Investing, while exciting, can also seem daunting. If you're wondering if now is the time to start, the answer is a roaring 'yes'.

A popular yet confusing question I get from my friends is this:

“When Is The Best Time To Start Investing? Should I do it when I accumulated a minimum of $10K savings or right after I get my first job or after I get married and settled down etc?”

Le Friend

My answer to them is always the same no matter what stage or age they are at:

“Now is the best time to start investing”.

Before you dismiss my simple answer, I have 2 main reasons why people should start investing as soon as possible and I have highlighted them below.

Start Small

One common misconception people have is that they think they require a large capital to get started on stocks investing. It makes sense at the initial thought because we are so accustomed to hearing all the big funds or institutions discussing about big name companies which are priced at more than $100 per share such as Amazon at US$1,934.43 and Apple at US$202.73 (at the time of writing).

Yet, while this may be true in the past, it isn’t reflective of an investor’s options these days. Long gone are the days that you need to put in a minimum lot of 1,000 shares per stock counter.

In case you aren’t aware, the minimum lot size of US stocks is just 1 share and SG stocks is 100 shares. Hence, you can effectively purchase 1 lot of DBS Group Holdings trading at S$25.00 for S$2,500 (excluding any commission, miscellaneous gst charges for this purpose). That said, you aren’t exactly diversifying your portfolio when you have S$10,000 and plow them into 400 shares of DBS Group.

With the advent of technological advancement, you can now seek to diversify your portfolio from the onset and even do it at a comfortable S$100-$200 savings per month through 2 popular financial instruments:

- Exchange Traded Funds (ETFs)

- Regular Savings Plans (RSPs)

What is ETF?

Simply put, an ETF is a collection of securities which tracks an underlying index and can be traded on an exchange just like a normal stock. In Singapore, we have the SPDR Straits Times Index ETF – which is last traded at S$3.43 per share.

This means that you can effectively get exposure to the top 30 stock constituents listed inside the STI with an extremely affordable amount – just S$343 per lot excluding the charges. Not to forget, you are also entitled to the semi-annual dividends paid by the ‘index’ ETF too.

You can read more about STI ETF here.

What is RSP?

Next up, if you don’t want the hassle of thinking when to buy stocks, you can opt for a regular savings plan (RSP). An RSP allows you to invest a minimum of S$100 per month regularly through dollar-cost averaging – you do not have to decide whether a stock is expensive or not, and if market conditions are right to invest.

In my opinion, dollar-cost averaging does wonders for young, time-strapped investors because of the low amounts to get started and the ability to stay invested in the markets for a long time to smooth out any huge price bumps. This brings me to my second point below – compound interest.

Hop on the 8th Wonder of the World

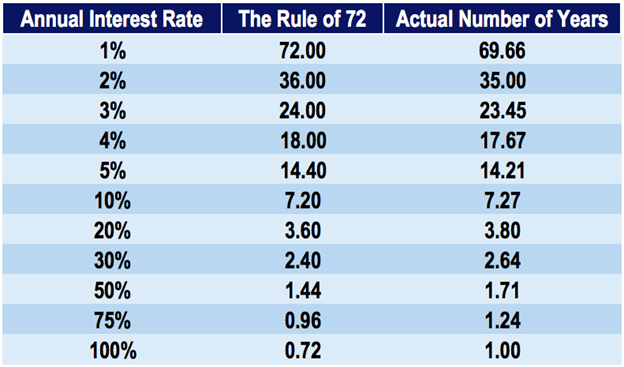

If there is one investing formula you must know in your whole life: it is the Rule of 72. It is an easy method to estimate the time taken in order to double your investment depending on your annual returns.

The table above depicts the amount of time you will take to double your investment based on different interest rates.

Take, for example, if you simply invest in the STI Index and gets around 8% return per year, divided by 72 and you would roughly double your money in 11.11 years.

The concept behind “Rule of 72” is compound interest, also dubbed as the 8th Wonder of the World by famous scientist Albert Einstein.

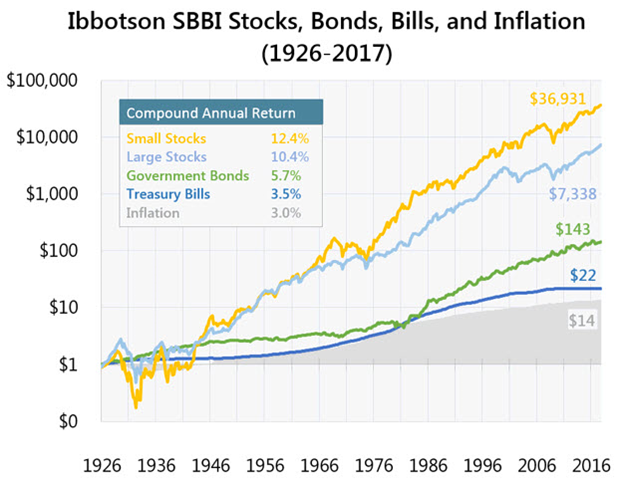

Historically, stock markets are poised to go up over the long term. In fact, if you look at the below chart, investing in the U.S. stock market would garner you at least 10% annual returns over the past decade.

One thing to note is how stocks outperform bonds over the long run too and can help you overcome the inflationary erosion of your wealth.

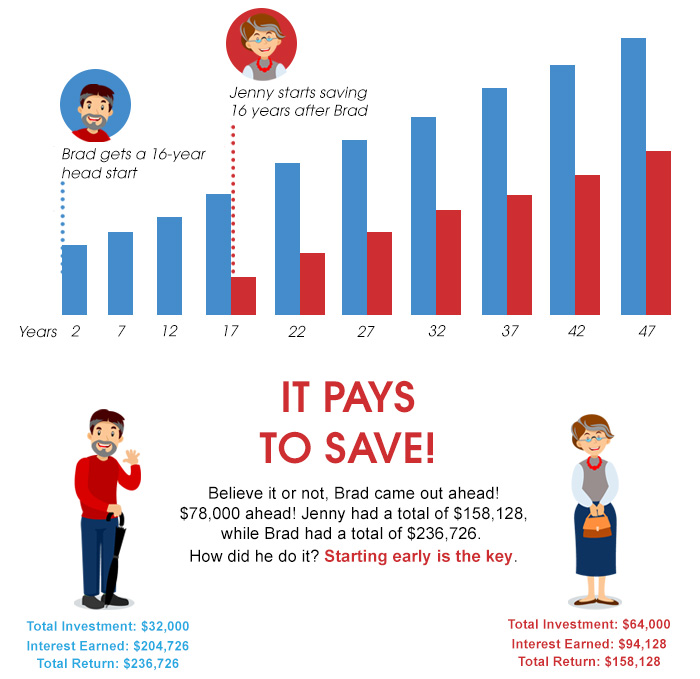

Hence, when we digest the element on how compound interest can work its magic over time, it is all the more important to get started early no matter what stage you are at.

To put that into perspective, a person investing $100 monthly at age 25 to 65 would end up with $335,737.25 assuming a compounded annualized return of 8%.

For another person who wants to start investing at age 40 and end up with the same amount of $335,737.25 at age 65, he has to put in a monthly investment of $354.33. That is 3.5 times the monthly requirement despite reaching the same future value!

Learn from Your Mistakes

Investing in the stock markets successfully requires more than simply your capital. It requires you to have the right discipline and temperament so that you can avoid common investing mistakes such as:

- Chasing the hot stock by favouring stocks that are in the news or ‘tipped’ by your friends

- Falling prey to hyped-up trading courses which promises them quick gains without much effort

- Procrastinating too long to pull the trigger and miss out on massive returns due to the lack in investment plan/clear goal on how to buy/sell stocks

Thus, it makes sense to start investing early because it's better to make mistakes when you have $20,000 investment compared to $500,000. You wouldn’t want to make a big mistake and have your retirement funds halved when you are so close to retirement.

Given that investing will entail many mistakes along the way (even Warren Buffett admits that he made a recent mistake of buying UK-listed Tesco), having a long way ahead of you allows you to overcome the mistakes and fine-tune your investment strategy earlier.

In conclusion

Although I have stated the reasons why you should start investing now, there are also some caveats to take note of.

For one, if you have upcoming life commitments like a marriage or house renovation, it is better to take care of those first. You wouldn’t want to affect your life goals drastically just because you understand the power of investing early.

Other than that, for the reasons mentioned above, it is best to start early and if you have not done so yet, the other best time is to start now.

A version of this article was first published on DrWealth.

Read these next:

Why (We Think) Millennials Love Alternative Investments

Singapore Savings Bonds (SSB): Interest Rates & How To Buy

3 Reasons Why Singapore’s STI (‘Super Terrible Index’) is a Bad Passive Investment Strategy

Robo Advisors Singapore: Complete 2019 Guide

CPF Has No Equal as Investment Vehicle: Singapore’s Mr. CPF

Regular Shares Savings (RSS) Plans: Complete 2019 Guide

Similar articles

Guide to Universal Life Insurance in Singapore

Best US Exchange Traded Funds (ETFs) To Invest In (2021)

5 Things That Are Much Cheaper in Johor Bahru Than Singapore

3 Most Value-For-Money Cars You Can Get In Singapore

Keep An Eye On Your Credit Score To Prevent Falling Victim To Fraud

The Real Cost: Ex-Busker-Turned-Actor Gavin Teo Says That He Earned A “Pretty Decent Amount” As A Street Singer, So Why Did He Quit?

Alternative Solutions To Borrowing From Loan Sharks in Singapore

Spin Studio Classes In Singapore 2022 — Best Packages, Promos and Deals