This article was originally published in 99.co on 24 July 2018.

One of the main killers of the property boom was the Total Debt Servicing Ratio (TDSR) framework, coupled with a tighter loan-to-value (LTV) limits. Implemented in 2013 by the Singapore government, these loan curbs were implemented as part of a broader range of cooling measures.

Restricting the amount that buyers can borrow to buy property (especially from the second property onwards), the TDSR and the more stringent LTV limit had a big impact on resulting property demand, pushing transaction volume and prices overall downwards.

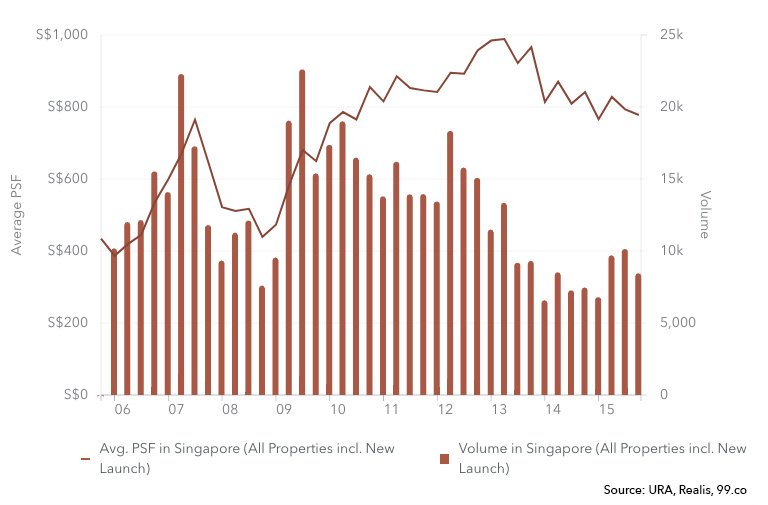

The 2013 cooling measures had their desired impact on property prices. Chart from 01/01/2016 to 31/12/2015.

Now, you’d think that it would be good for the property market for the TDSR and LTV to be lifted. Because nothing would make us happier than a flood of new buyers, right? Looking at the longer term, however, our government could recognise the need for current cooling measures to become even tighter.

How do TDSR and the LTV limits work?

The TDSR, which remains in place today, restricts your total debt obligations to 60% of your monthly income. So if your monthly income is $5,000, your home loan repayments, plus any other loan repayments, cannot exceed $3,000.

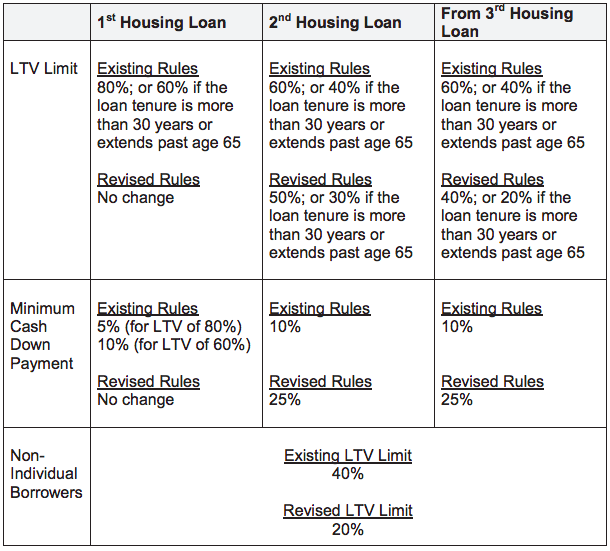

In addition, the maximum amount you can borrow for the purchase of a second property onwards was reduced based on loan tenure and your age. This is a rundown of the current LTV limits:

Credits: Monetary Authority of Singapore (MAS)

Now a lot of Singaporeans frown upon these specific cooling measures, but consider some simple facts:

- Before the loan curbs, property loan tenures were getting dangerously long

- A lot of Singaporeans lack diversification, and pour everything into their house

- Financially prudent numbers are far below the existing loan curbs

- A lot of borrowers aren’t considering long term interest rates

Point 1: Before the loan curbs, property loan tenures were getting dangerously long

Between 2009 to 2012, almost half of all home loans by financial institutions (about 45%) had tenures exceeding 30 years. The average home loan also stretched from 25 to 29 years during that time.

While the TDSR and LTV has mostly put a stop to it, buyers still have an underlying desire to own condos — or just the biggest flat we can get — by taking the longest loan tenure they can. But the fact is that they can’t work forever, and many of them will be dangerously close to our retirement age, or even past it, by the time they finish paying for their homes.

This usually results in roping in working children as co-borrowers, or being forced to sell and downgrade. Some elderly Singaporeans worsen the situation by refusing to let go (i.e. selling the house they’ve worked so hard for and raised their children in). This causes home loan repayments to soak up large parts of their retirement fund, which can very well run out in their lifetime.

As necessary measures have already been taken (i.e. cutting the loan amount based on age), we don’t mean that loan tenures need to be tightened further. But it’s probably not a good idea for the government not to loosen these age limits. Singaporean property buyers should also seriously contemplate capping their loans at 20 to 25 years. It may mean a smaller home, but do you really want to be paying a home loan at age 60?

Point 2: A lot of Singaporeans lack diversification, and pour everything into their house

Do we think property is a great investment? Of course we do, or we wouldn’t be listing them. But we think property is great in the same way power tools are — valuable only if you use them responsibly.

Some Singaporeans, however, are too optimistic about property assets. They tend to equate their house or flat with a retirement fund, as they assume they can sell it for big profits when they’re old (the worst of these plans end with “…and then I will move in with my children”).

This ignores the basic rule of diversification. Some Singaporeans sink so much into their property, they end up with minimal to no savings, and no other investment assets. This is likely for those who push to the very limit of the TDSR, taking on a housing loan that chews up the full 60% of their monthly income.

These people are making a dangerous bet on a single asset – they’re not even betting on the property market as a whole, but on the one specific unit that they’ve bought. That’s almost like emptying your life savings on a specific company’s stock, and assuming it will fund your retirement.

That’s a huge risk, one that the average, middle-class Singaporean probably shouldn’t be taking, and that the government surely doesn’t want. Perhaps if loan curbs were tighter, and Singaporeans spent less on housing, they’d consider a more diversified means of growing wealth.

See also: Should Your First Property Be an Investment?

Point 3: Financially prudent numbers are still far below the existing loan curbs

Speak to a financial adviser, wealth manager, or any other personal finance advisor if you want to clarify, but we’re sure most of them will give you these guidelines:

The price of your house shouldn’t exceed five years of your annual income, and your total repayments shouldn’t exceed 40% of your monthly income.

Now in Singapore, where housing is expensive, we do tend to go a little bit beyond this. But the truth is, even with existing cooling measures, buyers can reach quite far beyond their prudent levels. The TDSR, after all, lets them take on debt to the point where repayments are 60% of their monthly income.

If we’re going to enforce financial prudence, the loan curbs should actually be tighter. But of course, that brings up the whole issue of whether we want to live in a nanny state, and what will force the government’s hand.

Point 4: A lot of borrowers aren’t considering long-term interest rates

Home loans have been at a historic 10-year low. Before the big Global Financial Crisis in 2008 that prompted the US Federal Reserve to set interest rates to zero, home loans at 3 to 4% per annum were not uncommon.

Between 2008 till today, however, Singaporeans have gotten used to seeing rates of around 1.6 to 1.8%. Home loan interest rates are even lower than our CPF rates.

But what happens to the large numbers of borrowers, when (not if) the rates rise to their historic norms? Does even the TDSR restriction ensure that — when rates rise in future* — we’re able to deal with it?

Consider: say you make $5,000 today and you barely scrape through the TDSR; that means you’re paying around $3,000 a month. What if one day, your home loan rates rise to $3,800 per month? Can you survive with 76% of your income swallowed by just your home loan?

*At the time of writing, the US Federal Reserve has returned interest rates to pre-Crisis levels in 2008 (1.75 to 2%).

See also: Compare home loans on SingSaver for the best loan for your needs

Will the government impose even more cooling measures soon?

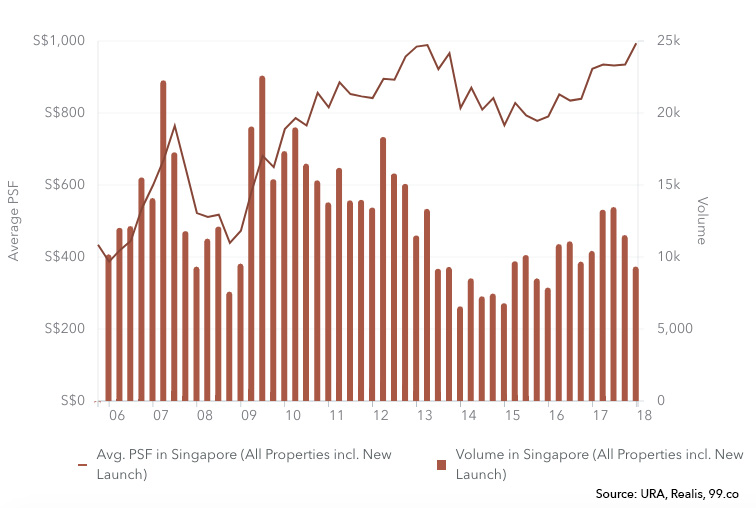

As of the end of Q1 2018, average psf prices of property in Singapore have returned to their 2013 high.

Average per square foot (psf) property prices in Singapore have returned to their highest levels at the end of Q1 2018.

As we near the end of Q2 2018, we forecast that average psf prices will be higher than the Q1 2018 figure, spurred by transactions in the non-landed private property market.

While property is still a great investment, there’s a chance that we could be over-eager to throw everything we have into it. Perhaps there does need to be tighter controls on how much debt we take on, especially in a hot property market. And perhaps the government recognises this, and there could well be another round of cooling measures just around the corner.

In any case, both homebuyers and investors should exercise prudence with their property decisions. Rather than relying government loan curbs and cooling measures to determine what they can afford and, in some cases, try to push these limits even further, they should take a step back to prevent overcommitment, failing which could lead to serious personal consequences down the road.

By 99.co

Discover the best way to find houses, condominiums, apartments and HDBs for sale and rent in Singapore with 99.co, Singapore’s Fastest Growing Property Portal. 99.co is a property search engine with the overarching goal of building a more transparent and efficient property market. We are working towards that future by empowering people with the tools and information needed to find a place to live in the best way possible.

Similar articles

What You Need To Know About The New Housing Loan Rules

Understanding TDSR And Its Impact On Your Loan Applications

Clearing Up the Confusion on New Property Measures in Singapore

Loan-to-Value Ratio & Limits In Singapore (30 Sept. 2022 Update)

What You Need To Know About The New Housing Loan Rules

New Singapore Housing Loan Rules In 2022 – How Much Can You Borrow?

Using Debt To Invest Still One of the Best Ways to Grow Wealth: Robert Kiyosaki

What Is A Bridging Loan, And Should I Get It?

.png?width=280&name=Housing6%20Things%20First-time%20Home%20Buyers%20Must%20Know%20to%20Avoid%20Regrets%20(2).png)