A local new start-up that helps consumers maximize credit card rewards at the point of sale soft launched in May. SingSaver caught up one of the co-founders of Whatcard.sg, Glenn Toh, who talked about his plans for the fledgeling company over an email interview.

SingSaver: Tell us about the three people behind WhatCard.sg. What you do, your backgrounds and how you came together?

Glenn: We are a team of three Singaporean co-founders with diverse backgrounds but a common interest in personal finance, technology, and entrepreneurship. I was previously in management consulting, and am currently pursuing my MBA studies at INSEAD. My two co-founders are respectively an analyst in a fund management company and a developer for a large global internet company. We’re all 29 years old this year.

We were schoolmates at NUS and participated in the NUS Overseas Colleges program during our undergraduate studies, a one-year entrepreneurship experience that we would highly recommend to all NUS students. Our experiences with leading-edge technology companies during that time made us realise the power of technology to simplify daily life.

We have always been deeply passionate about personal finance, with two of us having run personal finance blogs before this. This year, the three of us finally decided to work together on a project we were all passionate about. Thus, WhatCard.sg was born as our passion project to create something that would give value to everyday Singaporeans.

Entrepreneur Glenn Toh, 29, is one of three co-founders behind whatcard.sg.

What is WhatCard.sg. How did you come upon this idea and what’s it trying to solve, and for whom?

WhatCard.sg is a website that functions as a merchant/shop search engine, where users key in the merchant’s name in the search bar, and the website will show all the different credit cards currently available in Singapore, ranked by the amount of rewards given.

Existing card recommendations today are generally in the form of static blog posts, such as “The Best Credit Card for Dining (updated July 2019)”, but these posts lack granularity, as they do not go into the rewards from specific merchants that the user spends on.

We were inspired (among others) by travel hacker blogger Aaron Wong aka The MileLion, who lamented online that there wasn’t an existing solution that would recommend credit cards from the user’s lifestyle perspective. Further, there were multiple examples of crowdsourced compilations of user-submitted credit card rewards such as the Hardwarezone forum Credit Card Compilation that suggested that this was a real problem people faced.

We designed WhatCard to be a simple, convenient tool so that users (like ourselves) could, right before transacting at the merchant’s point-of-sale terminal, do a quick due diligence to know which of their existing cards would give them the best rewards, as well as discover new credit cards they do not currently have which would provide even better rewards for their spend.

One of the key USPs of your product is that it’s dynamic and also very granular, even down to specific merchants. With such a small team, how do you keep it up to date?

Currently, the way that data on cards and merchant rewards has been obtained is entirely manual. We leveraged on three main channels to collect information: 1) crowdsourced lists that are available on public domains, such as forums and online communities; 2) terms & conditions of various credit cards, uploaded on the landing page of credit card websites; and 3) personal transactions at the merchant with our own credit cards, calling the customer service divisions at credit card companies for the data.

It may seem like a huge undertaking, but it can be done surprisingly quickly given that we managed to pull the data together in less than a month on a purely part-time basis (as all three of us have full-time work/study commitments).

In the future, we hope to cultivate a community of users that will contribute feedback on errors or stale information on our site. This way, we can keep the site up-to-date at all times. As we grow, we will also explore automation options to accelerate data collection and validation to ensure the most up-to-date data for our users.

WhatCard.sg was launched in end-May. Are you pleased with the initial results and what kind of feedback have you received?

When we launched the site, we did not have a clear estimate or target number of users that we aimed to reach. Our goal was to build something that solved a real problem for ourselves and our users.

Since our launch, we have been heartened by results thus far. We had over 2,000 unique visitors to our site in June, and more importantly, logged close to 6,000 searches for merchants, which tells us that our visitors are actively engaging with the site.

We want to increase the number of regular users by rolling out updates and improvements to make the site even more relevant for users and grow organically without relying on paid marketing. We’ve gotten very good traction so far in July.

The feedback we have received has been very positive, even including features from local bloggers such as SG Budget Babe, Early Retirement SG, KPO and CZM and several others. Many people have commended us on our initiative to build a free tool for the personal finance community in Singapore, as well as our decision to make the merchant category code (MCC) data that we collected in our database transparent to all users instead of trying to hide our “proprietary” information.

While we really appreciate the positive encouragement, we are especially thankful for the abundant feedback received around bugs/errors/issues as well as suggestions on new features as these help us to improve the product and make it even more useful for everyone.

It’s still very early days yet. What are your immediate short-term plans for WhatCard?

In the near term, we want to continue building out our product. Besides adding new merchants to our list (currently at ~1,300 merchants), additional features in the pipeline include creating dedicated user profiles so that recommendations and rewards displayed can be tailored to the user’s existing credit cards, and improvements to our search engine to make it more forgiving to misspellings/typos to make it easier for people to find what they are looking for.

We’re also reaching out to bloggers and communities such as Singsaver to raise awareness about credit card optimisation and of our tool among savvy internet readers, because, what good is there in building a perfect tool without users?

What about medium/long-term? What features do you want to add and how do you see this going forward?

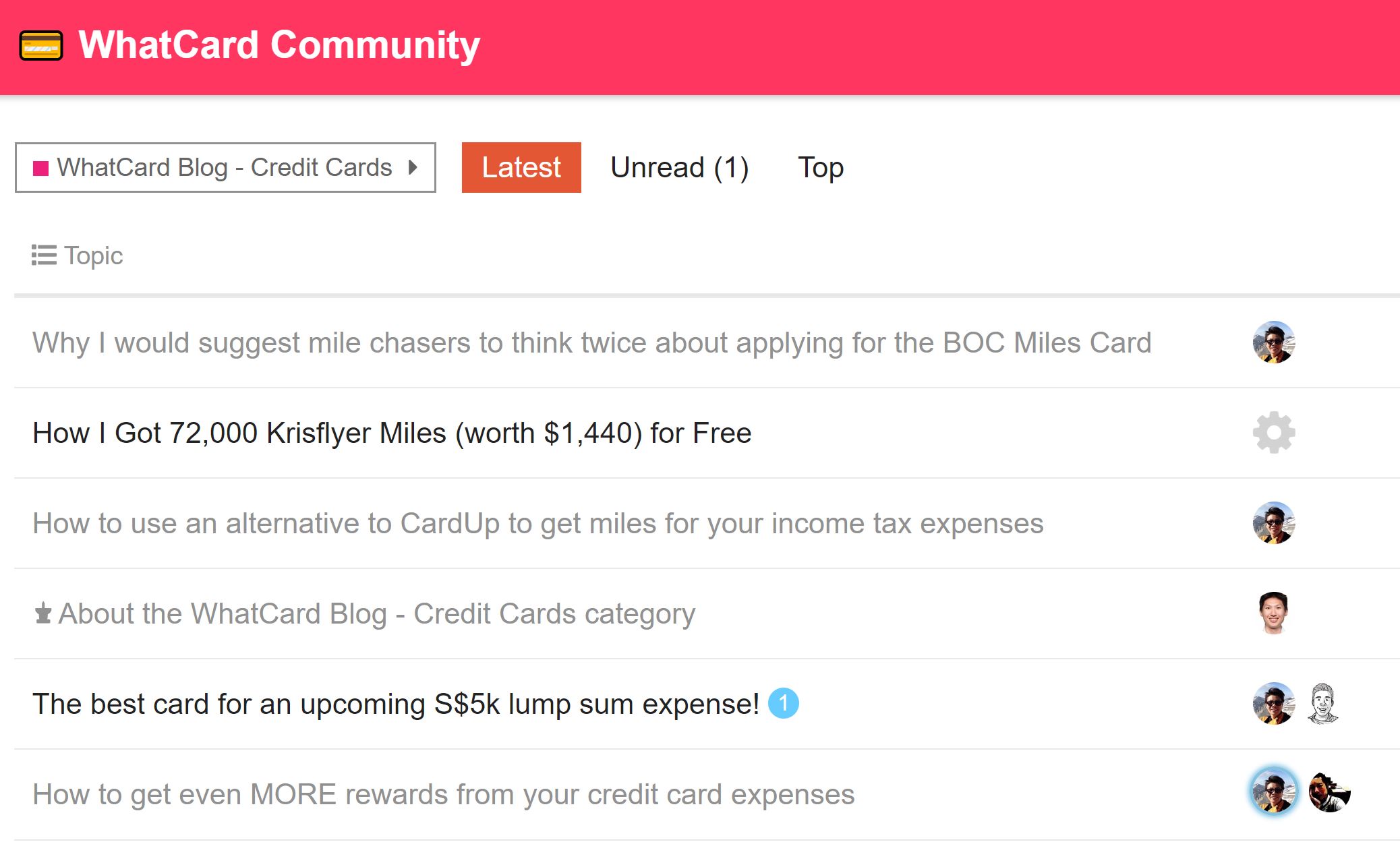

In the longer term, we would like to build WhatCard into a thriving community of savvy credit card users who share and learn from one another, to get the most out of their credit card usage. On our end, we will continue to add more features and functions to make WhatCard a valuable resource for the community.

All three of you seem to have been bitten by the entrepreneur bug. What’s been the biggest lesson learned so far?

One of the biggest lessons that we have learned is that entrepreneurship is not a sprint, but a marathon. We are grateful to our current users for supporting us and helping us with our traction so far and will continue working hard to make our product something that current and future users will love and use regularly.

Related stories:

MCC: The Three Most Important Letters When Earning Miles or Cashback

7 Ways To Earn More Miles With Everyday Expenses

6 Ways to Turbocharge Your Travel Hacking Game

‘I Have 19 Credit Cards But There’s Just 3 I Would Recommend’

Similar articles

Visa Supplier Locator: Find And Decode Any Credit Card MCC

Best Credit Cards Hacks To Go With Your Choice Of Buy Now, Pay Later (BNPL)

6 Credit Card Resolutions To Nail 2021

Zig Rewards vs GrabRewards – Which Offers You Better Rebates?

FavePay CardLink Launches: Earn Bonus Cashback Plus Credit Card Rewards

15 Best Free Dating Apps & Sites To Find A Companion In Singapore (2022)

The Beginner’s Guide To Earning Air Miles

Credit Card Comparison: Citi Rewards vs OCBC Rewards vs HSBC Revolution