large premium outlay. Moreover, you can easily stop or adjust their coverage any time they want, all done via the fuss-free SNACK app — that’s just how flexible it is.

Get SNACK-ing

Because we know FOMO hits hard, don’t miss out on your complimentary $500 personal accident coverage when you download SNACK today and link any lifestyle Trigger to the Accident product!

Simply apply promo code SS500 to redeem it. Terms & Conditions apply.

This article is written in partnership with SNACK by Income.

Read these next:

SNACK by Income: New Insurance Lets You ‘Pay’ For Coverage With Everyday Activities

Personal Accident vs Life & Medical Insurance: What You Need to Know

Personal Accident Insurance: What Does It Cover and Should You Buy One?

5 Types of People Who Must Get Personal Accident Insurance

Changes to Definition of ‘Critical Illness’ in Life Insurance Policies

Similar articles

SNACK by Income: New Insurance And Micro ILP That Lets You ‘Pay’ And ‘Invest’ With Everyday Activities

Baby Insurance: What’s Worth Buying For Your Newborn In 2025?

DBS & Manulife’s ProtectFirst Review: Great for Young Insurance Newbies

Buying Insurance for the First Time? This is the Perfect Starter Insurance Portfolio

5 Misconceptions Singaporeans Have About Disability Insurance

5 Reasons Why Every Millennial Needs Personal Accident Insurance

3 New Pay-As-You-Go Insurance Plans To Consider In 2021

Grab Travel Insurance and Ride Cover: Are These Grab Insurance Products Worth The Top-Up?