With a free hotel night, up to 50% off dining and one of the best miles earn rates in Singapore, securing an AMEX SIA Business Credit Card should be a no-brainer for SME owners.

Singapore Airlines' HighFlyer program is a loyalty scheme for small- and medium-sized enterprises (SMEs), rewarding businesses with 1 HighFlyer point per S$1 eligible spend. This is equivalent to 1 KrisFlyer mile per S$1. Up to five Corporate Travellers can be nominated and each nominee is entitled to a maximum of 30,000 KrisFlyer miles per calendar year.

Furthermore, all AMEX Singapore Airlines Business Credit Card members will earn the equivalent of 8.5 mpd (miles per S$1) on Singapore Airlines transactions, and 1.8 mpd everywhere else.

Whether you're a budding business or a flourishing corporation, read on to learn more about the HighFlyer programme, and why any SME owner should strongly consider getting an AMEX Singapore Airlines Business Credit Card.

Table of contents

- Overview: AMEX Singapore Airlines Business Credit Card

- What is HighFlyer?

- Reasons to get the AMEX Singapore Airlines Business Credit Card

- Eligibility, fees & charges

- How to apply?

- Conclusion

What the AMEX Singapore Airlines Business Credit Card can do for you

AMEX Singapore Airlines Business Credit Card product summary:

- 8.5 HighFlyer points per S$1 spend (8.5 KrisFlyer miles / 8.1% cashback) on all eligible Singapore Airlines Group Flights

- 1.8 HighFlyer points per S$1 spend (1.8 KrisFlyer miles / 1.7% cashback) on all other spend

- 2 complimentary Priority Pass lounge visits per year

- Complimentary Accor Plus Explorer membership (worth S$418) + 1 free night's stay per year

- Earn 5,000 HighFlyer points with S$500 spend within first 12 months of card approval

- Earn 15,000 HighFlyer points with S$10,000 spend annually on Singapore Airlines Group

- Fast-track membership upgrade to KrisFlyer Elite Gold (KFEG) status with S$15,000 spend on Singapore Airlines Group within first 12 months of card approval

- Complimentary Hertz Gold Status offering 10% off standard rates, one car class upgrade, and additional driver fee waiver

- Up to 51 days interest-free from transaction date

- Annual income requirement: Subjected to internal assessment and approval by American Express

- Minimum age: 21

- Annual fee: S$304.59 (incl. of 9% GST)

⭐ Every 1 HighFlyer point = 1 KrisFlyer mile

⭐ HighFlyer points are valid for 3 years and can be redeemed for Singapore Airlines bookings in part or in full, without any caps or blackout dates imposed

What is HighFlyer?

In the same way that individuals have KrisFlyer accounts, SMEs can open HighFlyer accounts. The programme is free to join and does not have any minimum spend commitment to start off; all that is required to sign up is an ACRA business registration number.

In a sense, HighFlyer operates like a cash rebate scheme. Registered companies earn 5 HighFlyer points per S$1 spent on Singapore Airlines, Scoot, Lufthansa and SWISS tickets (excluding government taxes and airport fees), and further points by spending on the AMEX Singapore Airlines Business Credit Card.

The corporate membership comes in four tiers as shown below:

| Programme tier | Minimum spend | Best for | Points earn rate |

| HighFlyer | – | Small-to-medium businesses | 5 HighFlyer points per S$1* |

| HighFlyer Silver | US$25,000 nett flown expenditure | Medium-to-large businesses | |

| HighFlyer Gold | US$200,000 nett flown expenditure | Large businesses | 6 HighFlyer points per S$1* |

| HighFlyer Platinum | By invitation only |

||

HighFlyer points can then be redeemed against Singapore Airlines charges like air tickets and ancillaries, Scoot e-vouchers, Changi Airport lounge passes, upgrade to KrisFlyer Elite Gold membership status^, and even convert HighFlyer points into KrisFlyer miles at a rate of 1,050 HighFlyer points = S$10 (0.95 cents/point).

💡Pro-tip: If you have HighFlyer Gold or Platinum status, you're entitled to priority reservation waitlist, priority airport standby, and other priority upgrades. You'll even have a dedicated Singapore Airlines account manager – talk about bougie!

HighFlyer points are valid for three years while KrisFlyer miles are valid for 39 months.

There are a few important restrictions to note: Each HighFlyer account shall only...

- Be linked to a maximum of five selected KrisFlyer accounts for the purpose of converting HighFlyer points to KrisFlyer miles

- Receive a maximum of 30,000 KrisFlyer miles converted from HighFlyer points per calendar year, regardless of which HighFlyer accounts the points are converted from

In other words, assuming you run a one-man company, the maximum KrisFlyer miles you can draw from the card each year is capped at 30,000. That’s not to say the rest of your spending is wasted though - you can still use the balance to pay for Singapore Airlines charges.

*Applies to qualifying fares only

^Not applicable for HighFlyer base membership tier.

Why should you get an AMEX Singapore Airlines Business Credit Card?

While this obviously won’t be an option for everyone (since you need to own a small business to be eligible), those with an ACRA-registered business should strongly consider applying for an AMEX Singapore Airlines Business Credit Card.

The card’s S$304.59 (incl. of 9% GST) annual fee is waived for the first year, but you’ll still enjoy a complimentary Accor Plus Explorer membership (from S$418 per year) just for signing up. Accor Plus Explorer members are entitled to a complimentary night's stay each year, redeemable at more than 1,000 participating Accor hotels and resorts worldwide. Even if overseas travel isn’t possible at the moment, it can still be used at local hotels including the Sofitel City Centre and Sofitel Sentosa Resort – basically a free staycation.

Accor Plus members will also enjoy up to 50% off dining at Accor hotel restaurants in Singapore and overseas, and 15% off beverages at Accor hotel restaurants within Asia. In Singapore, this includes restaurants like Prego, Mikuni, Asian Market Cafe and Szechuan Court at the Fairmont, SKAI, Bar Rouge, Cafe Swiss and Kopi Tiam at Swissotel and The Cliff, The Garden, Kwee Zeen at the Sofitel Sentosa Resort.

Other benefits include:

- 10% off the best available rate at Accor hotels

- Up to 50% off hotel rates during Red Hot Room sales

- Accor Live Limitless Elite status + bonus 20 nights

- Special invitation-only experiences

Outside of Accor Plus Explorer, AMEX Singapore Airlines Business Credit Card members receive:

- Two complimentary Priority Pass airport lounge visits (worth S$221)

- Complimentary Hertz Gold status with 10% off standard rates, one car class upgrade, and additional driver fee waiver

- A fast track to KrisFlyer Elite Gold status when S$15,000 or more is spent on SIA Group transactions in the first 12 months of membership

- Complimentary travel insurance when full travel fare is charged to card

In terms of points, cardmembers enjoy 8.5 HighFlyer points per S$1 spent on Singapore Airlines and Scoot transactions (this includes the 5 HighFlyer points that all HighFlyer registered companies already earn), and 1.8 HighFlyer points per S$1 everywhere else.

As mentioned earlier, this works out to:

- 8.5 mpd on Singapore Airlines and Scoot transactions

- 1.8 mpd on all other local and foreign currency spend

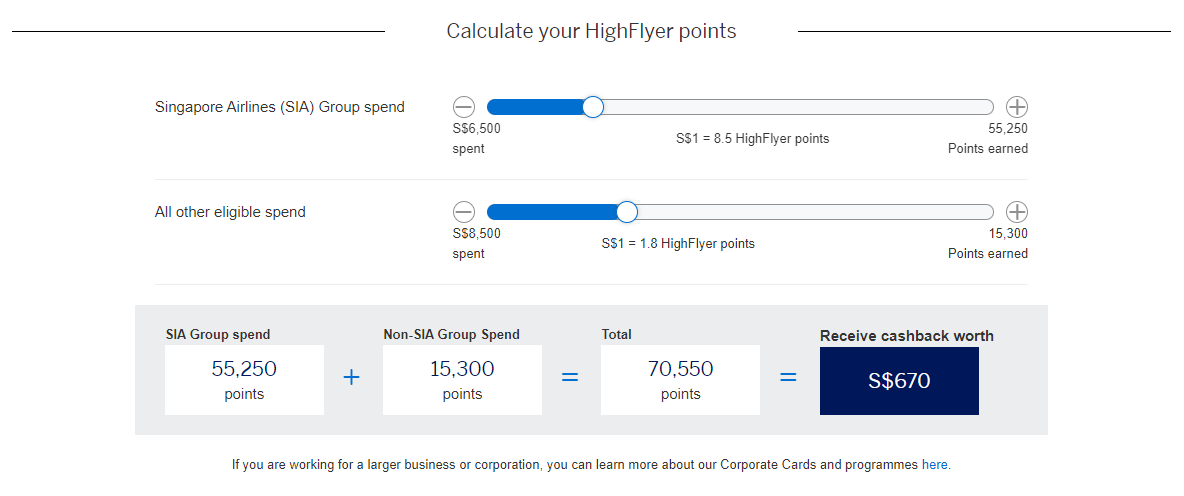

Here's an example of how many HighFlyer points you can earn:

Source: American Express

Source: American Express

For perspective, the highest general local spending in terms of regular credit cards earn 3 mpd, and the highest rate you could otherwise earn on Singapore Airlines tickets is 6 mpd.

Meanwhile, for business credit cards, the DBS World Business Card only earns 1 mpd on dining and the Citi Business Card only earns 0.8 mpd on local spend. In all regards, it seems that the AMEX Singapore Airlines Business Credit Card is a strong – if not, the best – contender for miles accumulation for you and your employees.

For SME owners looking to stretch their cash flow, all transactions enjoy 51 interest-free days (versus the usual 30 on other cards).

KrisFlyer UOB Card product summary:

|

Bonus miles earn rate

|

Up to 3 mpd on everyday categories:

|

|

3 mpd on Singapore Airlines, Scoot, KrisShop, and Kris+ purchases

|

|

|

Base miles earn rate

|

1.2 mpd

|

|

Minimum spend requirement

|

S$800 spend on Singapore Airlines, Scoot, and KrisShop per year

|

|

⭐ Up to S$500,000 complimentary travel insurance coverage

|

|

UOB Lady's Card product summary:

|

Bonus miles earn rate

|

6 mpd on one enrolled category per quarter:

|

|

Base miles earn rate

|

0.4 mpd

|

|

Bonus miles cap

|

S$1,000 spend per calendar month

|

|

⭐ e-Commerce protection on online purchases

|

|

UOB Lady's Solitaire Card product summary:

|

Bonus miles earn rate

|

6 mpd on two enrolled categories per quarter:

|

|

Base miles earn rate

|

0.4 mpd

|

|

Bonus miles cap

|

S$3,000 spend per calendar month

|

|

⭐ e-Commerce protection on online purchases

|

|

|

⭐ Up to S$100,000 complimentary travel insurance coverage

|

|

DBS World Business Card product summary:

|

Local spend

|

1 mpd / 5 DBS Points per S$10 on dining, entertainment, and travel bookings

|

|

Overseas spend

|

2 mpd / 10 DBS Points per S$10

|

|

Base miles earn rate

|

0.3 mpd on all other spend

|

|

⭐ Up to 10 complimentary Priority Pass lounge visits per year

|

|

|

⭐ Up to S$1 million complimentary travel insurance coverage when you charge full travel fare to card

|

|

|

⭐ Sign up for 2 or more cards to receive up to US$25,000 complimentary annual employee misuse coverage per cardmember and up to US$1.65 million per company

|

|

Citi Business Card product summary:

Citi Business Card product summary:

|

Local spend

|

0.8 mpd

|

|

⭐ Up to US$25,000 complimentary liability waiver insurance coverage per cardmember and up to US$1.65 million per company

|

|

|

⭐ Up to S$1 million complimentary travel insurance coverage when you charge full travel fare to card

|

|

What fees & charges should you look out for?

- Annual fee: S$304.59 (incl. of 9% GST)

- Late payment charge: S$100 if minimum monthly payment is not made by due date

- Minimum monthly payment: 3% or S$50, whichever is higher

- Interest-free period: 21 days from statement date if closing balance is paid in full

- Interest on purchases: 25.9% p.a. compounded (26.9% p.a. compounded w.e.f. 3 Oct 2023) if payment of closing balance in statement is not made in full by due date; or 29.99% p.a. if account has three or more defaults in past 12 months

- Interest on cash advance: 25.9% p.a. compounded daily from withdrawal date until full amount and relevant fees are paid

- Cash advance fee: 5% of withdrawal amount

- Foreign transaction fee: 2.95% (3.25% w.e.f. 1 Oct 2023)

- Dynamic currency conversion fee: N/A

Eligibility criteria

- At least 21 years of age

- Annual income requirement: Subject to internal assessment and approval by American Express

How to apply?

Thinking of applying for the AMEX Singapore Airlines Business Credit Card? Here are the requirements you'll need to fulfil:

- Click on any of the 'Apply Now' buttons found in this article

- Fill up the card application form on our SingSaver site

- Prepare the following documents during application:

- Be a business owner and/or person with executive authority of a company or business with a valid UEN

- Valid photo ID from NRIC/Passport

- Last 2 years' Income Tax Notice of Assessment

- Director's Resolution or Board Resolution (except for sole Proprietor/Partnership)

- Certified IDs of beneficial owners/shareholders (with 25% ownership or more)

Should you get the AMEX Singapore Airlines Business Credit Card?

With all these benefits and a first-year fee waiver, there’s very little to dislike about the AMEX Singapore Airlines Business Credit Card. It’s almost too good to be true that American Express is waiving the first year’s annual fee while still including the complimentary hotel night with Accor Plus Explorer. I’d try and grab it while it lasts.

Similar articles

4 Questions to Ask Before Taking Up an Employment Bond

8 Ways to Earn More Cashback on Credit Cards, Shopping Apps, and More

What Women Need to Know About Insurance

What Will Happen To Airfares After COVID-19?

6 Best Perks You Enjoy As A Private Banking Client

Home Insurance: Why Is It Important And How Do You Compare The Best Plans?

5 Secrets to Saving Money on Your Living Room Renovation

How to Perform a Successful Mid-Year Financial Review For Yourself in 2023