Next to financial independence, one of the foremost concerns on most Singaporeans' minds is whether we'll have enough funds to think about retiring and actually retire.

If you belong to the camp that believes retirement planning should start from your 1st pay-check, opening and investing with a Supplementary Retirement Scheme (SRS) account can belong in your longer term investment strategy.

When the Singapore government introduced the SRS in 2001, it was intended to supplement the CPF retirement savings scheme that Singaporeans are automatically part of.

Looking back, one can’t help but think how the concept has grown in its relevance, especially in times like now, where uncertainty continues to loom in the horizon. From new COVID-19. variants to layoffs and recessions, rolling with change is fast becoming an essential life skill.

So how does having an SRS account help you level up in the game of life?

Why open a SRS Account?

With its humble 0.05% interest rate, opening an SRS account doesn’t seem like an earth shattering money move. One could easily argue that putting the same amount in the CPF Special Account would earn significantly more interest.

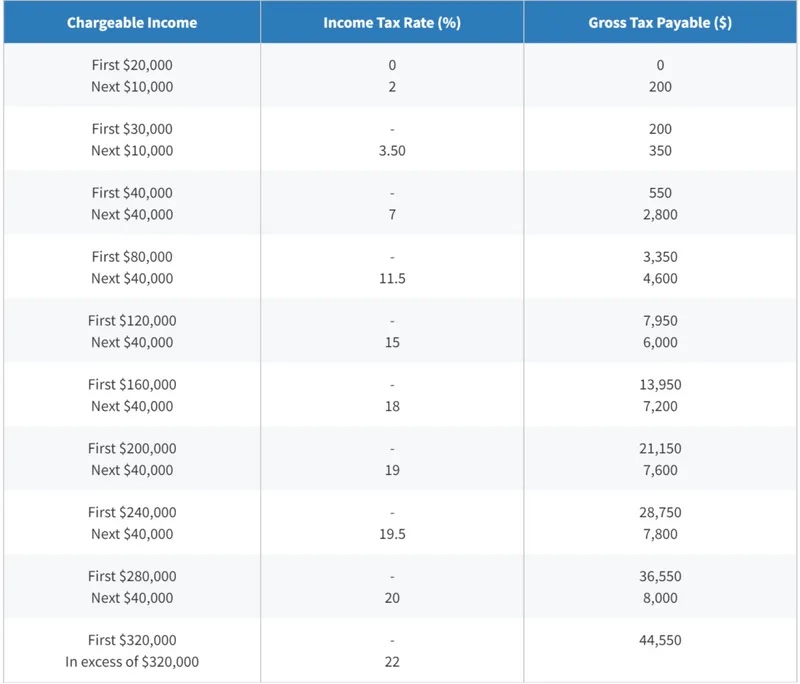

The main benefit of an SRS account is to enjoy tax relief on your taxable income, with the annual contribution capped at S$15,300 for Singaporeans and S$35,700 for foreigners in Singapore.

To enjoy the tax benefits and be able to withdraw your funds without penalty, your SRS funds have to stay in the account until the statutory retirement age set when you make your first contribution (which would be 63 in Singapore as of 1 July 2022). You can open an SRS account online through any of the three major banks - DBS, OCBC, UOB.

If for any reason you withdraw the money before then, you will need to pay a 5% penalty on the amount withdrawn and taxes on 100% of the withdrawal. The exceptions are if you withdraw the funds for medical reasons or bankruptcy.

Which brings us to the next question: What should you really be using your SRS account for then?

#1 - Inflation-proofing your savings

Even if you’ve not been keeping up with the news, there is simply no way you can ignore the rising costs of… just about everything. Thanks to one of the highest interest rates hikes in over two decades and inflation fears, buying groceries can be a startling experience these days.

By topping up your SRS account, the tax deductible funds automatically earn you extra savings. This becomes more obvious when your annual income falls between S$40,000 to S$80,000, where you’ll notice a jump of 3.5% in tax rate.

Reminder: Be sure to top up your account before 31 Dec every year to qualify for tax relief in the following Year of Assessment.

To future proof your savings, one way is to invest. Before that, make sure that you’ve built up a sufficient surplus of at least 6 months’ of living expenses in emergency savings. Should you decide to invest your money, make sure you’re investing above the inflation rate, currently at 2% in Singapore.

Unlike CPF investments, which are largely controlled by the CPF Board, investing through an SRS account opens up to a wider range of investment products including unit trusts, insurance plans, stocks, ETFs, REITs, and Singapore Savings Bonds.

Some investing platforms that allow trading with the SRS funds are Syfe, Endowus, and StashAway. Compare and see which one suits you best

#2 - Beef up your retirement stash

For most Singaporeans, the most common way of bumping up our retirement funds is to either transfer from the Ordinary Account to enjoy the higher interest rate of 4% or top up with cash (cap at S$7,000).

If you’ve worked out how much you’ll need for retirement, relying on one source of retirement savings is probably not enough. Furthermore, many Singaporeans would have used our CPF savings to purchase a property.

This makes scaling up your retirement funds a tad challenging, which investing with your SRS account can help you by maintaining an investing habit.

To reap the full benefits of compounding on an SRS account, it’s crucial that you’re only contributing funds that you won’t be needing for at least the next decade. So only contribute if you've set aside a deep enough cushion for your own emergency savings, and other responsibilities such as taking care of your parents' retirement.

Bear in mind that as 50% of every withdrawal will be subject to tax, timing withdrawals is key to maximising your tax advantages. You should withdraw when your marginal tax rate is lowest. What does that mean? It simply refer to the additional amount of tax payable

#3 - Investment returns are tax-free

While withdrawals are taxable, your investment returns are not. That means if you have the discipline to invest a sum every month (S$1,275 based on the S$15,300 cap), and let compounding work, you just might be able to get to your retirement goals.

In the context of keeping your investment funds locked for at least the next 10 years, low-risk products to consider are the Singapore Savings Bonds, fixed income, and annuities. A good example of a low-risk annuity is the CPF Life, which pays out a fixed monthly amount for your retirement over a period of time.

If you have a longer time horizon and are planning to take on more risk, your SRS funds can also be used to invest in real estate investment trusts (REITs), exchange-traded funds (ETFs), and stocks. As with any form of investment, you should do your due diligence to understand the products and companies you’re keen to invest in to avoid making rash decisions.

So should you invest using an SRS account? The answer really depends on your financial objectives and which life stage you’re at.

If you are a middle-to-high income earner looking to diversify your investment portfolio, and know that you won’t need to withdraw the funds before retirement age, contributing to your SRS account can be a welcome boost to your retirement stash.

Read these next:

Robo Advisors Singapore: A Complete Guide

StashAway Review: Goal-Getting Investments Through ETFs

Endowus Review: Investing Your Cash, CPF And SRS Money At Low Fees

Robo-Investing vs DIY Investing: Which One Should You Choose?

Comparing The Returns & Fees Of The Top Robo-Advisors In Singapore (2022)

Similar articles

Financial Topics That Are Safe for This Year’s Christmas/New Year Table

The Best Low-Risk Investments To Store Your Emergency Funds

Optimise Your Income Tax, Score Better Investment Returns. Here’s How

End-Of-Year Bonus: What To Do And How To Utilise It?

Guide To Supplementary Retirement Scheme (SRS) And Tips To Maximise It

Have a More Comfortable Retirement Through Tax Optimisation: SRS

Is the CPF Supplementary Retirement Scheme (SRS) Worth Using?

Pros and Cons of Having A Supplementary Retirement Scheme (SRS) Account

-2.png?width=280&name=Insurance%20(2)-2.png)