If you're interested in personal finance, you may have heard of the word “FIRE” being used several times.

What Is Financial Independence, Retire Early (FIRE)?

“FIRE” is a synonym for Financial Independence, Retire Early.

The idea is that through a combination of aggressive savings and or aggressive expense cutting, anyone can retire far earlier versus waiting to retire in their 60s or 70s.

Proponents of the extreme saving lifestyle often aim to save 70-80% of their monthly/annual income. Their eventual goal often is to save 30X their yearly expenses, often about $1 million, before they completely quit employment altogether.

Borne from the book Your Money or Your Life by Vicki Robin and Joe Dominguez, FIRE encompasses the idea that every dollar you earn, you are actually trading a small tiny part of your time, and thus, your life for.

Every expense is then compared to the time spent at work in order to earn the purchase.

- How many hours of work do you have to put in in order to pay for the car you drive?

- How many hours of work do you have to do in order to pay for the wedding of your dreams?

- For the home that you want to be able to afford?

- For the number of kids you want to have?

A big part of juxtaposing the number of hours you work in order to afford an item is to put into perspective how many hours of their lives they are trading away in order to afford something.

For example, a social worker earns between $3,300 a month to $4,500 a month depending on their level of seniority and education.

This salary sounds medium or even high to some people. But the social work industry is notorious – similar to the law industry in this case – for long hours of grinding work.

- Assuming 20% CPF contributions, the social worker’s average takes home pay based on $3,300 is just $2,640 a month.

- Assuming they also work on weekends, their total number of working hours a week, coupled together with time spent travelling to and from work, including work purposes can come up to about 16 hours a day, 6 days a week.

- That puts the average social worker in Singapore working about 96 hours a week, and 384 hours of work a month.

- Estimating their take-home pay of $2,640, they earn an average of $6.80 an hour. Which means anytime they spend $100, they actually gave up 14 hours of their lives for that purchase.

- For comparison, as a once part-time CISCO police officer, I took home $12 an hour for normal work and $18 for overtime.

Once you juxtapose time spent against expenses, you start to have a keener appreciation for things you should or should not be buying.

Now, instead of seeing a dollar sign next to an item on the price tag, you become more aware of the number of hours of your life you have to work to buy it in the first place.

The most obvious response for people then is that they too wish to FIRE.

They too wish to stop having to work and to start worrying about money and instead spend time doing what they love or want. So how does FIRE help achieve that?

Aggressive Savings Efforts

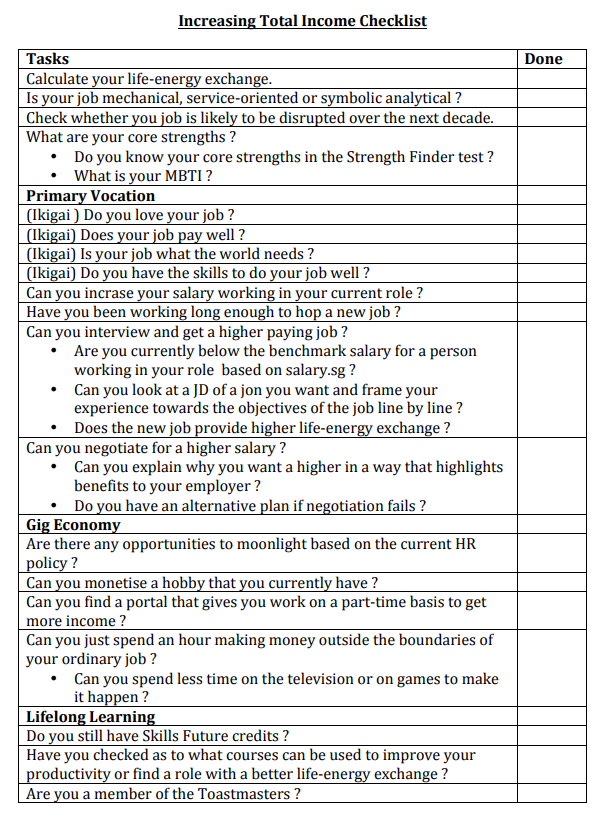

FIRE proponents typically work themselves through a checklist and reorganise aspects of their financial lives so they can reorganise their cash flow.

This is the most critical and important step.

How much you are paid at work is not something definitively within your control – even if you are a commissioned salesman.

Effort does not always equal reward. Thus, a person who wishes to start gaining financial control over their lives is often best-served first directing their efforts towards what can be controlled – their expenses.

What isn’t measured is not controlled. And what isn’t controlled, spins out of control really fast.

Cost-cutting is often the first and best way to reduce outwards cash flow and start increasing savings. This is necessary for any and all proponents of the FIRE lifestyle.

I have applied this in my own life and the cost savings have been substantial. I typically enjoy a breakfast of about 6 eggs ($3) and an iced coffee ($1.50). In total, this usually costs me about $4.50.

In a month, this is about $4.50 x 30 days = $135.

I decided this was way above what I should be spending. Lo and behold, a tray of 30 eggs at the local supermarket costs about $5.35. This settles the egg portion of my breakfast for 5 days. For a month, my expenses for eggs would be $5.35 x 6 = $32.10.

Coffee was swapped to what was available in the office via a dispenser. Lucky me.

Total savings? $135 – $32.10 = $102.90 per month.

I’ll put it at about $80-$90 true value because there are days where I break the routine. But $90 a month still puts me at $1,080 of extra savings a year.

All of this from just breakfast. I haven’t even begun delving into savings from phone bills, (where I plan to switch my mobile plan from Singtel to Circles.Life for $20/month, saving me about $80 per month or $960 a year) or working as a freelancer on the weekend.

Already, my savings for the year stands at $2,040. A fifth of the $10,000 typically required to start investing. That may seem small. But over a period of 10 years, that is $20,400 extra I wouldn't have before.

The plan here is simple. Cost cut where possible in a manner that makes sense. Funnel that money into other areas, either savings, investments, or even building a business.

In other words, do not cost cut in a way that is too abrupt for yourself.

Take it slow.

I used to have $8 lunches. Now my lunches and dinners rarely cost above $5. I still have the occasional extravagant meal now and then, but those happened anyway, so now I’m net cash on food.

It took me time and effort to slowly curtail my habitual spendings and to find new eating places. You can do the same. And it will help you as well if you slowly cut away unnecessary expenses from your life bit by bit as opposed to ripping them up wholesale, roots and all.

Baby steps.

Aggressive Income Efforts

Below is a list of things you can do to maximise your take-home cash.

On the other side of the spectrum from savings is earnings – and it is equally as important to optimise and manage, especially if you do not make a lot of money at your full-time job.

Most side gigs nowadays involve work as a food delivery rider or as a Grab driver. If done well, these can bring home about $600 to $1,000 extra a month.

I have friends who work part-time on weekends and nights after work and bring home an extra $2,000 to $4,000 a month, though this is mentally and physically taxing. It’s also not sustainable in the long run except for the most disciplined among us.

If you have a skillset, for example, copywriting, coding, development, legalese, website building, applications development, you can farm out your skills to 3rd parties for extra income – just make sure your full-time job does not prevent or specifically prohibit you from doing it.

You Have A Boatload of Cash – Now What?

If you have followed through with the above examples, you will by now have noted this is not a simple process.

FIRE is a process that is inherently built with great friction. It can be physically painful to take on extra work to make more money unless it is a hobby – which is why we suggested you monetise it above. It can also be equally painful to save money on things you love – like bubble tea or short getaway holidays. And yet it is necessary.

The process is one that works and is one that brings you significant cash savings – assuming you had the ability to go through with it.

Most FIRE proponents do a combination of two things at this point with the cash pile they have accumulated.

- Dump their cash into a low-risk, capital guaranteed, interest yielding account (like our CPF system), or;

- Start investing their now much more sizeable cash pile and aim to grow it exponentially larger within a period of 10 years, with the ultimate aim of passive income via dividends sustaining them once they finish full-time employment.

Whether you do the first or the second is up to personal preference. There are drawbacks to the CPF system which I am personally unable to accept,

- Inflexibility: You have no control over your money. It is not accessible in the case of emergencies such as an emergency operation or studying for a Masters in the field of your choice.

- Long wait time: You need to wait till you’re 65 before you can see that money come to you bit by bit, a month at a time.

- Returns are Capped: Your returns are a maximum of 4-5% a year. It doesn’t go up unless the government says so. And if the government says so, it might go down as well. If inflation rises above 4%, your CPF Special Account won’t be able to account for that.

- Currency Risk: The Malaysian Ringgit was once worth $0.50 Singapore dollar. Today, it’s 1 Malaysian Ringgit to $0.33 Singapore dollar. If the same happens to Singapore’s currency, your money locked away in the CPF Special Account prevents you from shifting your cash into an asset that can retain its value far better. Something like gold, or even another currency.

- I recently took a trip to Malaysia hoping to capitalise on the fact that our money was now worth more. While prices in general have gone up slightly across the board, their imported products like graphics cards or laptops jumped in price to reflect the degraded value of the ringgit. Can you imagine the vegetable uncle charging you $7 instead of $3 because the Singapore dollar lost value? That could destroy your retirement.

You might be of a different mind. You might believe in the Singapore government. You might believe that things will never go badly for us. And if that is the case, good for you.

You have a 4% guaranteed-a-year system inherently built by the Singapore government. There is nothing wrong or inherently mistaken about that. It is simply a matter of personal preference. So put your money where you feel it is best served to grow. And play it safe.

I, on the other hand, prefer not to take the risk of losing control of my money. I prefer investing my money because I retain maximum control over my holdings. I decide how to flow my funds in the case of an emergency and how I can protect myself from the Singapore dollar devaluing (unlikely but possible certainly).

In the unlikely event that I need cash urgently, and it is somehow beyond my emergency funds or not covered by my insurance, I can liquidate the holdings with which I have the least confidence in order to cross that hurdle.

There are fundamentally great resources for investing freely available on the web. I suggest you read them and take a look at your available options.

Critique of the FIRE Movement

You will notice the mechanisms which allow FIRE proponents to actually retire depend largely on Earning Power.

This is a basic critique of the FIRE movement: it is not accessible or practical as a method of retiring for people who do not possess strong earning power. Without Earning Power, you can’t really save too much money. You can really only save so much based on a $2,000 salary.

Earning Power also inherently dictates how much you can actually make on the side with your skill sets. The better you are, the more you make. And it is unlikely you can make more on the side doing something you’re doing full-time (hint: change your job if that’s the case. you are not maximising your earning power).

To some degree, you can simply drive Grab or deliver food, but those too, in and of themselves, do not deliver above-average earnings per hour for your time: they simply improve total take-home cash.

So what now?

What Can People Without High Income Do?

Maybe the case is that you are stuck. You don’t earn a large salary in the $5,000-$15,000 range, but you do earn enough to get by.

Saving and earning more money is one thing. But without growth for the cash you have saved, inflation will eventually kill whatever you have scrabbled together.

There are 3 main ways to grow the cash pile once you have accumulated it or started on the path of FIRE, even without a high income.

- An increase in salary via a promotion, renegotiation, or job change

- Starting a business

- Investing

On Negotiating For A Salary Increase: Read and Learn

If you aim for a salary increase, learn some top negotiation tactics. I would personally recommend you quantify your total worth to the company so you have grounds to ask for a raise or can get a better paying job elsewhere.

A useful book to read for application in all parts of life, and most important in salary negotiations is "Never Split the Difference" by Chris Voss. It details some of the best strategies to negotiate for a salary raise, including the Ackerman Model.

Besides that, staying engaged, up to date, and at the edge and flow of your industry is how you get paid more each year. Being the first to know about something helps a lot in convincing your boss to pay you more.

On Starting Your Own Business: Find Your Ikigai

What is an ikigai? Basically this.

If you intend to start a business, I would suggest first looking towards monetising your Ikigai and the fantastic article, 1000 True Fans by Kevin Kelley.

It details how you simply need to find 1,000 true fans. Fans who will buy anything you sell and fly halfway across the world to meet you because in your field of choice, in your ikigai’s zone, you’re the best there is or have something unique.

To meet this status, you obviously have to be good at something.

- Being half as good as Warren Buffett comes to mind.

- Being a well-known blogger or inspirational speaker comes to mind as well, though for some reason I experience a violent urge to hurl when it comes to ‘motivational talks’.

- There are other platforms; some kids make tens of thousands a month streaming video games.

The fundamental principle here at work? Find something you love and get truly, god-awesome, wonderfully, unspeakably good at it. And make sure it is uniquely you.

Twitch, a live game-streaming platform, for example, allows gamers to interact with their fans or live viewers. People can subscribe to you for $5 a month, of which you receive $3.50 after Twitch takes its cut (figures approximated from Reddit trawling).

Suppose you have 1,000 true fans, that’s $3,500 a month. And that’s a living for most people. That fan base will grow if you stay consistent and keep going.

If you have consistency and your Ikigai, you’re unstoppable. So go figure out your Ikigai and monetise it. And be creative about how you want to monetise it too. A blog, for example, can be a place for you to turn the most boring of hobbies (to outsiders) into a place for like-minded people to gather and access your thoughts and ideas, and essentially become a space for you to develop 1,000 true fans.

On Investing

Four things are required for any amount of consistent investing results.

- A methodology that works

- Consistently following and improving the methodology that is based on sound logical theory, not feelings

- Understanding that investing is a decade long game and that consistency over time is what leads to greater investment performance

- The right temperament

1) A methodology that works, in this case, would be what has displayed consistent track records.

It doesn’t matter what it is as long as you, YOU, the person right now reading this article, is able to believe it, understand it, learn it, and stick to it.

A methodology that works would be one that is based on sound logic, sound theory, and enjoys a long and consistent track record of working. Value investing is the most popular one thus far, and Warren Buffett (Berkshire Hathaway) is arguably the most famous and well recognised proponent of this.

2) A consistent following and improving of the methodology that is based on sound logical theory, not feelings.

Knowing a method is not enough. You must implement it. Use it. Feel it. Physically sink your money in and put it where your mouth is. You cannot learn something from textbooks alone all the time and investing is but one concept.

A key concept upon implementation is that you learn you are human, and that you make mistakes. It is important here to be aware of why they came about. A person low on introspection and low on self-locus of control would hardly be able to understand why he/she was wrong and will thus continue to be wrong many more times, in many different ways – until they give up because they have lost too much money, or they right the flaw in their investment approach.

Thus, constant improvement is necessary. And an approach based in rigour and logic, absent of emotion is absolutely critical, without which disaster strikes. Repeatedly.

3) Understanding that investing is a decade long game and consistency over time is what leads to greater investment performance.

Humans are short-lived creatures. We think of what we want for lunch, dinner. Tomorrow’s breakfast. Maybe even the trip to Japan or Europe or Americas next year. But we hardly even more fully, more broadly, and in greater detail think of where we want our lives to be in the next ten years.

This flaw comes back to haunt those who are unable to think long term when investing. Short-term thinkers will never understand long-term value. Short-term buyers of stocks will keep losers too long and sell winners too fast.

Investment is a long-term commitment to buying good quality cheaply, and holding it long and well, only selling when the price is right or if that quality is no longer there.

Few people understand this. Fewer understand that consistency is needed to stay the course over decades of market ups and downs.

From the Asian currency crisis to SARS to Brexit to the Trade War. There will be many seemingly calamitous events happening globally that will yank money from short-term thinkers who panic and sell off their stocks at bargain prices while simultaneously delivering bargain buys to long-term thinkers.

4) The right temperament is necessary for all things, including and especially, investing.

Investing is a painful activity. And that seems to be a constant truth of life.

FIRE proponents who do not invest their money and sit on cash piles will eventually see their buying power eroded. To survive, to move forward, FIRE proponent or not, you must embrace some amount of risk in order to even keep ahead. This is fact – whether you like it or not.

Thus, your temperament must either be cultivated, learned, or at the least inculcated in you by the readings you have, the education you seek, and the people who you surround yourself with.

Ultimately, I feel FIRE as a concept was an inevitability.

We do not work in a society that allows us to be fed based on the work of our choosing. Most of the time, we will be lucky to even be able to do something boring for a living.

To stay sane, we must have something to look forward to. It used to be Fridays, hence the prevalence of TGIF. Or the holidays. Or the year-end festivals. Endless amount of people will tell you to find meaning in your work. To find joy in it.

I propose differently.

Work is simply a job. You do it to sustain yourself. And you owe it to your employer to do it well while you are fairly compensated for it. But don’t work for the sake of living. Work for the sake of finding what drives you. Work so you can find what gives you hope. And excitement. And dream. Work so that you are afforded the time to find what you love.

Work so that you can then FIRE and live a life of meaning. Whether that means a lifetime of charity or a lifetime of reading books, that’s up to you.

Work so you can find your ikigai.

Without finding your ikigai, being successful at FIRE would merely upgrade you from a life Financially Insecure Meaninglessness to a life of Financially Secure Meaninglessness.

So what if you FIRE then?

- What are you going to do? Travel the world indefinitely? Then what?

- What makes you so inexorably excited about life you can’t wait to wake up in the morning?

- What makes you so excited you would hate to sleep at night?

Find the answer to these questions. And the motivation and inspiration to FIRE successfully – if that is even what you want – will come naturally to you.

A version of this article was first published on DrWealth.

Read these next:

Retirement Planning: It’s For Your Kids Too

3 Myths About Retirement Planning in Singapore (And Why They’re Wrong)

Retirement Age: What’s The “Correct” Age to Retire in Singapore?

4 Safest Ways to Grow Your Retirement Nest Egg in Singapore

Can You Afford to Retire at Age 50 in Singapore?

Similar articles

3 Myths About Retirement Planning in Singapore (And Why They’re Wrong)

3 Reasons Why You Should Start Investing With A SRS Account

What Are You Doing to Plan For Your Retirement?

Retiring Early: Why The F.I.R.E Movement Might Not Work For Everyone

Are Your Ageing Parents Ready For Retirement?

‘Want To Be Financially Free? Start Planning For Retirement As Soon As You Start Work’

How Much Do You Need To Retire in Singapore?

The Fundamentals of Financial Readiness

-2.png?width=280&name=Insurance%20(2)-2.png)