COVID-19 vaccines helped bring biotechnology companies into the limelight, but should investors focus on vaccine stocks alone?

The COVID-19 pandemic marks the first time in human history where a safe and effective vaccine was created and launched in record time. Even better, this could mark the dawn of a new age in the history of medicine, changing the future of vaccine science.

At the forefront of it all are three companies — Pfizer, BioNTech and Moderna — whose successful and highly demanded vaccines have shone a spotlight onto so-called vaccine stocks, drawing investor attention to the biotechnology sector.

This naturally brings up the question: Between vaccine stocks and the Nasdaq Biotechnology Index, which performed better?

Year-to-date performance: PFE, MRNA, BNTX and NBI

| Stock | Stock performance year-to-date |

| Pfizer Inc. (PFE) | -11.79% |

| Moderna Inc (MRNA) | -45.92% |

| BioNTech SE (BNTX) | -37.96% |

| Nasdaq Biotechnology Index (NBI) | -26.32% |

The biotech sector isn’t doing well

The table above shows the stock performance for three vaccine stocks thrust into popularity due to the COVID-19 pandemic — Pfizer, Moderna and BioNTech. Also included for comparison is the Nasdaq Biotechnology Index.

Note that the metric used is year-to-date. In other words, compared to 12 months ago from the time of writing, prices for these four stocks have fallen between 12 and 46 percent.

If you bought into any of these stocks last year — and why not, given the circumstances — you’re probably feeling like your stock portfolio needs a booster shot or something.

But the thing is, it’s not just the biotech sector. Those of you who’ve been keeping up with financial news headlines will know that the entire global stock market is floundering right as we speak.

Here, have a look.

| Market index | Year-to-date performance |

| Dow Jones Industrial Average (US) | -14.19% |

| S&P 500 (US) | -18.67% |

| Hang Seng Index (Hong Kong) | - 6.31% |

| NIFTY 50 (India) | - 8.08% |

| Nikkei 225 (Japan) | - 5.04% |

| Euro Stoxx 50 (Eurozone) | - 16.91% |

| FTSE 100 (UK) | - 2.5% |

| Straits Times Index (Singapore) | 1.86% |

From the US to UK and Europe, Japan, Hong Kong and India, every major financial market or financial hub across the world is currently down year-to-date.

The only bright spot, at least at the time of writing, is our very own Straits Times Index, which is slightly up by around 1.9%.

In case you’re wondering why markets are doing so badly, well it’s mainly due to a combination of pandemic lockdowns, runaway inflation, interest rate hikes, and the Ukraine war.

Are biotech and/or vaccine stocks worth investing in?

Given the current gloomy economic backdrop, it’s not too surprising that vaccine and biotech stocks are similarly depressed. However, does this mean that they are not worth investing in?

Well, not necessarily. Stock price isn’t everything when it comes to investing. Instead, looking at the underlying fundamentals is more important.

Pfizer, BioNTech and Moderna are looking terrible, true, but their balance sheets tell a different story. All screenshots are taken from Google Finance.

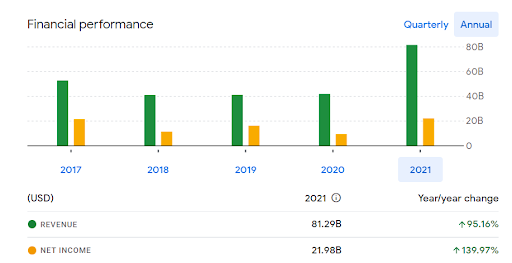

Here’s Pfizer’s revenue and net income over the past five years:

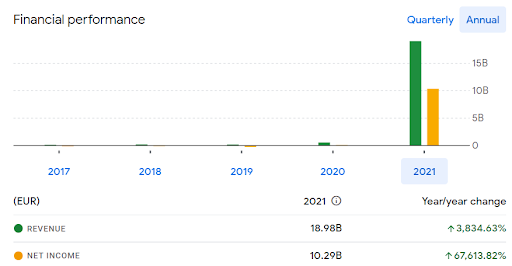

And here’s the same for BioNTech:

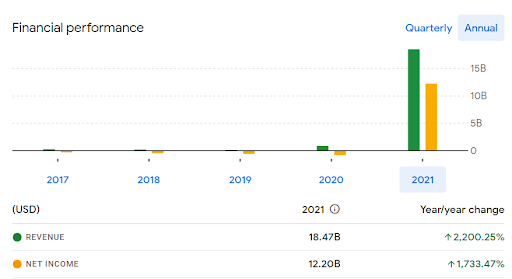

And similarly, for Moderna:

As you can see, these three vaccine manufacturers have done impressively well during the COVID-19 pandemic, resulting in massive spikes in revenue and profit for 2021.

Pfizer nearly doubled their earnings in 2021, which is outstanding by any measure. BioNTech and Moderna did even better, increasing their earnings by 38x and 22x respectively.

Now, these types of performances don’t happen often, and some may even consider them a flash in the pan for less established players such as BioNTech and Moderna.

However, given that COVID-19 is far from over — which also means vaccine shots and other treatments such as Pfizer’s oral drug Paxlovid, will continue to be in demand — it is reasonable to expect solid stock price performance from these three vaccine stocks once global macroeconomic factors improve.

As for the Nasdaq Biotechnology Index, things are a little different.

Firstly, it is a market index that is composed of several different stocks and funds, so there’s no singular set of earnings data to refer to. Secondly, the Index is composed of 274 constituents (stocks, funds and indices), so its performance is governed by a much wider set of factors and influences.

Regardless, it still stands to reason that once the bulls wrest control over from the bears, the biotechnology sector will also see better days.

Vaccine stocks vs NBI — an investing lesson

Let’s go back to the year-to-date performance of our three vaccine stocks and the Nasdaq Biotechnology Index (NBI).

Recall that Pfizer dropped 11.79%, BioNTech, 37.96%, and Moderna, 47.92%. Meanwhile, the NBI dropped by 26.32%.

Note that Pfizer, BioNTech and Moderna are all represented in the NBI, which nicely demonstrates the value of diversification in investing.

Here’s the deal. If you had invested in any of the three companies, or even all three, your portfolio would still be worse off than if you had invested in the NBI instead.

The only exception is if you had invested solely in Pfizer, in which case you’d be doing slightly better.

Since there’s no way anyone could have predicted today’s results, you had a greater chance of coming out ahead (or at least, with lesser losses) with the NBI.

This, then, is an example of the moderating effect of diversification at work. In this case, we can enjoy a protective effect on our investment portfolio.

Of course, the reverse is also true. During a bull run, individual stocks may provide greater returns compared to an index fund.

But, how would you know which stocks would come out ahead?

Picking stocks is notoriously difficult, with a recent study suggesting that the best way to invest is to do so at random.

That sounds scary, even for seasoned professionals who think they know the market and understand its behaviours.

Conclusion: Index funds can help you capture broad market movements

Perhaps there is one takeaway we can derive from all these.

When investing in a particular sector, it is probably more advantageous to pick a basket of different equities that together cover a wider segment of the market, than to focus on a narrow selection consisting of only a few stocks.

To do so, you can make use of mutual funds, index funds and exchange-traded funds to capture broad market movements.

This will allow your portfolio to follow the natural ebb and flow of the market at large, so you can enjoy a gentler ride on your investment journey.

Read these next:

Investing S$100,000: How To Build A Stock Portfolio

Guide to Value Investing, and Why You Should Consider Value ETFs

How to Build a Passive Income Portfolio Using ETFs (And Why You Should)

DBS, SIA & Sheng Siong: Beginner’s Guide To Blue Chip Stocks In Singapore

5 Ways To Invest Money That Are Better Than Buying Toto

Similar articles

5 Energy Stocks To Add To Your Watchlist

Best US Travel And Tourism Stocks To Consider In 2022

The Costs of Layoffs and How They Affect Stock Prices

SoFi Share Price and Review – Is It Worth Buying?

Meta vs Alphabet — A Look At These Tech Giants’ Q1 2022 Earnings Release

Moderna Share Price and Review – Is It Worth Buying?

Are US-listed Chinese Stocks Making a Comeback?

Global Tech Stocks For Value Investors in 2022