Charting Our New Way Forward Together — that's the name of Singapore Budget 2022. This article will provide you with live updates on the key announcements made during the Singapore Budget 2022.

Tune in and subscribe to our Facebook, Instagram and Telegram channels to receive live updates directly on social media.

In 2021, the Singapore government rolled out a three-pronged approach for the COVID-19 Resilience Package to help Singaporeans tide through these unprecedented times. Aside from S$11 billion set aside for the package, the government further allocated S$24 billion set aside to enable firms and workers to emerge stronger. Revisit last year’s Budget 2021 details here.

This year, our economy has rebounded strongly. Singapore has maintained its growth forecast at three to five percent. Thanks to the manufacturing, finance and insurance and trade sectors, the economy has expanded 7.6 percent last year.

Workers and businesses in struggling sectors who were negatively affected will also be given financial support through recovery grants. These support measures will provide 'temporary relief' for businesses and workers.

This year, the focus is on Charting Our New Way Forward Together, revealed by Finance Minister Lawrence Wong as the theme for the Singapore Budget 2022. He said that “it will set out how we can better position Singapore for future challenges and opportunities, and strengthen our social compact.”

1. Jobs and Business Support package (S$500m)

In order to support the individuals and businesses in struggling industries, the government will be provided more financial support as part of the small business recovery grant for F&B businesses and SMEs.

As part of the small business recovery grant, SMEs in eligible sectors will receive a payout of S$1,000 per local employee (up to a cap of S$10,000 per firm). Local sole proprietors and partnerships in eligible sectors, along with Singapore Food Agency-licensed hawkers, markets and coffee shop stallholders (without local hire) will also receive a S$1,000 payout to aid them financially.

Workers who are still facing income loss due to COVID-19 can still apply for the COVID-19 Recovery Grant, which has been extended to the end of 2022.

2. Household Support Package (S$560m)

To help family with bills, daily essentials and their children’s education expenses, a S$560m Household Support Package comprising the following will be rolled out:

- GST U-Save Voucher: GST Voucher-U-Save rebates will be doubled for the rest of the year. Eligible HDB households will receive additional rebates of up to S$285.

- Additional top-up to CDA/EduSave/PSEA: Children under 21 years will receive S$200 dollars each in their Child Development Account, Edusave Account or Post-Secondary Education Account on top of Edusave top-ups

- S$100 CDC vouchers: S$100 additional CDC vouchers for all Singaporean households.

3. Changes in tax system

Carbon tax — aim to move towards net-zero carbon emission

In a bid to work towards Singapore’s new net-zero ambition, Singapore will need a higher carbon tax, said Mr Wong. He mentioned that there will also not be an additional carbon tax on the use of petrol, diesel and compressed natural gas.

Carbon tax will be raised to S$25 per tonne in 2024 and 2025, and S$45 per tonne in 2026 and 2027, with the progressive aim of reaching S$50 to S$80 per tonne by 2030. The current tax of S$5 per tonne will remain unchanged until 2023, and increases to the carbon tax between now and 2030 will be paced.

The Government will announce subsequent increases ahead of time to provide certainty for businesses. The Minister said, “We will continue to review and adjust these fuel excise duties periodically.”

For households, the higher carbon tax will be felt mainly through an increase in utility bills. At S$25 per tonne, this would be an increase of about S$4 per month in utility bills for an average four-room HDB household at average consumption.

However, the Government will provide support, such as additional U-Save rebates to help cushion the impact during the transition. More details will be announced next year, ahead of the carbon tax increase in 2024.

Mr Wong clarifies that they do not expect to derive additional revenue from this increase in the carbon tax. Part of the carbon tax revenue will be used for cushioning the impact that households and businesses are poised to experience.

A large part of the revenue will be used to support a "decisive shift" towards decarbonisation through investments into new low-carbon and more energy-efficient solutions. These will help lower Singapore's emissions and move closer towards the net zero ambition.

GST

The GST increase will be delayed to 2023 and the increase will be staggered over two phases. The first increase will take place on 1 Jan 2023, from 7 percent to 8 percent while the second increase will happen on 1 Jan 2024, from 8 percent to 9 percent.

GST on publicly-subsidised healthcare and education will be absorbed by the Government, while Town Councils will receive an additional S$15m per year to absorb the additional GST payable on Service and Conservancy charges.

There will also be no increase in government fees and charges for one year from 1 Jan 2023, including license fees and fees charged by government agencies for the provision of services.

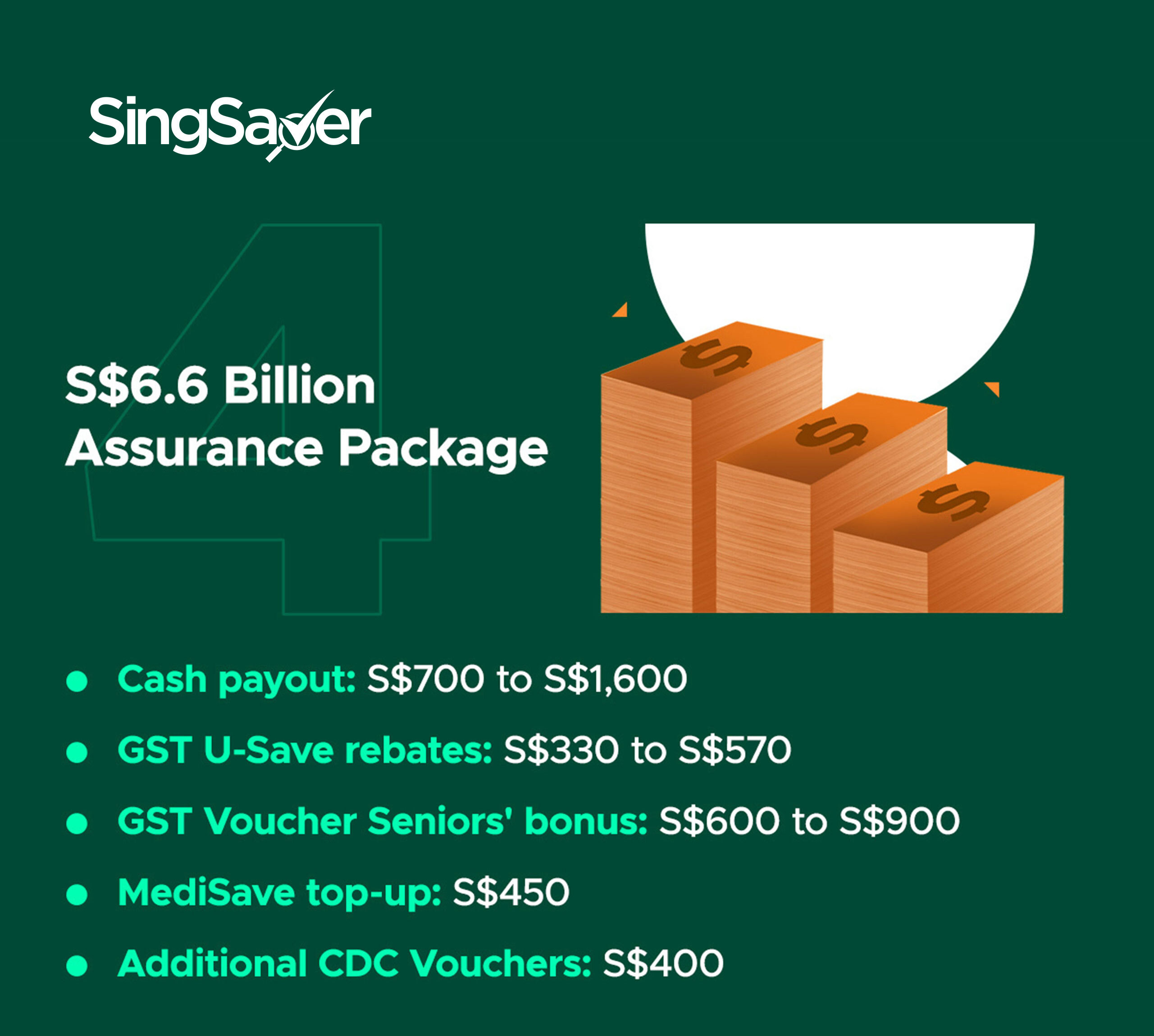

Assurance Package

However, the GST increase isn’t designed to hurt low-income households. An additional S$640m will be added to the S$6b Assurance Package — this is to help low-income households cushion the impact of GST hike.

The enhanced package will provide significant payouts to Singaporeans over the next five years:

- Every adult Singaporean will receive cash payouts totalling S$700 to S$1,600

- Eligible seniors will receive a special GST Voucher – Cash (Seniors’ Bonus) totalling S$600 to S$900

- Eligible HDB households will receive additional U-Save rebates totalling S$330 to S$570, depending on flat type

- All Singaporean children and seniors will receive MediSave top-ups totalling S$450

- All Singaporean households will receive two tranches of CDC vouchers worth S$200 each in 2023 and 2024

For lower-income households, they will receive much more, with offsets covering about 10 years' worth of additional GST expenses, he added.

Enhancement of GST Voucher (GSTV) scheme

The scheme currently has three components – a cash payout, MediSave top-up and utilities rebates.

It will be enhanced in three ways:

- The Service and Conservancy Charges Rebate will be made a permanent component of the scheme.

- The Assessable Income threshold for GSTV-Cash will increase from S$28,000 to S$34,000.

- There will be an increase in the quantum of the GSTV – Cash payout to S$500 for those residing in homes with annual values of S$13,000 and below; this payout will be S$250 for those residing in homes with annual values of between S$13,000 and S$21,000.

Wealth tax

Mr Wong says there will be more room for “greater progressivity” when it comes to personal income tax, adding that those who earn more will contribute more.

The top marginal personal income tax (PIT) rate will be increased with effect from the Year of Assessment 2024. The portion of chargeable income in excess of S$500,000 up to S$1 million will be taxed at 23 percent, while that in excess of S$1 million will be taxed at 24 percent. The current PIT rate stands at 22 percent. This increase aims to only affect the top 1.2% of taxpayers.

Property tax

Property tax rates for non-owner-occupied residential properties will be increased from 10 to 20 percent to 12 to 36 percent.

All non-owner-occupied residential properties will face higher property taxes, and the increase will be “more significant” for properties at the higher end, Mr Wong said.

A large non-owner-occupied detached house in the central area with an annual value of S$150,000 will see an annual property tax bill of about S$43,000 per year, he explained.

For owner-occupied residential properties, the property tax rates for the portion of annual value in excess of S$30,000 will be increased from 4 percent to 16 percent to 6 percent to 32 percent respectively.

This increase will impact the top 7 percent of owner-occupied residential properties, and the increase will be higher for properties in the top end.

Luxury cars

Luxury cars will be taxed at a higher rate to make Singapore’s vehicle tax system more progressive, and will be taxed at an additional 220%.

In a nutshell, here are the changes to Singapore’s tax system you need to know about:

- Carbon tax: Carbon tax to be raised from S$5 per tonne of emissions to S$50-S$80 by 2030

- GST hike: Broad-based consumption tax will increase from 7% to 9% over two years - 7% to 8% on 1 Jan 2023, 8% to 9% on Jan 1, 2024

- Wealth tax: Those with greater means will contribute more; the portion of chargeable income in excess of S$500,000 - S$1 million will be taxed at 23%, while that in excess of S$1 million will be taxed at 24%

- Property tax: Increase from 10% - 20% to 12% - 36%

- Luxury car tax: Increase to an additional 220%

4. CPF contributions

Singapore will continue to increase the employer and employee CPF contribution rates for workers aged 55 to 70. The first increase was implemented this year, and the next increase will be in 2023.

Workers aged 55 to 70 will witness a total increase of three to four percentage points in their CPF contribution rates over the next two years.

The CPF Basic Retirement Sum (BRS) will be raised by 3.5 per cent per year for the next five cohorts turning 55 from 2023 to 2027. There is no requirement for members to top up their CPF if they are unable to set aside their BRS.

5. Government to invest in new capabilities

The government believes that Singapore must invest in new capabilities, advance Singapore’s transition, renew and strengthen its social impact and develop a fairer and more resilient revenue structure to stay ahead in the game.

Digital capabilities

The first priority is to improve digital capabilities. One of these key initiatives is to upgrade its broadband infrastructure and invest in future technologies like 6G to aim to improve the broadband speed. There will also be new possibilities for augmented and virtual reality tools to make optimise processes.

As part of this, the government is putting in an additional S$200m to implement greater digital and automation solutions for businesses and workers. They will also be pushing for more pervasive innovation and a record S$25b will be set aside for further R&D under the RIE2025 strategy.

Local enterprise

The government also aims to strengthen the local enterprise ecosystem, and about S$600 million will be set aside to expand the range of available solutions under Productive Solutions Grant (PSG), and push for greater innovation of productivity solutions by SMEs over the next four years.

Schemes involved:

- Grow Digital scheme to aid firms in better leveraging digital platforms in reaching international markets.

- TechSkills Accelerator aims to develop a skilled information and communication technology workforce for Singapore’s digital economy.

Education

The government also wants to 'invest significantly' in education and will review the programming in Institutes of Higher Learning to enhance their provision of quality continuing education and training. Institutes of Higher Learning (IHLs), including autonomous universities, will be transformed into institutes for continual learning.

More details will be revealed at the Ministry of Education’s Committee of Supply.

Skills development

The Skills Development Levy requirement will be waived for the period of 1 Jan to 31 Dec 2022. This is estimated to double the number of eligible employers from 40,000 to 80,000, allowing more workers to benefit from this. The deadline to claim the credit will be extended by a year to 30 Jun 2024.

NTUC

About S$100 million will be set aside to support NTUC in its efforts to scale up the Company Training Committees (CTCs). To date, NTUC has formed more than 800 CTCs with companies of various sizes.

Part of the S$100 million will go into a new grant by NTUC with the aim of supporting companies that have set up CTCs to implement and kickstart their transformation plans.

6. Higher minimum qualifying salary for new EP applications

Employment Pass (EP) holders

There will be adjustments to foreign worker policies to allow companies to “access a diverse pool of manpower”, where the framework for Employment Pass (EP) holders will be updated.

From September 2022, the minimum qualifying salary for new EP applicants will be raised from S$4,500 to S$5,000. For the financial services sector, this will be raised to S$5,500 from the current S$5,000.

The qualifying salaries for older EP applicants, which increase progressively with age, will also be raised.

This aims to ensure that incoming EP holders are comparable in quality to the top one-third of our local professional, managerial, executive and technical (PMET) workforce.

S Pass holders

The minimum qualifying salary for new applicants will be raised from the current S$2,500 to S$3,000 in September this year. For the financial services sector, the minimum qualifying salary will go up to S$3,500.

The qualifying salaries for older S Pass holders will also be raised in tandem.

Thereafter, the minimum qualifying salary for new S Pass applicants will be raised in September 2023, and again in September 2025.

The Government will also progressively raise the Tier 1 levy from the current S$330 to S$650 by 2025 to better manage the flow of S Pass holders.

Work permit holders

The Dependency Ratio Ceiling (DRC) – the maximum permitted ratio of foreign workers to the total workforce that a company in the specific sector is allowed to hire – will be reduced from 1:7 to 1:5 from 1 Jan 2024.

A new levy framework will also replace the current Man-Year Entitlement (MYE) framework to encourage firms to support more offsite work, and also employ more higher-skilled work permit holders for increased manpower. These adjustments will mainly be applied to the broad middle of the workforce.

Lawrence Wong reassures that Singapore continues to stay open and welcome talent from around the world.

7. A greener Singapore

The Government will issue S$35 billion of green bonds by 2030 to fund the public sector of green infrastructure projects. Traditional sectors like aviation, energy, and tourism will see a 'greening' over the next ten years, while emerging green sectors like green finance and carbon services will become more prominent.

Singapore also aims to be a car-lite city by introducing cleaner and more efficient public. As part of the Singapore Green Plan, new Electrical Vehicles (EV) registrations have increased from 0.2% in 2020 to 4% in 2021. More charging points will also be built nearer to household estates to encourage the purchase of EVs over traditional cars. Green bonds will provide necessary financing for improving transport infrastructure.

8. Future healthcare needs

Singapore’s healthcare costs will be increased significantly. Government healthcare expenditure has already tripled from S$3.7 billion in 2010 to S$11.3 billion in 2019.

Current healthcare spending, excluding COVID-19 related expenditure, continues to increase at a similar rate over the next ten years, and it is projected that Singapore will spend about S$27 billion or about 3.5 per cent of GDP by 2030.

Mr Wong urges that Singapore continues to fundamentally rethink the way she delivers healthcare. He also added that the healthcare ecosystem has to be restructured over the longer term to centre the healthcare system around the patient, instead of the other way round.

9. Support for workers

Expansion of Progressive Wage Model

According to Mr Wong, the Progressive Wage Model will be extended to workers in the retail, food services and waste management sectors over the next two years.

The Progressive Wage Model will also be extended to in-house cleaners, security officers, landscape workers, administrators and drivers across all sectors.

That’s not all. For companies that employ foreign workers, they will be required to pay their local employees the local qualifying salary (currently set at S$1,400 per month) at least.

Progressive Wage Credit Scheme to co-fund wage increases for workers

The government will be implementing the Progressive Wage Credit Scheme (PWCS) to co-fund wage increases for workers earning up to S$2,500.

Starting with a S$2 billion injection, the PWCS fund will support wage increases for lower-wage workers in the next five years.

More lower-wage workers to benefit from Workfare Income Supplement

The qualifying income cap for Workfare Income Supplement will be increased from the current S$2,300 to S$2,500 per month from 1 Jan 2023.

A minimum income criterion for Workfare will be set at S$500 per month to encourage part-timers and casual workers to take up full-time work.

Workfare will be extended to a maximum payout of S$2,100 for younger workers from aged 30 to 34.

A maximum annual payout for other age groups will also be enacted:

- Aged 35 to 44: Increased to S$3,000

- Aged 45 to 59: Increased to S$3,600

- Aged 60 and above: Increased to S$4,200

Those with disabilities will receive a maximum payout of S$4,200 annually, regardless of age. This enhanced Workfare scheme aims to benefit more than 500,000 workers in our workforce.

Charting Our New Way Forward Together

All in all, the budget position remains expansionary and the government is expecting an overall deficit of S$3b, which is 0.5 percent of GDP for FY2022.

As the name of Budget 2022 would have it, the support measures announced by the government today serve to help prepare Singapore for future challenges and opportunities while helping Singaporeans tackle more immediate concerns such as higher cost of living, challenges that businesses and workers face and more.

Read these next:

Singapore Budget 2021: Key Highlights And Summary

Singapore Budget 2021: 5 Ways It Will Affect Your Daily Life

8 Job Support Measures You’ll Want To Know About From Budget 2021

Singapore Budget 2021: All The Important Numbers Businesses Should Know About

Singapore Budget 2021: Hawker Eats That Deserve Your $100 CDC Vouchers

Similar articles

How Singapore Budget 2020 Affects HDB, CPF & Living Costs

Singapore Wealth Tax: How Rich Must You Be To Be Affected?

Singapore Budget 2020: Summary And Key Highlights

Singapore Budget 2023: Key Impacts Affecting Inflation, Employees, and Businesses

Singapore Budget 2021: Key Highlights And Summary

Singapore Budget 2022: 6 Ways It Will Impact You

INFOGRAPHIC: Singapore Budget 2017 By the Numbers

Singapore Budget 2022: 4 Small Sacrifices You Can Make To Defray The Upcoming GST Hike