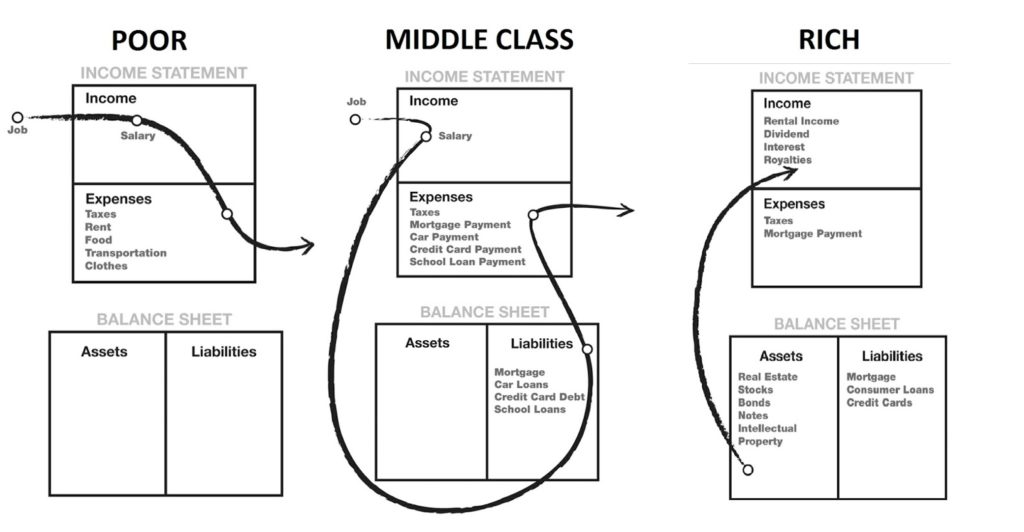

It’s never too late to grow wealth and get rich, but it all starts with understanding your very own financial scorecard, says best-selling author of “Rich Dad Poor Dad”, Robert Kiyosaki.

A financial scorecard or statement tracks the health of your personal finances and takes into account your income statement (income v expenses) and balance sheet (assets and liabilities).

Speaking exclusively to SingSaver, the 72-year-old businessman and investor said, “Your banker wants to see your financial statement. This is your report card when you leave school. If you have a good financial statement, bankers will give you all the money you want.”

Having a good financial statement is important so you can leverage money efficiently to grow your wealth.

He added that the key to growing one’s wealth is to have assets like property, stocks, bonds, notes and intellectual property that generate multiple sources of income (rental income, dividends, interest, royalty) besides your regular salary.

Your liabilities (such as your mortgage, consumer loans and credit cards) should be helping you generate or support your asset-building efforts. Your balance sheet is net positive if your assets are worth more than your liabilities.

Understanding a balance sheet

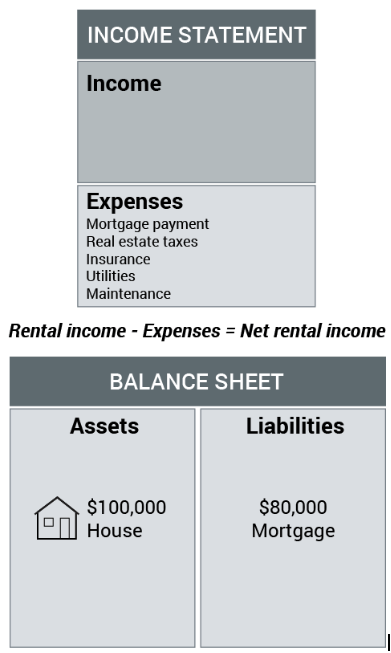

Let's consider your house as an example.

Based on the above chart, a $100,000 house -- usually seen as an asset -- can easily be a liability if your net rental income does not cover the cost of property expenses. Therein lies the dilemma: most people would consider their homes as an asset but Kiyosaki argues it could be a liability because every month it takes money out of your pocket (monthly loan payments, property taxes, home insurance, utility bills and maintenance fees).

In the US, Kiyosaki said it wasn't until the real estate market crashed in 2008 that people found out that they owed more on their house than it was worth before they started to understand their home was not an asset.

Kiyosaki also advised people to keep a close eye on expenses because if they are consistently high, they eat away at your overall income and prevent you from growing wealth.

What about CPF?

Kiyosaki, who is due to visit Singapore in late October for a workshop on wealth creation, took a controversial view around Singapore’s public pension scheme.

Contrary to what Singapore’s Mr CPF believes, Kiyosaki said Singaporeans couldn’t rely on the CPF to grow their wealth.

“I think pensions are for losers. They’re so terrified of making mistakes. They want a steady paycheck, and they want a guaranteed pension. I don’t think you can get rich from that point of view,” he said.

Kiyosaki, who is unabashedly a “capitalist”, says regular salary income earners need to know how to use other people’s labour to grow their wealth.

“These guys work for money. They are not capitalists. They work for money and invest their own money. Capitalists use other people’s labour and money to get rich. Which side do you want to be on?”

That’s how Kiyosaki famously borrowed US$300 million to invest in property during the 2008 U.S housing sub-prime crisis and profited once the market bounced back.

‘Live the best life you can’

When asked if he had any guilty pleasures, Kiyosaki said he likes expensive cars, but he knows how to fund his lifestyle.

“Why do I like Ferraris? It’s because I look better in a Ferrari than a Toyota. A lot of people say live below your means. But I want to live the best life I can live. So I built an asset and that asset bought my Rolls-Royce.

Summing up, Kiyosaki advised investors and Singaporeans alike not to get discouraged if they’d made mistakes.

“Unfortunately, our school system says that if you fail you get stupid. We learn from our mistakes. Mistakes are opportunities where we become smarter, be humble, and take a look at something,” he advised.

Age has nothing to do with when you get rich or poor, said Kiyosaki, and it’s never too late to learn to build the right financial scorecard.

Kiyosaki will be in Singapore on 23-24 October for the “Masters of the Century” workshop at Suntec Convention Singapore, organised by Success Resources. Tickets on sale now.

Read these next:

Kiyosaki Warns Investors: We're In A Very Dangerous Time Now

Use Debt to Invest and Grow Wealth: Kiyosaki

The Markets Are Paying Attention To The Wrong Things

Do You Have A Passive Income Strategy?

3 Reasons Why Singapore’s STI (‘Super Terrible Index’) Is A Bad Passive Investment Strategy

Similar articles

Why Financial Advice for Rich Singaporeans Won’t Work For You

How to Start a Side-business With Minimal Money Risk

Robert Kiyosaki Warns Investors: We’re In A Very Dangerous Time Right Now

How To Calculate Your Net Worth In Singapore?

Using Debt To Invest Still One of the Best Ways to Grow Wealth: Robert Kiyosaki

Column: How Do People Stay Rich When Their Business Goes Bankrupt?

CPF Has No Equal as Investment Vehicle: Singapore’s Mr. CPF

How To Get Rich: What Millionaires Do To Grow Their Money From $100k to 7-figures